Trader’s Diary: Everything you need to get ready for the week ahead

With war in Ukraine, the prospect of much tighter central bank policy and China’s Covid-19 mess all in play, here’s your background to a new week.

With war in Ukraine, the prospect of much tighter central bank policy and China’s Covid-19 mess all having an effect, here are the things you need to know if the week is going to be good to you. (No promises!)

Major economic headlines last week

Cast asunder upon an ocean of volatility, global share markets had yet another nauseatingly choppy week with a tide of worries about monetary tightening v. high inflation driving trade headlong toward what looks a lot like the icebergs of possible global recession.

Although local markets had a wee bounce at the end of the week from them that BTD when levels look oversold.

-

For the latest stock market news, sign up here for free Stockhead daily newsletters

-

For the week ending Friday 13th:

Wall St down 2.4%

EU markets up 1.4%,

Japan’s Nikkei down 2.1%

Chinese markets up 2%

ASX200 down 1.8% and;

The Emerging Companies (XEC) index down 6.2%

Bond yields pulled back from their highs and metal and iron ore prices fell. Oil rose, but honestly WTF. Worries about global growth also dragged the Aussie dollarbuck down and the greenback up.

NAB’s Alan Oster says concerns around the risk of a recession in either the US or Europe are a bit elevated.

The key headaches in play:

The Ukraine/Russia war, which has added to already high inflation

The rapid shift to much tighter (prospective) central bank policy

China’s zero-Covid way of wrecking its economy and the implications for domestic consumption, trade and global supply chains

US Earnings

More than 90% of US S&P 500 companies have now reported March quarter earnings with 76% beating expectations. Consensus earnings expectations for the quarter have now moved up to 11.7% yoy from 4.3% at the start of the US reporting season.

Industrials, energy, materials and industrials are seeing the strongest growth. Earnings growth in Europe & Asia has been averaging 13.9% yoy.

According to AMP Capital, from their bull market highs US shares are down 16%, and Eurozone shares are down 15%. Japanese shares are down 14%, global shares are down 15% while Australian shares are down 7%.

-

Visit The Australian’s Stockhead page, where ASX small caps are big deals

-

While European and Japanese shares initially fell harder after the invasion of Ukraine, the concern recently has swung back to higher inflation and higher interest rates which has really weighed on the US share market with its higher tech exposure. The tech-heavy Nasdaq has lost 27%.

The recent pullback in the commodity complex has weighed on local markets, but that’s been offset by the All Ords’ lower exposure to tech.

Shares could have a further near-term bounce from oversold levels. But risks around inflation, monetary tightening, the war in Ukraine and Chinese growth remain high and still point to more downside in share markets before they bottom.

US inflation

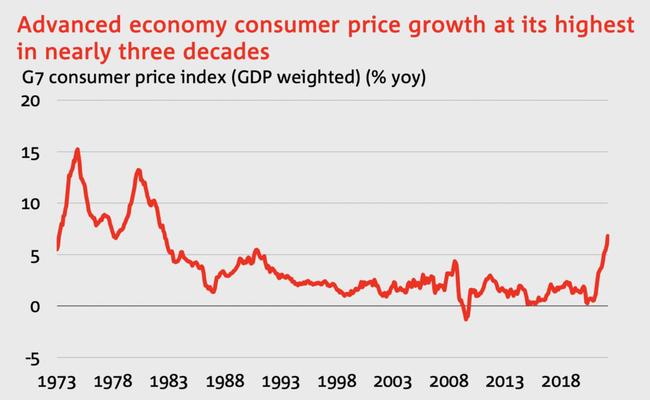

Yes, that came in toppier-than-expected again for April. While annual inflation fell slightly – from 8.5% yoy to 8.3% for the CPI and from 6.5% yoy to 6.2% for core inflation – it was still higher than expected, AMP’s Shane Oliver says.

“While inflation may have peaked it looks like staying too high for comfort for the Fed (and other central banks) for a while yet keeping it on track for 0.5% rate hikes at the next three meetings,” Dr Oliver added.

