Lunch Wrap: ASX surges on Washington relief, Neuren rockets and GGE leads small caps

ASX jumps on tariff relief, Wall Street ends strongly despite “Sell America” talk and Neuren and GGE take off.

ASX pops on tariff relief

Wall Street close strong despite “Sell America” talk

Neuren rockets after FDA green light; GGE skyrockets

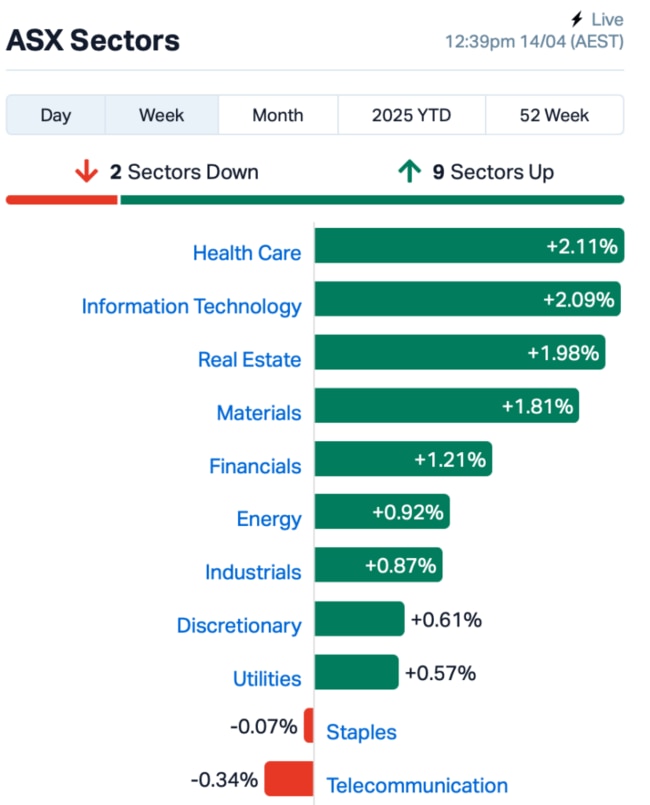

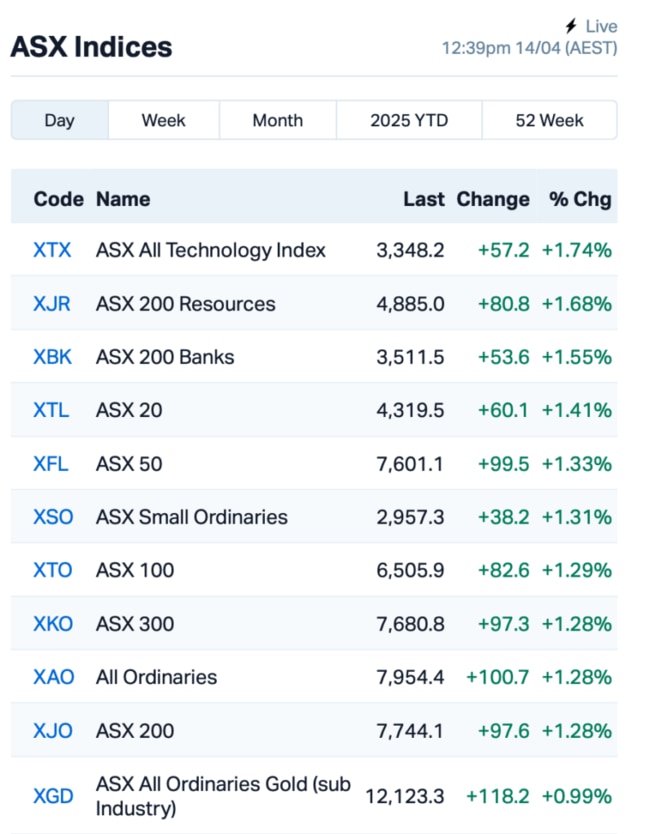

The Aussie sharemarket has kicked off the week on a tear, up by 1.3% at lunch time as it shrugged off global jitters thanks to a bit of breathing space from Washington.

After a roller coaster week, Wall Street ended on a high note Friday. The S&P 500 lifted 1.8 %, the Nasdaq jumped 2% and the Dow tacked on 1.5%. Despite all the chaos, it was actually the best week for US markets since 2023.

But under the surface, there’s still tension.

Yields on 10-year Treasuries shot up to the highest levels since February, while gold hit yet another record.

There’s even talk of a “sell America” trade bubbling up – basically, global fundies dumping US assets and taking their cash elsewhere.

"I do think it's severe," Marc Chandler at Bannockburn told Yahoo.

"People are concerned that maybe we're seeing a capital strike against the US, where large pools of capital are selling US assets and taking their money home."

Billionaire investor Bill Ackman has sharply criticised Trump's policies, warning that implementing such widespread tariffs could result in an "economic nuclear winter”.

China, meanwhile, has welcomed the US decision to exempt certain consumer electronics from its so-called “reciprocal tariffs”, calling it a “small step” toward undoing what it sees as a major trade blunder.

But Trump’s not backing down just yet. He made it clear those exemptions are just a short-term move while his team cooks up a more targeted semiconductor tariff plan.

Back on the ASX, local miners didn’t miss a beat. As iron ore prices jumped, so did the heavyweights like BHP (ASX:BHP) and Rio Tinto (ASX:RIO).

Oil stocks, which copped a big hit last week, bounced back too. Over the weekend, the US and Iran had their first high-level talks since 2022 in Oman, aiming to ease tensions over Iran's nuclear program.

Gold stocks were buzzing again, not just from global demand, but with M&A momentum heating up.

De Grey Mining (ASX:DEG) lifted as much as 2% after its major shareholder Gold Road Resources (ASX:GOR) threw its weight behind Northern Star Resources' (ASX:NST) $5 billion takeover bid.

But the large cap standout today was Neuren Pharmaceuticals (ASX:NEU), pushing the healthcare sector higher.

The biotech darling rocketed 18% after confirming the primary endpoints for its Phase 3 trial of NNZ-2591 in kids with Phelan-McDermid Syndrome (PMS) following a productive chat with the FDA. The trial will now focus on communication improvements, with past trials showing solid results – 16 out of 18 kids made progress.

Neuren said it was on track to kick off this trial in mid-2025, with funding already sorted. This is a big step towards the first-ever Phase 3 treatment for PMS, a condition with no current approved therapies.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 14 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| GGE | Grand Gulf Energy | 0.004 | 167% | 43,684,635 | $3,675,581 |

| RLC | Reedy Lagoon Corp. | 0.002 | 100% | 174,999 | $776,707 |

| CRB | Carbine Resources | 0.003 | 50% | 100,001 | $1,103,476 |

| FLG | Flagship Min Ltd | 0.061 | 36% | 172,195 | $9,161,740 |

| EXR | Elixir Energy Ltd | 0.027 | 35% | 11,719,416 | $27,925,585 |

| AX8 | Accelerate Resources | 0.008 | 33% | 2,430,366 | $4,723,132 |

| GMN | Gold Mountain Ltd | 0.002 | 33% | 343,857 | $6,868,835 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 2,614,020 | $8,179,556 |

| ASM | Ausstratmaterials | 0.520 | 33% | 733,692 | $70,722,866 |

| ARI | Arika Resources | 0.030 | 25% | 7,655,249 | $15,204,207 |

| LMS | Litchfield Minerals | 0.150 | 25% | 206,440 | $3,385,362 |

| FAU | First Au Ltd | 0.003 | 25% | 70,000 | $4,143,987 |

| GCM | Green Critical Min | 0.010 | 25% | 9,057,463 | $15,693,426 |

| RDN | Raiden Resources Ltd | 0.005 | 25% | 5,741,583 | $13,803,566 |

| SPQ | Superior Resources | 0.005 | 25% | 2,206,673 | $9,483,931 |

| TEG | Triangle Energy Ltd | 0.005 | 25% | 31,715,024 | $8,356,936 |

| VFX | Visionflex Group Ltd | 0.003 | 25% | 150,000 | $6,735,721 |

| NAG | Nagambie Resources | 0.021 | 24% | 3,048,699 | $13,656,140 |

| EWC | Energy World Corpor. | 0.017 | 21% | 265,458 | $43,104,897 |

| FEG | Far East Gold | 0.145 | 21% | 5,473 | $44,043,294 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 632,500 | $2,873,894 |

| BIT | Biotron Limited | 0.003 | 20% | 1,129,785 | $3,318,115 |

| CYQ | Cycliq Group Ltd | 0.003 | 20% | 355,000 | $1,151,292 |

| NES | Nelson Resources. | 0.003 | 20% | 50,000 | $5,429,819 |

Grand Gulf Energy (ASX:GGE) skyrocketed today after locking in a deal to potentially take a 70% stake in Block 2312 offshore Namibia, a hot spot for oil exploration. The area has seen major oil finds, with over 11 billion barrels discovered so far, and big players like Shell and Chevron are all over it. The block’s got plenty of seismic data, and previous reports estimate up to 1.1 billion barrels could be there. GGE said the deal is low-cost for the company, with payments only due once the exploration licence is granted.

DroneShield (ASX:DRO) has secured a major $32.2 million contract package from a long-standing Asia Pacific military customer, via a local reseller owned by a global, publicly listed defence company. The deal covers five separate repeat contracts for vehicle-mounted and fixed counterdrone systems, with deliveries and payments expected across Q2 and Q3 of 2025. This latest win builds on roughly $12.3 million worth of previous contracts with the same customer since mid-2024.

Accelerate Resources (ASX:AX8) is gearing up to drill high-impact gold targets at its Kanowna East project near Kalgoorlie. After digging into data, three priority targets have been identified: extending the paleochannel gold at Western Tiger, finding the bedrock source of high-grade gold there, and testing regional gold anomalies. Drilling is nowx`x` set to start in Q2 2025, with approvals and surveys already in the works. The company’s confident that these new targets could lead to a solid gold discovery.

Flagship Minerals (ASX:FLG) has secured the Pantanillo gold project in Chile’s Maricunga Gold Belt, a hotspot for gold mining. The project’s got an estimated 1.05 million ounces of gold, with plenty of drilling already done. Located next to major players like Barrick and Kinross, Pantanillo is set up for open cut mining and heap leach processing, offering Flagship a solid shot at getting into production quickly.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 14 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GTR | Gti Energy Ltd | 0.002 | -33% | 30 | $8,996,849 |

| VML | Vital Metals Limited | 0.002 | -33% | 252,540 | $17,685,201 |

| NNL | Nordicresourcesltd | 0.080 | -30% | 138,920 | $16,949,142 |

| BRX | Belararoxlimited | 0.120 | -25% | 1,281,646 | $25,043,577 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 46,958 | $15,846,485 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 400,328 | $8,100,749 |

| OLI | Oliver'S Real Food | 0.004 | -20% | 1,519,718 | $2,703,660 |

| OSL | Oncosil Medical | 0.004 | -20% | 5,524,709 | $23,032,901 |

| ASE | Astute Metals NL | 0.021 | -19% | 40,000 | $15,816,091 |

| EG1 | Evergreenlithium | 0.050 | -17% | 306,476 | $3,373,800 |

| ANX | Anax Metals Ltd | 0.005 | -17% | 7,344,807 | $5,296,845 |

| EM2 | Eagle Mountain | 0.005 | -17% | 100,000 | $6,810,224 |

| SER | Strategic Energy | 0.005 | -17% | 10 | $4,026,200 |

| ZMM | Zimi Ltd | 0.010 | -17% | 190,837 | $4,643,329 |

| MPP | Metro Perf.Glass Ltd | 0.055 | -17% | 17,500 | $12,234,954 |

| BNR | Bulletin Res Ltd | 0.072 | -15% | 1,111,327 | $24,957,132 |

| EBR | EBR Systems | 1.445 | -14% | 3,911,771 | $630,194,788 |

| KPO | Kalina Power Limited | 0.006 | -14% | 3,000 | $20,259,538 |

| MEM | Memphasys Ltd | 0.006 | -14% | 5,147,834 | $12,397,103 |

| PCL | Pancontinental Energ | 0.006 | -14% | 3,999,363 | $56,956,101 |

| RFA | Rare Foods Australia | 0.006 | -14% | 30,362 | $1,903,883 |

| TMX | Terrain Minerals | 0.003 | -14% | 24,732,665 | $7,012,448 |

| SSH | Sshgroupltd | 0.125 | -14% | 65,608 | $9,555,479 |

| LIS | Lisenergylimited | 0.100 | -13% | 12,686 | $73,623,026 |

EBR Systems (ASX:EBR) just scored a major win, a full FDA approval for its WiSE CRT System, the world’s first leadless heart pacing device for patients who’ve been left out by traditional tech. It’s a breakthrough move into a $3.6 billion US market, and it puts EBR on track to start selling in late 2025, with a full rollout coming in 2026.

But despite the good news, its shares dropped 12%. Perhaps the market wasn’t too stoked about the slow revenue ramp. The initial launch is limited, with cash flow not expected until late next year.

IN CASE YOU MISSED IT

Preparing to produce a pre-feasibility study for the Minyari Dome gold project in WA, Antipa Minerals (ASX:AZY) is advancing several parallel workstreams, including metallurgical test work, environmental studies and permitting activities. The company also plans to complete an exploration drilling program targeting resource expansion, near-term development and new discoveries.

Leeuwin Metals (ASX:LM1) has ticked off a maiden reverse circulation drilling program at the Marda gold project in WA, focused on untested strike and depth extensions to historical pits at Marda Central. Phase 2 drilling will begin once LM1 receives the results, expected in 3-6 weeks.

Following up on a result of 4m at 9 g/t gold from 12m at the Newman gold project, Peregrine Gold (ASX:PGD) is gearing up for an 8,000-metre air core program, with a specific focus on the Tin Can prospect. Soil sampling recently extended gold and arsenic anomalies in the Tin Can trend, indicating the presence of mineralisation.

At Stockhead, we tell it like it is. While Antipa Minerals, Leeuwin Metals and Peregrine Gold are Stockhead advertisers, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.