‘No solution without nuclear’: Five reasons uranium is about to boom

Demand for uranium is set to explode as nations struggle to break dependence on Russian energy and tackle climate change at the same time.

There’s “no solution without nuclear” as governments scramble to balance their clean energy mission with a shift away from Russian energy supply, Cameco (NYSE:CCJ) CEO Tim Gitzel says.

“Suffice to say we are seeing governments and companies turn to nuclear with an appetite that

I’m not sure I have ever seen in my four decades in this business,” the boss of the world’s largest publicly traded uranium company said late last month.”

-

For the latest mining news, sign up here for free Stockhead daily newsletters

-

“Therefore, it is easy to conclude that the demand outlook is durable and very bright.

“But supply is quite a different picture.”

Here are five (of many) reasons why uranium stocks are set to boom in the years ahead.

Nuclear will be crucial for hitting net zero emissions

A vast majority of governments have committed to zero emissions. That’s easy to say, but how do they get there?

The standout performer in zero carbon technologies is nuclear, says Deep Yellow (ASX:DYL) boss John Borshoff.

-

Visit Stockhead, where ASX small caps are big deals

-

“That low-carbon footprint is for 24 hour per day production, whereas the carbon footprint for wind and solar – which is higher, by the way - is only for six hours per day production,” he says.

“That’s the reason nuclear is such a lay down misère.

“The US, UK, EU, Japan, Korea, Middle East, China – they are all saying ‘we need more nuclear’.”

Factors drive Boom in power plant construction

The European war has highlighted the need for energy security, which nuclear provides, says Bannerman Energy (ASX:BMN) CEO Brandon Munro.

“We are therefore seeing a return of nuclear power in the key market of Europe,” he says.

“The largest single uranium market, the US, has just received support under the Inflation Protection Act, which grants $30bn in tax credits to support the long-term continued operation of the US reactor fleet.”

But the biggest growth market is China, which sees nuclear power as a critical pillar of its decarbonisation and energy security strategies, Munro says.

“China is building 10 large reactors a year for the next 15 years, which will see it become the largest single market despite it having very little domestic uranium production,” he says.

Asia is embracing nuclear power, thanks to the global energy crisis â˜¢ï¸ â¤ï¸

— Stephen Stapczynski (@SStapczynski) August 27, 2022

🇯🇵 Japan is halting anti-nuclear policies

🇰🇷 Korea is reversing a nuclear phaseout

🇨🇳 China is accelerating its huge buildout in reactors

🇮🇳 India is moving to build more plantshttps://t.co/YTPHQFWFJa

End users - the utilities - will soon focus on procuring U3O8

Until recently, the nuclear power plants have been very distracted by the need to secure enrichment and the downstream nuclear fuel cycle, Munro says.

Enrichment is the process of upgrading natural uranium into a nuclear fuel.

“Russia provides more than 40% of the world’s enrichment capacity, so nuclear utilities have been scrambling to ensure security of supply in the face of government and social sanctioning of Russian supply,” Munro says.

“This has overwhelmingly distracted them from the business of buying U3O8 (triuranium octoxide, a comound of uranium).

“When that changes, we expect to see the start of the long-term contracting cycle.”

That brings the advanced project developers such as Bannerman and Deep Yellow into play.

“These are the companies capable of writing long-term contracts; the restart players, and a couple of the advanced developers,” Munro says.

Money starting to flow into uranium sector via M&A

From an equities point of view, this sector is starting to heat up with consolidation.

The Deep Yellow and Vimy merger is now complete. Meanwhile we are seeing the first genuinely competitive M&A action this cycle with UEC and Denison competing over the acquisition of UEX.

More activity is expected as the sector starts to boom.

“M&A is good for investors,” Borshoff says.

“It’s a wealth creating environment, not just in terms of the merger, but what that new platform then can do to create further value. It’s a win-win.”

There will not be enough uranium to go around

There is a huge gap between supply, projected supply and what will be required into the future.

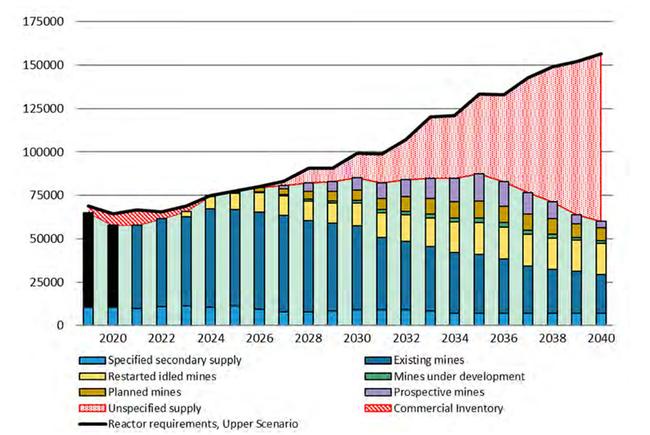

Just check out this chart from the World Nuclear Association:

Munro says WNA’s upper scenario above “is now looking realistic” as future demand keeps growing.

Even if every mothballed mine comes back online and all the advanced projects are developed, there remains a big area of ‘unspecified supply’ (above in red).

No one knows where that uranium supply is going to come from.

There are also expectations that secondary supply - the light blue section - will decrease as well.

“Demand expectations are surging for both conventional reactors and SMRs (small modular reactors)” he says.

“Almost every week I need to make an adjustment to projected demand as more reactor builds are announced and existing reactors are extended rather than closed.

“We are witnessing fundamental policy turnarounds in all the key markets including US, France, UK, South Korea and Japan.”

NOW READ: Uranium stocks guide - Sit back and relax, here’s everything you need to know

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here