Crypto-crash

I guess we should talk about stablecoins and the demise of TerraUSD (UST) flailing to $US0.4. This led to a domino impact hitting demand for the broader sector.

Bitcoin, which UST’s supposedly reliable sister coin (LUNA) and its reassuringly named Luna Foundation Guard sold off to try and save/support UST, added to the pace of selling.

Crypto, already under pressure, had a week to forget. Bitcoin is now worth less than half what it was during last year’s bull run.

Economic calendar for this week

Australia

Tuesday

RBA Minutes

Wednesday

April Westpac – MI Leading Index

Q1 wage price index

Thursday

April Unemployment

Global

Monday

China April retail sales

China April fixed asset investment

China April industrial production

EU March trade balance

UK May Rightmove house prices

US May Fed Empire state index

Tuesday

EU Q1 GDP

UK March ILO unemployment rate

US April retail sales

US April industrial production

US March business inventories

US May NAHB housing market index

Fedspeak – Chair Powell interview. Bullard, Harker and Master speaking too.

Wednesday

NZ GlobalDairyTrade auction price (WMP)

Japan Q1 GDP

Japan March industrial production

EU April CPI read

UK April CPI read

US April housing starts

Thursday

NZ Q1 PPI (inflation) read

NZ Budget 2022

Japan March machinery orders

US Initial jobless claims 203k

US May Philadelphia Fed index

US April existing home sales

US April leading index

Friday

NZ April trade balance

Japan April CPI

EU May consumer confidence

UK May GfK consumer sentiment

UK April retail sales

Sources: CommSec, Westpac, NAB Trade

IPO Watch

These are the companies listing this week, according to the ASX:

Southern Cross Gold (ASX:SXG)

Listing: 16 May

IPO: $10m at $0.20

This gold explorer is focused on revitalising the Victorian goldfields, which host Fosterville and Costerfield, two of the highest-grade underground deposits in the world.

The company is a spin-out from Toronto Stock Exchange listed Mawson Gold – which is now a Nordic focused gold exploration company that holds the Rajapalot gold-cobalt project in northern Finland.

SXG operates the Sunday Creek, Redcastle and Whroo projects in Victoria, along with the Mt Isa polymetallic project in Queensland.

Demetallica (ASX:DRM)

Listing: 16 May

IPO: $15m at $0.25

Another explorer, this one is a spin-out from Minotaur Exploration (ASX:MEP) targeting gold, gypsum and base metals at its projects across Queensland and SA.

The company holds the Pyramid Gold project, Windsor copper-zinc-lead-gold-silver project and Chimera copper-gold-lead-silver-zinc projects in Queensland.

DRM also has the Peake and Denision copper-gold, zinc-lead-silver JV and the Lake Purdilla gypsum project in SA.

“The company benefits from the past decade of intensive minerals exploration and resource definition work carried out by Minotaur,” chairman Dr Roger Higgins said.

“Demetallica will continue on that pathway, focused primarily on copper-gold exploration within Australia.”

Aurora Energy (ASX:1AE)

Listing: 18 May

IPO: $8m at $0.20

This company is focused on the exploration and development of its Aurora Project in Oregon, USA.

The project hosts a defined uranium resource and is prospective for lithium. The company will conduct exploration and evaluation programs to assess the potential of both these minerals.

Bindi Metals (ASX:BIM)

Listing: 19 May

IPO: $4.8m at $0.20

This explorer is planning to acquire the Biloela project in Queensland which is prospective for gold and copper.

The company plans to compile data and geophysical surveys at the Flanagans and Great Blackall prospects, followed by a drilling program at both prospects.

TG Metals (ASX:TG6)

Listing: 20 May

IPO: $6m

This explorer is focused on assets prospective for nickel, lithium and gold in the Goldfields-Esperance region of WA.

It actually holds the largest land package ever held by one company in the history of exploration within the Lake Johnston Greenstone Belt and says the region has been historically overlooked and underexplored – with the Lake Johnston project never the main focus for nickel majors that previously held the ground.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout