Stockhead: They’re not being cryptic – this is how ATO will kick your Doge when it’s down

A fraught financial year in crypto is coming to an end, and the ATO bloodhounds are about to be let off the leash. Here’s what you need to know.

Hola, Coinheads.

Capital gains on crypto assets like Bitcoin and Doge are totally taxable in Australia. Just thought it might be a good time to flag that.

Now might also be a handy time – I mean, Bitcoin has carved out a steadying range between $28k and $32k in the past week – to consider the wonderful variety of tax implications the ATO has in mind for all the other fun crypto-centric tricks we like to play, from token swaps, staking, or just plain yield farming.

For most of May, BTC kept in lock step with the US stock market, and that tether actually is holding as BTC retreated like everyone else after the pretty alarming economic outlook peddled by JPMorgan Chase CEO Jamie Dimon.

–

For the latest crypto news, sign up here for free Stockhead daily newsletters

–

Overnight BTC is down 7% and trading below whatever is suggested by the ‘key psychological threshold’ that everyone pegs as US$30k.

Dimon’s talk of a looming ‘hurricane’ follows the historic crypto market freefall which erased billions of dollars of crypto market values, just as it did from the bank balances of mum and dad investors alike.

That doesn’t change anything.

Right on cue, the ATO put out a wee-reminder/warning to Aussie crypto-investors, nudging them that “capital gains and losses must be reported every time a digital asset, which includes non-fungible tokens (NFT)”, is sold.

The assistant commish Tim Loh, a big fan of bad news and ‘carrying the one’, added “crypto losses can’t be offset”. Unlike, say, negative gearing.

Adding that there’s no escape – we’ll find you, hunt you down like a Doge in the street and extract every last wayward coin – Loh said that via the ATO’s new kick-ass data collection processes, “we know that many Aussies are buying, selling or exchanging digital coins and assets”.

“So it is important people understand what this means for their tax obligations.”

Woo.

Obligations?

These are volatile times and volatile assets like the BTCs of this world need to be high on our list of address-ables as we near the end of fiscal ’22.

Speaking to Stockhead patiently – like I was a child in all matters tax, correctly – Elinor Kasapidis, senior manager tax policy at CPA Australia, warned regardless whether you’ve made or lost money on crypto, exchanged one cryptocurrency for another or sold some airdropped coins, you’ll probably have some tax issues to think about in the next weeks.

–

Visit The Australian’s Stockhead page, where ASX small caps are big deals

–

Because, while Australian citizens don’t have to pay tax on the way into Cyrptoland – ie: pay tax when buying cryptocurrencies, as long as the purchase is made with fiat currencies – things change on the other end.

“And if the terms wallets, protocols, chain splits, staking rewards, DeFi and airdrops mean something to you, well, maybe you should familiarise yourself with the rules on crypto investment and trading pretty quick,” Kasapidis says, possibly ironically. I couldn’t tell.

How does the ATO clock your crypto asset?

First up, kids, the Australian Taxation Office views crypto assets as property – which means they fall within the remit of capital gains tax.

“Like other capital losses, crypto losses are deductible against your capital gains. So, if you’ve lost money on your investment, you can deduct it from other gains you’ve made.

“If you’ve exchanged your Ethereum for Dogecoin, lost money on Tether or bought some goods with your Bitcoin debit card, don’t forget about the tax rules. It can be confusing so consider talking it through with a registered tax agent to get it right.”

Savvy, one of Australia’s largest online financial brokers, reminds us that Crypto can be taxed when swapped, spent or gifted.

It says 70% of Aussies buy crypto to build wealth, 34% to retire early and 28% for portfolio diversification.

Crypto is tax-free if used for personal purchases or donations.

Woah. Isn’t cryptocurrency untraceable?

In theory, two transactions between two individual crypto wallets are untraceable – unless you can reveal the identity of the wallet holders.

According to Savvy, for most crypto holders, they usually convert their fiat currency (or normal money) into crypto by way of an exchange.

In order for major crypto exchanges to trade financial instruments in Australia, they need to stay under the auspices of the consumer watchdoge, ASIC (Australian Securities and Investments Commission) or the banking regulators at APRA, the (Australian Prudential Regulatory Authority).

These exchanges become Designated Service Providers (DSPs).

If you’ve ever signed up for an exchange, you’ll know they want heaps of personal data – this is Know Your Customer (KYC) data.

Like the 100 points of government issued ID, a current photo to check, your bank account, your ABN and so on.

