Lunch Wrap: ASX back to the grind after US Fed rate hold; Locksley doubles on US rare earths hunt

The ASX wobbled as the Fed held its ground, ANZ slipped, Orica shot up, and Pro Medicus locked in a US deal.

ASX wobbles as Fed holds steady

ANZ stumbles, Neuren cashes in on royalties

Orica surges, Pro Medicus inks US deal

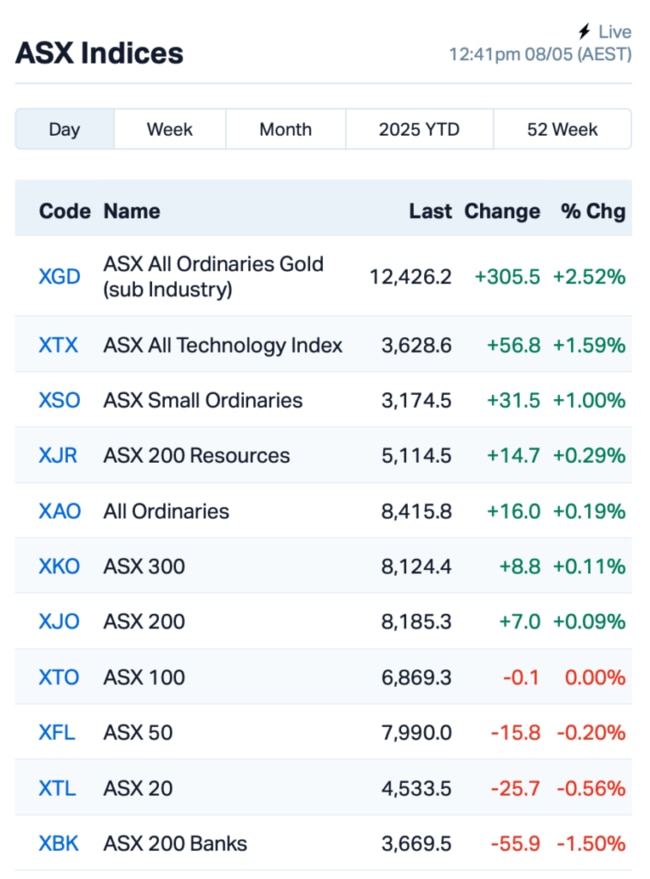

The ASX wobbled its way through Thursday’s morning session, up by 0.05% at lunch time AEST as global markets digested the US Fed Reserve’s decision to hold interest rates steady.

The Fed kept rates on ice last night, holding its benchmark steady between 4.25% and 4.5%, even as President Trump kept firing off demands for a cut.

Wall Street closed higher, with the S&P 500 up by 0.43%, and the tech-heavy Nasdaq by 0.27%.

Markets weren’t exactly shocked with the Fed’s decision, everyone saw it coming, but the real story is the backdrop of those brutal tariffs.

Fed Chair Jerome Powell didn’t mince words, saying: "Uncertainty about the economic outlook has increased further."

"There are cases in which it would be appropriate for us to cut rates this year, there are cases in which it wouldn’t. We just don’t know."

Trump, though, still isn’t buying that argument.

He’s been banging the drum for rate cuts, and has been at Powell’s throat for months, even hinting he’d fire him at one point.

