Lunch Wrap: Energy stocks drag down ASX as crude crumbles; Mesoblast joins ASX200 club

The ASX has slipped so far on Thursday with energy stocks down. Amcor fell on restructure news, while Mesoblast landed ungainly on the ASX 200.

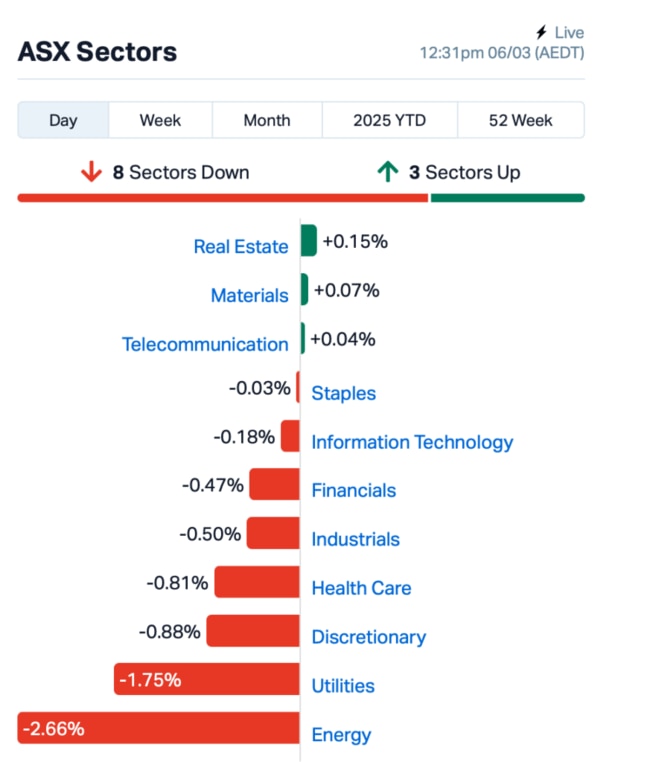

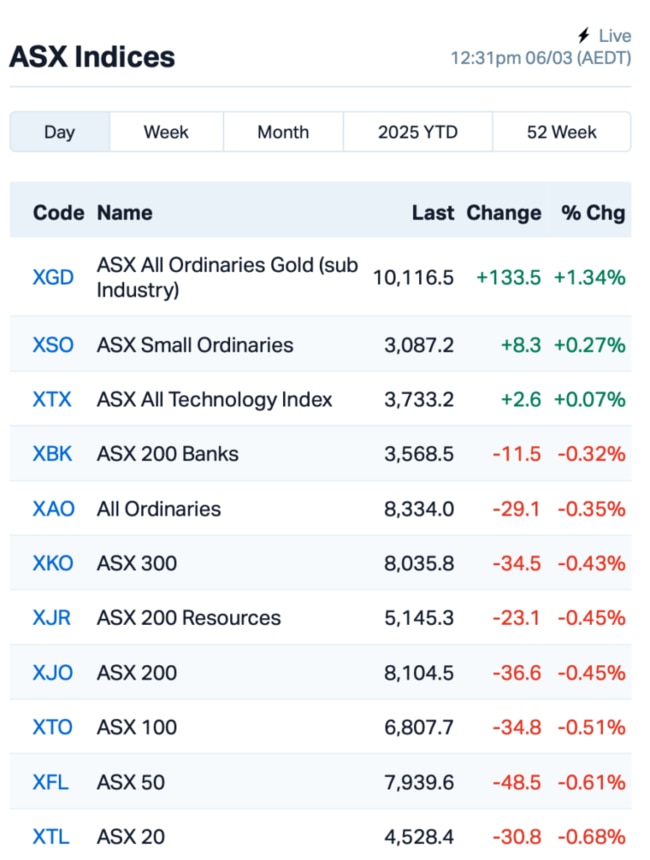

ASX drops with energy sector taking a hit

Amcor drops on restructure news

Mesoblast slips after ASX 200 inclusion

The ASX is lower by around 0.6% on Thursday at 1pm AEDT, with the energy sector in particular feeling the heat and dragging down sentiment.

Oil prices took a 4% hit overnight, trading now at US$66 a barrel. A few key things are weighing on prices.

First off, the uncertainty around US tariffs is throwing a massive shadow over energy demand. On top of that, OPEC+ decided to ramp up production again starting in April, adding 138,000 barrels per day back into world supply.

“Oil prices also continue to be undercut by the thaw in US-Russian relations, and possible peace talks on the Russia-Ukraine war...” said Rich Asplund at TradingView.

Silver, meanwhile, climbed to a one-week high as trade war fears sparked higher demand with investors turning to precious metals for safe haven. The weakening US dollar is also pushing gold prices and the Aussie dollar higher.

Over in Wall Street, there was a bit of a relief rally going on last night after Trump decided to delay some of the tariffs on cars and car parts coming from Mexico and Canada.

The S&P 500 closed the day 1% higher, while the tech-heavy Nasdaq surged by 1.46%, and Bitcoin rose by 4% in the last 24 hours to above US$90k.

Back to the ASX, energy stocks were the worst performers today, but real estate and miners helped cushion the losses.

In the large caps space, packaging giant Amcor (ASX:AMC) dropped by 1% after revealing a major restructure post-its $13 billion merger with Berry Global.

Amcor's CEO Peter Konieczny said that Amcor will now be split into two main divisions: Global Flexibles and Global Closures & Containers. The company also got big plans to reorganise and are on the hunt for new leadership, which always throws up a bit of uncertainty in the short term.

Mesoblast (ASX:MSB) fell by 6% after it was added to the S&P/ASX200 Index. While the inclusion should’ve been positive news, investors seemed unimpressed, possibly because the stock had already been priced in for this move, who knows?

In December, Mesoblast’s cell therapy Ryconcil received FDA approval to treat steroid-refractory acute graft versus host disease (SR-aGvHD) in kids. This life-threatening condition, affecting those who undergo bone marrow transplants, had no previous treatment options.

Elsewhere, Arcadium Lithium (ASX:LTM) shares will no longer be trading after today. This is because the Royal Court of Jersey has approved its acquisition by Rio Tinto (ASX:RIO). The $10.7 billion deal will see Arcadium absorbed into Rio, and with the deal now finalised, Arcadium is being removed from the ASX200 index.

And finally, Capricorn Metals (ASX:CMM) reported a 10% boost in profits for the half, hitting $90.7 million, thanks to higher gold prices and a 17% jump in gold sales. However, despite the good numbers, shares were down 2%, likely due to a rise in expenses, with its costs nearly doubling to $1.1 million.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 6 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| RTG | RTG Mining Inc. | 0.029 | 53% | 31,063,429 | $20,589,265 |

| AXP | AXP Energy Ltd | 0.002 | 50% | 3,378,101 | $6,574,681 |

| CR9 | Corellares | 0.003 | 50% | 333,480 | $935,487 |

| VPR | Voltgroupltd | 0.002 | 50% | 1,000,000 | $10,716,208 |

| DDB | Dynamic Group | 0.285 | 43% | 52,382 | $28,632,356 |

| M2R | Miramar | 0.004 | 33% | 250,000 | $1,369,040 |

| MEL | Metgasco Ltd | 0.004 | 33% | 37,999 | $4,372,760 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 400,000 | $12,000,000 |

| TG6 | Tgmetalslimited | 0.130 | 24% | 554,710 | $7,466,292 |

| AUG | Augustus Minerals | 0.040 | 21% | 517,093 | $3,933,317 |

| LML | Lincoln Minerals | 0.006 | 20% | 100,000 | $10,281,298 |

| YAR | Yari Minerals Ltd | 0.006 | 20% | 1,230,930 | $2,411,789 |

| ABX | ABX Group Limited | 0.043 | 19% | 553,735 | $9,010,564 |

| FNR | Far Northern Res | 0.140 | 17% | 3,270 | $4,351,899 |

| ENV | Enova Mining Limited | 0.007 | 17% | 91,714 | $7,383,862 |

| WOA | Wide Open Agricultur | 0.012 | 15% | 631,575 | $5,336,866 |

| G50 | G50Corp Ltd | 0.155 | 15% | 198,978 | $21,680,684 |

| PCL | Pancontinental Energ | 0.016 | 14% | 5,211,892 | $113,912,202 |

| PIL | Peppermint Inv Ltd | 0.004 | 14% | 2,750,000 | $7,633,812 |

| C29 | C29Metalslimited | 0.050 | 14% | 121,587 | $7,664,282 |

| ORP | Orpheus Uranium Ltd | 0.034 | 13% | 234,432 | $7,118,828 |

| BEO | Beonic Ltd | 0.215 | 13% | 10,000 | $13,463,592 |

| SMP | Smartpay Holdings | 0.580 | 13% | 211,433 | $124,600,884 |

| SWP | Swoop Holdings Ltd | 0.135 | 13% | 143,885 | $25,549,195 |

| AYT | Austin Metals Ltd | 0.005 | 13% | 660,000 | $5,296,765 |

RTG Mining (ASX:RTG) said Mt. Labo Development Corp has teamed up with global giant Glencore to finance Stage 1 of the high-grade Mabilo copper-gold project, securing up to US$30m in a three-part financing deal. The project will mine about 100,000 tonnes of copper-gold material.

RTG said it expects to receive about 50% of the total cash flow from Stage 1 of the project, based on current commodity prices. This includes the early repayment of around US$26m that Mt. Labo owes to RTG, a 2% royalty on the project's gross revenue, and 40% of the net profits.

TG Metals (ASX:TG6) has snapped up 80% of the Van Uden gold project in WA for $2.5 million in cash and shares. The project has four mining leases and past production from two open pits, with plenty of room for growth by expanding the mineralisation down dip. TG Metals said it was eyeing near-term cash flow from stockpiles, and is close to processing plants for quick toll treatment. The deal will be funded from its cash reserves, with no shareholder approval needed.

Augustus Minerals (ASX:AUG) has extended high-grade gold mineralisation at its Music Well project near Leonora, WA. Recent rock chip samples from Clifton East and St Patrick’s Well showed impressive gold grades, including up to 50.3g/t. The gold trend now spans 700m at Clifton East and 300m at St Patrick’s Well, with further exploration underway. Augustus is planning more drilling and mapping to explore these targets.

ABx Group (ASX:ABX) said it has the largest gibbsite-type metallurgical bauxite assets in eastern Australia, and is looking to capitalise on a surge in global bauxite prices. With global supply disruptions pushing prices up 60% in just a few months, ABx is actively exploring ways to monetise its resources, including potential production starting in 2025. The company has key projects in Queensland and New South Wales, and is in talks with various parties about offtake, investment, and asset sales.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 6 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 56,426 | $6,819,838 |

| ICU | Investor Centre Ltd | 0.002 | -33% | 4,796 | $913,534 |

| HLX | Helix Resources | 0.002 | -20% | 900,000 | $8,410,484 |

| NAE | New Age Exploration | 0.004 | -20% | 1,773,827 | $10,781,995 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 1,050,338 | $4,026,248 |

| TMX | Terrain Minerals | 0.004 | -20% | 997,010 | $10,017,783 |

| PFT | Pure Foods Tas Ltd | 0.029 | -17% | 696,879 | $4,739,897 |

| CTN | Catalina Resources | 0.003 | -17% | 49,086 | $3,948,786 |

| OSL | Oncosil Medical | 0.005 | -17% | 221,819 | $27,639,481 |

| IFG | Infocusgroup Hldltd | 0.016 | -16% | 8,275,863 | $3,539,159 |

| FG1 | Flynngold | 0.023 | -15% | 261,852 | $7,055,545 |

| ARI | Arika Resources | 0.031 | -14% | 4,746,823 | $22,806,311 |

| BKT | Black Rock Mining | 0.026 | -13% | 874,482 | $37,561,458 |

| ACU | Acumentis Group Ltd | 0.083 | -13% | 600,301 | $21,038,229 |

| ANX | Anax Metals Ltd | 0.007 | -13% | 206,028 | $7,062,461 |

| EMT | Emetals Limited | 0.004 | -13% | 209,999 | $3,400,000 |

| GBZ | GBM Rsources Ltd | 0.007 | -13% | 32,555 | $9,368,560 |

| MOH | Moho Resources | 0.004 | -13% | 100,000 | $2,865,898 |

| OLI | Oliver'S Real Food | 0.007 | -13% | 500 | $4,325,855 |

| WEC | White Energy | 0.028 | -13% | 166 | $6,367,497 |

| EXT | Excite Technology | 0.015 | -12% | 200,169 | $30,904,522 |

| HE8 | Helios Energy Ltd | 0.015 | -12% | 1,070,991 | $44,268,841 |

| RGT | Argent Biopharma Ltd | 0.160 | -11% | 30,359 | $10,669,008 |

| AQX | Alice Queen Ltd | 0.008 | -11% | 10,001 | $10,322,011 |

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.