Why prognosis is excellent for ASX medical imaging stocks

The global medical imaging market, worth $38.5 billion in 2020, is forecast to hit $68.8 billion by 2030. And these ASX stocks are in the front line.

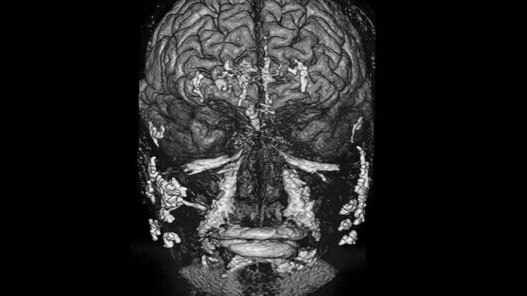

Medical imaging, also known as radiology, has come a long way since the days of the invention of the X-ray by German professor of physics Wilhelm Rontgen in 1895.

The first X-ray image was the hand of Roentgen’s wife Bertha. Medical imaging has become an essential part of healthcare from screening, diagnosis, treatment selection, and follow-up monitoring of patients.

Today medical imaging covers a variety of technologies including X-rays, ultrasounds, MRIs, CT scans, flurosocopy, and nuclear medicine imaging.

For the latest health news, sign up here for free Stockhead daily newsletters

So what are the differences between them?

- X-rays basically use a small amount of radiation to display the contrast between soft and hard tissue on film.

- Sonography uses high-frequency sound (or ultrasound) waves to create images of organs and tissues and can also look at blood flow.

- Magnetic Resonance Imaging (MRI) uses electromagnetic fields and radio waves to interact with the body’s water molecules to produce three-dimensional detailed anatomical images.

- A computerised tomography (CT) scan uses a series of X-ray images taken from different angles and uses computer processing to create cross-sectional images or slices of the bones, blood vessels and soft tissues.

- Fluoroscopy can be thought of as an X-ray movie allowing real-time monitoring using a contrast dye which the patient takes via IV, enema or a drink.

- Nuclear medicine uses radiopharmaceuticals to assess bodily functions, diagnose and treat disease, such as cancer.

Other medical diagnostics are also often grouped under medical imaging including those producing physiological functioning data such as:

- Electroencephalograms (EEG) monitoring brain function

- Electrocardiography (ECG) measuring heart activity

- Bioimpedance spectroscopy (BIS) analysing the body’s fluid composition using electrical resistance.

MORE FROM STOCKHEAD: Mach 7 positions for uptake | Knock, knock knocking on FDA’s door | LGP leads rush to psychedelics

Growth of market

The medical-imaging market size globally was valued at $38.5 billion in 2020 and is forecast to reach $68.8 billion by 2030, growing at a CAGR (compound annual growth rate) of 5.8 per cent from 2021 to 2030.

Factors contributing to the growth include an ageing population and greater demand by treating doctors for enhanced optical images for better diagnosis.

An emerging approach to maximising therapeutics’ effectiveness by taking into account individual variability in genetic and environmental factors – known as precision medicine – also is contributing to growth.

Here are some ASX-listed medical imaging stocks that could benefit from sector growth:

PRO MEDICUS (ASX:PME)

PME is a developer and supplier of healthcare imaging software and services to hospitals, diagnostic imaging groups and other healthcare organisations in Australia, North America and Europe.

The company was among Morgans healthcare analyst Scott Power’s picks for 2023. Power described the medical imaging company as one of the best growth stories on the ASX over the past decade.

“If you look at its history Pro Medicus has just been extraordinary and there’s no reason why that’s going to stop,” Power said.

“Outside of new contract announcements, we see confirmation on several banner customers as key to cementing the view its offering as best-in-class.

PME has five-year forward contracted revenue of $450m with many of its customers being tier one hospitals and integrated health-delivery networks.

IMEXHS (ASX:IME)

Considered a much smaller version of PME, IME is a next-generation ASX medical imaging company, based in Latin America.

