Predator and Prey: Asra Minerals in the right locale to attract multi-billion dollar WA gold miners

Predator and Prey analyses emerging explorers and why they might attract acquisition interest. This time we’re looking at Asra Minerals.

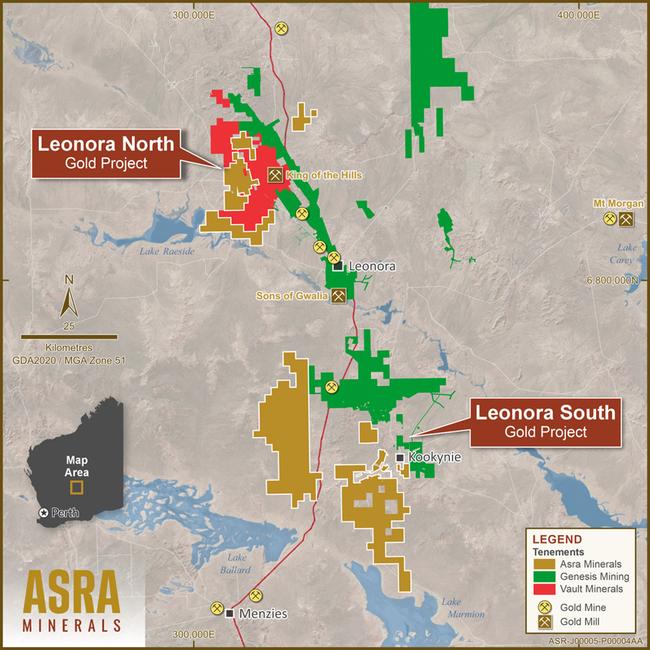

Asra Minerals' Leonora North - Mt Stirling assets sit on the doorstep of Vault Minerals

Its Leonora South assets are in the backyard of Genesis Minerals, which is looking to consolidate resources around its Gwalia and Laverton mills

Asra will be going hard with drilling over the next six to 12 months to prove its project up

Mergers and acquisitions can be a huge value creator for shareholders, especially for those invested in the target firm.

Predator and Prey takes a close look at ASX explorers in the early stages of their journey and why they could be hunted by a larger player.

Last year record gold prices led to a plethora of M&A across multiple districts but most notably the prolific Goldfields region where a $2.2bn merger between Red 5 and Silver Lake Resources morphed into multi-billion-dollar company Vault Minerals (ASX:VAU).

The deal saw the consolidation of the King of the Hills, Deflector and Mount Monger gold operations following a 97% yes vote from Red 5 shareholders to swallow 100% of Silver Lake Resources.

As the deal kicked off, then Red 5 chair Russell Clark said on a webcast that the move put Vault in a great position to be acquisitive in the future, which is something it will look at once they’ve “bedded the company down”.

For neighbour Asra Minerals (ASX:ASR), those comments hold great weight.

Asra owns 936km2 of highly prospective gold tenure in the Goldfields region, with its Leonora North – Mt Stirling asset immediately surrounded by the 12.4Moz gold miner.

It's not the only giant in Asra's orbit.

Down the road is $2.4bn gold giant Genesis Minerals (ASX:GMD) and its 2Moz Leonora and Kookynie operations, long mooted as a potential merger partner with Vault. Its Gwalia and Laverton mills are known to be hungry for more ore.

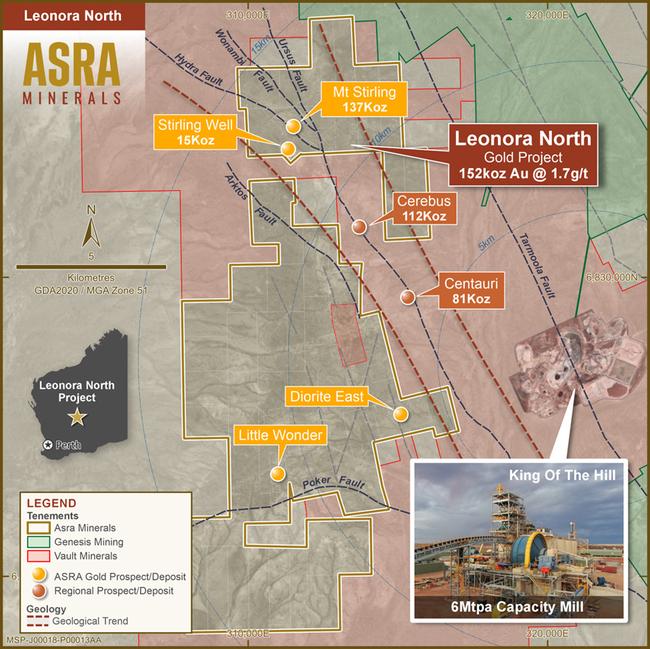

Asra already has a 152,000oz gold deposit in place at Mt Stirling and more than 20 major gold prospects that have never been drill tested.

Further south at the newly acquired Kookynie East gold tenements, a huge amount of historical workings and intercepts such as 6m at 166g/t gold and 9m at 4.3g/t have laid relatively dormant since 1992, before Genesis started drilling on the northern side of the Kookynie structure in 2015.

ASR CEO Paul Stephen believes there is a massive opportunity for the team to expand on what has already been done and expects the next six to 12 months to be a busy period for the budding gold junior.

Hearty catch for the hunters

“We are starting our life with about 200,000 ounces next door to multi-billion-dollar predators but if it’s such an obvious tie up, you have to ask the question, why hasn’t it happened yet?” he said.

“There are a few different answers to that – our land to the south has only been in the company for six months and historically it had problematic ownership. If you trace it back it was owned by a Chinese state-owned company who lost the ground because they didn’t spend any money on it.

“It then wound its way into a prospectors’ hands before it was sold it into Asra for shares so it’s been on a journey to get to where it is today."

Stephen's task is to add value to the well-located micro-cap.

“To some degree, we are almost not big enough to be a suitable prey if you like, when you are $2 or $3 billion company, buying a 5 – 10 million company isn’t a significant event for you, albeit the land looks really interesting.

“Our job now is to make ourselves look more attractive to either of those two potential suitors by going flat out and generating more resources so that we are more like a half-million or million-ounce company.

“Suddenly, when that happens, we will become a meaningful meal for the predator.”

12km of un-drilled fault structures

At the Leonora North – Mt Stirling project, Stephen said Asra is sitting on the same geological and faults as Vault’s 112,000oz Cerebus-Eclipse and 81,000oz Centauri deposits.

“The theory here, which all the aeromag and geochemical work points to, is that by going and doing more drilling along those faults we might find our next orebody,” he said.

“We’ve got 12km of fault that hasn’t ever had a drill hole in it and companies like Vault Minerals ... logically want to replenish those ore reserves in order to have a long-life project.

“The situation is, as we prove up additional resources those companies will do the maths on what sort of money they can make out of mining our resources, and will look at what it would cost them to buy it,” he said.

At Stockhead, we tell it like it is. While Asra Minerals is a Stockhead advertiser, it did not sponsor this article.