Lunch Wrap: ASX lacks Monday energy as miners and James Hardie dip; Bitcoin quietly rises

The ASX lacks vigour on Monday after Friday’s flat close on Wall Street. James Hardie and miners led losses in early trade.

ASX lacks vigour on Monday after Friday's flat close on Wall Street

Building products giant James Hardie has taken a big hit, while miners (although not MinRes) also struggle

Bitcoin, however, is having a better day so far as investors hope for a sentiment shift

The ASX 200 index slumped out of bed with a yawn and a sigh on Monday morning, hitting the Groundhog Day clock radio with a heavy fist before shuffling down to breakfast table and tucking into a bowl of 'Meh'.

A coffee and maybe a bagel later and it was looking to find some better form. At the time of writing, the benchmark, however, is down 0.12%.

Miners and industrials have been leading the losses. Not Mineral Resources (ASX:MIN), though, which is up 2.7% after resuming haulage operations along the Onslow Iron dedicated haul road following a temporary safety-related pause.

Yet to open its account for this week, Wall Street closed up shop on Friday pretty flat. The S&P 500 and Dow Jones indexes were up 0.1 per cent and the technology-focused Nasdaq gained 0.5 per cent.

The Aussie dollar meanwhile is trading around US63c.

And in the land of magical internet money, the bull goose cryptocurrency Bitcoin, meanwhile, has quietly moved back above US$85,000 this morning.

Could the winds of sentiment be about to blow back in a positive direction for BTC? Despite some serious backing from the pro-crypto US admin this year, Bitcoin and the crypto market certainly haven't been exempt from the knock-on effects of the Trump tariffs on global markets. In fact, the crypto market as a whole has been brutalised over the past month or so.

“I don’t know if we’ll have a recession or not, but a recession would be a big catalyst for Bitcoin,” Robbie Mitchnick, BlackRock’s head of digital assets, told Yahoo Finance in a recent interview. He added that increased fiscal spending, deficit accumulation, lower interest rates and monetary stimulus have all historically boosted the price of Bitcoin.

ASX market news

On the ASX, global building products group James Hardie (ASX:JHX) turned heads this morning, with its shares taking a battering. It's down more than 13% after moving to buy US rival Azek, an outdoor living products company, for $US8.75bn ($14bn).

It'd be the biggest buyout in Australia since 2022.

Per The Australian's Valerina Changarathil this morning:

The deal, flagged by DataRoom last year, is set to complete later in 2025, potentially triggering a $US500m buyback. The company told investors earlier on Monday that its cash-scrip deal unlocks “an extraordinary opportunity to accelerate our growth strategy”.

Why's it down on acquisition news? According to Bridget Carter at The Australian:

The cash and scrip deal offered by James Hardie to Azek investors is a 37.4 per cent premium to Azek’s last closing share price of $US41.39 (representing a market value of $US5.9bn), which market experts consider overpriced.

In other large-ish caps news of note, shares in lenders mortgage insurance provider Helia Group (ASX:HLI) crumpled by more than 28 per cent to $3.48 after the group signalled that it's not looking good for the continuation of its contract with CBA – a contract that's underpinned its gross written premium business for the past 50 years.

The the big four bank/lender has entered into exclusive negotiations with an alternative provider. "Given our longstanding and successful relationship with CBA, we are disappointed in this development," said Helia CEO and managing director Pauline Blight-Johnston. "We would have welcomed the opportunity to continue our partnership."

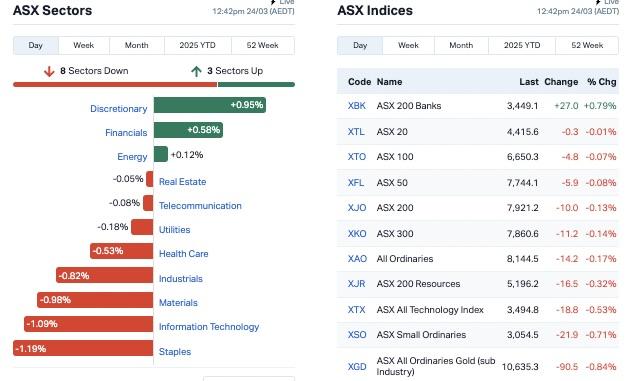

ASX sectors wise, eight out of the 11 were struggling with materials (resources), industrials, IT and staples all deep in the red zone

Meanwhile, some of the best large to mid cap movers of the morning included Energy Resources of Australia (ASX:ERA), Botanix Pharmaceuticals (ASX:BOT) and Novonix (ASX:NVX) – all on no fresh news to speak of.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 24 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ERW | Errawarra Resources | 0.057 | 119% | 2,707,250 | $2,493,937 |

| 1TT | Thrive Tribe Tech | 0.002 | 100% | 20,000 | $2,031,723 |

| MEM | Memphasys Ltd | 0.011 | 57% | 29,986,525 | $12,397,103 |

| FHE | Frontier Energy Ltd | 0.1325 | 35% | 3,905,973 | $50,476,619 |

| AOK | Australian Oil. | 0.002 | 33% | 500,000 | $1,502,674 |

| GLL | Galilee Energy Ltd | 0.008 | 33% | 11,978,905 | $3,343,157 |

| CDT | Castle Minerals | 0.0025 | 25% | 3,000,000 | $3,855,646 |

| ERA | Energy Resources | 0.0025 | 25% | 154,483 | $810,792,482 |

| ARV | Artemis Resources | 0.0085 | 21% | 429,727 | $17,699,705 |

| JGH | Jade Gas Holdings | 0.034 | 21% | 60,003 | $47,231,357 |

| AZI | Altamin Limited | 0.035 | 21% | 38,001 | $16,660,584 |

| NAG | Nagambie Resources | 0.018 | 20% | 240,373 | $12,049,535 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 198,057 | $9,929,183 |

| JAV | Javelin Minerals Ltd | 0.003 | 20% | 223,000 | $15,115,373 |

| LNR | Lanthanein Resources | 0.003 | 20% | 166,666 | $6,109,090 |

| LYK | Lykosmetalslimited | 0.012 | 20% | 5,000 | $1,883,556 |

| EMN | Euromanganese | 0.045 | 18% | 3,775,387 | $7,898,836 |

| HT8 | Harris Technology Gl | 0.013 | 18% | 9,594 | $3,618,617 |

| BDG | Black Dragon Gold | 0.06 | 18% | 550,343 | $15,489,519 |

| HIQ | Hitiq Limited | 0.028 | 17% | 115,130 | $8,797,499 |

| STM | Sunstone Metals Ltd | 0.007 | 17% | 2,779,728 | $30,900,022 |

| WNR | Wingara Ag Ltd | 0.007 | 17% | 75,000 | $1,053,255 |

| AKA | Aureka Limited | 0.18 | 16% | 25,271 | $15,877,409 |

| BUX | Buxton Resources Ltd | 0.037 | 16% | 198,616 | $7,113,039 |

| XGL | Xamble Group Limited | 0.015 | 15% | 70,000 | $4,407,185 |

Errawarra Resources (ASX:ERW) was leading the small caps gainers earlier with a 119% blast up the charts. This comes on the back of an announcement this morning detailing binding agreements for the company to acquire 70% of the historical Elizabeth Hill silver project, 70% of the silver rights to the Pinderi Hills project tenement package and 70% of the ownership of 3 tenements or tenement applications surrounding the silver project.

The collective tenement package totalling 180km2 is in the Tier 1 mining jurisdiction of the Pilbara, WA and the Elizabeth Hill project acquisition is conditional upon meeting the condition precedent and obtaining relevant approvals.

Memphasys (ASX:MEM), a company specialising in reproductive biotechnology for commercial applications, has announced the successful

unblinding and data analysis of its pivotal clinical trial for the Felix system. The company says this confirms its "best-in-class performance in sperm selection for Assisted Reproductive Technology (ART)". The study was conducted in clinical partnership through Monash IVF.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 24 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OM1 | Omnia Metals Group | 0.01 | -87% | 4,919,253 | $5,233,153 |

| EDE | Eden Inv Ltd | 0.001 | -50% | 300,000 | $8,219,762 |

| VML | Vital Metals Limited | 0.002 | -33% | 222,000 | $17,685,201 |

| HLI | Helia Group Limited | 3.61 | -26% | 3,872,682 | $1,321,503,314 |

| H2G | Greenhy2 Limited | 0.018 | -25% | 13,591,062 | $14,356,420 |

| HPC | Thehydration | 0.007 | -22% | 91,080 | $2,744,218 |

| CAZ | Cazaly Resources | 0.012 | -20% | 98,209 | $6,919,545 |

| TOU | Tlou Energy Ltd | 0.024 | -20% | 1,282,050 | $38,957,530 |

| FGH | Foresta Group | 0.008 | -20% | 324,804 | $26,529,065 |

| ANG | Austin Engineering | 0.46 | -18% | 794,037 | $347,281,255 |

| EUR | European Lithium Ltd | 0.039 | -17% | 1,530,106 | $67,923,529 |

| AMS | Atomos | 0.005 | -17% | 10,166 | $7,290,111 |

| ASQ | Australian Silica | 0.02 | -17% | 11,133 | $6,764,649 |

| CZN | Corazon Ltd | 0.0025 | -17% | 1,291,554 | $3,553,717 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 1,523,821 | $20,705,349 |

| TYX | Tyranna Res Ltd | 0.005 | -17% | 80,000 | $19,727,552 |

| BXN | Bioxyne Ltd | 0.029 | -15% | 2,289,092 | $69,673,777 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 1,217,259 | $22,185,079 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 954,232 | $36,668,998 |

| M24 | Mamba Exploration | 0.012 | -14% | 66,732 | $4,132,319 |

| OKJ | Oakajee Corp Ltd | 0.012 | -14% | 125,000 | $1,280,244 |

| JHX | James Hardie Indust | 40.33 | -14% | 1,632,458 | $20,115,518,951 |

| EV1 | Evolutionenergy | 0.013 | -13% | 317,316 | $5,439,757 |

| MEG | Megado Minerals Ltd | 0.013 | -13% | 229,279 | $6,295,249 |

| ADN | Andromeda Metals Ltd | 0.007 | -13% | 746,887 | $27,429,822 |

IN CASE YOU MISSED IT

Top End Energy (ASX:TEE) has named Luke Velterop as its new CEO. He joined the company in December 2024 through the acquisition of Serpentine Energy and brings extensive experience in natural hydrogen, including roles at Serpentine Energy and HyTerra.

At Stockhead, we tell it like it is. While Top End Energy is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.