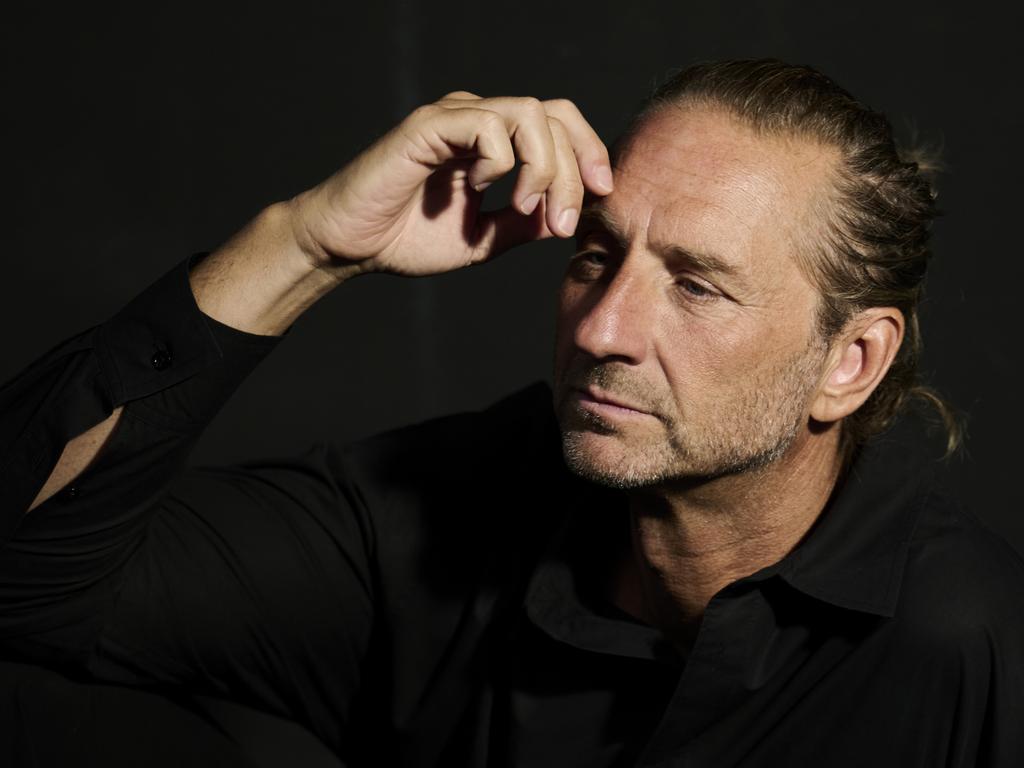

Tech visionary and investor Tim Heath isn’t afraid of a high-stakes game

He’s the most prolific individual investor on The List with money in more than 100 start-ups. But Tim Heath wants more, and isn’t afraid of his latest high-stakes move.

Tim Heath likens investing to a game of poker. It’s a mentality the 45-year-old Estonian-based cryptocurrency gambling magnate has put to use in investing an initial €200 million ($330 million) of his own funds, derived from the profits he has made from running some of the world’s biggest online gambling brands.

Heath has quickly become one of the most prolific individual Australian investors around, spreading his money across roughly 100 startups and early-stage companies, including fintech firms, blockchain-related companies and gambling industry service providers, dotted around the globe.

Mostly, Heath invests in the ecosystem around online casino operators, sportsbooks, payment providers, gambling compliance platforms and wagering affiliate firms.

So successful has Heath been that he has built up a portfolio that now has about €620m ($1.03bn) assets under management.

This article is from The List — Australia’s Richest 250, published March 15, where Heath is ranked in the top 70.

He is generally interested in anything related to the emerging online gambling sector, although he has also invested in a travel-booking technology company that brings corporate travel bookings to a Slack bot, after trying to find a way to save time and money for himself and his executives at his Yolo Group. He also invested in a bitcoin mining operation powered by windmills and solar panels, which transforms excess server heat into gas for municipal heating on one of the Estonian islands.

