Resources Top 5: Investors eye pot of gold at end of West Cobar Metals’ rainbow

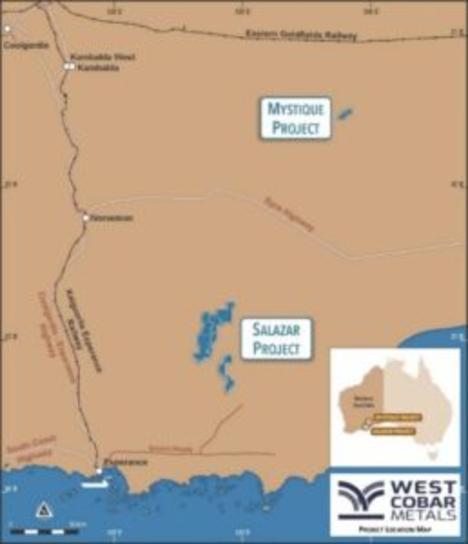

West Cobar Metals has completed the purchase from IGO of the Mystique gold project in Western Australia’s Fraser Range.

West Cobar Metals has completed the purchase of the Mystique gold project in Western Australia’s Fraser Range

MTM Critical Metals hits a new record after fielding strong antimony recoveries from US e-waste using its Flash Joule Heating technology

After being reinstated to the ASX on May 21, 2025, Bastion Minerals is making progress

Your standout resources stocks for Friday, June 6, 2025

West Cobar Metals (ASX:WC1)

Investors reacted strongly after West Cobar Metals completed the purchase from IGO of the Mystique gold project in Western Australia’s Fraser Range, believing it may represent a pot of gold at the end of a rainbow.

Shares more than doubled to a daily high of 3.1c, an increase of 107% with more than 77m shares changing hands.

West Cobar believes the project is highly prospective for orogenic gold deposits and is encouraged by strong results returned by the IGO/Rumble Resources (ASX:RTR) joint venture at the Themis prospect, just 250m outside of, and north of, the Mystique project boundary.

While exploring the adjoining tenements, the JV encountered gold intercepts in saprolite and bedrock that included 25m at 2.42g/t gold from 42m, including 5m at 10.85g/t from 49m, and 16m at 6.69g/t from 42m, including 4m at 22.2g/t from 50m.

Mystique, which covers 35km2 within the Albany-Fraser Province and is about 225km SSE of Kalgoorlie, remains relatively unexplored as most of the area is covered by 30m or more of transported Eocene sediments and there is little surface expression of geology or mineralisation.

“We are delighted to have completed the acquisition of the Mystique Gold Project,” West Cobar Metals’ managing director Matt Szwedzicki said.

“The tenement comprises a key land area with exceptional and immediate potential for both shallow saprolite hosted and large-scale basement hosted gold deposits.

“We have identified two high priority targets which justify immediate exploration drilling."

There are Immediate targets at Mystique, supported by widespread drill intersected gold anomalism in transported cover and saprolite, and WC1’s intentions are:

- To drill test the palaeochannel/saprolite and bedrock gold mineralisation that is likely to extend southwards into West Cobar’s ground (Themis South prospect);

- To drill test and define significant gold mineralisation targets in the saprolite and basement rocks at the Torquata prospect; and

- Drill program being prepared to follow up key targets.

Completion of the acquisition of IGO’s 100% interest in tenement E28/2513 occurred following the satisfaction of conditions precedent.

MTM Critical Metals (ASX:MTM)

It has been a strong week for MTM Critical Metals, rising 51.43% to 53c, a new record high, after fielding strong antimony recoveries from US e-waste using its proprietary Flash Joule Heating technology.

The company achieved 98% recovery of the critical mineral and extracted 3.13% antimony from printed circuit board feedstock, with the grade far exceeding that of typical mined ore.

Even China’s largest antimony deposits — which dominate global supply — average just 0.5% to 0.7% antimony, making e-waste a vastly richer and largely untapped alternative.

The material had been thermally pre-processed to strip out plastics and volatiles, producing a dense, metal-rich carbon-based residue.

MTM Critical Metals views the results as clear proof of the technical strength and strategic promise of its Flash Joule Heating technology for recovering critical metals from e-waste.

Flash Joule Heating works by passing an electric current through metal-bearing material, rapidly elevating its temperature to more than 3000 degrees kelvin.

This vaporises the target metals as chlorides in seconds and collects the vapours for refining.

“This result demonstrates the strong technical and commercial potential of our FJH process for recovering strategic metals from e-waste,” MTM managing director and CEO Michael Walshe said, adding:

“Achieving 98% recovery of antimony at over 3% grade, from domestic urban feedstock, is particularly significant given the US currently has no meaningful domestic Sb production.

“With antimony designated as a critical metal by both the DoD and DoE, these outcomes reinforce MTM’s ability to contribute to onshore supply solutions for high-priority metals. “Combined with our recently secured, pre-permitted demonstration site in Texas, we are well positioned to scale operations and advance commercial deployment.