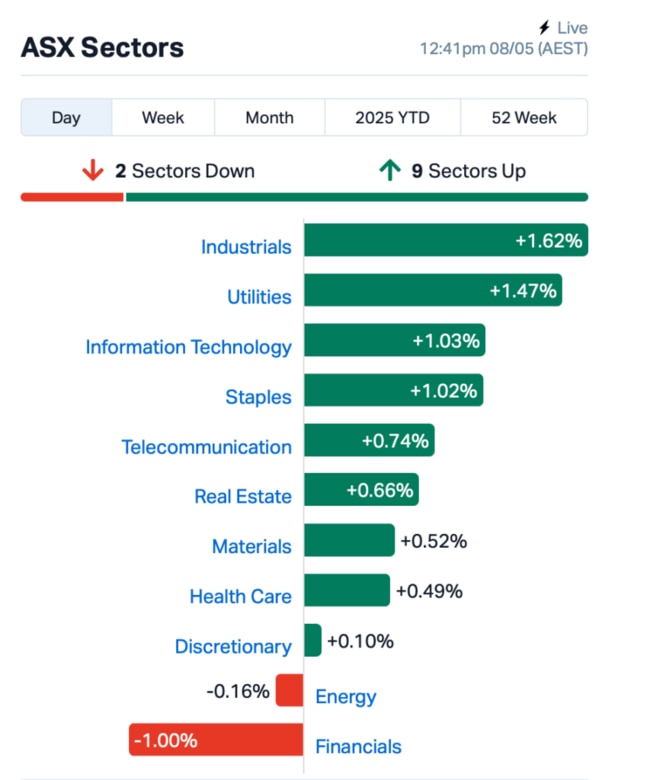

Back to the ASX, Powell’s cautious tone saw money flow into typically defensive plays.

Coles Group (ASX:COL) climbed 1.4%, while AGL Energy (ASX:AGL) notched up 2% as investors took shelter in utilities, consumer staples, and communications.

Miners, however, took a hit after the iron ore price dropped below US$98 a tonne.

In large cap news this morning, Australia and New Zealand Banking Group's (ASX:ANZ) half-year results landed with a bit of a thud, showing a flat $3.6 billion profit and a net interest margin of 1.56%, which fell short of expectations.

Even with record revenue of $11 billion, investors weren’t impressed, especially with no dividend bump. ANZ’s shares were dumped, down almost 3%.

Mining explosives maker Orica (ASX:ORI) surged 7%, pumping up the industrial sector, despite reporting a half-year statutory net loss of $89 million, largely pinned on a $308 million impairment linked to its Latin American operations.

Rett syndrome drug maker Neuren Pharmaceuticals (ASX:NEU)’s pockets just got a bit fatter, with Q1 sales up 11% to $132 million, all thanks to a boost in US royalties. Shares were flat.

Gaming tech firm Light & Wonder (ASX:LNW) crashed by 5% after warning investors of near-term cost pressures tied to White House trade policies, even as it reaffirmed its full-year earnings guidance.

Over in the fast-food space, Guzman y Gomez (ASX:GYG) rallied 4% after upbeat profit forecasts and plans to open 31 more restaurants.

And finally, health imaging device maker ProMedicus (ASX:PME) inked a $20 million, five-year contract with Iowa Health Care through its US subsidiary, Visage Imaging. PME's shares jumped 5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 8 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LKY | Locksley Resources | 0.054 | 98% | 80,763,989 | $3,960,000 |

| MOM | Moab Minerals Ltd | 0.002 | 50% | 50,000 | $1,733,666 |

| PPY | Papyrus Australia | 0.013 | 44% | 1,092,646 | $5,136,136 |

| RPG | Raptis Group Limited | 0.014 | 40% | 180,000 | $634,864 |

| HRE | Heavy Rare Earths | 0.026 | 37% | 1,245,677 | $3,952,644 |

| CRB | Carbine Resources | 0.004 | 33% | 776,953 | $1,655,213 |

| ERA | Energy Resources | 0.002 | 33% | 11,234,999 | $608,094,361 |

| AOK | Australian Oil. | 0.003 | 25% | 201,571 | $2,003,566 |

| C7A | Clara Resources | 0.005 | 25% | 1,393 | $2,046,417 |

| DTM | Dart Mining NL | 0.005 | 25% | 1,039,091 | $2,751,056 |

| XGL | Xamble Group Limited | 0.026 | 24% | 62,119 | $7,119,299 |

| BWF | Blackwall Limited | 0.410 | 22% | 77,409 | $56,213,860 |

| 8IH | 8I Holdings Ltd | 0.011 | 22% | 23,000 | $3,133,448 |

| RR1 | Reach Resources Ltd | 0.011 | 22% | 1,734,471 | $7,869,882 |

| BMR | Ballymore Resources | 0.165 | 22% | 74,609 | $23,858,629 |

| ALY | Alchemy Resource Ltd | 0.006 | 20% | 939,059 | $5,890,381 |

| ENT | Enterprise Metals | 0.003 | 20% | 500,490 | $2,945,793 |

| MEM | Memphasys Ltd | 0.006 | 20% | 4,949,442 | $9,917,991 |

| MKL | Mighty Kingdom Ltd | 0.006 | 20% | 10,507 | $1,825,273 |

| FRE | Firebrickpharma | 0.079 | 20% | 37,385 | $14,822,046 |

| G88 | Golden Mile Res Ltd | 0.013 | 18% | 8,847,333 | $5,986,726 |

| SVY | Stavely Minerals Ltd | 0.013 | 18% | 114,633 | $5,984,463 |

| VHL | Vitasora Health Ltd | 0.047 | 18% | 1,440,533 | $63,011,088 |

| DES | Desoto Resources | 0.140 | 17% | 1,775,308 | $22,346,934 |

Locksley Resources' (ASX:LKY) shares almost doubled after announcing that it will push ahead with its Mojave Antimony and Rare Earths Project in the US, located just 1.4km from Mountain Pass, America’s only active rare earth mine. Locksley has formally submitted its drilling permit to the Bureau of Land Management (BLM), and the process is expected to move faster thanks to President Trump’s March 2025 Executive Order aimed at speeding up critical mineral projects.

Recent samples from the Desert Antimony Mine showed standout results with up to 46% Antimony (Sb) and 1,022 g/t Silver (Ag), confirming strong surface mineralisation over 400 metres. There’s also promising rare earth potential at the El Campo Prospect, with assays hitting 12.1% TREO and 3.19% NdPr. With its prime location and high-grade finds, Locksley said it was betting big on Mojave to become a key US supply source for antimony and rare earths.

Memphasys (ASX:MEM) has just pulled off successful trials for its RoXsta Mega Cell High-Throughput Assay, a new device that can test antioxidant levels in biological samples – humans and animals – at lightning speed. In trials, it processed 96 samples in under an hour, a massive leap from the usual 16-hour wait with traditional methods.

The tech has already been put to the test with cattle and professional footballers, where it delivered quick and accurate data on oxidative stress. Memphasys reckons this could be a game-changer for labs looking to scale up testing without the hefty costs.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 8 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -33% | 1,330,329 | $6,164,822 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 380,501 | $4,880,668 |

| ARV | Artemis Resources | 0.006 | -25% | 6,886,949 | $20,228,234 |

| CUL | Cullen Resources | 0.003 | -25% | 68 | $2,773,607 |

| RNX | Renegade Exploration | 0.003 | -25% | 1,625,000 | $5,153,454 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 679,986 | $9,673,198 |

| BGT | Bio-Gene Technology | 0.024 | -20% | 91,879 | $6,040,847 |

| TEM | Tempest Minerals | 0.004 | -20% | 100,000 | $3,672,649 |

| MIO | Macarthur Minerals | 0.018 | -18% | 407,000 | $4,392,641 |

| EM2 | Eagle Mountain | 0.005 | -17% | 60,001 | $6,810,224 |

| PSL | Paterson Resources | 0.016 | -16% | 159,022 | $8,664,720 |

| GEN | Genmin | 0.027 | -16% | 2,012,967 | $28,393,155 |

| PEB | Pacific Edge | 0.085 | -15% | 16,000 | $81,191,597 |

| M4M | Macro Metals Limited | 0.009 | -14% | 4,819,350 | $41,762,884 |

| AJL | AJ Lucas Group | 0.006 | -14% | 534,607 | $9,630,107 |

| AN1 | Anagenics Limited | 0.006 | -14% | 507,555 | $3,474,243 |

| HHR | Hartshead Resources | 0.006 | -14% | 1,941,579 | $19,660,775 |

| NFM | New Frontier | 0.012 | -14% | 388,803 | $20,408,295 |

| TSL | Titanium Sands Ltd | 0.006 | -14% | 259,034 | $16,357,230 |

| GNM | Great Northern | 0.013 | -13% | 122,357 | $2,319,436 |

| TRI | Trivarx Ltd | 0.013 | -13% | 2,700,745 | $8,553,196 |

| ABX | ABX Group Limited | 0.040 | -13% | 365,481 | $11,542,922 |

| ADG | Adelong Gold Limited | 0.007 | -13% | 13,513,777 | $11,179,890 |

| AUR | Auris Minerals Ltd | 0.007 | -13% | 279,562 | $3,813,008 |