The Emerald Standard: Asia could be the next top tier ASX gold destination

These forward-looking ASX-listed resource juniors are proving that their Asian gold resources that have the hallmarks of significant plays.

Asia is home to significant gold potential as highlighted by the success of companies such as Emerald Resources

Investment criteria for resource projects in Asia are not any different from any other region

Besra Gold and Far East Gold have been progressing their respective projects in Malaysia and Indonesia

Continued geopolitical uncertainty has sent investors flocking to safe haven investments, sending gold prices soaring in the past year to record highs over the US$3000/oz mark.

Prices are likely to remain elevated and as is typically the case in any commodity bull market, junior resources companies have scrambled to acquire gold assets in a bid to capitalise on the gains.

Most such companies chase areas below or along strike from known resources in historical mining centres in the belief that they will have a better chance of making a significant discovery.

However, this is decidedly conservative and the companies looking for the big payoff have ventured off the beaten track.

Emerald Resources (ASX:EMR) was one notable example. The company chose to focus on exploration and development of its Cambodian projects back in 2016, and its success nonetheless highlights the benefits of taking risks.

Its wholly-owned Okvau gold project is about 275km northeast of the capital of Phnom Penh in the province of Mondulkiri and poured first gold in 2021.

The first gold miner of commercial scale in the late developing country, the mine achieved its FY2024 production guidance of 114,000oz of gold and currently has an open pit reserve of 10.7Mt at 1.7g/t gold, or 600,000oz contained gold, and an underground resource of 1.7Mt at 5.5g/t, or 310,000oz contained gold following a recent upgrade that demonstrated its ability to replenish resources on a yearly basis.

Up over 1000% in the past five years, Emerald is now a near $3 billion company, running at similar valuations to its WA peers.

Asian success story

Argonaut Securities mining analyst Patrick Streater told Stockhead that EMR’s success was due to a combination of strong management and asset quality.

“EMR is run by Morgan Hart, who before Emerald, had an extensive operational track record in WA and West Africa,” he said.

“The Okvau deposit itself is a fairly continuous, thick, high-grade orebody starting at surface, which is ideal for a profitable open pit operation.

“So with EMR, you had a rare situation where you had a proven operator take control of a high-margin asset who built the project on time (and) on budget and then executed the mine plan to a tee.

“Since commissioning, Okvau has consistently met production targets at one of the lowest AISC in the sector.”

He noted that prior to the development of Okvau, Cambodia was not well known as an active gold mining jurisdiction for ASX investors.

As such, EMR was a first mover.

“An existing mining framework was already in place with financial terms that were fairly attractive and clearly designed to attract foreign investment into Cambodia's mining sector,” Streater said.

“As with any investment into an unfamiliar jurisdiction, companies and their investors want to have clarity and certainty on the fiscal terms - they had that with Cambodia. To date, the Cambodian Government has been very supportive of EMR and its operations.”

He added that the investment criteria for a resource project in Asia shouldn't really be any different from any other region.

“Like with any attractive developer or producer, you are looking for a combination of quality deposits and proven management. These opportunities, I would say, are quite rare, with EMR being an exception. So in most circumstances, you'll need to relax these criteria,” Streater pointed out.

“In the developer space, the first thing I will look at is the orebody. Assuming the project progresses into production, the management skillset will evolve but not even strong management will fix an unviable orebody.

“So initially, investors should be doing a quick screen of the grades, orebody complexity, metallurgy and size of the deposit. All those aspects are important but probably where most new gold projects stall is simply not having a large enough reserve base to cover the initial capital costs of building a mill.

“Applying the above criteria, you'll probably screen out ~90% of the potential options available. If I find a project that fits my criteria then that is when I would look into the sovereign risk.

“Screening out Asian jurisdictions to invest in should be a fairly quick exercise as an ideal Asian jurisdiction would be a stable democracy, friendly to Western companies and preferably with a Mining Code and existing workforce in place.

“Moving outside of those attributes you'll be taking on more sovereign risk and the asset quality and upside need to be there to take on this extra risk.

“This is also a situation where you need to be comfortable that management will be able to navigate the mining legislation and permitting pathway which is key to progress the project in a reasonable timeframe that minimises shareholder dilution.”

ASX Asian gold plays

While EMR is the poster child for ASX-listed plays operating in Asia, it certainly isn’t the only one.

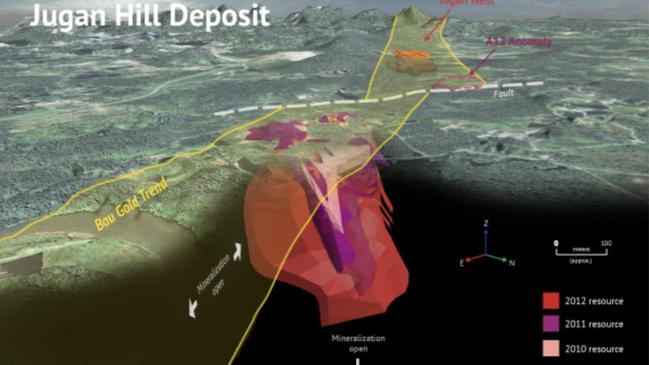

BEZ is focused on developing of its Jugan project – part of the broader Bau Corridor goldfield about 30-40km from Kuching, the capital of Sarawak state in east Malaysia – through first pilot production then delivery of a definitive feasibility study.

The 98.5%-owned Bau project has a very high confidence measured resource of 3.4Mt at 1.5g/t gold, or 166,000oz of contained gold, a high confidence indicated resource of 16.4Mt at 1.57g/t gold, or 824,800oz contained gold, and an inferred resource of 47.9Mt at 1.29g/t, or ~1.99Moz contained gold.

Bau is defined by a gold bearing mineralisation system covering an 8km by 15km corridor.

The company’s planned Jugan 50tpd pilot plant will trial various batch processing combinations in order to develop optimal protocols for processing the Jugan refractory ore to produce a concentrate for further processing, including doré.

These trial results will form an important component of the overall definitive feasibility study for future commercialisation.

BEZ also has the required licensing and capability to increase the processing throughput to up to 200tpd.

Over in Indonesia, FEG has been progressing its Idenburg project in Papua province, which also hosts world class multi-million-ounce gold and copper deposits including Grasberg (+70Moz gold), Porgera (+7Moz gold), Frieda River (20Moz gold) and Ok Tedi (20Moz gold).

In November 2024, the company defined an initial JORC resource of 540,000oz of contained gold at 4.1g/t and 468,000oz of silver at 3.6g/t from three of 14 prospects identified by historical exploration within the project.

Adding further interest, previous exploration had only covered about 30% of the total area with most of the property remaining largely unexplored.

FEG noted then that it was confident of expanding this resource through a planned detailed surface mapping and sampling program followed by a Phase 1 drill program.

Independent evaluation of the historical exploration results suggests the potential for an upper range exploration target of 7.2Moz at 6.1g/t gold.

At Stockhead, we tell it like it is. While Besra Gold is a Stockhead advertiser, it did not sponsor this article.