IME develops cloud-based software as a service (SaaS) imaging solutions that includes a picture archiving and communications system (PACS), a radiologyinformation system (RIS), a cardiology information system (CIS) and an anatomical pathology laboratory information dystem (APLIS).

IME provides medical imaging software and radiology services in 18 countries, including Colombia, the US and Australia.

The company recently announced that RIMAB, its wholly owned subsidiary, had won its first contract with Colombia’s fifth-largest insurance provider, Famisanar.

Famisanar serves more than 2.4 million patients across 16 departments in the country.

The deal is expected to contribute an estimated $1.1 million in annual recurring revenue (ARR).

Visit Stockhead, where ASX small caps are big deals

VOLPARA HEALTH TECHNOLOGIES (ASX:VHT)

Medical imaging stock VHT, which specialises in the early detection of breast cancer, is another pick of Morgans for 2023.

Under the helm of its new CEO Teri Thomas VHT has risen 44 per cent YTD, after positive announcements, including a first profitable quarter.

Furthermore, the US FDA recently finalised a new federal regulation requiring mammography facilities across the country to inform patients whether their breasts are composed of dense tissue.

The new ruling will significantly benefit VHT as nearly 40 million mammograms are performed each year in the US, with the company’s software is used to assess the breast density of more than 6 million annually.

VHT has moved to securing deals with several “elephant-sized” industry leaders for recurring revenue growth and profitability.

MICRO-X (ASX:MX1)

MX1 produces a range of portable X-ray systems, most commonly used in healthcare applications such as aged care homes and military or humanitarian field hospitals.

The company is also branching out from the medical sphere, with its bomb detection Argus X-ray camera commercial launch due in the next couple of months, which is set to be a key catalyst for the company.

Mx1 claims the new Argus IED X-ray camera will allow bomb-disposal technicians to safely image suspect packages remotely with greater clarity than ever before.

OPTISCAN IMAGING (ASX:OIL)

OIL is a leader in development of endomicroscopic imaging technologies for medical, translational and preclinical applications.

The company’s tech enables real-time, in-vivo imaging at the cellular level in human and animal tissue and is used by leading research institutions and hospitals in North America, Europe, Asia and Australia.

Its goal is to support medical practitioners and researchers in providing better outcomes while saving resources for healthcare providers.

It helps surgeons make instantaneous decisions in operating theatres to improve patient outcomes and has potential to revolutionise clinical practice, cancer surgery and life sciences research, the company says.

Optiscan recently announced positive interim results of its oral imaging study conducted by Professor Farah and his team at the Australian Centre for Oral Oncology Research & Education.

The results show that diagnostic accuracy was extremely high, at 88.9 per cent, for the presence of dysplasia/carcinoma.

MACH 7 (ASX:M7T)

M7T has emerged as a leader in enterprise imaging, with three modular products that work to provide an integrated approach to creating, storing and viewing medical images.

The company is working to help hospitals move away from departmental imaging solutions to a broader enterprise approach, so clinicians have access to all medical images of a patient rather than just those taken in just their department.

M7T said 80 per cent of images produced in a hospital are out of the radiology department but its enterprise solutions incorporate images captured throughout the whole hospital, which are often just digital images on a camera saved as a JPEG to a hard drive in a department such as ophthalmology or dermatology.

M7T posted a record Q2 FY23 in sales orders, aided by the signing of its largest contract to date in December with Nasdaq-listed Akumin Inc.

Sales orders for Q2 FY23 were a record $22.4 million (TCV), up 280 per cent on $5.9 million in Q2 FY22 (or up 240 per cent on $6.6 million in constant currency).

NOW READ: Mach 7 positions for enterprise imaging uptake

Telix Pharmaceuticals (ASX:TLX)

TLX is focused on the development and commercialisation of diagnostic and therapeutic radiopharmaceuticals.

The company’s research pipeline aims to address significant unmet medical need in prostate, renal, brain, and hematologic cancers as well as a range of immunologic and rare diseases.

TLX products use targeted radiation to image disease and deliver personalised therapy.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here