Going nuclear: Trump’s EOs offer atomic opportunities for Australian uranium industry

Trump’s executive orders aim to revitalise the US nuclear industry, creating opportunities for Australia’s uranium sector amidst growing global demand.

President Trump has signed sweeping executive orders promoting the US nuclear industry

The EOs set out a plan to quadruple US nuclear power production

Australia has the largest uranium reserves in the world

The morning of July 16, 1945, a thunderstorm washed the Jornada del Muerto desert clean, delaying a test that would change the course of history.

By about 5am, the skies had cleared and winds had died to nothing.

At exactly 5:29 and 21 seconds, the pre-dawn darkness was engulfed in blindingly bright light, transforming from yellow to red to purple and finally white in a matter of seconds.

A massive shockwave thundered through the earth as a 600-metre-wide fireball punched up into the heavens, scattering what cloud remained.

As the dust settled, where once had stood a 30-metre-tall steel tower topped by a plutonium bomb, there was now only desert sand – transformed into radioactive-green glass.

The Trinity nuclear weapon test was a success. Humans had harnessed the power of the atom, if only for a single, stunning moment.

A nuclear future

Fast forward almost 80 years, and nuclear power produces 9% of the world’s electricity generation.

No longer the bogeyman of our grandparents' generation, nuclear power has become a standard component of the global energy mix, regarded with caution and optimism rather than outright fear.

Today, there are about 440 nuclear reactors operating in 31 countries, providing about 25% of the globe’s low-carbon energy.

The United States is home to 94 of those reactors across 54 nuclear power plants, but that number is almost certain to rise in the next decade.

US President Trump has signed sweeping executive orders aimed at kick-starting a new era of production within the US nuclear power industry, positioning it as a leader in nuclear technology once again.

The EOs outline a plan to quadruple nuclear power generation in the US from 100 gigawatts to 400GW by 2050.

To achieve that, the US government intends to ramp up power production at existing nuclear plants and initiate construction on at least 10 new large reactors by 2030.

Supported by federal grants and funding from the Department of Energy, much of that new nuclear energy capacity will be used to support data centres and similar Artificial Intelligence infrastructure.

Of course, building more reactors is all well and good, but you still need enriched uranium to power them.

Russia and China dominate enriched uranium production

One of the core focuses of Trump’s new nuclear power EOs is divesting uranium imports away from Russia and China, which collectively account for about 57% of the world’s enriched uranium production.

They’re followed by France (12%), the US itself (11%), the Netherlands (8%), the UK (7%) and Germany (6%).

There are only four major companies that enrich uranium – Rosatom, CNNC, Urenco and Orano, all majority state-owned.

Russia and China also have outsized control over global uranium mining production.

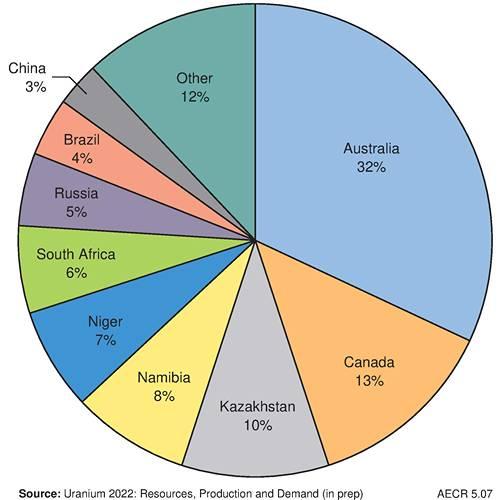

Kazakhstan is the largest uranium miner globally, producing about 43% of total supply, followed by Canada (15%) Namibia (11%) and Australia (9%).

As a former soviet bloc country, Kazakhstan has had close ties with Russia for decades, enriching much of its uranium with its northern neighbour.

It’s estimated about half of Kazakhstan’s uranium is exported to China, with the rest going to Canada, Europe and the US.

Trump is expected to invoke the Cold War-era Defense Production Act to declare a national emergency over America’s reliance on Russian and Chinese enriched uranium and expand domestic conversion capacity.

To that end, the administration intends to build out a commercial nuclear fuel recycling and reprocessing sector, a distinct departure from previous government policy which forbade the use of recycled fuel in commercial reactors.

The EOs also detail a plan to expand domestic uranium conversion capacity and enrichment capabilities, with the end goal of producing enough enriched uranium to meet both civilian and defence reactor needs.

What does it all mean for Australia?

While the social, economic and environmental impacts from this step change in US energy strategy are bound to be far reaching and potentially world changing over the next few decades, today they represent an opportunity.

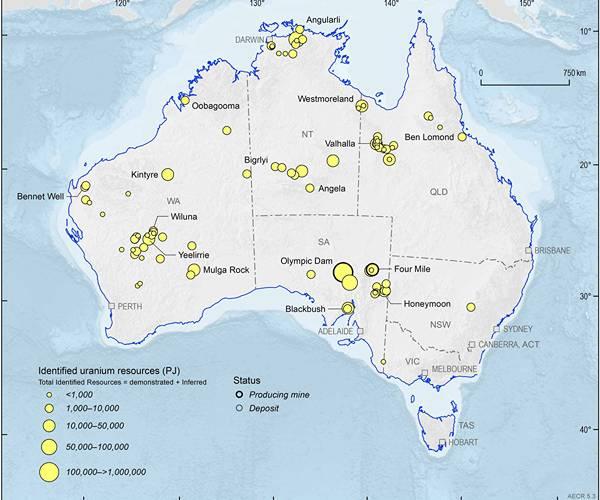

Although much of it is locked away by state-based uranium mining bans, Australia holds about one third of total global resources of uranium.

South Australia is home to the only producing mines at present, but the deposits themselves are scattered across the country, many in premier mining districts.

As a political, economic and geographically strategic ally of the United States of America, Australia – alongside our cousins over in Canada – is incredibly well placed to take advantage of increased uranium demand.

“The latest Executive Orders reflect a clear, strategic shift in US energy policy,” Recharge Metals managing director Felicity Repacholi said.

“With projections suggesting the US will need up to four times more uranium to meet its clean energy and national security goals, the focus is finally returning to where it all begins – the mine gate.

“You can’t expand nuclear energy, conversion, or enrichment capacity without a reliable supply of uranium.”

Stepping into the uranium demand gap

Recharge Metals (ASX:REC) is an ASX-listed uranium and lithium mining company with projects in the US and Canada.

The company’s US-based Carter project in Montana holds two uranium deposits with a total of about 5.1 million pounds of the yellow stuff.

REC is currently moving through the permitting process for Carter, a regulatory requirement that could be drastically expedited under Trump’s new EOs.

“There’s now real momentum from the US government to reduce reliance on foreign uranium supply. That sends a strong signal to markets, developers, and explorers alike,” Repacholi explained.

“The increased regulatory flexibility and positive sentiment are making it more feasible than ever to bring new supply online. The US needs uranium and Recharge aims to be part of that solution.”

Australian uranium companies are already benefiting from a surge in positive sentiment for the industry, which has been under pressure from short sell positions in recent months.

At time of writing, Boss Energy (ASX:BOE) has climbed 24% in the last month, with several fellow ASX uranium companies adding materially to their share prices in the same period.

Deep Yellow (ASX:DYL) shares have jumped 16.7%, Terra Uranium (ASX:T92) 16.67% and Recharge Metals 80% in the last 30 days.

Trump’s push to accelerate the US nuclear energy industry isn’t without its flaws, and critics no doubt have a raft of valid concerns, but even without this new administrative push the demand for uranium has only been growing.

AI data centres hungry for low-carbon energy

Ever since the artificial intelligence arms race between major technology companies like Microsoft and Apple kicked off, tech companies have been starving for more energy generation capacity.

As many of them have climate and emissions targets, nuclear power has emerged as a highly desirable, low-carbon option.

Last year, Microsoft signed a 20-year deal to reopen the Three Mile Island nuclear reactor, while Google has ordered six or seven small nuclear reactors from California’sKairos Power and Amazon purchased a nuclear-powered data centre from Talen Energy.

Goldman Sachs estimates some 85-90GW of nuclear capacity will be needed just to meet data centre power demands by 2030.

“In the US alone, big tech companies have signed new contracts for more than 10 GW of possible new nuclear capacity in the last year, and Goldman Sachs Research sees potential for three plants to be brought online by 2030,” a research note stated.

The World Nuclear Association’s 2023 Nuclear Fuel Report predicts a 28% increase in uranium demand from 2023 to 2030, and a 51% increase from 2031-2040.

That would take global uranium demand from 80,000 tonnes today, to about 102,000 pounds in 2030 and 120,000 pounds by 2040.

Whether it’s the Trump Administration or the Nasdaq’s Magnificent Seven driving demand, the appetite for uranium is growing, and Australia is very well placed to meet it.

At Stockhead, we tell it like it is. While Recharge Metals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.