Stockmarkets tank as coronavirus fears take hold

Global markets were shaken overnight after Australian shares suffered their worst day in six months, plunging 2.3 per cent.

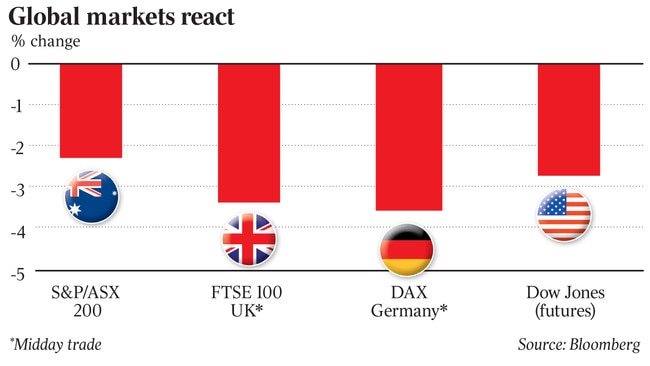

Markets were shaken overnight, with shares in Germany and London sliding more than 3 per cent on opening amid fears the coronavirus would cause a deeper hit to the global economy than previously expected.

The selldown came after Australian shares suffered their worst day in six months, plunging 2.3 per cent, while markets through Asia were sold off.

Bourses in Frankfurt and Paris both dived more than 3.5 per cent by midday and London’s FTSE dropped more than 3.2 per cent during the morning session.

The flight to safety was just as swift. Gold surged 2.5 per cent to a seven-year high of $US1680 an ounce.

South Korean authorities on Monday reported 161 new cases of the virus as Italy raced to contain the biggest outbreak in Europe.

Australia’s chief medical officer, Brendan Murphy, said the international developments were “cause for some concern”. He also flagged “significant growth” in the number of new cases in the Chinese province of Hebei, and “an increase in the number of deaths each day”.

Monday’s 2.3 per cent drop to 6978 points on the benchmark S&P/ASX 200, just days after Australian stocks made record highs, reflected the intensified fears about the potential damage wrought by the virus, which has now killed almost 2500 people.

Korean shares were hit even harder, slumping 3.9 per cent, while Hong Kong stocks were down 1.7 per cent in late trade. Futures markets pointed to further falls on Wall Street.

Wilsons Advisory head of Australian equities John Lockton said the growth in new cases outside China was a “critical factor” driving the sell-off.

“Part of the market’s narrative has been that COVID-19 is largely a Chinese issue with limited global spillover,” he said. “New cases in Italy and Korea test this assumption.”

PwC chief economist Jeremy Thorpe said the spike in cases in the manufacturing hubs of Italy and South Korea was “meaningful”, and warned that the epidemic would have a wider, deeper and longer-lasting impact than anticipated. He said it was “hard to believe” that the toll on the economy would not extend into the second quarter of the year, cruelling hopes for a sharp but short disruption similar to that of the SARS outbreak in 2003.

Yet Australian exporters struggling to deal with the collapse in demand from the country’s largest trading partner can expect some relief from a plunging currency.

The Australian dollar on Monday fell below US66c — its lowest level since March 2009 — bringing the devaluation to nearly 20 per cent since the dollar peaked above US81c in late January.

Futures traders brought forward their expected timing for further monetary stimulus to July from August, with the chance of a rate cut at the Reserve Bank’s April meeting rising to 41 per cent from 35 per cent.

Earnings season for ASX-listed companies has featured several businesses warning of crimped profits due to the closure of large parts of the Chinese economy over recent weeks as authorities struggle to contain the virus.

BlueScope Steel CEO Mark Vassella on Monday flagged its Chinese division was likely to make no money over the first six months of the year, with its four main steelmaking plants “heavily impacted” by the epidemic.

Economists also scrambled to update their models on the potential hit to growth.

Experts warned that the hit to the economy would now spill into the second quarter and that the government would struggle to achieve its promised surplus for this financial year.

KPMG chief economist Brendan Rynne said that “we are now seeing the coronavirus extending to something that is not going to be just a temporary impact on the global economy”.

A number of banks, including UBS and ANZ, already expected the economy to contract over the first three months of 2020 in what would be the first quarterly contraction since 2011.

Mr Rynne said he was even more convinced that Josh Frydenberg would not achieve a budget surplus this financial year, saying fulfilling the election promise would be a “tough ask” as the slowdown in the economy crunches corporate profits and boosts welfare payments.

The Treasurer has already flagged he is prepared to sacrifice the surplus to support rebuilding of bushfire-devastated regions.

“The reality is that, under the current economic circumstances, to continue to pursue a surplus at the expense of appropriate spending and support measures for the economy and the public would be the wrong policy option,” Mr Rynne said.

In a statement following a meeting of G20 finance ministers in Saudi Arabia over the weekend — attended by Frydenberg — International Monetary Fund managing director Kristalina Georgieva said “we all hope for a V-shaped, rapid recovery”, but warned that “given the uncertainty, it would be prudent to prepare for more adverse scenarios”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout