Lunch Wrap: ASX up on Nvidia and gold surge, Albanese seeks tariff break from Trump

ASX rises with Nvidia and gold’s record high, Trump’s tariffs hit, Albanese talks to Trump, Musk’s OpenAI bid blocked.

ASX up following Nvidia and gold rally

Trump’s tariffs hit, but markets stay bullish

Albanese chats with Trump, Musk’s OpenAI bid gets shut down

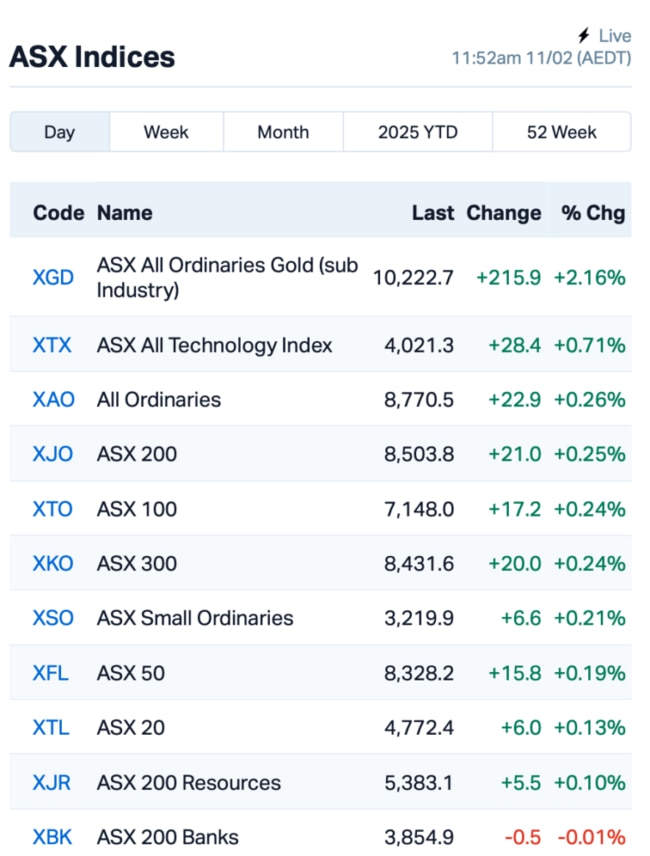

The ASX200 opened higher this morning by 0.25%, following a rally on Wall Street driven by Nvidia and metals stocks.

The Aussie benchmark index bounced back from yesterday's loss, despite US President Trump officially signing off on his steel and aluminium imports tariffs.

Markets on Wall Street pretty much shrugged it off, with the S&P 500 and Nasdaq rising, and Nvidia shares surging by 3%.

Analysts believe dip buyers are swooping in on these oversold big names like Nvidia.

“The ‘buy everything' mode seems validated by the US economy showing strength, China’s busiest port shipping a record amount of goods....” said Moomoo’s Jessica Amir.

“Altogether it's a bullish narrative for markets.”

At the same time, gold is also at a record high, trading just shy of US$3000.

“It seems my thesis of gold hitting US$4000 could become a reality,” added Amir.

Futures absolutely rocketed to US$2,941.41/oz this morning, a gain of 2.78%, with Trump's tariffs and a pause in hostage releases in Gaza as Hamas accused Israel of violating the terms of a near month-long ceasefire bolstering safe haven demand.

Back home, PM Albanese has called for an exemption from Trump, pointing out that Aussie steel and aluminium are crucial to US manufacturing and defence.

Albanese had a chat with the US president this morning, a call that was already lined up before Trump dropped the 25% tariffs bombshell.

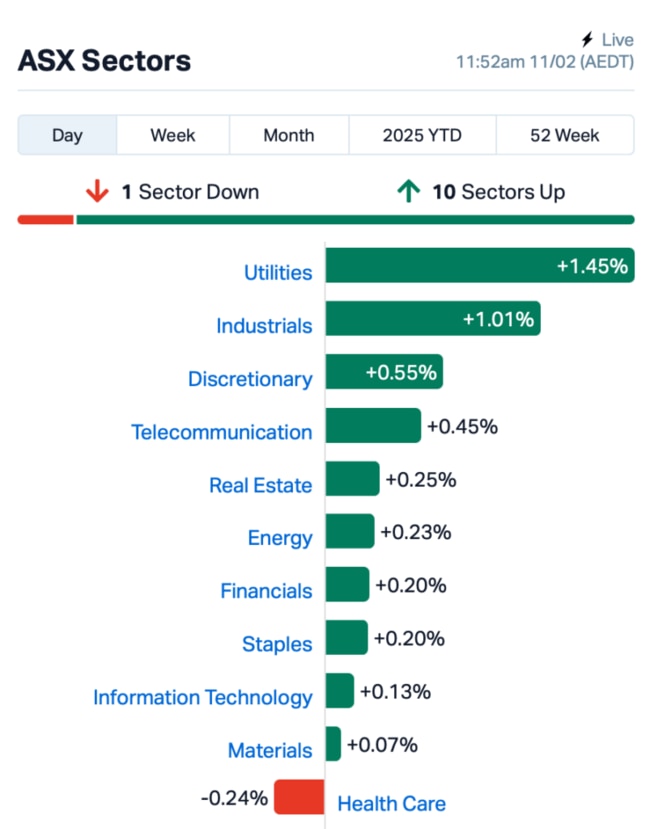

And here’s where things stood on the ASX around lunch time:

In the large caps space, Ramsay Health Care (ASX:RHC) flagged a $305 million hit to its balance sheet due to goodwill and impairment charges. Shares were up 2.5%.

CSL (ASX:CSL) reported solid earnings, driven by strong performance in its blood plasma business despite a hit from weak vaccination sales in the US. Shares rose over 1%.

Meanwhile in other news, Elon Musk's A$155 billion bid to take control of OpenAI was rejected by CEO Sam Altman.

Musk's group offered US$97.4 billion for the non-profit, but Altman shot it down with a cheeky response, saying, "No, thank you, but we’ll buy Twitter for $9.74 billion if you want."

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 11th :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EVR | Ev Resources Ltd | 0.006 | 100% | 16,785,094 | $5,797,510 |

| AS2 | Askari Metals | 0.016 | 52% | 40,048,911 | $2,795,420 |

| AOK | Australian Oil. | 0.003 | 50% | 199,506 | $2,003,566 |

| TX3 | Trinex Minerals Ltd | 0.002 | 50% | 1,000,000 | $1,878,652 |

| E79 | E79Goldmineslimited | 0.048 | 45% | 17,625,427 | $3,371,367 |

| MAT | Matsa Resources | 0.065 | 38% | 12,677,105 | $34,432,229 |

| MMR | Mec Resources | 0.004 | 33% | 369,923 | $5,549,298 |

| RGL | Riversgold | 0.004 | 33% | 14,502,272 | $5,051,138 |

| RNX | Renegade Exploration | 0.008 | 33% | 5,655,795 | $7,704,021 |

| RCR | Rincon | 0.017 | 31% | 7,945,218 | $3,803,312 |

| SLM | Solismineralsltd | 0.082 | 30% | 402,460 | $4,850,927 |

| GMN | Gold Mountain Ltd | 0.003 | 25% | 87,234 | $9,158,446 |

| C29 | C29Metalslimited | 0.058 | 23% | 136,725 | $8,186,847 |

| M2M | Mtmalcolmminesnl | 0.018 | 20% | 134,198 | $3,397,134 |

| EPM | Eclipse Metals | 0.006 | 20% | 83,333 | $14,299,095 |

| TMK | TMK Energy Limited | 0.003 | 20% | 200,000 | $23,313,913 |

| PV1 | Provaris Energy Ltd | 0.020 | 18% | 50,735 | $11,677,022 |

| CRI | Criticalim | 0.021 | 17% | 9,124,130 | $48,392,075 |

| VMC | Venus Metals Cor Ltd | 0.088 | 16% | 413,344 | $14,905,780 |

| TFL | Tasfoods Ltd | 0.015 | 15% | 260,929 | $5,682,242 |

EV Resources (ASX:EVR) said China's export controls on molybdenum, which it produces nearly half of globally, could boost demand for the Parag copper-molybdenum project in Peru. EV Resources' Parag project has already drilled high-grade molybdenum intersections, making it well-positioned to supply the US and Latin America. With molybdenum trading at nearly five times the price of copper, the project is attracting interest from roasters keen to source this key mineral.

Askari Metals (ASX:AS2) announced an upgrade on its Burracoppin Gold Project in WA. The new JORC 2012 mineral resource estimate shows 2.14 million tonnes at 1.2g/t gold, which holds 82,700 ounces of gold, up 28% from the last estimate. The MRE now includes the Benbur-Christmas Gift, Easter Gift, and Lone Tree prospects, and there's plenty of space for growth with more drilling between Benbur and Easter Gift. Askari said it had some drill hits too, like 3m at 17.41g/t from Easter Gift. The project’s generating a lot of interest, and talks are heating up with potential buyers.

E79 Gold Mines's (ASX:E79) shares rose after KalGold’s recent drilling next door to E79’s Laverton South Project uncovered a potential gold discovery at Lighthorse. KalGold’s drill hits, including 8m at 2.29g/t Au and 17m at 4.81g/t Au, are close to E79’s tenement, and the mineralisation trends onto E79’s ground. E79’s already planning aircore drilling to test these fresh targets in the coming months.

Matsa Resources (ASX:MAT) hit gold at Fortitude North with a stellar intercept of 22.4m @ 9.19g/t Au, including a standout 7.2m @ 12.98g/t Au. This marks the highest-grade result yet and confirms a second lode 120m below previous mineralisation. Further drilling is lined up to test this new info and expand on the stacked lode system at Fortitude North. Its shares are now trading at a significant premium to the unsolicited 4.5c on-market takeover offer launched by cashed up Patronus Resources on Monday.

Riversgold (ASX:RGL) is a step closer to converting its Kalgoorlie-based Northern Zone gold project into a mining lease, following the submission of its application on December 10, 2024. The company has confirmed that the Department of Energy, Mines and Industry Regulation and Safety (DEMIRS) has set the Section 29 closing date under the Native Title Act for May 29, 2025.

Renegade Exploration (ASX:RNX) has found high-grade antimony, gold, and silver at its Myschka Prospect in the Yukon, Canada. The prospect, located 10km from a major deposit, has returned rock samples with up to 1% antimony, 1.05g/t gold, and 560g/t silver. Myschka, which has never been drilled, is near Snowline Gold’s multi-million-ounce discovery, raising excitement for potential gold finds.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 11th :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 41,787 | $11,649,361 |

| YOW | Yowie Group | 0.011 | -45% | 339,238 | $4,587,358 |

| OCT | Octava Minerals | 0.049 | -37% | 2,809,929 | $4,758,726 |

| NRZ | Neurizer Ltd | 0.002 | -33% | 722,664 | $9,674,012 |

| GGE | Grand Gulf Energy | 0.002 | -25% | 6,956 | $4,900,774 |

| JAV | Javelin Minerals Ltd | 0.003 | -25% | 4,766,152 | $24,149,766 |

| CUL | Cullen Resources | 0.004 | -20% | 154,600 | $3,467,009 |

| PR1 | Pureresourceslimited | 0.105 | -19% | 32,692 | $5,981,143 |

| NWM | Norwest Minerals | 0.013 | -19% | 722,108 | $7,761,912 |

| AJL | AJ Lucas Group | 0.009 | -18% | 88,738 | $15,133,026 |

| BCB | Bowen Coal Limited | 0.005 | -17% | 46,171,398 | $64,653,841 |

| C7A | Clara Resources | 0.005 | -17% | 27,862 | $2,860,496 |

| HYD | Hydrix Limited | 0.021 | -16% | 1,785,020 | $6,819,221 |

| BUY | Bounty Oil & Gas NL | 0.003 | -14% | 137,501 | $5,465,151 |

| CTO | Citigold Corp Ltd | 0.003 | -14% | 1,156,147 | $10,500,000 |

| SPQ | Superior Resources | 0.006 | -14% | 203,625 | $15,189,047 |

| STM | Sunstone Metals Ltd | 0.006 | -14% | 2,087,568 | $36,050,025 |

| CWX | Carawine Resources | 0.086 | -14% | 34,020 | $23,612,545 |

| MKL | Mighty Kingdom Ltd | 0.007 | -13% | 2,000,000 | $1,728,507 |

| PLC | Premier1 Lithium Ltd | 0.007 | -13% | 70,000 | $2,944,485 |

| T3D | 333D Limited | 0.007 | -13% | 62,499 | $1,409,468 |

| ARV | Artemis Resources | 0.008 | -11% | 1,042,576 | $19,848,442 |

IN CASE YOU MISSED IT

Drilling has commenced at Belararox’s (ASX:BRX) Malambo copper-gold porphyry target within its TMT project in Argentina’s San Juan Province. This follows ongoing drilling at Tambo South, where copper sulphides have been observed in core. The first hole at Malambo is planned to reach a total depth of 1200 metres.

Vertex Minerals (ASX:VTX) has strengthened its board with the appointment of experienced mining executive Sean Richardson as an independent non-executive director. With 30 years of experience spanning operations, consultancy, and managerial roles across Australia, North America, Africa, and Asia, Richardson has held senior positions at several ASX-listed companies, including MD of Empire Resources, COO of Bardoc Gold, and operations manager for Shaw River Manganese.

At Stockhead, we tell it like it is. While Riversgold, Belararox and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.