Afterpay shares lifted by bullish Goldman report

Afterpay shares jumped after analysts tipped a positive surprise in the buy now, pay later platform’s results.

Afterpay’s shares have rallied strongly after Goldman Sachs analysts tipped the buy now, pay later platform would deliver positive surprises in its interim profit results.

A note from Goldman analysts led by Ashwini Chandra said Afterpay was well positioned to deliver bumper first-half results, with lead indicators and earnings metrics beating the broker’s estimates by about 10 per cent.

The report noted that the customer base of the buy now, pay later service could be close to 7.2 million globally as at December 31, based on the latest app download data. That would outpace Goldman’s estimate of 6.6 million Afterpay customers.

The broker also estimated gross merchandise value through Afterpay of around $4.8bn for the first half, including the $3.7bn disclosed in the company’s November update. That was 9 per cent higher than Goldman’s estimate of $4.3bn.

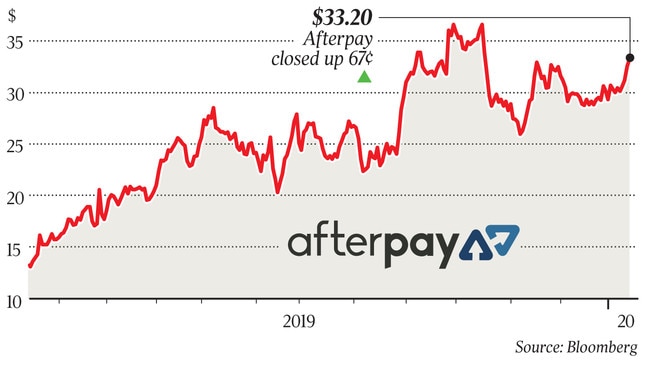

Afterpay’s shares climbed more than 4 per cent in early Tuesday trading, before retracing some gains to close 2.1 per cent higher at $33.20. That followed a 4.5 per cent jump in the stock on Monday after peer Zip Co reported record quarterly revenue in the three months ended December 31.

Despite Goldman’s positivity, the broker didn’t ratchet up its annual profit estimates, noting potential for softer trends in January and February after a very strong seasonal contribution, particularly from the US late last year.

“We believe it too early to capitalise this potential upside until we can more clearly observe customer addition trends through the March 2020 quarter,” the report said.

“We anticipate net transaction profit margins for November and December 2019 are likely to be lower than they may have been for the July to October 2019 period to take into account higher default rates with the seasonally strong sales.”

Goldman’s bullish view — it has a “buy” rating on Afterpay and the stock sits on its conviction list — is countered by other analysts, including those at UBS, who have raised concerns about the instalment payment group’s model.

The UBS analysis from late 2019, led by analysts Jonathan Mott and Tom Beadle, took a different lens to a formula used by Afterpay to calculate impairment charges and treated the company as a financial services provider.

Moving away from Afterpay’s calculation, which looks at sales, UBS assessed impairment charges over average gross loans and got 14.8 per cent.

The report said on its measure Afterpay’s credit losses were “materially higher” than Prospa at 9.6 per cent, Zip at 4.6 per cent and Flexigroup on 4.4 per cent.

UBS has a “sell” rating on Afterpay and a 12-month price target of $17.60.

Afterpay last month updated investors saying it hit a record $1bn in underlying sales in November, buoyed by the Black Friday and Cyber Monday shopping frenzy.

Goldman Sachs’ rating on the company is based on a “market opportunity for its payment service in ANZ, US and UK … estimated to be a $1 trillion opportunity”.

The report also cites the fact that Afterpay is a leading provider in the buy now, pay later industry and trends that suggest “rising frequency of use” of instalment products.

Goldman’s 12-month Afterpay target price is $42.90.

The report noted that, though, that in the US rival group Klarna was growing customers “most strongly”, despite slower additions of retailers and merchants and weaker customer reviews.

Goldman is also mindful that financial crimes regulator Austrac is yet to give conclusions on an Afterpay audit of its compliance processes.

Separately, Splitit Payments told investors on Tuesday it had registered with Austrac to provide factoring services, which allow it to provide its model directly to merchants in Australia.

Splitit also said it had utilised about half of its interim funding facility. Its shares rose 9.2 per cent to 72c.