Stockhead Trader’s Diary: Everything you need to get ready for the week ahead

As we head back to work, here’s a wrap of recent events likely to affect the market and a look at the week ahead.

As we head back to work, here’s a wrap of recent events likely to affect the market and a look at the week ahead.

China remained a point of focus last week, with the People’s Bank of China having eased monetary policy twice the week before.

But the surprise came on Thursday, when China’s unofficial No. 2, Premier Li Keqiang popped up to warn everyone that the world’s second largest economy is in its worst shape since Wuhan 2020. That hit the miners and put a cloud over a very large part of the local bourse.

The sheer unorthodoxy of the announcement – in the run up to a very important National People’s Congress for third term wannabe, President Xi Jinping – is also raising eyebrows.

–

For the latest ASX news, sign up here for free Stockhead daily newsletters

–

Power struggle anyone?

But first … after a quick dash around the global stage with new PM Anthony Up The Road Albanese, who returned on Thursday to get a start on the ritual economic trash-talking of the fiscal mess the last bunch left.

On Wednesday, new Treasurer Jim Chalmers laid the groundwork with an old refrain, telling literally every news outlet – except maybe us and Better Homes and Gardens magazine – that he’d just checked the books and was appalled to discover he’d inherited a dogs dinner of a dire fiscal situation, warning that family budgets would be under pressure as interest rates spike with inflation.

“I want an economy that works for people, not the other way around,” Albanese told ABC television on Thursday, repeating a bit of an election mantra which ends with a promise to “business and unions to drive productivity, to lift wages and profits.”

It was a busy week all round

Albo was sworn in on Monday so he and FM Penny Wong could fly the flag at a key Quad Group meet in Japan about China, which sees the grouping – made up of India, the US and Japan – as obvious pushback against its growing influence in the Indo-Pacific.

- In Tokyo he signed onto a new plan to deal with China’s illegal fishing activities;

- And signed up to a new 13-member economic love-in that includes the Quad and other major regional partners and looks a quick fix for the failed Trans-Pacific Partnership blown up by the previous US administration of former US president Donald Trump;

- Albo got to talk clean energy and stake his credentials for a global climate chat hosted by Albo here in god’s own;

- Then Foreign Minister P. Wong hit the islands for a regional outreach race/program arriving in Fiji just ahead of Chinese Foreign Minister Wang Yi, who’s touring the facilities himself – visiting five Pacific Islands nations over the next fortnight, including the Solomon Islands.

- P. is telling any Pacific nations who’ll listen that Australia will stand “shoulder to shoulder” with them to blunt Chinese influence … no, wait – to address the climate crisis …

- And China ended a years-long sulk of being incommunicado with an official Albogram, congratulating Albo, P. and the rest on their election win, which was significant, but not a game breaker.

Meanwhile, in central bank, central

Last week the central banks of several advanced economies – and New Zealand – began in earnest their shift away from the ultra-low interest rate environment of the pandemic era.

The theme is hiking and some of the big hitters came out to play.

On Monday, the minutes from the US Federal Reserve’s last meet revealed the current POV is that after two more 50 basis point (bps) hikes the bank will adopt a ‘wait and see what we’ve done’ posture. The Fed began its tightening cycle in February with a 25bps hike, the first since 2018, followed by a further 50bps at the last meet.

In any case, Wall Street took this as goodbye to the chance of any 75bps hikes suggesting it’ll be all flexibility from the bank and more breathing room for investors. Probably why US markets came out 6.6% ahead, Wall Street’s first weekly gain after seven straight weeks of declines.

–

Visit The Australian’s Stockhead page, where ASX small caps are big deals

–

Last week the States had better than expected retail data, a pick-up in M&A action (not you Elon), some solid US economic data and more signs the US may’ve already hit peak inflation.

RBNZ to lift the cash rate by 0.5% – 50bps – taking it to 2% while upwardly rebooting its forecasts for the Kiwi cash rate to peak at 3.9% next year.

On Wednesday, ECB President Christine Lagarde got out in front of speculation over near-term monetary policy moves at this year’s Davos Thingy, which pretty much everyone forgot about.

She said that’ll be it for quantitative easing by early next quarter, with a rate hike booked for July.

