Resources Top 5: A Meteoric rise on a maiden rare earth resource

Meteoric Resources moved as much as 36.3% higher after releasing a maiden resource estimate for the Bara do Pacu licence at its Caldeira rare earths project in Brazil.

A maiden resource for Bara do Pacu has lifted Caldeira project resources to 1.5Bt at 2359ppm TREO

Also in Brazil, Araxá project is shaping as a standout strategic REE supplier

Sunrise Energy Metals continues to shine on recent high-grade scandium assays

Your standout small cap resources stocks for Tuesday, April 15, 2025.

Meteoric Resources (ASX:MEI)

Heightening geopolitical risks are shaking up the global rare earths market with pricing of the metals reacting in response, albeit a little more tardily than other critical minerals.

The trade war initiated by US President Donald Trump’s executive order to boost domestic mineral production and pledge to make the US “the leading producer and processor of non-fuel minerals, including rare earths”, is sparking demand from the West for non-Chinese sources.

Although this has since escalated with China and the US retaliating with progressively higher tariffs, it is not new as in 2006 China enforced quotas to manage the supply of REEs and banned the export of technology to extract and separate REEs.

In December 2023, China, which dominates REE processing, accounting for more than 90% of the market, also banned the export of technology to make REE magnets and on April 4, 2025, it announced new export controls on certain medium and heavy rare earth-related items.

ASX-listed companies with rare earth deposits are picking up efforts to bring them into production and benefitting from positive exploration results with improved share prices.

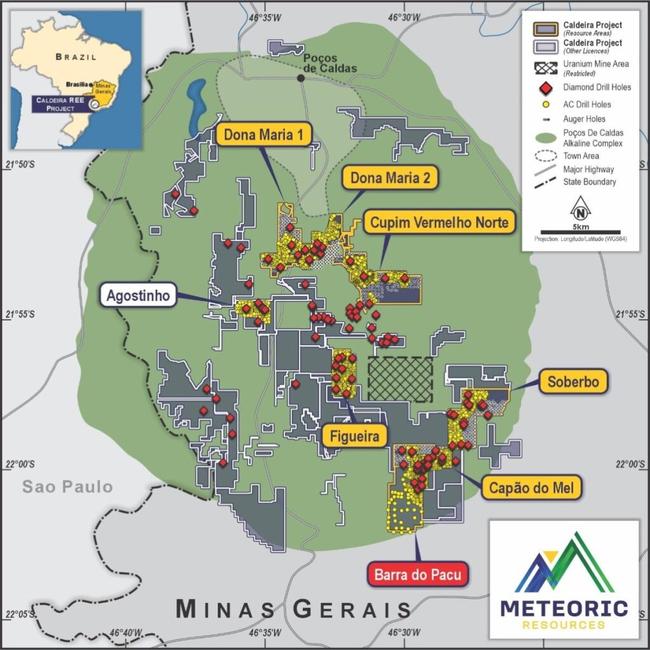

Among them are Meteoric Resources (ASX:MEI) which has been as much as 36.3% higher to 9.4c on volume of more than 55m after releasing a maiden resource estimate for the Bara do Pacu licence at its 100%-owned Caldeira Rare Earth Element Ionic Clay Project in Brazil.

The resource of 389Mt at 2204ppm total rare earth oxides with 432ppm magnet rare earth oxides has reinforced the Tier-1 rare earths status of Caldeira and makes it one of the highest-grade ionic clay rare earth deposits in the world.

Importantly, it includes 77Mt of indicated resource at 2917ppm TREO with a higher grade component of 32Mt at 4,130ppm TREO.

The Bara do Pacu resource takes the overall Caldeira resource to 1.5Bt at 2359ppm TREO and grows the total measured and indicated resources to 666Mt at 2,685 ppm TREO including 22.5% magnet rare earths.

“Barra do Pacu is immediately south of the Capão do Mel resource and with this update we can now include it in the upcoming pre-feasibility study,” managing director Stuart Gale said.

“This resource estimate effectively doubles the indicated resource located within 1,000m of the proposed processing plant site.

“The combined measured and indicated resource for Capão do Mel and Barra do Pacu is in excess of 150Mt at greater than 3,000ppm TREO including greater than 20% MREO.

“This represents an obvious starter area for future mining at the Caldeira project to drive strong economic returns and a rapid capital payback.”

The project also contains significant upside exploration potential to define higher grade mineralisation, and mineralisation with enriched MREO content, which supports the scalability of future processing capacity.

St George Mining (ASX:SGQ)

Also in Brazil, St George’s Araxá project is shaping as a standout strategic REE supplier as China’s export restrictions on critical metals, including REEs, come into play.

This month China implemented export restrictions on a range of rare earth elements – as well as permanent REE magnets – creating a supply chain shock around the globe.

Araxá hosts a 40.64Mt at 4.13% TREO resource and is already one of the world’s largest and highest grade hard-rock rare earth deposits.

It also hosts the high-value magnet rare earths neodymium and praseodymium (NdPr) with 7,800ppm for 320,000 tonnes of contained NdPr highlighting the potential for Araxá to become a significant supplier to permanent magnet manufacturers in Brazil and elsewhere.

More than 95% of the resource is between surface and 100m depth while significant mineralisation has been intersected below this in deeper rock but has not been included in the latest estimate.

With mineralisation open in all directions and less than 10% of the project tenure drilled out, there is even more potential to increase the resource – with further drilling scheduled to begin in the coming weeks.

“China’s increased restrictions on the export of rare earths and permanent magnets have significantly disrupted the global supply chains for these commodities which are critical to a wide range of sectors including defence, electric vehicles, energy, smartphones, robotics and medical equipment,” SGQ executive chairman John Prineas said.