“In parallel, the company is engaging with US government agencies, including the DoD and DoE, regarding potential funding to support domestic critical metal recovery.

“While early-stage and non-binding, these discussions reflect strong interest in scalable US-based refining technologies.

“The strategic role of antimony in defence, particularly in armour-piercing alloys and flame-retardant systems, was a consistent theme during recent meetings in Washington.”

Antimony is an essential metal for munitions, semiconductors, batteries and flame retardants, yet the US lacks meaningful domestic production and depends heavily on imports from China.

This reinforces MTM Critical Metals ability to contribute to onshore supply solutions for high-priority metals.

The company has locked in more than 1100 tonnes per year of e-waste feedstock under agreements with US suppliers, providing a strong foundation for commercial deployment.

Bastion Minerals (ASX:BMO)

After being reinstated to the ASX on May 21, 2025, Bastion Minerals is making progress, with a newly appointed leadership team; a review of projects in Chile, Sweden, Australia and Canada; an Exploration Work Permit granted for its ICE copper-gold project in Yukon Province Canada; and an upcoming maiden JORC resource estimate for ICE.

A considerable jump in the company’s share price to 0.4c has seen BMO field a price query from the ASX, prompting a trading halt while it prepares a response and details of the resource estimate.

On reinstatement Bastion’s non-executive chairman Gavin Rutherford said: "Bastion’s recommencement of trading marks a significant and exciting turning point. We have a refreshed board to provide focused leadership and renewed commitment to delivering shareholder value.

“As investors, the incoming board members recognise the value and fantastic potential of the overseas projects in BMO’s inventory.

“Our preferred direction is to unlock the potential of these projects through generating partnerships, positioning BMO with equity exposure in the project whilst the selected partner invests and acts to unlock its potential.

“For BMO shareholders this is the best way to combine timeliness, effective investment and shareholder weighted outcomes on three international fronts.

“Meanwhile, Australia has no shortage of gold-weighted projects available, with many of them residing in the hands of private owners.

“We are working through multiple opportunities with an eye to bring projects into BMO that are paid for via exploration. There is no need to expose BMO to the inherent risk of a project purchase when, in my mind, the best due diligence we can execute is via on-ground exploration that resides within a traditional earn-in model.

“We will crawl before we walk, we will build wealth in the company through prudence and I am very much looking forward to BMO shareholders joining us on this journey.”

Subsequently, the company was granted a work permit for ICE, with Rutherford stating: "We are very grateful to have received this consent from the Tu Łidlini Lands Department and the Ross River Dena Council for our ICE Copper-Gold Project in Yukon.

“The consent is a vital access step in our pathway to getting ‘boots on ground’.”

Coronado Global Resources (ASX:CRN)

In light of volatile met coal prices and markets, another company moving in the right direction at last is Coronado Global Resources, which has lifted 15.2% to a daily high of 19c and has risen 90% during the week.

Encouragement has come from a refinanced debt facility with private equity firm Oaktree Capital Management, bringing another player into the potential bidding for the company after reports Czech bargain hunter Pavel Tykac’s Se.Ven Global Investments had bought up around US$40m of its debt last month.

The new three year asset-based lending facility comprises $75m to be drawn at financial close with the remaining $75m to be drawn in $25m increments over 12 months.

There will be no testing of leverage and interest coverage financial covenants for the June 2025 quarter, with covenant thresholds from Sept 2025 onwards “designed to afford the business flexibility” in the current low price environment.

Met coal futures are running at around US$183/t. But that’s for the really high quality stuff.

Then, in response to media speculation, Coronado Global Resources advised on Thursday that it is in confidential discussions with Stanwell Corporation regarding potential changes to its coal-supply agreements with Stanwell.

These will potentially provide up to US$150 million in near-term liquidity to Coronado (not in the form of a loan) with Coronado to provide access to additional coal supply for Stanwell to support its power generation capacity.

Waratah Minerals (ASX:WTM)

Turning heads in the copper-gold prolific Macquarie Arc of Central West NSW with an aggressive exploration program at the Spur project is Waratah Minerals, which was 15.5% higher to 41c.

Spur is just 5km west of the Cadia Valley Operations of Newmont and the emerging discovery is showing similar geological markers to those seen in the multi-million-ounce Cowal and Boda systems in the same region of the Lachlan Fold Belt.

The company has a dual focus at Spur with two rigs targeting a large epithermal gold system, while a third rig – the second diamond drill – is set to return to Breccia West prospect to follow up promising porphyry intercepts such as 108m grading 0.52% copper and 0.22g/t gold from surface to end of hole.

Exploration has outlined a broad zone of epithermal stringer and lode-style mineralisation, accompanied by porphyry-style alteration – characteristics consistent with the upper levels of a larger porphyry system, akin to those found elsewhere in the Macquarie Arc.

“We’re getting very busy on the ground and getting more confidence, we’re recognising what is important in the rocks,” Waratah managing director Peter Duerden said.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While MTM Critical Minerals and Waratah Minerals are Stockhead advertisers, they did not sponsor this article.