Monsters of Rock: Gold’s at US$2650, Aussie miners are barely pricing in US$1900

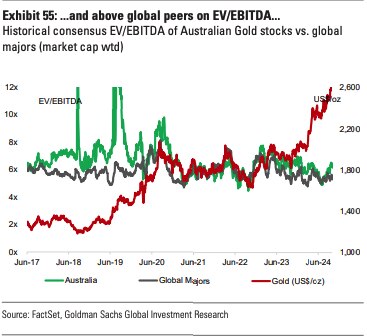

Goldman Sachs says some Aussie mid-tiers are trading at valuations pricing in long-term gold prices as low as less than $US1800/oz.

Goldman puts faith in mid-tier Australian goldies as valuations trail record spot price

Regis dropped to sell on growth worries, valuation, but prices are now running beyond cost inflation as reporting season approaches

Reactions from around the grounds as Rio Tinto corners lithium miner Arcadium

Goldman Sachs estimates a swag of Australian gold miners under its coverage are being valued at a gold price sitting over $US700 below current gold prices.

It comes as the investment bank maintains buy ratings on three of the sector's most prominent ASX 200 mid-caps, while lopping a sell label on beleaguered WA goldie Regis Resources (ASX:RRL).

Ahead of earnings season plenty of attention will turn to the bank accounts of ASX gold miners, most of whom have collected the spoils of a record price run powered by geopolitical risk and a first US rate cut through the September quarter.

Most are now unhedged having cleared two way bets with banks that fell heavily out of the money as inflation and gold prices surged over the past two years.

According to Goldman's Hugo Nicolaci, Paul Young and Isaac Brooke, the Aussie gold sector is pricing in $US1920/oz on average with the bank's preferred picks of Bellevue Gold (ASX:BGL), Gold Road Resources (ASX:GOR) and De Grey Mining (ASX:DEG) (the latter pre-development) all running at near or below $US1800/oz.

Spot gold is trading at $US2640/oz today, while GS has lifted its long run forecast from $US1800/oz to $US1950/oz from 2028 onwards.

Regis, which has been downgraded to a sell despite expecting strong cash generation following the close of its millstone of a hedgebook, is trading at $US2200/oz on GS' numbers, with concerns about growth from its only incrementally extending Duketon and Tropicana mines.

On the plus side, the Government induced pause of the $1bn McPhillamys development – while leaving RRL with a declining production profile from 2029 – could see dividend payouts return in the next 12 months and franked returns from 2026, according to the analysts.

At the upper end of the market a recent price run for Evolution Mining (ASX:EVN), which is also leveraged to copper and has lifted around 18 per cent in the past month, has seen GS downgrade the $9bn miner from buy to neutral. GS also remains neutral on Capricorn Metals (ASX:CMM) and Northern Star Resources (ASX:NST), with caution still on the execution required respectively for CMM to build its Mt Gibson gold mine in WA and NST to hit its 2Mozpa production target by 2026.

Golden glow

With commodities from lithium to nickel to iron ore still on shaky ground, investors will be looking longingly at their gold stocks for a bit of a pick me up in October's reporting season.

Goldman says equities could begin to move as gold price rises start to outpace cost inflation.

"Gold has continued its run through 2024, up c.13 per cent QoQ and c.18 per cent YTD, with increases in recent months outpacing YoY cost increases into FY25 and supporting a recovery in the correlations of gold equities; however, we note that over the past 15 months or so our covered gold companies are up about 29 per cent (~32 per cent TSR), while $US/$A gold prices are up c. 38 per cent /34per centover the same period," Nicolaci and his fellow analysts wrote.

"Our global team remains constructive into 2025 given the geopolitical and macroeconomic environment, where we raise our long run gold price to S$US1950/oz (from $US1800/oz) from 2028 onwards (real $2024)."

Of course, it's worth noting you'd be a bit mad to really value a company at spot, given all the unknowns with production, costs, M&A and the volatile nature of commodity prices. Try doing that with lithium companies 18 months ago ...

The market reacts to Rio's lithium plunge

The early verdicts are in on the news Rio Tinto (ASX:RIO) is chasing a deal in the order of $US5 billion to buy up Arcadium Lithium (ASX:LTM), which responded with a ripsnorting run on Monday that pulled the rest of the lithium mid-tier with it.

The most strident opposition has come in the form of a letter from Blackwattle Investment Partners, which wants $US8 billion with portfolio managers Tim Riordan and Michael Teran poo-pooing the reported deal price as opportunistic.

Rio has shied away from major M&A in recent years, having proved to be just about the worst exponent of the practice in the last boom when it collected Alcan in 2007 and Riversdale Resources in 2011 only to impair the assets acquired to oblivion.

CEO Jakob Stausholm has regularly stated it would be sad if a business which has painted the portrait of a turnaround story in recent years were to ruin that with ill discipline.

In the investment banking community there are a range of takes.

Matt Fernley, MD of the Battery Materials Review, said he was surprised by the reported approach, calling Arcadium (a merger of Australia's Allkem and America's Livent) an amalgamation of Tier 2 assets, far from the Tier 1 projects Rio typically looks to acquire.

"Of course, it wouldn't be the first time that I've been surprised by RIO's M&A strategy. I was pretty stunned when RIO bid for Alcan in 2007, also surprised when RIO bid for Riversdale in 2011," he said on LinkedIn.

"What was the similarity in both of those acquisitions? The acquiring company ended up writing a large amount of the acquisition value off. Fair to say that RIO doesn't have the best record in identifying targets for M&A, so maybe I shouldn't be too surprised in this case, after all...!"

Sam Catalano of Wilsons was more constructive, saying he understood the strategic rationale given Arcadium's exposure to multiple different areas of the value chain.

While the Arcadium assets may not be considered 'tier 1' on cost and production today, the growth outlook delivers scale to a company with the financial muscle to navigate the capex.

RBC meanwhile lifted its price target on LTM from $US3.10 to $4.05 (or $6.10 for its ASX stock), putting a 30 per cent premium on its value for the potential change of control transaction.

They think the deal is 'counter-cyclical', but that it aligns well with Rio's strategic objectives and existing lithium investments, pointing to the scale LTM's large Argentine brines provide (near Rio's own pre-development Rincon project) and the potential to bring forward production from LTM's hard rock Galaxy and Whabouchi projects in Quebec.

"In North America, ALTM’s assets include James Bay, Nemaska (Whabouchi mine and Becancour plant) in Canada and US lithium processing (Bessemer)," RBC analysts led by Kaan Peker said.

"RIO has its low-cost hydro-powered aluminium smelters and Sorel operation in Quebec, Canada. RIO recently also signed exploration JVs in Quebec’s James Bay region. This makes Quebec an ideal location for supplying the growing electric vehicle market in North America, particularly as it is a free trade partner of the US.

"In Argentina, ALTM has two operational brine assets (Olaroz and Hombre Muerto) and development assets in Sal de Vida and Cauchari, while RIO is developing Direct Lithium Extraction (DLE) technology, which it plans to modularize for use in Rincon. ALTM boasts significant experience in DLE technology, a key differentiator vs peers."

LTM and Rio confirmed the approach after reports that also linked Rio to Albemarle, the world's largest lithium producer. That deal would come at a far dearer price, but would net a 49% stake in Greenbushes, the world's biggest and best lithium mine, along with half of the Wodgina mine in the Pilbara, conversion plants in China and WA, and world class brine operations in Chile.

Arcadium closed 2.46 per cent lower at $5.94 after a massive lift Monday, but remains 46 per cent lower YTD.

And on the market

Gold stocks led the market as the materials sector tumbled 1.59 per cent on a disappointingly mild Chinese stimulus update.

West African Resources (ASX:WAF) surged higher after announcing it expected to hit the upper end of its 2024 production guidance of 190,000-210,000oz at the Sanbrado mine in Burkina Faso, a day after it was slaughtered on commentary from the country's military junta that it wanted to cancel mining permits held by multinationals.

WAF assured the market today it was not in violation of any Burkina laws and would not be having its permits cancelled.

“WAF personnel have recently communicated directly with officials from the Ministry of Mines and Quarries in Burkina Faso who have confirmed that none of WAF’s mining permits are under review and all of them remain in good standing," exec chair Richard Hyde said. WAF sold 49,643oz at an average price of $US2493/oz in the September quarter, taking its YTD total to 151,596oz at an average price of $US2297/oz.

Capricorn Metals (ASX:CMM) lifted after announcing 25,559oz produced in the September quarter, in line with its 2025 mine plan (guidance 110,000-120,000oz at an AISC of $1370-$1470/oz), while Emerald Resources (ASX:EMR) allayed fears a wall slip at its Okvau mine in Cambodia would hurt its plans to hit guidance, delivering 28,046oz (upper end of quarterly guidance of 25,000-30,000oz) and boosting its cash on hand from $125.3m to $180.8m over the three months to September 30.

Iron ore fell ~2.5 per cent in Singapore, with Twiggy Forrest's Fortescue (ASX:FMG) more than 5 per cent lower.

Making gains

West African Resources (ASX:WAF) (gold) +7.5%

Bellevue Gold (ASX:BGL) (gold) +2.7%

Capricorn Metals (ASX:CMM) (gold) +1.7%

Ora Banda (ASX:OBM) (gold) +1.6%

Eating losses

IGO (ASX:IGO) (lithium/nickel) -5.5%

Fortescue (ASX:FMG) (iron ore) -5.3%

Liontown Resources (ASX:LTR) (lithium) -5.1%

Champion Iron (ASX:CIA) (iron ore) -4.4%