If you use a DSP in Australia, it’s highly likely the ATO has all your KYC and transactional data already – as far back as 2014, in fact.

All Australian-operating exchanges share data with the ATO as part of their regulatory framework.

The last few years, hundreds of thousands of crypto-Aussies got a warm letter saying failure to declare crypto holdings gets a charge of tax evasion. Just like Wesley Snipes.

This is going to go down one of two ways

Basically you’re staring down a two-way street – just as in life or when supporting a shite football team – a binary outcome in terms of possible tax events

Firstly, the generic Aussie taxman or taxwoman has been trained to look at cryptocurrency just like other assets – say shares or Vaucluse mansions.

Whatever profits you mercantile fiends have made in the last 12 months, these are all totes liable for capital gains tax. And so too is your cryptocurrency.

For this they are just looking at the gains element only. So the dollars you’ve gleamed when selling price is subtracted from the buy price.

You bought at $5 you sold at $7, they’ve added $2 to your income statement for the year and taxed outrageously on that.

If you’re a company, you’re not entitled to any capital gains tax discount and you’ll pay 30% tax on any net capital gains. Period, the end, no more.

If you’re a bloody individual (like the perfectly sane gentleman below), the rate paid is the same as your income tax rate for that year.

For SMSFs, the tax rate is 15% and the discount is 33.3% (rather than the fitty per cent for individuals, like the ordinary Aussie above).

The other path the taxbeasts will look at is a bit blurrier and examines whatever gains you’ve made outside of the ordinary buy and sell.

Here we’re talking crypto staking, token exchanges and yield farming et al. Any cunning profits you’ve made here fall within the remit of income tax, which – you can bet the house that Dogecoin built – will be instead slapped onto your income tax for the year you splurged.

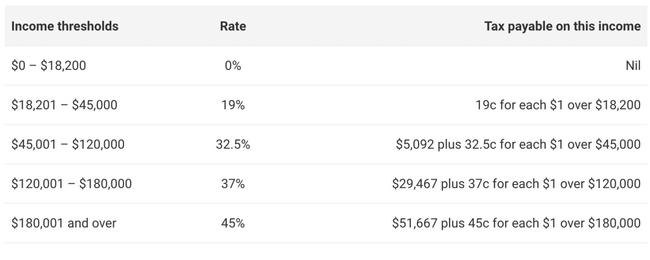

Australian income tax rates for 2020–21 and 2021–22 (residents)

Australian income tax rates for 2020–21 and 2021–22 (residents)

Kasapidis says there’s now millions of Australians out there poking about exploring non-traditional alternatives to shares and property to build their wealth … and almost one in five of these taxpayers now invest in cryptocurrency, and must report any gains or losses in their tax return.

However, if you hold onto your crypto for over a year, which I’m told can happen, a full fitty (50%) discount on your capital gains liability will apply.

That’s pretty good, remembering the exact dollar-buck tax rate you end up bleeding will depend on your personal circumstances, how rich you aren’t/are, how many houses and/or shares in the small cap cannabis sector you own and the total investment returns for each specific period and asset.

“The ATO matches transaction data from digital exchanges, so it is more important than ever to ensure cryptocurrency gains and losses are correctly reported,” Kasapidis says.

“If you use cryptocurrency in business, such as to run your start-up or to trade large volumes of cryptocurrency, different rules apply,” she added before falling – I felt a little cryptically – silent.

Spoiled for CHOICE

Meanwhile, the consumer advocate legends just down the road in Alboville (Marrickville, duh) at CHOICE magazine are hoping some of our exchanges which are controlling, flogging or snapping up crypto assets will soon be subject to the same kind of consumer protection obligations which are all over the shop in traditional financial services.

The ATO seems to be all over governing this stuff, and it’s not even about the cost on mind and soul and bank balance when the volatility gets volatile.

Only about one in 10 Australians have purchased a cryptocurrency over the past 12 months, but plenty have been scammed.

In light of the data, which shows the increasing interest in crypto trading, the rise in aggressive marketing and the huge growth in scams, the legends at CHOICE are ‘urgently calling for better regulation’.

“The crypto market is booming, but our laws are lagging behind,” CHOICE’s Patrick Veyret said on Wednesday.

“More and more Australians are purchasing crypto assets such as Bitcoin and Etherum without adequate consumer protections.”

Earlier this year, CHOICE reported Aussies had been fleeced of almost $100 million via crypto investment scams in 2021.

The total loss for crypto scams in general was $129 million.

Veyret says it was the country’s costliest scam at the time, and probably still is.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout