Stockhead: Why end to China’s coal ban might not be huge deal

An inkling China might lift its ban on Aussie coal has driven up ASX stocks – but our miners are doing just fine without the Middle Kingdom.

In October 2020, China struck Australian coal miners off its list of suppliers who were allowed in the club.

Ostensibly the still-never-officially-announced boycott to suspend a trade relationship covering a third of the almost 200Mt of Australian coal sold on the seaborne market was designed to hurt.

Australia and its then prime minister Scott Morrison had entered China’s bad books after calling for an investigation into the origins of Covid-19.

But with Anthony Albanese now in the Lodge it appears as though moves are afoot to bring the trade partners closer together.

–

For the latest mining news, sign up here for free Stockhead daily newsletters

–

Aussie foreign minister Penny Wong enjoyed what we can only imagine was a six-pack of Bintang with her Chinese counterpart Wang Yi in Bali on Friday in a hint frosty relations between the nations are thawing.

Then yesterday a note emerged from Shaw and Partners’ venerable research chief Peter “Rocky” O’Connor, suggesting industry monitor Sxcoal was reporting Aussie coal would be allowed back in by the bouncers at China’s ports in August or September, with steel mills advised.

Cue manic buying in Australian coal stocks on the ASX.

Yancoal (ASX:YAL) climbed 9.71% to $5.65, New Hope Corp (ASX:NHC) was up 6.97%, Bowen Coal (ASX:BCB) rose 14.29%, Stanmore (ASX:SMR) gained 5.95%, Queensland coal miners Coronado (ASX:CRN) and Terracom (ASX:TER) were both up more than 8.5% and diversified players BHP (ASX:BHP) and South32 (ASX:S32) lifted 2.49 and 1.71% respectively.

‘News to us’: Experts

Market experts though have questioned what impact the reversal of the ban will actually have on the Australian coal trade.

China is largely self-sufficient in thermal coal supply, meaning the main beneficiary of an end to the trade ban would be coking coal producers, who supply steelmakers.

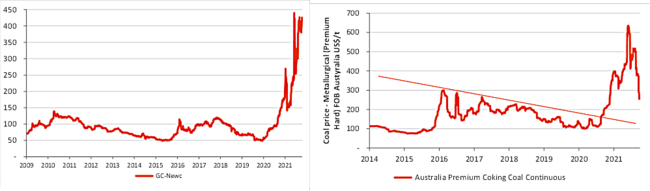

But prices for met coal are already down more than 60% since their outlandish peak of US$671/t in March, as global economic jitters and an industrial slowdown in Covid-stricken China take the heat out of the market.

–

Visit Stockhead, where ASX small caps are big deals

–

O’Connor said the return of the Aust-Sino coal trade would benefit coking coal producers the most.

“This Chinese decision may be the catalyst that closes the met coal price higher (~US$250/t) towards thermal coal price (~US$430/t). This would go some way to redress the pricing anomaly that has recently seen met coal price – the premium coal offering – trade at a discount to thermal coal,” he wrote yesterday.

On the other hand, Merlon Capital Partners analyst and portfolio manager Ben Goodwin, who knows his way around the energy market, says the news comes as steel demand in the Chinese market is on the wane, amid poor mill margins.

“I have no information on this potential move by China, but do question why they would be relaxing the coal import ban as it has increased its own production of thermal coal and their steel mills seem to be reducing production due to 1) production caps and 2) poor end market demand due to Covid,” he told Stockhead.

“The only reason I can think of could be a deal with Biden post tariff negotiations.”

Wood Mackenzie’s Rory Simington, who heads up its Asia-Pacific coal research, says the news largely seems to be piggybacking off the thawing diplomatic relations between China and Australia’s new Albanese Government.

“(The reports) don’t surprise me but we haven’t heard anything that indicates that the ban’s going to be lifted,” he said.

“It seems to be based on the fact the Australian and Chinese Governments are now talking to each other again, which is positive news, but I think it’s likely there is some way to go before the ban is actually lifted.”

Out from the coal

Since the ban came into place, Australian coal miners have been untethered from the Chinese market.

They’ve been none the poorer for it, as China’s rush to secure replacement tonnes gave coking and thermal coal their first post-Covid boost.

“China needed to replace that Australian material, they had to go to other markets to get it and the availability of replacement coal wasn’t that easy to get,” Simington says.

“It ended up pushing up prices for non-Australian coal, which then supported prices for Australian coal.”

That dynamic has been superseded as the price driver for thermal and metallurgical coal by a crippling gas shortage in Europe and Asia and lately the supply shock from Russia’s invasion of Ukraine.

Newcastle 6000kcal low vol thermal coal is paying a near record US$432/t right now.

Met coal prices have slipped back in recent days – more on that later – but were supporting huge mining margins in the first half of the year with prices for premium met coal as high as US$671/t.

Australian coal miners who had their backs to the wall two years ago are now retiring debt and their shareholders bathing Scrooge McDuck-like in monstrous dividends.

Australia’s largest pure play coal miner, the majority Chinese owned Yancoal (ASX:YAL) delivered a ridiculous $930 million dividend alone.

Other company profits have taken collective payments from the sector so far in 2022 to well over one billion buckaroos.

Clearly they’re doing all right without the China market at this point.

A spokesman over at $5.5b Aussie coal bellwether Whitehaven (ASX:WHC), which was up a rollicking 6.5% yesterday to a four-year high, responded to our questions on the Chinese whispers with a cool indifference.

“China is not a market for us as our coal spec is oriented to premium (JKT) markets,” he said.

Aussie supply all bought up

A spokeswoman for BHP (ASX:BHP), Australia’s largest exporter of coal for steelmaking, said the firm had seen the reports circulating but did not comment on speculation.

The world’s biggest miner’s CEO, Mike Henry, has previously stated he expected the freeze to last for several years, suspending a relationship that BHP’s chief analyst Hugh McKay called the solar system around which the seaborne coal trade orbited.

However, Australian miners have had little trouble finding replacement markets, and most are booked to the absolute gills right now.

The ex-China market for thermal coal is particularly tight, something that has seen prices rise sharply on supply shocks like heavy rains which have cut off rail access to the major coal export hub of Newcastle.

“I think there’s very little if any spare coal at the moment,” WoodMac’s Simington said.

“Exports out of Newcastle have basically ground to a halt, the Newcastle rail line has been closed, we’re probably looking at one or two weeks of no rail at all, and there’s very little coal at ports.

“The shiploading has basically ground to a halt.

“We actually think (exports) are now going to be a little weaker in 2022 just from the supply side, not the demand side because demand is exceptionally strong at the moment.”

Simington thinks the traditional premium for coking coal over energy coal will return in time, but it could take a while for the current supply crunch to run its course.

“You’ve got a totally different demand outlook for the two different coal types,” he said.

“While we go through the impact the sanctions on Russian coal are going to have in the market and while the steel market and the global economy is looking very fragile, this gap between thermal and coking coal prices could persist for a while.

“Ultimately you would think some sort of normality will return and we’ll see more traditional pricing with coking coal higher than thermal coal.

“I think we’re going to have to see thermal coal prices reducing probably more so than coking coal prices increasing.”

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout