Closing Bell: ASX falls while Flight Centre flags turbulence ahead

The ASX has fallen Friday as Aussie jobs data and concerns about China’s economy weigh on the markets.

ASX closes lower as Aussie jobs figures and new China figures weigh on markets

Flight Centre falls after releasing Q1 FY25 results where it noted "trading had been volatile"

InhaleRX enters into a significant funding agreement with Clendon Biotech Capital to cover trial costs

The ASX has retreated from record highs on Thursday to have its worst day in six weeks on Friday with the S&P/ASX 200 closing down 0.87% to 8283.20 points.

On Thursday, the ASX 200 reached an all-time high of 8384.50 points before finishing 0.8% higher, setting a new record daily close at 8355.9 points. Today... not so much.

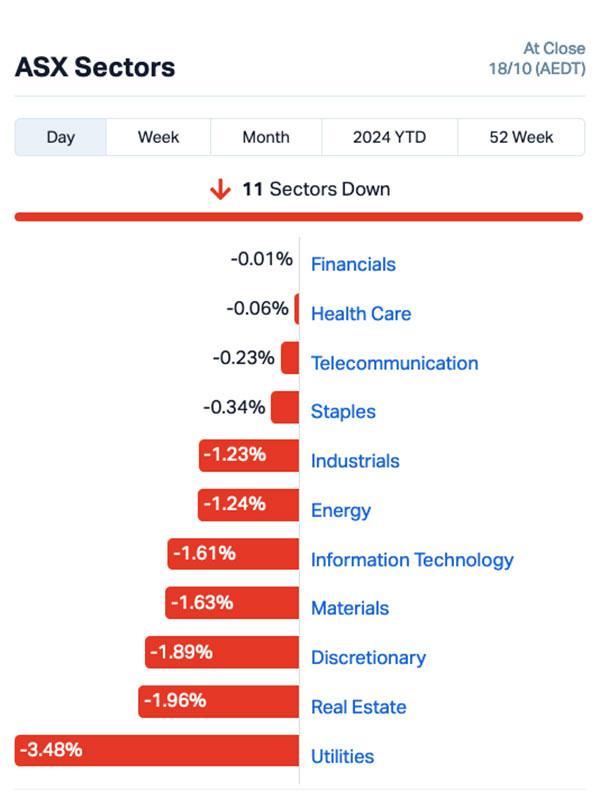

All 11 sectors of the ASX were down to finish the week with utilities leading the falls, down ~3% followed by consumer discretionary, which dropped ~2%.

The Aussie bourse extended losses after Chinese sent concerns among investors about a slowdown in the world's second biggest economy.

On an annual basis, gross domestic product (GDP) was up by 4.6% in the three months to the end of September, according to data from China's National Bureau of Statistics, which is less than the previous quarter and below the government's target of ~5% for the year.

In recent weeks the Chinese Government has announced several stimulus measures aimed at boosting growth.

Also adding pressure to the ASX today was Thursday's jobs report, which dampened expectations for an interest rate cut. ABS data showed the Aussie economy added a surprising 64,100 jobs in September – way above the 25,200 expected – while the unemployment rate stayed steady at 4.1%.

The consumer discretionary sector felt the headwinds of ~20% drop in Flight Centre (ASX:FLT) today after its Q1 FY25 results.

FLT said trading was "marginally above" pcp across most key metrics including total transaction value (TTV), profit margin, and underlying profit but it was "currently too early to draw conclusions" as to likely trading patterns over the full year."

FLT also warned that trading had been volatile, with "some inconsistency month-to-month" with the company due to provide FY25 guidance at its AGM next month.

Not the ASX

Overnight, Wall Street was mixed with the S&P 500 inching 0.02% lower, the Nasdaq adding 0.04% and the Dow up 0.37% to yet another record high.

Chinese stocks climbed after its central bank launched a swap facility to boost the equity market. However, shares across the rest of Asia were mixed following the latest Chinese data, which raised question about the robustness of its economy.

At 3.30pm (AEDT) the Hang Seng was was 0.75%, the Shanghai Composite Index rose 0.67% and Japan's Nikkei was p 0.02%. South Korea's Kospi retreated 0.74%.

The US futures are looking down for the Dow and S&P 500 for Friday trading, while the Nasdaq is pointing up. European shares are also looking for a softer open with the FTSE and DAX futures also down.

In the US Housing starts and building permits data for September will be released on Friday, while US Federal Reserve president and CEO of Atlanta Dr Raphael W Bostic along with the central bank's president and CEO of Minneapolis Neel Kashkari are due to speak.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ERA | Energy Resources | 0.005 | 118.6 | 59,564,738 | $50,657,590 |

| DOU | Douugh | 0.009 | 100.0 | 13,361,002 | $4,869,310 |

| OVT | Ovanti | 0.024 | 71.4 | 154,931,539 | $21,788,877 |

| GCR | Golden Cross | 0.003 | 50.0 | 3,026,345 | $2,194,512 |

| PRX | Prodigy Gold | 0.003 | 50.0 | 1,138,345 | $4,664,912 |

| TSL | Titanium Sands | 0.006 | 50.0 | 2,075,342 | $8,846,989 |

| LGP | Little Green Pharma | 0.16 | 39.1 | 2,345,128 | $34,830,394 |

| IRX | InhaleRX | 0.03 | 36.4 | 4,374,897 | $4,250,659 |

| SLM | Solis Minerals | 0.13 | 34.0 | 703,440 | $7,506,083 |

| SFG | Seafarms Group | 0.004 | 33.3 | 44,400 | $14,509,798 |

| BDG | Black Dragon Gold | 0.02 | 33.3 | 481,414 | $4,012,765 |

| CMX | Chemx Materials | 0.048 | 26.3 | 60,000 | $4,902,848 |

| AUZ | Australian Mines | 0.015 | 25.0 | 39,110,529 | $16,782,145 |

| BYH | Bryah Resources | 0.005 | 25.0 | 100,000 | $2,013,147 |

| INP | Incentiapay | 0.005 | 25.0 | 306,601 | $5,060,960 |

| RNE | Renu Energy | 0.0025 | 25.0 | 1,386,831 | $1,690,490 |

| MPP | Metro Perf.Glass | 0.062 | 24.0 | 34,630 | $9,268,904 |

| TGH | Terragen | 0.051 | 21.4 | 140,160 | $15,501,407 |

| AZ9 | Asian Battery Metals | 0.042 | 20.0 | 841,272 | $10,577,524 |

Energy Resources of Australia (ASX:ERA) was higher following Thursday’s resumption of the company’s Rio Tinto-led 19.87 for 1 non-underwritten pro rata renounceable entitlement offer, seeking to raise about $90.

InhaleRX (ASX:IRX) has entered into a significant funding agreement with Clendon Biotech Capital, securing up to $38.5m in funding to

cover all direct costs associated with the Phase 1 and 2 clinical development of the company’s key projects, IRX-211 and IRX-616a.

IRX-211 is a drug-device medication, specifically designed to target breakthrough cancer pain, while IRX-616a is an innovative drug device medication designed to offer fast and effective relief for individuals suffering from panic disorder.

Anteo Diagnostics (ASX:ADO) was also up today after responding to a query from the ASX. The biotech announced earlier this week it had secured a deal for the first commercial order of its Ultranode product from “leading European EV manufacturer EV1”.

In response to a query from the ASX, ADO today announced that EV1 is in fact the AMG arm of German automaker Mercedes Benz.

Tech services contracting company BSA (ASX:BSA) also rose more than 12% today after releasing its latest quarterly report, showing continued strong financial performance into the new financial year, with Q1 FY25 revenue of $76.9m, an improvement of 35.6% on pcp. The company also announced Q1 FY25 EBITDA of $6.5m, and an increase of 47.7% on pcp, with an EBITDA margin of 8.4% also increasing on pcp as the Group aims for improved margins throughout FY2025.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MOV | Move Logistics Group | 0.21 | -36.4 | 102,179 | $42,112,626 |

| PER | Percheron | 0.088 | -34.8 | 23,129,178 | $121,708,571 |

| CDE | Codeifai | 0.001 | -33.3 | 1,020,000 | $3,961,942 |

| CAV | Carnavale Resources | 0.003 | -25.0 | 444,234 | $16,360,874 |

| MHC | Manhattan Corp | 0.0015 | -25.0 | 50,000 | $8,995,940 |

| RML | Resolution Minerals | 0.0015 | -25.0 | 163,900 | $3,220,044 |

| FLT | Flight Centre Travel | 17.17 | -20.6 | 6,679,938 | $4,796,888,033 |

| SBW | Shekel Brainweigh | 0.047 | -20.3 | 709,765 | $13,455,613 |

| 88E | 88 Energy | 0.002 | -20.0 | 10,000,005 | $72,334,530 |

| CTO | Citigold Corp | 0.004 | -20.0 | 575,816 | $15,000,000 |

| EFE | Eastern Resources | 0.004 | -20.0 | 9,812,999 | $6,209,732 |

| MOM | Moab Minerals | 0.004 | -20.0 | 1,412,000 | $4,044,071 |

| PUA | Peak Minerals | 0.002 | -20.0 | 1,740 | $6,242,776 |

| T3D | 333D | 0.008 | -20.0 | 161,384 | $1,194,449 |

| TOU | Tlou Energy | 0.024 | -17.2 | 1,260,192 | $37,658,945 |

| EGY | Energy Tech | 0.03 | -16.7 | 1,035,950 | $15,714,142 |

| HE8 | Helios Energy | 0.015 | -16.7 | 308,514 | $46,872,890 |

| AD1 | AD1 Holdings | 0.005 | -16.7 | 4,528,800 | $6,584,090 |

| CUL | Cullen Resources | 0.005 | -16.7 | 20,009 | $4,160,411 |

| ERG | Eneco Refresh | 0.01 | -16.7 | 867,439 | $3,268,300 |

IN CASE YOU MISSED IT

Hillgrove Resources (ASX:HGO) has upgraded resources at its Kanmantoo copper mine in South Australia by 96% to 19.3Mt grading 0.77% copper and 0.14g/t gold and defined a maiden ore reserve of 2.8Mt at 0.91% copper and 0.15g/t gold. It produced 2923t of copper during the September 2024 quarter.

Drilling of Omega Oil & Gas’ (ASX:OMA) Canyon-1H horizontal well within the Taroom Trough in southern Queensland’s Bowen Basin is progressing smoothly with strong gas shows and signs of condensate recorded while drilling within the target Canyon Sandstone.

Tryptamine Therapeutics (ASX:TYP) has achieved a key milestone in development of its innovative IV-infused psilocin formulation TRP-8803 after it was found to be generally safe and well tolerated in healthy volunteer participants dosed in a clinical setting.

Regener8 Resources (ASX:R8R) has executed a contract with Gyro Drilling for maiden drilling at its East Ponton project in WA.

The program will initially test the Hatlifter paleochannel-hosted nickel-cobalt target, where historical drilling returned a high-grade, end-of-hole intersection of 3m at 1.26% nickel and 0.6% cobalt from 57m.

Hatlifter shares many geological similarities to the Mulga Rocks project owned by Deep Yellow (ASX:DYL) and is located within the same paleochannel system.

Drilling will also test the Grasshopper rare earths and niobium carbonatite prospect where historical drilling by Anglo Gold Ashanti in 2013 highlighted numerous REE anomalies coincident with magnetic features interpreted as an intrusive complex.

R8R’s magnetic inversion modelling indicated that historical drilling did not fully intersect the magnetic features, and the prospect remains effectively untested.

At Stockhead, we tell it like it is. While Hillgrove Resources, Omega Oil & Gas, Regener8 Resources and Tryptamine Therapeutics are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a

registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial

decisions.