Stocks sink in regional sell-off as US-China trade war escalates

A new front in the trade war between the US and China ripped open, wiping $38 billion from the Australian market.

A new front in the escalating trade war between the US and China has ripped open, sending stocks skittling across the region and wiping $38 billion from the Australian market which suffered its biggest one day loss this year.

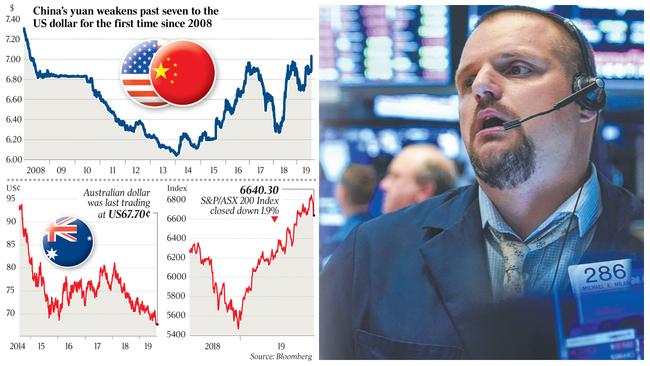

The fall in the value of China’s yuan below a key psychological mark — widely seen as Beijing’s response to US President Donald Trump’s move last week to add tariffs to another $US300 billion of imports from China — set off broad-based selling across the regions.

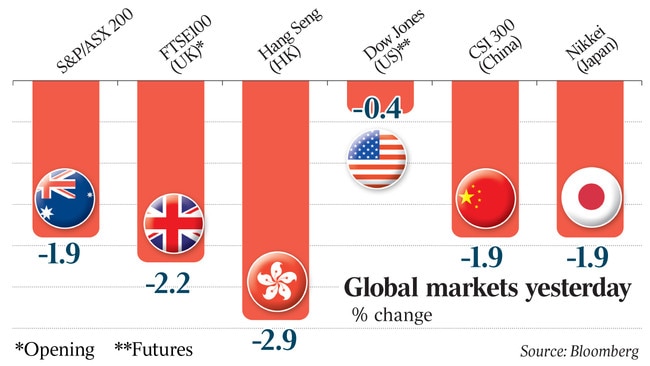

Hong Kong was hit hardest, down 2.9 per cent yesterday as investors sold stocks whose unhedged returns will be lower as a result of the currency fall. But Australia’s S&P ASX 200 ended the day down 1.9 per cent after losing 109 points in a sell-off that gathered steam through the day.

Currency markets were also caught in the downdraft as the Australian dollar also plumbed fresh decade lows.

Losses were amplified by a collapse in the iron ore price below $US100 a tonne, which hammered market heavyweights BHP, Rio Tinto and Fortescue Metals. Other China focused stocks including Bellamy’s, A2 Milk and Treasury Estate were hit hard in the broadbased sell-off.

The dollar continued to sell off and hit a new long-term intraday low of US67.48c — the cheapest since March 2009 — before recovering last night to US67.70c.

The latest round of volatility come as the Reserve Bank holds its monthly board meeting today. While economists expect the RBA to keep rates steady, they say it has retained its easing bias.

Kevin Bertoli, who manages an Asia-focused fund and listed investment company for PM Capital, said Hong Kong’s standing as a market window on China mainland earnings left its market particualry vulnerable to a depreciation in the Chinese currency.

“It’s important because the Hong Kong market is made up of companies that are exposed to the Chinese domestic market and their earnings are all being undermined,” Mr Bertoli said.

China, which usually manages the exchange rate in a tight band, allowed the currency to slip below the seven yuan to the US dollar in a move seen as retaliation to Mr Trump escalating tariffs on Chinese imports.

Both the onshore and offshore yuan pushed past the key resistance level, sparking commentary from the People’s Bank of China that the currency had been “affected by unilateralism and trade protectionism measures”.

A devaluation would help absorb some of the shock of the new tariffs and appeared likely to further provoke Mr Trump who wants a lower US dollar exchange rate to amplify the impact on Chinese exports.

But Mr Bertoli said the move carried risks of encouraging capital to flow out of China and highlighted that the months-long campaign against its trade tactics may be starting to bite.

“If you are resorting to your currency it means that you are probably running out of options,” he said.

The last bout of currency weakness in 2015 sparked what was described as the largest flight of capital in human history.

Julian Evans-Pritchard, senior China economist with Capital Economics, said the PBOC has “effectively weaponised the exchange rate” by linking the currency with the US trade war.

“Given that their goal is presumably to offset some of the impact from additional US tariffs, they are likely to allow the currency to weaken further, probably by 5 to 10 per cent over the coming quarters,” he said.

The currency comes amid ongoing protests in Hong Kong, with China-backed leader Carrie Lam making her first appearance in two weeks to warn the city was becoming dangerous and unstable. At the close of local trade, China’s Shanghai Composite was lower by 1.3 per cent while the Hang Seng had lost 2.9 per cent to hit its lowest levels since January.

Markets across the region were all down, following tumbles in European and US exchanges on Friday. Shares in London opened more than 2 per cent lower, weighed down by falls in mining stocks. Futures markers were pointing to falls on Wall Street when it opened for the week.

Mr Bertoli said the trade war escalation would have a delayed impact on the Chinese economy, which is already showing some strains including problems with some regional lenders forcing intervention from the state.

PM Capital has sold banks and other stocks exposed to broad macro themes recently to protect the fund from an unpredictable environment, with financial exposures cut from 15 per cent to 5 per cent.

China has threatened to retaliate to any new US tariffs, having already imposed its own duties on $US110 billion ($163bn) in American goods, almost all of the products it imports from the country.

A report from Bloomberg News said China has also asked its state-owned enterprises to stop buying US farm goods, in a further sign of escalating tensions.

Falling iron prices sent BHP 3.6 per cent lower to $37.38, Rio Tinto slid by 3.5 per cent to $91.49 while Fortescue shares slumped by 7.2 per cent to $47.09.

Iron ore futures in Singapore fell as much as 5.3 per cent, following a 10 per cent drop last week as iron ore port inventories in China rose for a third straight week.

The two key macro factors that inspired a massive run in iron ore prices this year — namely supply disruptions in Brazil and strong steel demand in China — have both started to turn against the sector in more recent days.