Property: ANZ says no rate cuts this year as tide of new listings keeps rising

A wave of new property listings is sweeping across Australia, despite ANZ’s gloomy prediction about the prospects of interest rate cuts this year.

A wave of new property listings is sweeping across several Australian cities, despite ANZ’s gloomy prediction about the prospects of interest rate cuts this year.

ANZ’s head of Australian economics Adam Boyton this week backed away from the earlier expectation (held by the other majors too) that the Reserve Bank would cut rates in November.

For the latest property news, sign up here for free Stockhead daily newsletters

Now Boyton says he expects rates will stay on hold until next February.

Sellers seem undeterred.

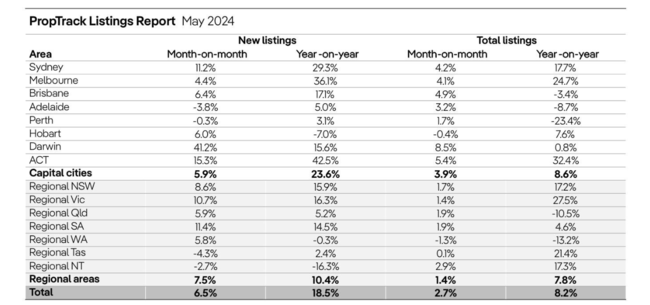

According to PropTrack’s latest, listings nationally on realestate.com.au are up and away some 18.5 per cent from a year ago.

Across the country’s combined capitals, new listings were up 23.6 per cent year-on-year with the ACT, Melbourne, and Sydney leading growth.

“Now past the seasonal impacts from shifting Easter timing, new listings in May displayed the strength seen earlier in the year to be 12.6 per cent higher over the calendar year-to-date compared to the same period in 2023,” PropTrack said.

New listings are higher in every capital city (except Hobart).

New listings in the combined regional markets were 7.5 per cent higher over the month and 10.4 per cent higher year-on-year, with only regional WA (-0.3 per cent) and regional NT (-16.3 per cent) recording a year-on-year decline.

Altogether, PropTrack says, the total listings were 2.7 per cent higher over the month and 8.2 per cent higher year-on-year, making it the highest May for active listings since 2020.

Though the outlook was broadly sunny for May, over the longer term, the numbers have varied wildly across the capital cities.

MORE FROM STOCKHEAD: Oil looks a stubborn beast | FDA roadblock for MDMA | Apple’s AI takes bit out of Nvidia

The ACT (+32.4 per cent), Melbourne (+24.7 per cent) and Sydney (+17.7 per cent) have seen the largest increase in total listings over the past year among capital cities, while Perth (-23.4 per cent), Adelaide (-8.7 per cent) and Brisbane (-3.4 per cent) have recorded falls.

Rate cut ‘hard to see’

Back in the less-cheery world of interest rates, Boyton said several factors prompted the rate call change, adding it was “hard to see” the RBA having the confidence to move by the November meeting.

“Since November 2022, we have expected that the first cash rate cut in Australia this cycle would be in November 2024,” he said.

“More recently, however, we have been cautioning that the risks around that view were skewed to a later start to the easing cycle.”

That seems to be playing out in the US too, with the Federal Reserve holding steady at its meeting overnight and trimming its forecast for the number of rate cuts this year down to one, (from two in March and three last December).

US inflation fell to 3.3 per cent in May, down from 3.4 per cent in April.

Month-on-month, the CPI was steady in April, whereas the forecast was for a rise of 0.1 per cent.

Visit Stockhead, where ASX small caps are big deals

Monthly and yearly core CPI readings (which exclude the volatile prices associated with energy and food) were also lower than expected/slightly better than the reports for April and March.

The Fed on hold means the cost of cash stays at a 23-year high of 5.25 per cent – 5.5 per cent.

At home however, not only did the local central bank start lifting rates later than most, but the recent overshot Consumer Price Index (CPI) seems to imply prices won’t return to the RBA’s 2-3 per cent inflation target until at least the end of next year.

The RBA is widely expected to remain on hold next week, with most of the goggling to be espied at the now usual post-match press conference, with the bank’s governor Michele Bullock under tight scrutiny for any clues on the path forward.

From the ANZ, however - it’s all academic.

“The stronger than expected Q1 CPI also makes it hard to see the RBA being sufficiently confident that inflation will return to and stay in the band by the time the November meeting comes around,” Boyton says.

“Accordingly, we now expect the first cash rate cut in February 2025.”

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here