Closing Bell: ASX slides lower again; and long-awaited data centre REIT, DigiCo, slips on IPO debut

The ASX hits near 4-week low, led by losses in miners, as DigiCo Infrastructure REIT underwhelms in IPO debut today

ASX drops to 4-week low, miners lead losses

Rio Tinto slumps after $2.5bn lithium investment, iron ore prices fall

DigiCo REIT slips on IPO debut

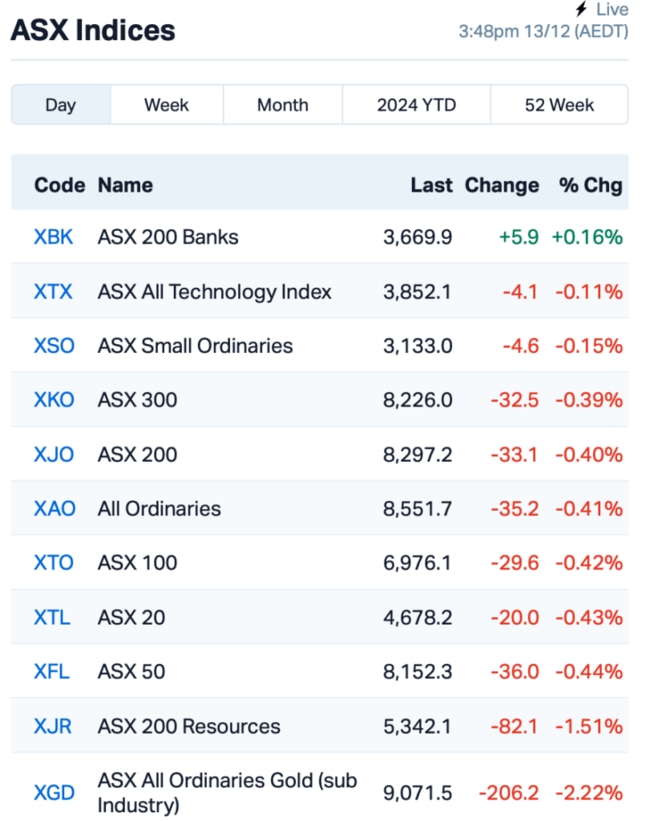

The ASX has closed lower by 0.4% on Friday to near its lowest level in a month. For the week, the benchmark S&P/ASX 200 index was down 1.5%.

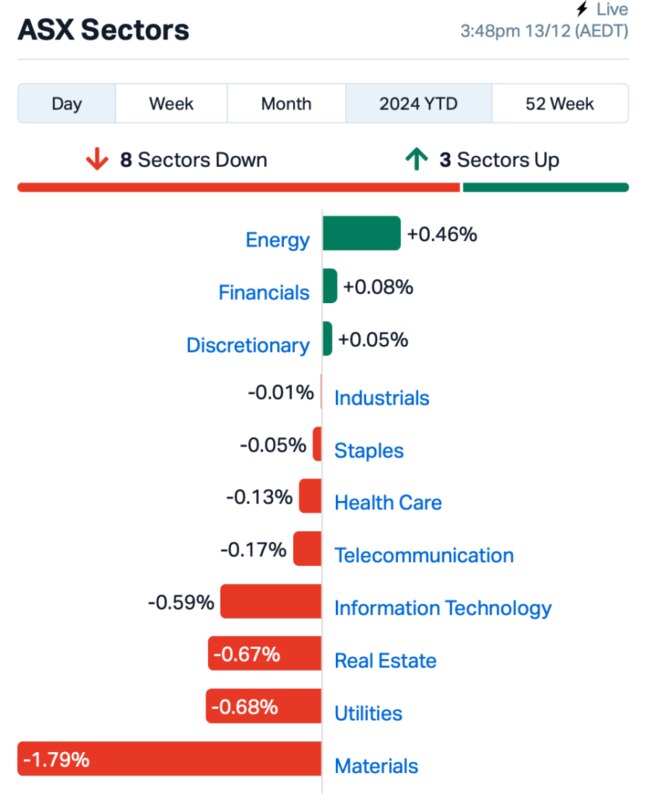

Six out of 11 sectors retreated, with the mining sector leading the losses. News of potential fiscal stimulus from Beijing this afternoon wasn’t enough to spark confidence in the mining sector.

This is where things stood at 15:45 AEDT:

At the large end of town, Rio Tinto (ASX:RIO) was under additional pressure after it committed to a hefty US$2.5 billion investment to expand its Rincon lithium project in South America. Rio’s shares tumbled by almost 3%.

Meanwhile, in Singapore, the January iron ore futures contract fell almost 3%, further dampening investor sentiment towards Aussie miners.

The real estate sector also came under pressure, with sector leader Goodman Group (ASX:GMG) falling by over 1%.

DigiCo Infrastructure REIT (ASX:DGT), a data centre landlord, made its long-awaited $2.7bn IPO debut today.

At the time of writing, DGT's shares were trading at $4.80, down from its initial price of $5 in what was the ASX's largest IPO of the year.

But while the broader market struggled, Iress (ASX:IRE), a technology provider, surged 9% after the company reaffirmed its earnings guidance of $126 million to $132 million for FY24 and announced the reinstatement of dividends.

Vulcan Energy Resources (ASX:VUL), the renewable energy and lithium miner, caught investor attention with a €500m loan commitment from the European Investment Bank to fund its Lionheart Lithium Project. Shares slumped by 11%.

Elsewhere in the region, the latest readout from China’s Central Economic Work Conference failed to provide much-needed clarity on policy measures to boost consumption and economic growth.

As a result, Asian equities, including Australian stocks, continued to slide today.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | 100% | 492,140 | $703,362 |

| AUH | Austchina Holdings | 0.002 | 50% | 113,085 | $2,400,384 |

| ICU | Investor Centre Ltd | 0.003 | 50% | 1,012,100 | $609,023 |

| TMK | TMK Energy Limited | 0.003 | 50% | 4,438,644 | $18,651,130 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 735,756 | $7,254,899 |

| TTI | Traffic Technologies | 0.004 | 33% | 880,000 | $3,356,454 |

| TX3 | Trinex Minerals Ltd | 0.002 | 33% | 2,500,000 | $2,742,978 |

| HRE | Heavy Rare Earths | 0.034 | 31% | 37,515 | $2,191,154 |

| XGL | Xamble Group Limited | 0.026 | 30% | 327,326 | $5,923,142 |

| RDN | Raiden Resources Ltd | 0.014 | 27% | 29,847,038 | $37,959,806 |

| AAU | Antilles Gold Ltd | 0.005 | 25% | 100,000 | $7,431,504 |

| CUL | Cullen Resources | 0.005 | 25% | 1,173,632 | $2,773,607 |

| ENL | Enlitic Inc. | 0.090 | 23% | 1,200 | $42,017,655 |

| KEY | KEY Petroleum | 0.061 | 22% | 100 | $1,258,975 |

| BGE | Bridgesaaslimited | 0.042 | 20% | 105,000 | $6,995,072 |

| AOK | Australian Oil. | 0.003 | 20% | 664,969 | $2,504,457 |

| AUK | Aumake Limited | 0.006 | 20% | 285,127 | $15,053,461 |

| CZN | Corazon Ltd | 0.003 | 20% | 100,000 | $1,919,764 |

| PIL | Peppermint Inv Ltd | 0.006 | 20% | 1,412,166 | $10,794,292 |

| TIG | Tigers Realm Coal | 0.003 | 20% | 1,000,000 | $32,666,756 |

| ION | Iondrive Limited | 0.025 | 19% | 22,642,620 | $18,472,307 |

Marketing platform, Xamble Group (ASX:XGL), has secured a $1.5 million strategic investment from 7-Eleven Malaysia’s subsidiary, Convenience Shopping (Sabah). The investment, which involves the issuance of 42.8 million new shares, will help Xamble enhance its influencer marketing platform and expand its operations.

Base metals explorer Cullen Resources (ASX:CUL) said RC drilling has started to test strong IP anomalies at the Wongan and Rupert Prospects. The drilling program, which involves 4-6 holes over 600-800m, will begin at Wongan, where harvesting has been completed, and then move to Rupert, following additional harvesting and weather considerations.

OzAurum Resources (ASX:OZM) has raised $1 million through a share placement of 38.46 million shares at $0.026 each. The funds will be used to continue exploration at its Mulgabbie and Patricia gold projects in Western Australia and progress work at the Brazil Niobium project. The placement was supported by both existing and new investors, and is expected to settle by 20 December.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NC6 | Nanollose Limited | 0.017 | -43% | 1,552,667 | $5,160,191 |

| PNT | Panthermetalsltd | 0.010 | -33% | 11,641,203 | $3,530,230 |

| IBX | Imagion Biosys Ltd | 0.025 | -31% | 8,109,596 | $1,815,767 |

| MKR | Manuka Resources. | 0.029 | -28% | 5,403,604 | $32,430,707 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,964,426 | $57,867,624 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | 11,867 | $1,842,067 |

| LNU | Linius Tech Limited | 0.002 | -25% | 1,595,997 | $12,302,431 |

| OB1 | Orbminco Limited | 0.002 | -25% | 707,758 | $4,333,180 |

| PAB | Patrys Limited | 0.003 | -25% | 55,000 | $8,229,789 |

| SKN | Skin Elements Ltd | 0.003 | -25% | 78,340 | $3,424,611 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 603,108 | $1,929,431 |

| HE8 | Helios Energy Ltd | 0.010 | -23% | 461,940 | $33,852,643 |

| BCB | Bowen Coal Limited | 0.006 | -21% | 13,047,626 | $70,000,228 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 1,055 | $3,852,080 |

| EVR | Ev Resources Ltd | 0.002 | -20% | 170,666 | $4,511,258 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 222,333 | $11,058,736 |

| VML | Vital Metals Limited | 0.002 | -20% | 306,650 | $14,737,667 |

| EQN | Equinoxresources | 0.105 | -19% | 818,532 | $16,100,500 |

| NWM | Norwest Minerals | 0.017 | -19% | 1,044,747 | $10,187,510 |

| CMB | Cambium Bio Limited | 0.440 | -19% | 44,267 | $6,442,743 |

| OLI | Oliver'S Real Food | 0.009 | -18% | 312,500 | $5,948,051 |

| APC | APC Minerals | 0.019 | -17% | 141,285 | $2,349,981 |

| BSN | Basinenergylimited | 0.015 | -17% | 222,594 | $1,878,293 |

IN CASE YOU MISSED IT

ADX Energy (ASX:ADX) has brought the Anshof-2A oil well into production at an initial rate of ~70 barrels per day, increasing total output to 170bpd, with 100bpd net to the company. The company is assessing long-term production potential while exploring further appraisal and nearby exploration opportunities.

Uvre (ASX:UVA)is looking to sure up multiple paleochannel targets ahead of drilling as it kicks off a second-phase exploration program at its highly prospective uranium assets in South Australia. If all goes to plan, the company aims to begin drilling in the March quarter of the new year.

Golden Mile Resources (ASX:G88) is expanding its planned maiden drilling program at the Pearl copper project in Arizona to include the Ford and Odyssey prospects. Drilling is expected to begin in early 2025, with Ford being a historical mine that produced grades of up to 31.3% lead, 10.6% copper, and 16.7g/t gold.

Brazilian Critical Minerals (ASX:BCM)has attracted further interest from brokers and sophisticated investors, raising $1.44 million through the placement of 144 million shares at 1 cent each. The funds will support ongoing studies and an updated MRE for BCM’s Ema project in northern Brazil.

Javelin Minerals (ASX:JAV) shareholders have approved the acquisition of the Eureka gold project in WA from Delta Lithium (ASX:DLI), which has a MRE of 2.45Mt at 1.42 g/t gold for 112,000oz. The company plans to begin its first drill program in early 2025 and has appointed experienced finance professional Peter Gilford as a non-executive director.

At Stockhead, we tell it like it is. While ADX Energy, Uvre, Golden Mile Resources, Brazilian Critical Minerals and Javelin Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.