Lunch Wrap: ASX rebounds after Powell’s relaxed stance; Nanosonics gets FDA green light

The ASX has bounced back after Wall Street’s surge. Meanwhile Nanosonics has soared on FDA approval, and Bitcoin is back above $86k while gold grabbed another personal best.

ASX up after Wall Street rally and Fed holds steady

Nanosonics jumps after FDA approval

Bitcoin rebounds to $86k, gold hits new record

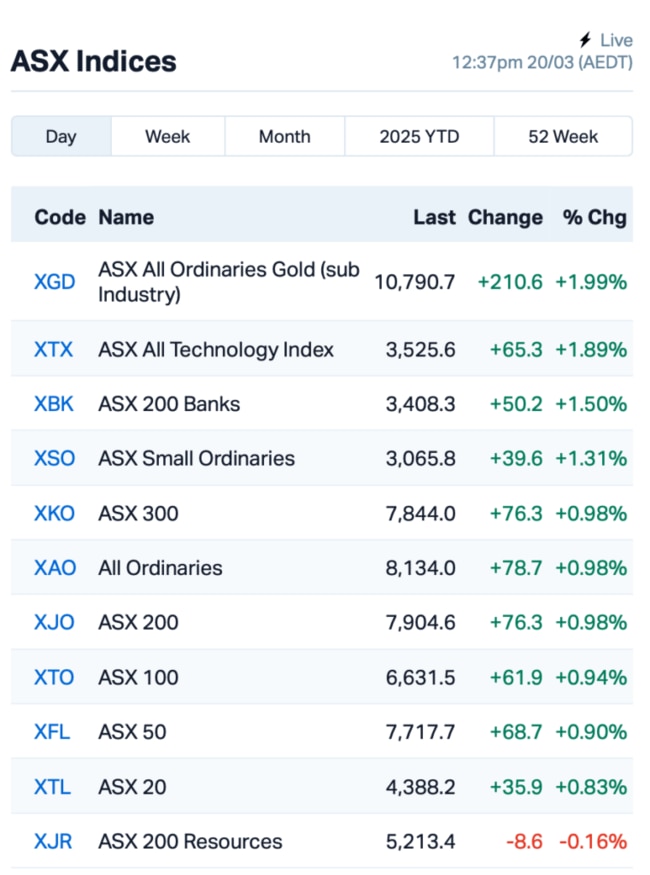

The ASX kicked off Thursday on a solid note, up by almost 1% after the Federal Reserve signalled it wasn’t rushing to change its interest rate plans.

Overnight, Wall Street and European stocks also surged after the Fed held rates and confirmed that it still expected a 50 basis point rate cut by the end of the year.

Fed Chairman Jerome Powell surprisingly said he wasn’t overly concerned about tariffs pushing inflation up, saying any inflation bump would be “transitory”.

However, he gave this warning: “I do think with the arrival of the tariff inflation, further progress may be delayed.”

According to Nigel Green at de Vere Group, markets want certainty that the rate-cutting cycle will begin imminently.

“A lack of decisive communication could trigger market instability, while a well-telegraphed shift would provide a necessary cushion against emerging risks,” said Green.

But Powell’s generally laid-back attitude set the stage for a good run in stocks globally, with the S&P 500 rising 1% and Tesla rebounding by 5%.

Bitcoin got in on the action, too – jumping 6% and breaking the US$86,000 mark.

And gold grabbed itself another record, rising to $3052.70 per ounce as investors still sought a hedge in safe-haven assets.

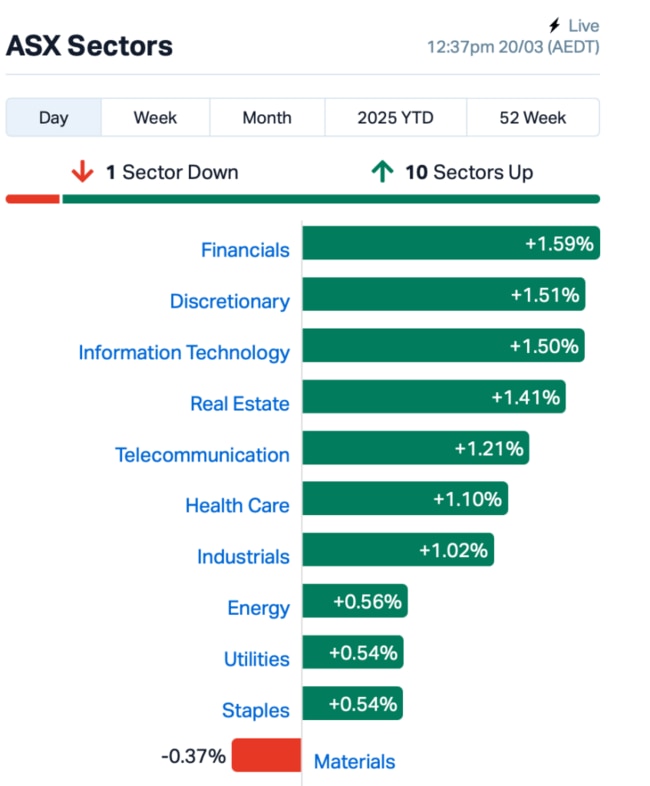

Back on the ASX, local shares followed the global rally, with financials leading the way this morning.

National Australia Bank (ASX:NAB) managed to rise by 1% despite a downgrade from Morgan Stanley, which shifted its rating to “equal weight” after recent exec changes at NAB.

In large caps news, Nanosonics (ASX:NAN) stole the headline, shooting up by 14% after a US FDA approval for its new Coris system, which helps clean flexible endoscopes better, reducing infection risks. The product will be tested in a few hospitals starting in Q1 FY26, with plans to expand and get approval in the UK, Europe, and Australia by the same year.

Also read > Health Check: Join in the Coris as Nanosonics wins key FDA approval

Cleanaway (ASX:CWY) has struck a deal to acquire unlisted Contract Resources for $377 million. Contract Resources is a top player in catalyst handling, decontamination, and chemical cleaning.

Meanwhile, TPG Telecom (ASX:TPM) got the green light from the competition watchdog for its $5.25 billion sale of its fibre networks to Vocus Group, pushing TPG’s shares up by 5%.

And finally from the large end of town, mining services firm NRW Holdings (ASX:NWH) struck a $100 million deal with Rio Tinto (ASX:RIO) for its seawater desalination project, adding a solid chunk to its order book. NRW’s shares were up 2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 20 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SFG | Seafarms Group Ltd | 0.002 | 100% | 700,491 | $4,836,599 |

| CRR | Critical Resources | 0.005 | 50% | 12,041,917 | $7,392,664 |

| LNR | Lanthanein Resources | 0.003 | 50% | 4,260,236 | $4,887,272 |

| VPR | Voltgroupltd | 0.002 | 50% | 10,863,629 | $10,716,208 |

| D3E | D3 Energy Limited | 0.070 | 35% | 369,202 | $4,132,700 |

| 1AD | Adalta Limited | 0.012 | 33% | 2,664,630 | $5,789,005 |

| AKM | Aspire Mining Ltd | 0.285 | 33% | 254,021 | $109,141,952 |

| MRR | Minrex Resources Ltd | 0.009 | 29% | 3,684,390 | $7,594,073 |

| NSM | Northstaw | 0.050 | 25% | 4,572,767 | $10,907,060 |

| ERA | Energy Resources | 0.003 | 25% | 2,098,460 | $810,792,482 |

| CYB | Aucyber Limited | 0.092 | 24% | 753,452 | $12,103,689 |

| CHR | Charger Metals | 0.048 | 20% | 95,514 | $3,096,810 |

| ENT | Enterprise Metals | 0.003 | 20% | 500,000 | $2,945,793 |

| KGD | Kula Gold Limited | 0.006 | 20% | 753,154 | $4,606,268 |

| STM | Sunstone Metals Ltd | 0.006 | 20% | 1,814,626 | $25,750,018 |

| OSX | Osteopore Limited | 0.025 | 19% | 170,439 | $2,538,239 |

| LSA | Lachlan Star Ltd | 0.065 | 18% | 28,689 | $13,891,526 |

| BIT | Biotron Limited | 0.004 | 17% | 1,355,418 | $2,707,148 |

| CAZ | Cazaly Resources | 0.014 | 17% | 21,200 | $5,535,636 |

| MKL | Mighty Kingdom Ltd | 0.007 | 17% | 2,137,963 | $1,296,380 |

| BTC | BTC Health Ltd | 0.064 | 16% | 15,000 | $17,892,782 |

| TKM | Trek Metals Ltd | 0.044 | 16% | 3,416,813 | $19,825,469 |

| IND | Industrialminerals | 0.185 | 16% | 44,463 | $12,851,600 |

Critical Resources (ASX:CRR) has announced that after a thorough geophysical review and airborne magnetic survey, it’s clear that its Halls Peak project in NSW holds serious potential for gold-antimony mineralisation, alongside its existing base metal systems. The new findings highlight previously overlooked structural corridors and deep-rooted fault systems, suggesting the area could host multiple types of mineralisation, including Hillgrove-style gold-antimony. This opens up new targets for exploration.

Biotech firm AdAlta (ASX:1AD) has just scored its first external investment for its “East to West” cellular immunotherapy strategy, with SYNthesis BioVentures chucking in $2 million into its subsidiary, AdCella. This will fund the planning and prep for three major immunotherapy assets, with SYNBV also locking in the right to invest $5.5 million in the Series A round. The funds will help speed up clinical development and secure licensing agreements.

Charger Metals (ASX:CHR) and RTX (Rio Tinto Exploration) have locked in a $1.1 million exploration budget for the Lake Johnston lithium project in 2025, with RTX footing the bill. This includes 5,000m of drilling to test top lithium targets at Mt Day, Mt Gordon, and Pagrus. Charger’s farm-in deal with RTX means RTX will fund the work, and Charger will keep pushing ahead with exploration despite the downturn in lithium prices.

Arafura Rare Earths (ASX:ARU) has signed a binding deal with Traxys Europe to supply up to 300 tonnes per year of NdPr oxide from the Nolans Project over five years. The deal will help Arafura hit its target of securing 80% of planned production under binding agreements. Traxys will market the NdPr globally, helping to diversify the supply chain and manage delivery schedules. The deal is subject to Arafura completing Nolans' construction and starting commercial production.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 20 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.001 | -50% | 1,650,000 | $9,158,446 |

| WSR | Westar Resources | 0.006 | -33% | 12,855,253 | $3,588,523 |

| VML | Vital Metals Limited | 0.002 | -33% | 25,000 | $17,685,201 |

| RFA | Rare Foods Australia | 0.011 | -31% | 1,225,069 | $4,351,732 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 5,321,381 | $57,867,624 |

| AOK | Australian Oil. | 0.002 | -25% | 3,500 | $2,003,566 |

| BSA | BSA Limited | 0.064 | -25% | 1,618,892 | $6,381,427 |

| PAB | Patrys Limited | 0.002 | -20% | 110,000 | $5,143,618 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 1,661,500 | $22,646,967 |

| ASR | Asra Minerals Ltd | 0.003 | -17% | 1,625,283 | $7,119,380 |

| SER | Strategic Energy | 0.005 | -17% | 950,129 | $4,026,200 |

| 1AE | Auroraenergymetals | 0.040 | -15% | 12,740 | $8,415,996 |

| AX8 | Accelerate Resources | 0.006 | -14% | 1,519,171 | $5,227,278 |

| TMK | TMK Energy Limited | 0.003 | -14% | 2,453,089 | $32,772,828 |

| WNR | Wingara Ag Ltd | 0.006 | -14% | 613,000 | $1,228,798 |

| ADN | Andromeda Metals Ltd | 0.007 | -13% | 21,780,090 | $27,429,822 |

| FCT | Firstwave Cloud Tech | 0.014 | -13% | 733,144 | $27,416,299 |

| GBZ | GBM Rsources Ltd | 0.007 | -13% | 289,745 | $9,368,560 |

| LU7 | Lithium Universe Ltd | 0.007 | -13% | 267,054 | $6,287,837 |

| XPN | Xpon Technologies | 0.007 | -13% | 45,250 | $2,899,532 |

| AMO | Ambertech Limited | 0.140 | -13% | 63,127 | $15,264,765 |

| AHK | Ark Mines Limited | 0.120 | -11% | 42,333 | $7,485,266 |

| AAU | Antilles Gold Ltd | 0.004 | -11% | 1,519,183 | $9,541,692 |

| NAG | Nagambie Resources | 0.016 | -11% | 292,839 | $14,459,442 |