Heath is talking to The List from a wintry Tallinn, Estonia’s tech-savvy capital, where he runs his stunningly successful and extremely profitable group based on online crypto sportsbooks and casinos, namely, Sportsbet.io and Bitcasino.io.

Those businesses are humming along – Sportsbet.io handles roughly €2.5 billion betting turnover per month alone – which has allowed Heath the time and money to pursue gambling of a different kind: the quest to make big returns in technology-focused startups.

“I look at it as a game of poker,” he says of his investment strategy and style. “And, you know, how do you play it? You’re trying to win each hand, but you can’t win every single hand. And so, how do you learn from that hand you’re playing and play it better next time?

“How do you play it like a poker tournament? You’ve got to accelerate at some points and you’ve got to decelerate and be defensive at some points. You’ve got to manage cash flow, you’ve got to read the room and pick your spots.

“You’ve got to be interacting and networking with everyone on the table, the marketplace. And the strategy behind the poker game is what is exciting, I find. Investing in people. I’m almost in that game again, but I need to work out what is the best game theory to win.”

His investing has, Heath says, led to a 41 per cent extended internal rate of return since 2017 (although most of his investments have been made in the past few years). He is typically investing €500,000 to €5 million for 10 to 30 per cent shareholdings in startups or early stage businesses.

Now, for the first time, Heath will invest on behalf of other investors, in his second fund, Yolo Fund II. He’s putting €50 million of his own money into the fund, with another €50 million being raised from outside investors.

Heath has made his fortune from Sportsbet.io and maintains ownership of the business, which makes more than €100 million in pre-tax earnings before interest and tax, depreciation and amortisation annually, but he is now concentrating more on investing.

Given this focus, he differs from many founders on the Richest 250, who will often spend their entire lives in charge of their businesses and not trust others to be at the helm. But he is also sticking closely to the industry he knows best, given most of his fund’s holdings are related to the ecosystem behind the online gambling industry.

“For me, personally, why do this? I don’t want to do the daily operations anymore. I’ve done it for 20 years. So it’s now [about] how I can use my strategic experience to help guide others to avoid the mistakes I’ve made. And I like to invest into the people who are able to execute that strategy.

“That’s a privileged position. I’ve worked very hard to get here but I can still feel a part of the game. I’m not the one accountable for the execution of the strategic company growth, but I can say, ‘This is where I see the market and technology moving in 12 months’ time,’ and guide them in that direction.”

Heath is a director of Australian social betting business Dabble, which Yolo invested in on a $10 million valuation before it launched in 2021. Dabble raised $33 million from ASX-listed giant Tabcorp in late 2022, giving it an enterprise value of $165 million. That means Heath is already up more than a dozen times on his original investment.

Yolo is up on similar returns with its 2020 investment in iGaming NEXT, an igaming events and media business that it invested in on a €2.2 million valuation. Plus, it’s up 5.3 times on its investment in payment services provider ONE.io. It has also doubled its money on an April 2021 investment in chatbot and multilingual call centre automation firm Proto, which it initially invested in on a $10 million valuation.

I asked the question: ‘What’s the upside here? How big can a $25 billion company go? Will it go to $100 billion? That’s only four times. That’s not the return we are looking for’

Heath’s other investments include Kero Gaming, which offers algorithmically curated bets; Enteractive, specialising in customer retention and reactivation; Basketball Forever, a fast-growing sports media company; London-based BoomFi, a payment processing platform for digital currencies; Indian neobank Open; and Japanese streaming platform 17LIVE.

Yolo made successful exits from other companies, such as gaming platform Coolbet, making a seven times return, and Brazilian neobank Nubank, which IPOed in 2022.