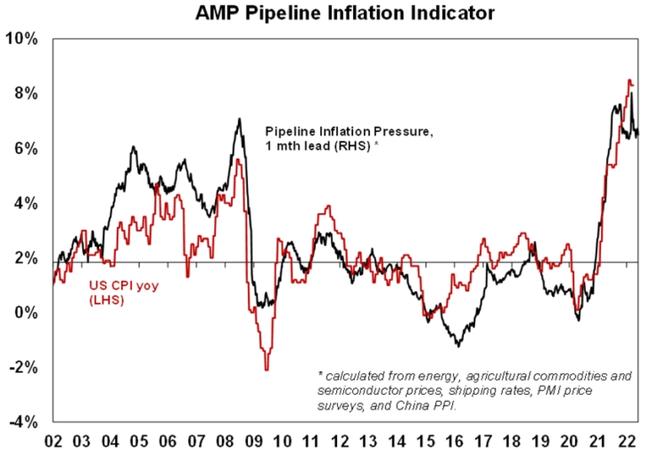

But this is the message from AMP’s Dr Shane Oliver, who warns don’t hit peak, “peak inflation” too early. With these totally unpredictable and awfully toppy gas, electricity and oil prices “a fly in the ointment of the peak inflation theory”.

“Commodity prices generally still look strong, this could be accentuated if Europe bans Russian oil (as looks likely) and there is a disruption to Russian gas flowing to Europe.”

He says, even if American inflation has peaked it will take a while before it’s fallen back to levels where the Fed Chair Powell and his Federal Open Market Committee buddies can expect to sleep soundly again.

At home, AMP has previously forecast that Aussie inflation likely won’t peak until later in 2022 – with petrol prices already higher, energy bills spiking (on earlier very high wholesale power prices which only arrive in power bills next month) and supermarkets apparently unable to contain rising prices.

But on the plus side, Dr Oliver told Stockhead Australian sharemarkets are yet to see “clear signs of a wash out bottom”.

“With the VIX and put-call ratios yet to reach levels seen at past major share market bottoms … look, while we remain optimistic recession will be avoided in the next 18 months and so shares can rise on a six-12 month view, the bottom line is that shares are still at risk of more downside in the short-term … notwithstanding that the current bounce may have further to go,” he said.

Economic calendar for this week

Source: Commsec.

AUSTRALIA

Tuesday

ABS April dwelling approvals

ABS Q1 company profits

ABS Q1 business inventories

ABS Q1 current account,

ABS Q1 net exports

ABS Q1 public demand

Wednesday

CoreLogic home value index

ABS Q1 GDP

Thursday

April trade balance

Friday

April housing finance

INTERNATIONAL

Monday

US Memorial Day – public holiday. Markets closed.

EU May economic confidence

EU May consumer confidence

Tuesday

NZ April building permits

NZ May ANZ business confidence

Japan April industrial production

China May manufacturing PMI

China May non–manufacturing PMI

EU May CPI

UK April net mortgage lending

US March S&P/CS home price index

US May Chicago PMI

US May consumer confidence index

US Dallas Fed index

Wednesday

Japan May Nikkei manufacturing PMI

China May Caixin China PMI

EU May S&P Global manufacturing PMI

EU April unemployment rate

UK May S&P Global manufacturing PMI

US May S&P Global manufacturing PMI

US April construction spending

US May ISM manufacturing

US April JOLTS job openings

Federal Reserve’s Beige book.

And in Canada, the Bank of Canada policy decision!

Thursday

NZ Q1 terms of trade

US May ADP employment change

US Q1 productivity

US Initial jobless claims

US April factory orders and durable goods orders

Friday

NZ Q1 building work put in place

Japan May Nikkei services PMI

EU May S&P Global services PMI

EU April retail sales

US May non-farm payrolls

US May unemployment rate

US S&P Global services PMI

US May ISM non–manufacturing

Companies listing

These are the companies are listing next week: according to the all ordinary ASX and the all extraordinary Emma Davies.

Uvre (ASX:UVA)

Listing: 30 May

IPO: $6m at $0.20

The company plans to explore and potentially develop its East Canyon project in Utah.

The project is prospective for both uranium and vanadium, two minerals anticipated to play a key role in the generation and storage of low-carbon energy.

Kingsland Minerals (ASX:KNG)

Listing: 31 May

IPO: $5.5m at $0.20

This company has four projects across the NT, including the Allamber uranium and copper project, the Shoobridge uranium and gold project, the Woolgni gold project and the Mt Davis copper and gold project.

Kingsland also holds the Lake Johnston nickel and cobalt project in WA.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout