The Ethical Investor: Hurricane Milton shows why insurance stocks could be ethical picks

“Storm of the century” Hurricane Milton could cause US$175bn in damage, placing insurance companies in spotlight for ESG investors.

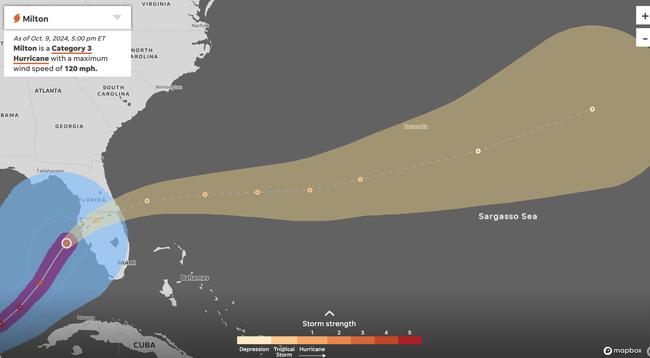

"Storm of the century" Hurricane Milton has landed

Climate change linked to more powerful hurricanes

Insurance companies are in spotlight for ESG investors as a result

Hurricane Milton struck Florida yesterday, resulting in 12 fatalities so far and leaving more than 3.4 million people without power.

The hurricane unleashed destructive tornadoes, with towering waves reaching up to 7 metres tall, fierce winds of up to 230km/hour, torrential rain, and a menacing storm.

President Biden called Milton "the storm of the century", while begging Florida residents to flee. "Evacuate now, now, now!"

Vice President Kamala Harris added that even the toughest Floridians wouldn’t withstand this “historic” hurricane.

Analysts predict damages could exceed US$50 billion, with the worst-case scenario reaching US$175 billion.

Hurricane Milton struck just two weeks after Hurricane Helene battered the area, prompting many to wonder if climate change is playing a role in the increasing frequency of these devastating storms.

What does the science say?

Milton is the fifth storm to hit the US this year, and its catastrophic impact highlights a worrying trend: hurricanes are becoming more powerful and deadly.

Hurricanes form over warm tropical waters, but climate change is warming these ocean temperatures and increasing moisture in the atmosphere, creating ideal conditions for these storms.

Data shows that the Atlantic Ocean and the Gulf of Mexico have been unusually warm for over 18 months, largely due to climate change and the El Niño weather phenomenon.

This warmth contributes to heavier rainfall and severe flooding, as seen with Hurricane Helene, which absorbed vast amounts of moisture before making landfall.

“Even if hurricanes themselves don’t change , the flooding from storm surge events will be made worse by sea level rise,” said Tom Knutson at NOAA (National Oceanic and Atmospheric Administration).

Studies have revealed that climate change has made hurricanes like Helene about 10% more intense, which can result in significant increases in damage. Experts warn that even a small uptick in storm intensity can lead to devastating impacts.

Marine heat waves, exacerbated by climate change, also play a crucial role in such rapid intensification, affecting both storm strength and wind speed.

Experts say the frequency and intensity of these storms serve as a stark reminder of the urgent need to address climate change.

“If humans keep heating the climate, we will keep seeing storms rapidly morph into monster hurricanes, leading to more destruction,” said Bernadette Woods Placky at Climate Central.

Why insurance companies could appeal to ethical investors

The recent hurricanes have undeniably placed insurance companies in the spotlight, drawing attention to their vital role in providing financial security during times of crisis.

A home insurance policy obviously covers only some — and not all — of the damage a hurricane causes.

But some ESG experts believe investing in insurance stocks can be a smart choice for those who prioritise ethical considerations.

By offering insurance coverage, these companies make a positive impact on society, assisting people in facing unexpected challenges.

Data shows that many insurance companies are also increasingly investing in sustainable assets.

For instance, AXA has divested from coal and is focusing on green investments.

Swiss Re has integrated ESG benchmarks into its investments, and Zurich Insurance currently leads in green bonds and has clear targets for its impact investments.

Allianz, meanwhile, is integrating ESG factors into its investments and committing to renewable energy projects.

While European insurers have been at the forefront, US companies, and more recently Aussie companies, are increasingly following suit, furthering the trend towards sustainability in the insurance sector.

ASX insurance companies boost ESG credentials

Insurance companies on the ASX are increasingly stepping up their ESG efforts and prioritising sustainability.

Many are integrating ESG factors into their business practices, making sustainable investments, and developing strategies to address climate change.

Here's a look at some of them:

IAG is taking significant steps to address climate change and its potential impacts on the business.

The company has recently refreshed its climate scenario analysis, testing its strategy against different future warming scenarios - including 1.5°, less than 2.0°, and 3°+.

This analysis helps it understand how these scenarios could affect operations in the short, medium, and long term.

In New Zealand, the company adapted scenarios from the Insurance Council of New Zealand, while in Australia, it’s developing similar scenarios to assess potential impacts.

In 2024, IAG became a founding member of the UN body, the UNEP Forum for Insurance Transition for Net Zero.

QBE says it's focusing on three key ESG areas, including partnering with various stakeholders through initiatives like the QBE Foundation and QBE Ventures.

QBE Ventures invests in early-stage tech companies that could change the insurance industry.

For example, in 2022, QBE partnered with Geosite, a platform that collects and analyses geospatial data to help organisations respond to major weather events more effectively.

PSC has launched key initiatives, which include monitoring and reducing energy consumption, and promoting the reuse and recycling of materials.

The company encourages staff to minimise air travel, opting for video and audio communication instead.

In a recent move, PSC has switched its Australian offices to 100% green electricity, sourced through a government-accredited renewable energy program.

In FY24, NIB conducted a double materiality assessment to identify the key sustainability challenges.

The company has set ambitious targets, such as engaging over 42,000 members in health interactions and maintaining carbon neutrality.

While it has achieved success in developing a Climate Action and Resilience Plan, the company is facing challenges when it comes to emissions targets and leadership gender balance.

Nonetheless, NIB says it remains dedicated to its sustainability journey.

NobleOak actively manages its environmental impact, with its Sydney headquarters boasting a 5-star NABERS Energy Rating and a 4.5-star Water Rating.

The company has launched initiatives like a new client portal to minimise paper use. In FY24, it offset its remaining carbon emissions through carbon credits.

NobleOak has a 40% female representation in its senior leadership team and a focus on diversity in talent acquisition.

The company also encourages community engagement through a giving program that matches employee donations.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.