Closing Bell: ASX stumbles through a forgettable week as banks drag; Austal at five-year high

The ASX dipped on Friday, with banks and GYG down. Domain jumped on takeover, Bullock admitted to slow rate hikes, while Alibaba rebounded.

ASX hovers near one-month low, dragged by GYG and banks

Domain soars on takeover bid

RBA’s bullock admits slow rate hikes, while Alibaba rebounds

The ASX had a rough afternoon on Friday, with the market closing near its one-month low.

Despite an upbeat start at the opening bell, the benchmark ASX 200 index finished the day 0.32% lower, and for the week, it lost around 3%.

A broad sell-off in consumer stocks and big names like Commonwealth Bank (ASX:CBA) – which fell 2.5% – dragged the index lower today.

Bank stocks have been facing a bit of turmoil after National Australia Bank (ASX:NAB) and Australia and New Zealand Banking Group's (ASX:ANZ) less-than-stellar updates earlier this week.

“So, is this market shake-up a warning sign, or a golden opportunity?” asked Dale Gillham at Wealth Within.

“If history has taught us anything, it’s that when fear takes hold, smart money isn’t far behind.”

Meanwhile, Domain Holdings Australia (ASX:DHG) was the standout today, surging nearly 40% after US real estate giant CoStar lobbed a bid to buy the platform at $4.20, sending shares in Domain’s parent, Nine Entertainment Company (ASX:NEC), also up by 20%.

But REA Group (ASX:REA), Domain's biggest competitor, fell by more than 11% on the news.

Earnings reports from Aussie companies also played a big role in today’s market moves, with some big names hitting it big while others stumbled.

Ship builder Austal's (ASX:ASB) shares jumped 15% to a five-year high after posting strong earnings for the half, with revenue up 15% to $825.7 million and net profit more than doubling to $25.1 million.

The company’s cash position improved massively too, hitting $353.9 million thanks to a couple of big US contracts.

Telix Pharmaceuticals (ASX:TLX) was another standout, jumping by 13% after posting impressive earnings; while Accent Group (ASX:AX1), the footwear retailer behind Platypus and Hoka, gained 2% despite cutting its dividend to preserve cash.

Market darling Guzman y Gomez (ASX:GYG), however, was in the bad books, down by almost 12%, even though the Mexican food chain announced it was on track to beat its full-year profit forecast.

And, iron ore stocks, like BHP (ASX:BHP), Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) made gains as the iron ore price crept up, helping keep the ASX from falling too deep in the red.

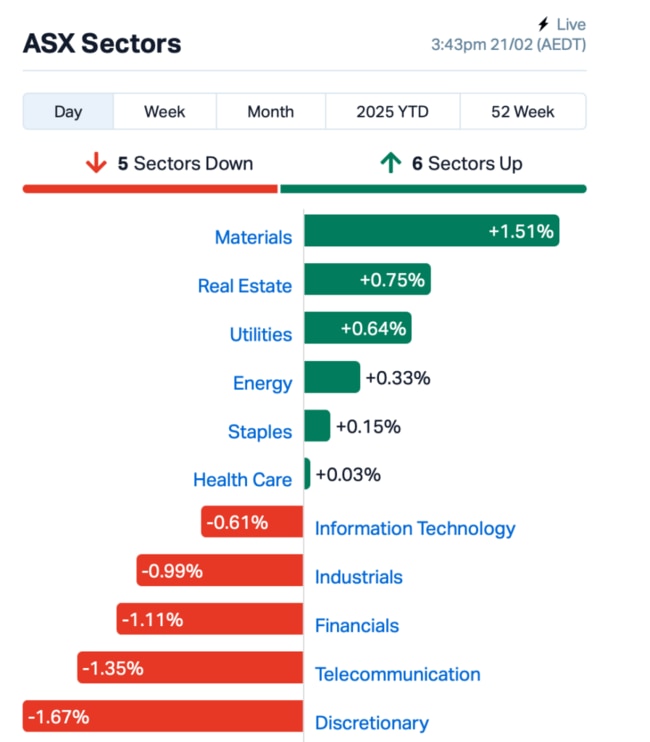

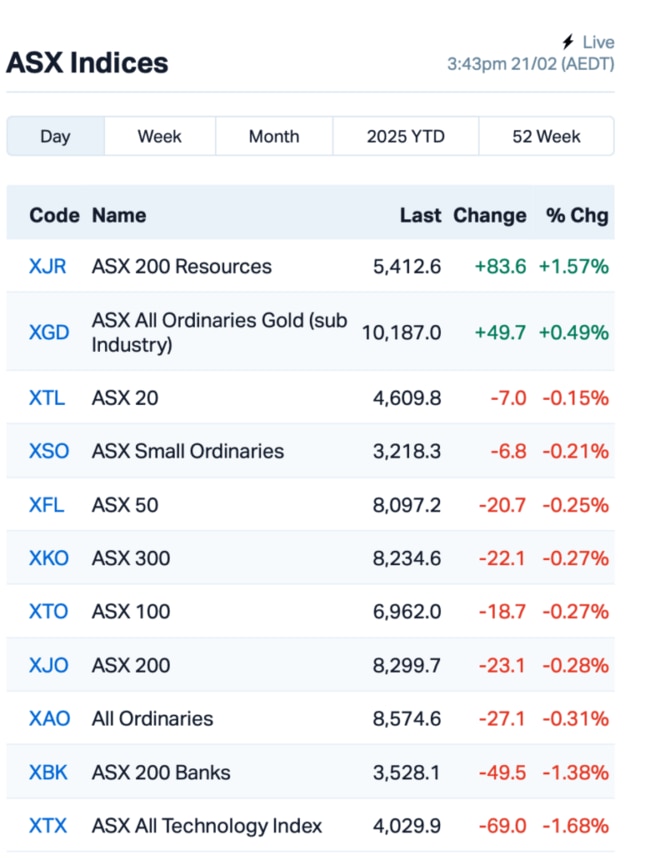

This is where we stood leading up to Friday's close:

Meanwhile, at the House of Representatives Economics Committee this morning, RBA boss Michele Bullock shared some interesting thoughts about the current state of the economy.

She admitted that the Reserve Bank had been a bit slow to lower interest rates to tackle inflation, but said that if the bank had eased too quickly, inflation might not come down as hoped.

And elsewhere in Asia today, Alibaba is bouncing back big time.

The Chinese giant posted its fastest revenue growth in over a year, driven by e-commerce and cloud services, including AI. Shares jumped around 8% in HK and NY, adding US$24 billion to its market value.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap TX3 Trinex Minerals Ltd 0.002 50% 1,000,000 $1,878,652 CVR Cavalier Resources 0.21 45% 1,776,992 $8,387,121 DHG Domain Holdings Aus 4.37 40% 4,100,976 $1,970,770,317 VRC Volt Resources Ltd 0.004 33% 77,762 $13,588,180 MYX Mayne Pharma Ltd 7.21 33% 4,936,106 $439,539,924 UCM Uscom Limited 0.021 31% 47,000 $4,007,632 ALC Alcidion Group Ltd 0.11 29% 14,614,221 $114,150,979 CDT Castle Minerals 0.003 25% 588,686 $3,793,628 CRR Critical Resources 0.005 25% 55,102 $9,856,885 NEC Nine Entertainment 1.795 25% 10,359,696 $2,283,497,457 JAT Jatcorp Limited 0.54 20% 276,198 $37,469,997 14D 1414 Degrees Limited 0.024 20% 102,650 $5,700,025 1AI Algorae Pharma 0.006 20% 263,845 $8,436,974 TYX Tyranna Res Ltd 0.006 20% 145,352 $16,439,627 KGL KGL Resources Ltd 0.115 20% 73,168 $62,218,853 DES Desoto Resources 0.125 19% 630,466 $9,721,530 NAG Nagambie Resources 0.019 19% 907,279 $12,852,838 EOL Energy One Limited 8.5 18% 69,132 $225,877,180 IGN Ignite Ltd 1.073 18% 2,125 $14,849,878 FBR FBR Ltd 0.021 17% 32,768,427 $91,077,458 BNL Blue Star Helium Ltd 0.007 17% 141,418 $16,169,312 FIN FIN Resources Ltd 0.007 17% 1,172,089 $3,895,612 IPB IPB Petroleum Ltd 0.007 17% 605,000 $4,238,418 OSL Oncosil Medical 0.007 17% 500,000 $27,639,481

Cavalier Resources (ASX:CVR) rose on yesterday’s announcement, where the company signed a non-binding US$11-million stream finance deal with Raptor to fund the development of its Crawford gold project. This will cover Stage 1 open-pit development and drilling to upgrade resources. The deal is non-dilutive, meaning no new shares will be issued, and Cavalier won’t need to raise more equity.

Mayne Pharma (ASX:MYX) shares jumped after it announced a deal with Cosette Pharmaceuticals to be acquired for $7.40 a share, a 37% premium to the pre-announcement price. The Mayne Pharma board is backing the scheme, subject to shareholder and court approvals. Cosette, a US pharma company, is fully funding the acquisition.

Castle Minerals (ASX:CDT) said its Kpali gold prospect is a major find with some impressive gold intercepts from its drilling in Ghana. Eight holes hit strong shallow mineralisation, with standout results like 12m at 8.29g/t Au, and a peak 1m intercept of 20.43g/t Au. Castle is now looking to expand its drilling program to explore even more prospects in the area, aiming to confirm a 1Moz gold resource.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOM | Moab Minerals Ltd | 0.001 | -50% | 185,045 | $3,133,999 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 306,097 | $57,867,624 |

| MMR | Mec Resources | 0.003 | -25% | 1,407,278 | $7,399,063 |

| OLI | Oliver'S Real Food | 0.006 | -25% | 890,311 | $4,325,855 |

| PRM | Prominence Energy | 0.003 | -25% | 5,873 | $1,556,706 |

| BIT | Biotron Limited | 0.0085 | -23% | 13,021,275 | $9,926,210 |

| LBL | Laserbond Limited | 0.465 | -22% | 1,550,264 | $69,812,250 |

| 4DX | 4Dmedical Limited | 0.44 | -20% | 3,165,034 | $227,774,217 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 349,000 | $6,620,957 |

| ERA | Energy Resources | 0.002 | -20% | 166,631 | $1,013,490,602 |

| SIS | Simble Solutions | 0.004 | -20% | 1,546,600 | $4,181,652 |

| SPK | Spark New Zealand | 2.15 | -19% | 13,582,142 | $4,868,405,837 |

| RSH | Respiri Limited | 0.045 | -18% | 2,572,317 | $82,633,613 |

| AUR | Auris Minerals Ltd | 0.005 | -17% | 56,400 | $2,859,756 |

| LAU | Lindsay Australia | 0.71 | -15% | 3,031,018 | $264,465,847 |

| SCN | Scorpion Minerals | 0.022 | -15% | 1,932,557 | $10,645,861 |

| GNM | Great Northern | 0.018 | -14% | 816,658 | $3,247,211 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 317,606 | $22,185,079 |

| BLZ | Blaze Minerals Ltd | 0.003 | -14% | 36,621 | $5,484,317 |

| MEM | Memphasys Ltd | 0.006 | -14% | 835,052 | $12,397,103 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 995,316 | $5,665,530 |

| IXC | Invex Ther | 0.065 | -13% | 48,500 | $5,636,539 |

| SP3 | Specturltd | 0.013 | -13% | 516,645 | $4,622,252 |

| 3PL | 3P Learning Ltd | 0.645 | -13% | 14,901 | $201,950,826 |

IN CASE YOU MISSED IT

With antimony prices surging to US$50,000/t this week, the timing couldn’t be better for Nova Minerals (ASX:NVA) as it targets production at its Estelle project by late 2025. Located in Alaska’s Tintina Belt, the Estelle gold and critical minerals project holds a JORC resource of 9.9Moz gold, with further drilling planned this year to grow the resource.

With a scoping study due for release this quarter, Brazilian Critical Minerals (ASX:BCM) has further increased confidence in the Ema indicated resource tonnage by 97% to 248Mt at 759ppm TREO. The company says the updated starter zone is sufficient enough to underpin a long-life scoping study and Ema project economics.

Horseshoe Metals (ASX:HOR)has secured a native title agreement for its Glenloth gold project in South Australia, clearing the way for a strategic review of the Old Well target area, along strike from Barton Gold’s (ASX:BGD) 1.5Moz Tunkillia project. While aiming to commercialise the asset, the company remains focused primarily on its copper assets in WA.

Green Technology Metals (ASX:GT1)has delivered an optimised Preliminary Economic Assessment, outlining the potential to deliver robust economics. After-tax NPV and IRR are estimated at ~US$251m and 33% respectively, while the company has slashed capex to US$182m. GT1 is eyeing a FID in 2026, before delivering first production the year after.

At Stockhead, we tell it like it is. While Nova Minerals, Brazilian Critical Minerals, Horseshoe Metals and Green Technology Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.