“This development is evidence that single-source supply chains are a risk, from China or anywhere else.

“The need for a sustainable rare earths industry outside China has never been stronger.”

The grade and size of the Araxá resource compares favourably with world-class rare earths mines such as Mt Weld in Western Australia and Mountain Pass in California.

“One of the largest producing hard-rock rare earths mines outside of China is the Mt Weld mine owned by the $7.3 billion-valued Lynas Rare Earths Lynas (ASX:LYC) with a total resource of 106Mt at 4.1% TREO,” Prineas said.

The Araxá resource “illustrates the potential value upside for St George as we progress through development studies and resource expansion drilling to demonstrate the potential for a commercial rare earth mining operation at Araxá.”

Metallurgical testwork is underway to determine the optimal flowsheet for potential commercial production of niobium and REE products at Araxá.

Along with its rare earths resource, Araxá has a niobium resource of 41.2 million tonnes at 0.68% Nb2O5 and it is adjacent to CBMM’s niobium mining operations in a region of Brazil with a long history of commercial niobium production.

On the back of the positive reports emanating from Araxá, SGQ has been up to 37% higher to 2.6c on volume of almost 131m.

Sunrise Energy Metals (ASX:SRL)

Continuing its strong performance since receiving high-grade assays of the critical mineral scandium at the Syerston project in NSW is Sunrise Energy Metals, which has reached 73c, a 47.5% increase on the previous close.

Assays of drill pulps from 1997 that were not previously assayed for scandium returned up to 6m at 553ppm Sc from 4m, including 2m at 760ppm from 8m, and 12m at 458ppm from 12m.

SRL is moving quickly to validate these results and is planning a new drilling campaign to test the step-out targets aimed at expanding the high-grade zones.

This work will also provide additional data for input into the updates of the Syerston mineral resource estimate and project feasibility study for the development of a dedicated scandium mine and processing plant at Syerston.

Syerston’s current resource comprises 60.3Mt at 390ppm Sc for about 23,500 tonnes of contained Sc at a 300ppm Sc cut-off grade.

Parkes-based drilling contractor Resolution Drilling has been engaged for the drilling of up to 5000m over 125 holes and the program is due to start upon receiving the necessary approvals from the NSW Resources Regulator.

The drilling will focus on expanding the tonnage within the high-grade Sc areas of the deposit. A number of undrilled areas are on the periphery of the dunite intrusion where the high-grade Sc appears to be concentrated.

Prospect Resources (ASX:PSC)

The Mumbezhi copper project of Prospect Resources in Zambia is attracting plenty of attention and now one of the world’s leading copper miners First Quantum Minerals has jumped onboard, taking a 15% stake in the company.

This has seen Prospect shares up to 31.82% higher to 14.5c.

TSX-listed First Quantum, which produces 402,000t of copper in concentrate at the nearby Sentinel and Kansanshi mines, will take a 15% cornerstone stake in the $80m capped ASX-listed junior via a $15.2m placement.

At an issue price of 15c, the investment is at a 36% premium to Prospect’s previous closing price of 11c and 28% premium to its 20-day VWAP of 11.7c.

It will also see First Quantum become a key technical partner to support Prospect’s exploration team at Mumbezhi.

Mumbezhi has quickly emerged as one of the largest pre-development copper resources on the ASX, with a recent resource estimate clocking in at 107.2Mt at 0.5% copper for 514,600t of contained copper.

Given its scale and the rapid nature of the resource’s growth since Prospect became an 85% owner of the project 12 months ago in an initial US$6.5m deal, it’s understandable the resource announcement caught the eye of FQM, whose +200,000tpa Sentinel mine is just 25km to the northwest.

Fellow major shareholder Eagle Eye Holdings has also tipping in $2.8m at 15c to maintain its 15.3% stake. That gives Prospect $18.5m in new funding to accelerate exploration, with a phase 2 drill program to start this quarter.

“The FQM strategic investment offers us a considerable funding runway, coupled with serious regional exploration expertise, to continue advancing our planned exploration of Mumbezhi,” PSC managing director and CEO Sam Hosack said.

“We are also grateful for the continued support of our existing shareholder, Eagle Eye, as a reflection of its confidence in Prospect’s strategy and vision in Zambia as we welcome First Quantum.”

Southern Hemisphere Mining (ASX:SUH)

Another mover in the copper space has been Southern Hemisphere Mining, up as much as 50% to 3.5c after fielding positive geophysical results from the Llahuin project in Chile.

A deep penetrating Magneto-Telluric survey has established a clear correlation between previous litho-geochemical depth target modelling and Induced Polarisation data at the large Curiosity copper-gold target.

Curiosity is a sub-circular target 1km to 2km in diameter and the large MT resistivity anomaly extends significantly to depth.

“The new Magneto-Telluric 3D inversion model outlines an area of low resistivity, extending over 1,400 metres below surface, which, reinforced by our geochemistry and shallow drilling results demonstrate Curiosity’s potential to host a significant copper gold porphyry deposit,” Southern Hemisphere chairman Mark Stowell said.

“This study has increased the potential to grow the copper mineralisation footprint in the southern part of Llahuin substantially beyond the existing Central Cerro and Ferro open pit style deposits.

“The configuration of the Curiosity MT target is remarkably similar to the original MT target at the large Valeriano porphyry copper-gold deposit in Chile operated by Atex Resources.”

SUH intends to drill test the MT resistivity target with three to six deep drill holes. The first hole will collar from an existing drill pad at Llahuin to a depth of ~1,400m and is designed to intersect the MT and fathom modelling target zones.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Meteoric Resources, St George Mining and Prospect Resources are Stockhead advertisers, they did not sponsor this article.