Telstra facing $100m compensation bill for outage

Telstra is facing a compensation bill of up to $100 million after an outage knocked out merchant EFTPOS terminals and ATMs.

Telstra is facing a compensation bill of up to $100 million, with the telco hit by a furious backlash from retailers after an outage knocked out merchant EFTPOS terminals and ATMs across the country.

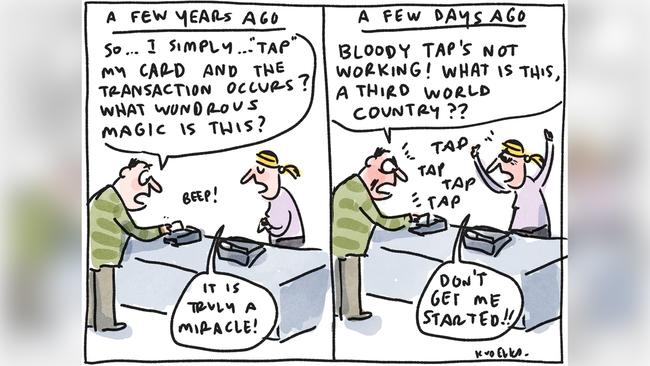

The outage on Thursday afternoon crippled electronic payments, forcing retailers including Woolworths to process millions of dollars of transactions manually and, in some cases, to insist on cash.

While Telstra is still investigating the cause of the outage, affected retailers are seeking redress from the telco, with the National Retail Association pegging the cost of lost sales at around $100m.

The crash has also attracted the attention of the Reserve Bank, which has expressed frustration at the increasing number of outages in the payment network. At the same time, questions are being asked about the lack of redundancy in the network, which is now central to the economy and processes billions of dollars a day.

National Retail Association chief executive Dominique Lamb said yesterday that while it would some time to calculate the full cost, the timing of the outage was unfortunate, with Thursday coinciding with late-night shopping in Sydney.

“As some shoppers would have paid with cash instead or simply delayed the purchase of essential items such as groceries, it is still a little difficult to ascertain the exact cost to retail sales at this early stage,” she said.

“The amount in lost sales could be as high as $100 million for the day.

“Given both the time of day and the businesses affected, the Telstra outage certainly caused a large degree of inconvenience for both shoppers and retailers yesterday.”

The big four banks have been swamped by calls from their merchant customers, even after services were restored last night, and Telstra is now bracing for an avalanche of queries after the Telecommunications Industry Ombudsman yesterday asked all affected consumers to get in touch with the telco.

“Telstra customers impacted by the national EFTPOS outage yesterday who have an issue they would like Telstra to address should contact Telstra in the first instance,” it said.

“If the matter remains unresolved, the consumer or small business can contact the Telecommunications Industry Ombudsman.”

Telstra said it was in discussions with affected parties and customers and would look at issues on a case-by-case basis.

Still, the ombudsman’s advice raises the potential of consumers being caught in a blame game, because the telco provides the service to banks rather than the affected merchants and consumers.

Telstra provides the IP-based virtual private network for a transaction hub known as the Community of Interest Network (COIN). Payment terminals in stores and service stations are connected to COIN via fixed or wireless networks.

With the banks managing the customer relationship with the retailers, industry sources told The Weekend Australian that businesses and consumers seeking compensation were likely to be caught up in a protracted process.

How the process is managed will be closely watched by the Reserve Bank, which has already raised concerns about the increasing frequency of disruptions to the retail payment systems. In a speech the Central Bank Payments Conference at Berlin in June, RBA assistant governor (financial system) Michele Bullock warned that payment outages posed a significant risk to “day-to-day economic activity”.

“Ageing and complex systems within financial institutions pose a significant risk to the efficiency and resilience of payment systems,” she said.

“Both the number of software failures and the average time taken to resolve the issues rose sharply in 2018.”

According to Ms Bullock, around half of the number of service disruptions in 2018 were to mobile and online banking channels, while card services accounted for around 10 per cent of the incidents. Software failures were cited as the most common cause of outages.

“More generally, the increasing complexity of the IT environment seems to be an important reason why incidents are taking longer to be resolved.”

The RBA was a participant in the recently concluded consultation, carried out by the Australian Payments Council, which has led to the launch of new strategic agenda to make payment infrastructure more secure and efficient.

Network resilience is one of the five key priorities outlined in the agenda, with the APC now working to identify, manage and mitigate risks to payment system resilience.

One issue that’s likely to top the APC’s list is the reliance of big banks on Telstra’s network.

While payment terminals capable of taking e-SIMs are able to switch to another service provider in case of an outage, most terminals are rendered useless if there is a problem with Telstra’s infrastructure.

This dependency is one reason for the scale of the outage on Thursday.

Banking industry sources said outages of this sort were harming public trust in the use of electronic payments.

Telstra rival Optus, which participated in a payments industry consultation process, is pushing to give institutions an alternative to Telstra, and the advent of 5G mobile networks could give the telco a chance to better make its case.

Optus Business Director, Centre for Industry 4.0, Rocky Scopelliti said that 5G networks could play a big role in making payment infrastructure more resilient. “5G is designed with a set of standards that provide more capacity, latency and connectivity, which is necessary for mission-critical services.”

With Australians ditching cash for electronic payments, Mr Scopelliti, a former Telstra executive, said the payment systems were a vital piece of infrastructure.

“5G technology will give payments systems the sort of resiliency we see in the mining sector and emergency services.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout