Lunch Wrap: ASX dips on global sell-off; Nickel Industries plunges 21pc as Indonesia eyes tax hike

ASX drops after global market sell-offs and crypto crashes. Meanwhile, Star eyes $940m loan and Nickel Industries tumbles on Indonesia’s tax plans.

ASX dives as global sell-off hits

Tesla and Nvidia take big hits, crypto tumbles

Star eyes $940m loan; Nickel Industries plunges on Indonesian tax

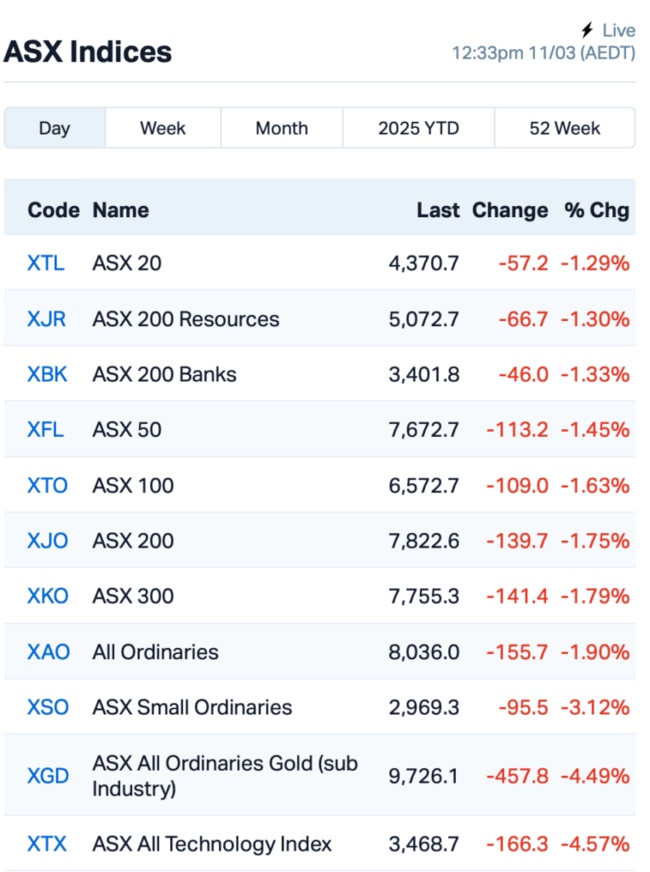

The ASX dropped by over 1.3% within just the first 30 minutes of trading on Tuesday, hitting a seven-month low.

Investors were rattled by a heavy sell-off in the US, where the Nasdaq plunged 4%, its worst day since 2022, while the S&P 500 fell 2.7%.

Crypto prices tumbled, corporate bond sales were pulled, and Wall Street's fear gauge, along with key credit risk indicators, spiked.

The sell-off has been intensifying in recent days after President Trump’s aggressive trade policies raised fears of a slowdown in the US economy.

Tesla saw a massive 15% dip overnight, having lost over half of its value from December’s highs. Nvidia also felt the sting, shedding 5%.

“The trading today felt like an absolute death spiral,” said Alon Rosin at Oppenheimer & Co.

As the losses mounted, investors sought safety in energy, consumer staples and utility stocks – sectors that tend to perform better during economic slowdowns.

“If investors perceive that there’s rough weather ahead, these are the places where investors tend to hide out. Shelter from the storm," said Steve Sosnick at Interactive Brokers.

Back in Australia, the ASX reflected the global nerves, with the local market bleeding red, too, particularly the tech sector, which dropped more than 5%.

WiseTech Global (ASX:WTC) and Xero (ASX:XRO) slipped around 5% each.

The local banking giants didn’t fare much better, with the Big Four all being sold off.

But there was some good news.

Consumer sentiment in Australia has risen to a three-year high, according to Westpac this morning, with the index jumping 4% in March, signalling that Aussies are feeling a bit more optimistic.

In the large caps space, embattled casino operator Star Entertainment Group (ASX:SGR) said it has taken note of recent media speculation.

Star confirmed that it had indeed received a refinancing proposal that could provide up to $940 million in loans from Salter Brothers Capital. If finalised, this would give The Star enough liquidity to refinance all of the group’s existing debt. Shares in Star remain suspended for now.

Nickel Industries (ASX:NIC), with mines in Indonesia, plunged by 21% as the country mulls higher taxes on miners to help cover budget gaps. The government is currently considering hiking royalties on metals like copper, coal and nickel. This move comes amid Indonesia's struggle to fund initiatives like free school lunches. Nickel royalties could jump from 10% to as high as 19%, adding more pressure on producers already dealing with lower prices.

Suncorp Group (ASX:SUN), meanwhile, said it had to deal with a large volume of insurance claims after ex-tropical cyclone Alfred, though most of these claims were covered by government reinsurance. Shares were down 2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 11 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| MPW | Metal Powdworks Ltd | 0.370 | 155% | 6,102,542 | $14,784,092 |

| AAJ | Aruma Resources Ltd | 0.016 | 60% | 9,551,255 | $2,220,582 |

| NWM | Norwest Minerals | 0.011 | 22% | 1,093,405 | $4,366,076 |

| BCB | Bowen Coal Limited | 0.006 | 20% | 1,706,163 | $53,878,201 |

| 8CO | 8Common Limited | 0.025 | 19% | 382,374 | $4,705,993 |

| PIL | Peppermint Inv Ltd | 0.004 | 17% | 778,039 | $6,634,438 |

| SKK | Stakk Limited | 0.007 | 17% | 388,924 | $12,450,478 |

| TMK | TMK Energy Limited | 0.004 | 17% | 8,225,616 | $28,090,995 |

| BNL | Blue Star Helium Ltd | 0.008 | 14% | 650,508 | $18,864,197 |

| CCG | Comms Group Ltd | 0.057 | 14% | 1,003,000 | $19,493,427 |

| PNT | Panthermetalsltd | 0.017 | 13% | 10,806,510 | $3,722,561 |

| AJL | AJ Lucas Group | 0.009 | 13% | 662,345 | $11,005,837 |

| HAW | Hawthorn Resources | 0.049 | 11% | 16,179 | $14,740,687 |

| AON | Apollo Minerals Ltd | 0.020 | 11% | 250,000 | $16,712,224 |

| GES | Genesis Resources | 0.011 | 10% | 188,880 | $7,828,413 |

| LYK | Lykosmetalslimited | 0.011 | 10% | 1,910 | $1,883,556 |

| GT1 | Greentechnology | 0.055 | 10% | 238,590 | $19,437,605 |

| IND | Industrialminerals | 0.175 | 9% | 3,100 | $12,851,600 |

| NMG | New Murchison Gold | 0.013 | 8% | 57,775,346 | $97,636,796 |

| BVR | Bellavistaresources | 0.335 | 8% | 2,985 | $31,273,592 |

| GC1 | Glennon SML Co Ltd | 0.500 | 8% | 1,900 | $22,361,001 |

| AMI | Aurelia Metals Ltd | 0.220 | 7% | 7,554,273 | $346,770,739 |

| MAU | Magnetic Resources | 1.480 | 7% | 779,177 | $368,130,387 |

| IPT | Impact Minerals | 0.008 | 7% | 30,000 | $21,416,036 |

Metal Powder Works (ASX:MPW) hit the ASX today with the ticker 'MPW' after raising $10 million at 20 cents per share through a reverse merger with formerly listed K-TIG Limited. MPW has developed its patented DirectPowder process, which offers a new approach to powder production in additive manufacturing. This tech has already been tested across various methods like 3D printing and laser fusion, and it counts big names like the US Department of Defense, Westinghouse, and Toho Titanium as customers.

Norwest Minerals (ASX:NWM) just hit a big milestone with its Bulgera gold project. The company has secured the State Deed for the mining lease, which has been approved by the Marputu Aboriginal Corporation, the Traditional Owners of the land. The deed will now go to the Department of Energy and Mines for final approval.

Fintech company Stakk (ASX: SKK) is cruising towards $1.95m in annual revenue for FY25, with US operations leading the charge. So far, Stakk's US business has pulled in $1.13m in the first eight months of FY25, up 45.8% year on year. With a growing roster of clients, including 25 banks, nine neobanks and fintech partners, Stakk said it’s got a strong pipeline for future growth.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 11 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -33% | 88,888 | $9,862,021 |

| NTM | Nt Minerals Limited | 0.002 | -33% | 15,001 | $3,632,709 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,247,860 | $57,867,624 |

| CDT | Castle Minerals | 0.002 | -25% | 112,523 | $3,793,628 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 2,311,110 | $6,716,008 |

| QXR | Qx Resources Limited | 0.003 | -25% | 34,500 | $5,240,311 |

| SIS | Simble Solutions | 0.003 | -25% | 5,000 | $3,345,321 |

| PKD | Parkd Ltd | 0.030 | -23% | 150,086 | $4,056,541 |

| NIC | Nickel Industries | 0.590 | -22% | 235,791,362 | $3,238,806,459 |

| BXN | Bioxyne Ltd | 0.023 | -21% | 3,601,950 | $59,427,633 |

| AUK | Aumake Limited | 0.004 | -20% | 3,747,996 | $15,053,461 |

| PAB | Patrys Limited | 0.002 | -20% | 536,075 | $5,143,618 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 58,200 | $7,937,639 |

| SP3 | Specturltd | 0.013 | -19% | 541,158 | $4,930,402 |

| LMS | Litchfield Minerals | 0.160 | -18% | 729,062 | $5,501,212 |

| ION | Iondrive Limited | 0.018 | -17% | 5,690,833 | $24,839,563 |

| PEB | Pacific Edge | 0.100 | -17% | 9,181 | $97,429,917 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 102,391 | $3,448,673 |

| EPM | Eclipse Metals | 0.005 | -17% | 3,511,600 | $17,158,914 |

| MRD | Mount Ridley Mines | 0.003 | -17% | 47,434 | $2,335,467 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 1,175,242 | $20,705,349 |

| CUE | CUE Energy Resource | 0.105 | -16% | 73,961 | $87,386,578 |

| HMY | Harmoney Corp Ltd | 0.460 | -16% | 29,686 | $55,570,460 |

| COB | Cobalt Blue Ltd | 0.049 | -16% | 2,046,520 | $25,489,451 |

IN CASE YOU MISSED IT

Maronan Metals (ASX:MMA) has lodged an application for a Mineral Development Licence to advance its namesake copper-gold and silver-lead project in Queensland to “mine-ready” status. Once approved, the MDL will secure tenure over the area and allow for advanced exploration, including underground drilling and bulk sampling.

At Stockhead, we tell it like it is. While Maronan Metals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.