So why allocate his money across so many small companies? Heath cites a recent example of a decision to spurn the opportunity to invest in a global technology company that was raising money on a $US25 billion valuation. “I asked the question internally to our investment committee: ‘What’s the upside here? How big can a $25 billion company go? Will it go to $100 billion? That’s only four times. That’s not the return we are looking for.’

“I’d prefer to get into something that is worth $10 million now. I can drive it to $150 to $200 million, which is 20 times [the return]. That absolute return on investment, that is what excites me.”

Heath started investing in other companies by buying a stake in an online slots software developer in 2017, building on his idea of trying to find efficiencies and improve profit margins for his gambling companies. “We identified inefficiencies in the supply chain, so to solve this, we asked the question: ‘Do we build something better ourselves; acquire a better company; or invest into a company building the solution, enjoy more efficient margins and help them grow their distribution and, hence, valuation?’”

He chose the latter.

That led to him looking at the entire gambling ecosystem and distilling it to what he calls a giant ecommerce engine that includes payment processing and fintech, odds compiling, risk management, customer support, retention, marketing, technology and other facets of the industry.

“You need to acquire a customer, drive them through the player funnel until they have a shopping cart with sports bets in it, which they then need to pay for via a payment service provider, and pending the results, we need to pay the customer winnings back as quickly as possible.”

His theory is that if he can create a network of companies to invest in that all improve the capabilities and profitability of the online gambling sector he operates in, then his companies will improve their distribution and turnover, hence financial performance, and he will also make good returns from investing from improved valuations.

“We want to strategically guide these companies – not overrule them – but if we can bring distribution that helps grow their valuation and a network of B2B [business to business] partnerships where they can do deals as more people use their software or increase their cashflow, then we’re also increasing our valuation on a longer-term play,” he says.

As for how Heath keeps track of his 100 investments? He has an investment committee and a team of about 15 people, all based in Guernsey and Estonia, to oversee the portfolio, but he also has a natural affinity with numbers. “I can recall distinct poker hands and odds against different opponents from when I used to play Texas hold ’em during my university days.”

Which is also where Heath’s career in gambling started.

He studied at the University of Melbourne, but jokes he got his MBA “at the Crown Casino poker room”.

He left Australia, hitched a ride on the Trans-Siberian Railway, stepped off in Russia to compete in a national poker championship (finishing fifth) then settled in Tallinn.

He later started an online poker website that went close to collapsing in 2013 when a third-party platform failed to reconcile player winnings. His parents helped him settle player balances.

A discussion over Christmas dinner with colleagues that year led to a talk about bitcoin and how blockchain technology, in which transactions are recorded in an open-source ledger, would remove the need for third- party settlements.

It solved Heath’s issues, and he and his team retooled the poker business into a bitcoin platform with slot machine games that proved immensely popular and eventually became the basis for Bitcasino.io.

Three years later, Heath got his developers to build a European sportsbook that became Sportsbet.io. He was away, parlaying deals to build global brand awareness with English soccer clubs such as Watford, Arsenal and, more recently, Newcastle United.

Today, the Yolo group employs more than 1100 staff across 13 countries.

More recently, Heath has spent €50 million to purchase and revamp an 800-year-old building on a cobblestone alley in the centre of Tallinn, transforming the block into an exclusive high-roller entertainment venue featuring upscale hotel accommodation, dining and, of course, a casino.

The private members’ club will allow players to continue their online gaming in the real world, building on Heath’s Bombay Club, which includes a yacht and Bombay Live, a global collection of live dealer studios supplying content to online casino partners. That in-person gambling and hospitality will keep Heath busy, but the investment side is something on which he also has a big focus.

When asked if he would consider selling Sportsbet.io and his other gambling firms, Heath says “everything is for sale at the right price”.

“If we got the right offer, then I’d say yes, but … we’re fortunate the money we are making allows us the facility to invest in this ecosystem and the network,” he says.

“If there was €500 million or €1 billion, I honestly think it wouldn’t change me in the slightest. “It would probably just mean I go and set up a few more funds and keep doing what I enjoy.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout