Lunch Wrap: ASX lights up as risk returns; Paladin rockets 25pc but gold sees heavy profit-taking

The ASX lit up on hopes of a China trade thaw, sending gold tumbling as risk came back on the menu.

ASX lights up on China trade thaw and Wall Street buzz

Gold tanks as risk-on sentiment returns

Paladin and Telix pop, gold miners cop it

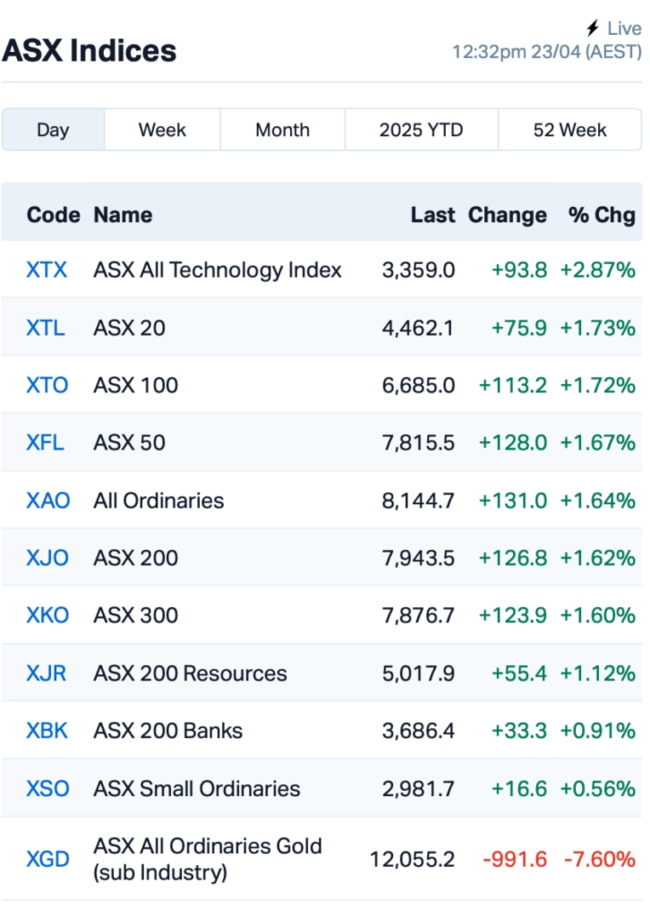

The ASX came out swinging this morning, putting on 1.5% by lunch time amid fresh whispers the US-China trade tiff might be winding down.

Driving the risk-on mood was a private comment from US Treasury Secretary Scott Bessent, who reckons the current tariff standoff with China just isn’t sustainable.

He let slip at a JPMorgan investor summit that a de-escalation is likely on the cards, in the “very near” future.

“I do say China is going to be a slog in terms of the negotiations,” Bessent said, adding that “neither side thinks the status quo is sustainable.”

That little nugget of optimism lit a fire under Wall Street, where all three major indexes clocked more than 2% gains overnight.

Bessent’s remarks also sent gold prices down, and pushed the greenback a nudge higher.

President Trump, never one to miss a mic moment, echoed the vibe, saying a deal with China was on the way, and tariffs wouldn’t be anywhere close to current levels.

He even promised to “be very nice” to China and predicted Beijing would return the favour.

“We’re going to be very nice and they’re going to be very nice, and we’ll see what happens,” Trump said.

And after sparking a bit of a selloff Monday with vague threats to fire Fed boss Jerome Powell and calling him “major loser”, Trump walked it back with a shrug.

“I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates.”

For markets hungry for a circuit breaker, that was enough.

Iron ore and oil prices got a boost, with traders hoping the worst of the China slowdown talk is behind us.

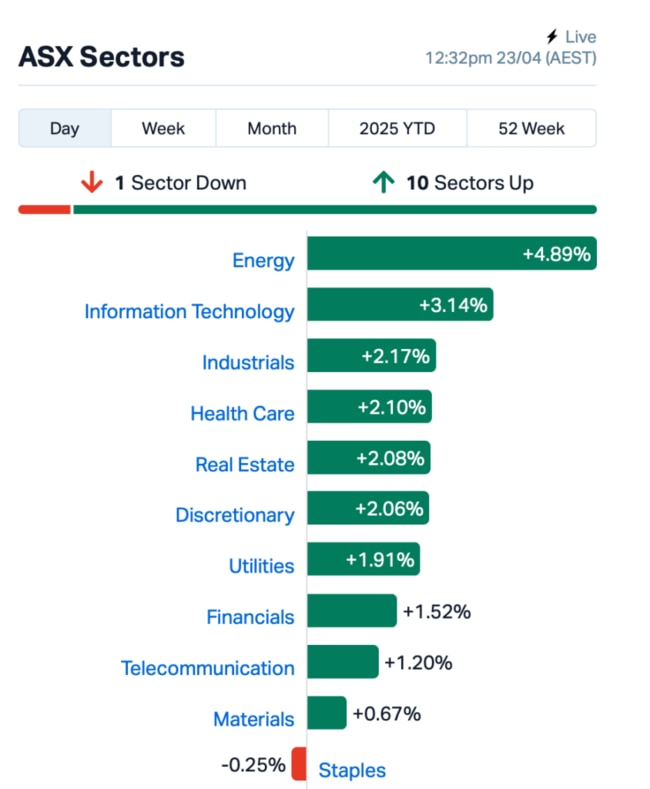

Back home on the ASX, investors piled into tech and energy stocks.

Not everyone had a good morning, though. Gold miners took a hiding as prices eased back from record highs.

After touching $US3500 an ounce for the first time, bullion dropped over 1% in Asian trade today, triggering some heavy profit-taking.

In large caps news, BHP (ASX:BHP) climbed 3% as rumours bubbled that CEO Mike Henry may be preparing to step aside, with a succession race quietly underway. BHP has not made any official announcement to this effect.

Woodside Energy Group (ASX:WDS) also rose 3% despite production dipping by 4% in Q1 thanks to rough weather and unexpected outages at its key sites. But stronger output in the US helped cushion the blow, and on a year-on-year basis, both output and revenue were actually up.

In uranium, Paladin Energy (ASX:PDN) was the standout. Its shares soared 25% after its Langer Heinrich mine in Namibia clocked a record quarter, pumping out over 745,000 pounds of uranium oxide despite copping a battering from wet weather.

Telix Pharmaceuticals (ASX:TLX) had a cracker morning too, jumping 11% thanks to a year-on-year 62% revenue lift in Q1, on the back of strong demand for its prostate cancer imaging drug.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 23 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| M2R | Miramar | 0.004 | 100% | 14,698,944 | $1,993,647 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 1,500,000 | $3,253,779 |

| RAN | Range International | 0.003 | 50% | 333,334 | $1,878,581 |

| PPY | Papyrus Australia | 0.011 | 38% | 13,750 | $4,565,454 |

| ACS | Accent Resources NL | 0.008 | 33% | 60,000 | $2,838,764 |

| BNL | Blue Star Helium Ltd | 0.008 | 33% | 1,473,566 | $16,169,312 |

| RDS | Redstone Resources | 0.004 | 33% | 2,618,087 | $2,776,135 |

| CUS | Coppersearchlimited | 0.022 | 29% | 180,006 | $2,017,456 |

| RFA | Rare Foods Australia | 0.009 | 29% | 485,766 | $1,903,883 |

| GCM | Green Critical Min | 0.012 | 28% | 29,194,954 | $17,655,105 |

| KNI | Kunikolimited | 0.175 | 25% | 135,330 | $12,169,398 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 1,905,216 | $12,314,111 |

| TAR | Taruga Minerals | 0.011 | 22% | 1,330,000 | $6,354,241 |

| PDN | Paladin Energy Ltd | 4.850 | 22% | 5,257,867 | $1,587,861,950 |

| BMG | BMG Resources Ltd | 0.012 | 20% | 1,298,293 | $8,383,972 |

| JLL | Jindalee Lithium Ltd | 0.285 | 19% | 295,832 | $17,662,044 |

| ABE | Ausbondexchange | 0.039 | 18% | 218,181 | $3,718,048 |

| AGE | Alligator Energy | 0.028 | 17% | 14,454,597 | $92,966,384 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 429,095 | $3,448,673 |

| SPX | Spenda Limited | 0.007 | 17% | 175,201 | $27,691,293 |

| TEG | Triangle Energy Ltd | 0.004 | 17% | 5,600,699 | $6,267,702 |

| TOE | Toro Energy Limited | 0.225 | 15% | 1,033,453 | $23,454,960 |

| AEE | Aura Energy | 0.115 | 15% | 781,040 | $89,074,814 |

| CU6 | Clarity Pharma | 2.055 | 14% | 1,448,202 | $580,039,660 |

Papyrus Australia (ASX:PPY)reported a solid quarter, kicking big goals both in Vietnam and back home. It teamed up with local partner Thung Dung to push ahead with its banana waste-to-product tech, and a recent site visit confirmed the joint venture’s in good nick. Back in Australia, it’s powering through setup of its R&D hub in Adelaide, with early product tests looking promising. It’s also raised $200k to keep the commercialisation engine ticking over.

Blue Star Helium (ASX:BNL) has successfully drilled its Jackson 27 development well to total depth within the company’s broader Galactica helium project in Las Animas County, Colorado. The company confirmed gas presence, with the well flowing naturally both during drilling and at total depth, verified by wireline logs. Gas samples have been sent to the laboratory for analysis of helium and CO2 concentrations.

Redstone Resources (ASX:RDS) has kicked off diamond drilling at its Tollu copper deposit in WA’s West Musgrave. It’s punching down a 1,200m hole under the high-grade Tollu copper zone, hoping to hit a Voisey’s Bay-style copper-nickel jackpot hiding beneath. Previous drilling has already pulled up some promising copper hits, one even hit 18% copper over a metre.

Green Critical Minerals (ASX:GCM) has teamed up with Aussie data centre GreenSquareDC to work on cooling tech using its VHD Graphite. GreenSquareDC builds next-gen, AI-ready data centres, so this deal shows there’s serious real-world interest in GCM’s gear. GCM said this is a big step in its push to get its tech into the hands of big players across Australia, the US, and Europe.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 23 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -33% | 6,981,035 | $43,400,718 |

| FTC | Fintech Chain Ltd | 0.004 | -33% | 583,050 | $3,904,618 |

| T3D | 333D Limited | 0.006 | -25% | 22,222 | $1,409,468 |

| NGX | Ngxlimited | 0.100 | -20% | 73,985 | $11,326,480 |

| CTN | Catalina Resources | 0.002 | -20% | 776,798 | $4,159,399 |

| FAU | First Au Ltd | 0.002 | -20% | 58,227 | $5,179,983 |

| LML | Lincoln Minerals | 0.004 | -20% | 2,665 | $10,512,849 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 5,000,000 | $8,419,651 |

| TRP | Tissue Repair | 0.205 | -18% | 628,015 | $15,116,211 |

| CTT | Cettire | 0.540 | -18% | 5,388,646 | $249,711,034 |

| KPO | Kalina Power Limited | 0.005 | -17% | 5,315,165 | $17,365,318 |

| SHP | South Harz Potash | 0.005 | -17% | 72,000 | $6,495,472 |

| REE | Rarex Limited | 0.032 | -16% | 14,943,330 | $30,432,142 |

| 8CO | 8Common Limited | 0.017 | -15% | 6,695 | $4,481,898 |

| IR1 | Irismetals | 0.135 | -14% | 300,698 | $26,926,103 |

| AAU | Antilles Gold Ltd | 0.003 | -14% | 100,000 | $7,442,287 |

| CLA | Celsius Resource Ltd | 0.006 | -14% | 1,907,211 | $20,352,998 |

| FFF | Forbidden Foods | 0.006 | -14% | 5,514,266 | $4,984,714 |

| HHR | Hartshead Resources | 0.006 | -14% | 3,226,541 | $19,660,775 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 6,993 | $11,196,728 |

| W2V | Way2Vatltd | 0.006 | -14% | 350,000 | $6,538,001 |

| OBM | Ora Banda Mining Ltd | 1.030 | -14% | 5,855,173 | $2,250,645,829 |

| C1X | Cosmosexploration | 0.074 | -13% | 13,378 | $8,794,661 |

| AGD | Austral Gold | 0.061 | -13% | 95,141 | $42,861,795 |

Online fashion retailer Cettire (ASX:CTT) slumped by 15% after reporting a bit of a mixed bag this quarter. It pulled in $260 million in sales, up just 1% on pcp, but it took a $4.7 million EBITDA hit, thanks in part to currency losses and heavy discounting. The company said demand’s been patchy across the luxury market, especially in the US, but it still grew its active customer base to around 696,000.

At Stockhead, we tell it like it is. While Blue Star Helium is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.