Stockhead Gold Digger: Investors falling in love with junior ASX gold stocks again

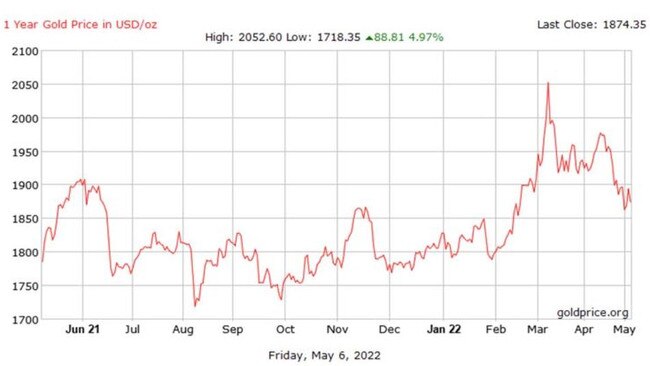

Gold is coming out of a wild week, in which it hit a three-month low. Yet good news stories are finally moving the dial on junior ASX gold stocks.

What a wild week for gold

Gold hit a 3-month low early in the week as traders priced in a super aggressive Fed tightening, which didn’t materialise.

On Thursday, the Fed hiked by 0.50%, and eased concerns around future 0.75% hikes. Gold jumped sharply to $US1881.50 an ounce in response, before continuing its rally in Asia, gaining an impressive 1.10% to $US1901.65 by close of play.

That rally didn’t last long, but gold continues to hold up quite well, says OANDA senior market analyst Jeffrey Halley.

“Gold staged quite an impressive rally in early trading yesterday, but as the US Dollar soared, it gave back all those gains to finish 0.23% lower at $1877.00 an ounce, where it remains in moribund Asian trading,” he said late Friday.

–

For the latest mining news, sign up here for free Stockhead daily newsletters

–

“Still, given the moves seen in other asset classes, gold is holding up reasonably well.

“It is steady despite US 10-year yields moving above 3.0% once again, and it is definitely outperforming Bitcoin right now.”

That said gold needs to close above resistance at $US1920, and preferably $US1960 an ounce, to get the gold bugs excited again, Halley says.

“I see more whipsaw trading ranges in the days ahead,” he says.

“Gold looks set to vacillate around its 100-day moving average, today at $1881.65, in a wide but real range of $1850.00 to $1920.00 an ounce, for the time being.”

Speccy gold stocks are stirring

For the first time in a long time, good news stories are moving the dial on junior ASX gold stocks.

Metalstech (ASX:MTC) led the pack last week on latest infill drilling results out of the 1.5Moz gold, 10.93Moz silver ‘Sturec’ mine in Slovakia, which included 173.2m grading 3.27g/t gold and 11.8g/t silver from surface.

This intersection is not true thickness, the company says, which is always the width of the vein/orebody etc at its narrowest point. Resource modelling suggests the true thickness on mineralisation in this area is about 55m, which is still excellent.

This ongoing drilling program was designed to increase confidence in the existing resource (infill drilling), as well as extend mineralisation to the south (extensional drilling).

MTC has an exploration target of between 2.2Moz and 5.1Moz of gold eq, which is in addition to the existing resource.

A scoping study – the first proper look at the economics of building a project — is due this quarter.

Ballymore Resources (ASX:BMR) could have some exciting news in the pipeline.

BMR hit the bourse late last year with a portfolio of Queensland gold and base metals projects including ‘Dittmer’ (a historic high-grade goldfield), ‘Ruddygore’ (a large copper-gold porphyry target) and ‘Ravenswood’ (a bunch of drill ready targets in a 17Moz gold province).

The company is currently punching deep holes in Ruddygore: a large 1,000m by 300m target corresponding closely with a strong, +500ppm copper-in-soil anomaly and extensive historic workings.

The early signs are positive.

“Drilling to date has encountered broad zones of strongly altered and brecciated granodiorite with extensive quartz-carbonate-pyrite chalcopyrite-sphalerite veining and breccia infill,” BMR said Friday.

Emphasis ours. Chalcopyrite is the most abundant copper ore mineral, while sphalerite is the most important ore of zinc.

Drilling at Ruddygore will continue this quarter with initial drill assay results expected in May, BMR says.

Tombola Gold (ASX:TBA) remains on track for first gold production and cashflow from its Mt Freda Complex in Queensland in Q3 this year.

Mt Freda is expected to produce ~64,000oz of gold over an initial 30-month life of mine, it says. At a gold price of $2,285/oz Aussie (currently $2,600/oz), TBA expects to make a nice $79m profit.

This week it hit some visual copper-cobalt right next door at the ‘Little Duke’ project.

“We are very excited with the significance of this drill hole,” TBA managing director Byron Miles says.

“The 170m of mineralisation from 70m beneath surface has the potential to establish this project as a very large target for the copper, gold and cobalt operation located proximate to our flagship Mt Freda Gold Mine that is expected to produce initial gold over the coming months.”

“I can only see upside from these prices,” he says.

“A recent note by Petra Capital analyst, David Brennan, has a share price target of 65¢. That is 260% higher than the market price last week.”

In 2020, Top 10 Aussie gold producer Westgold Resources (ASX:WGX) spun its Northern Territory gold-base metal assets into Castile, which hit the bourse with a market cap of about $40m.

Castile’s high-grade – but deep — Rover 1 iron oxide-copper-gold discovery was gathering dust in the basement of Westgold’s portfolio for several years. But no longer.

Rover 1 has a 4.7 Mt resource grading at 1.73 gpt gold, 1.63% copper and 0.08% cobalt for 242,00oz gold, 63,400t copper and 2,900t cobalt.

“The tonnage has shrunk a little but the quality of the resource has improved, as has the copper grade,” Grigor says.

“This is sufficient for an eight year mine life, but we would expect extensions to this figure.”

The company is scheduled to release its PFS in about six weeks.

Total capital expenditure is estimated to be $130m according to a research note released by Petra Capital, with the processing plant accounting for $80m.

“All up operating costs are estimated to be $220 pt, which is less than half of the anticipated revenue on recent metals prices of $560 pt,” Grigor says.

“This suggests an operating margin in the order of $150m p.a.”

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout