Closing Bell: ASX dips further as Macquarie downgrade sends coal stocks tumbling

Tariffs pressured the ASX lower on Thursday, as coal shares fell following Macquarie’s downgrade.

ASX dips further amid tariff uncertainty

Coal stocks fall after Macquarie downgrade

Gold gains as ASX correction looms

The ASX saw fluctuations on Thursday, with early gains reversed in the afternoon as investor apprehension grew around the implications of Donald Trump's tariff policies.

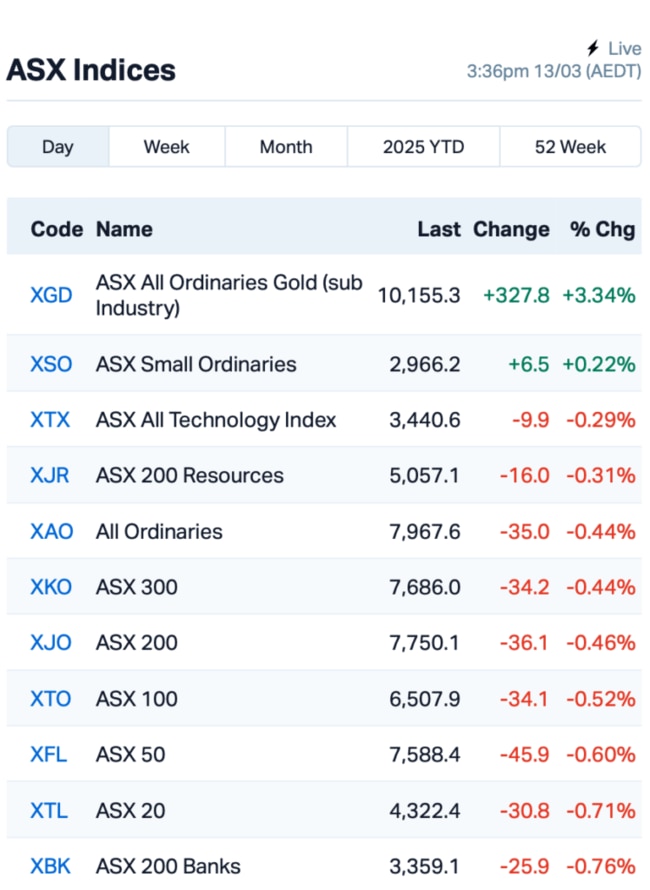

The benchmark ASX 200 Index concluded today's session with a decline of 0.48%, which brings it closer to the seven-month low recorded on Wednesday.

The index also sits just below 10% from its recent peak in February, approaching the threshold that defines a market correction.

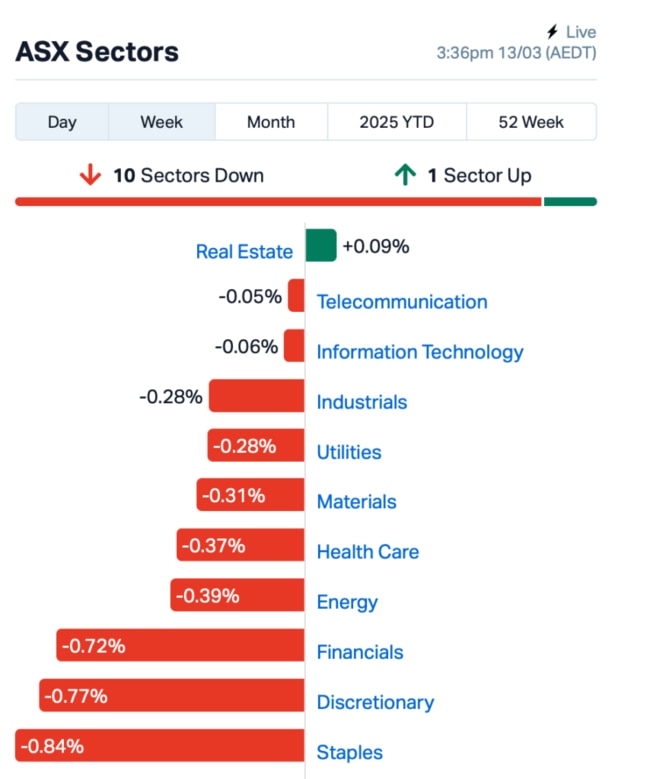

Across the exchange, 10 of the 11 sectors reported losses.

Both discretionary and non-discretionary retailers were among the hardest hit.

The energy sector also faced pressure, primarily due to revised coal price forecasts from Macquarie – in a note we received from brokerage firm, IG.

Macquarie cited weakening demand, particularly from key markets like China, and an increase in supply from Russia and Mongolia as factors contributing to its revised projections.

Consequently, Macquarie downgraded several coal stocks, including New Hope Corp (ASX:NHC), Whitehaven Coal (ASX:WHC) and Coronado Global Resources (ASX:CRN). Also, Yancoal Australia's (ASX:YAL) share price fell sharply by 13% as the stock traded ex-dividend.

On the other side of the ledger, the winners today include the real estate sector.

Gold miners also continued their upward trend, driven by investor demand for safe-haven assets. Bellevue Gold (ASX:BGL) rose 6%.

This is where we stood leading up to Thursday’s close:

Over in Asia, things were also looking a bit calmer today.

Traders were really trying to figure out where they stood – weighing up the potential fallout from more tariffs against the softer-than-expected US inflation that dropped overnight.

But Fed chair Jerome Powell has practically said that the US central bank will hold rates steady at its next meeting on March 18-19.

“The economy’s fine. It doesn’t need us to do anything, really. And so we can wait, and we should wait,” Powell had said previously.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap CR9 Corellares 0.004 100% 3,672,699 $935,487 WOA Wide Open Agricultur 0.027 69% 42,985,981 $8,538,986 SCP Scalare Partners 0.195 50% 615,688 $4,534,764 BUY Bounty Oil & Gas NL 0.003 50% 3,935,583 $3,122,944 AVW Avira Resources Ltd 0.008 33% 262,162 $881,638 BP8 Bph Global Ltd 0.004 33% 49,871 $1,824,924 RLT Renergen Limited 0.450 29% 869 $10,614,092 ADG Adelong Gold Limited 0.005 25% 30,795,026 $5,589,945 ALR Altairminerals 0.003 25% 305,443 $8,593,488 BLZ Blaze Minerals Ltd 0.003 25% 31,250 $3,133,896 ERA Energy Resources 0.003 25% 242,396 $810,792,482 FAU First Au Ltd 0.003 25% 10,365,475 $4,143,987 TSL Titanium Sands Ltd 0.005 25% 39,333 $9,346,989 WSR Westar Resources 0.010 25% 2,173,895 $3,189,799 VMC Venus Metals Cor Ltd 0.115 24% 511,556 $18,239,968 AKN Auking Mining Ltd 0.006 20% 2,887,039 $2,873,894 ASR Asra Minerals Ltd 0.003 20% 6,001,309 $5,932,817 TYX Tyranna Res Ltd 0.006 20% 580,022 $16,439,627 ETM Energy Transition 0.085 20% 17,330,992 $110,064,816 MHK Metalhawk. 0.425 20% 1,073,238 $40,911,976 AR3 Austrare 0.084 18% 302,288 $11,288,271 DY6 Dy6Metalsltd 0.040 18% 141,368 $1,713,968 NTU Northern Min Ltd 0.020 18% 7,085,721 $142,071,649

Boss Energy (ASX:BOE) has snapped up 23.5 million shares in Laramide Resources (ASX:LAM), boosting its stake to 18.4%. The $15.5 million deal, paid in cash and shares, secures Boss a chunk of Laramide’s Westmoreland uranium project in Queensland, which could be a big win if the state lifts its uranium mining ban. Meanwhile, Boss said it will continue to focus on ramping up production at its Honeymoon uranium project in South Australia.

Zinc of Ireland (ASX:ZMI) has locked in the green light for drilling at its Mt Clere project in WA after getting the Program of Work approval. The focus will be on the Robin 21 anomaly, a massive untested geophysical target with potential, and drilling is set to kick off in April. It’s a high-risk, high-reward move, said ZMI, targeting a large mineral system in a base metal-rich region that’s never been fully explored.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AFA | ASF Group Limited | 0.003 | -40% | 105 | $3,961,988 |

| OB1 | Orbminco Limited | 0.001 | -40% | 59,764,803 | $3,610,839 |

| GTR | Gti Energy Ltd | 0.002 | -33% | 211,060 | $8,996,849 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 400 | $2,600,499 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 3,685,251 | $7,254,899 |

| SLH | Silk Logistics | 1.470 | -26% | 637,721 | $161,464,244 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 25,632,104 | $6,716,008 |

| WYX | Western Yilgarn NL | 0.030 | -23% | 470,034 | $4,844,822 |

| CDR | Codrus Minerals Ltd | 0.017 | -23% | 40,407 | $3,638,525 |

| IMI | Infinitymining | 0.011 | -21% | 407,054 | $5,894,221 |

| AOK | Australian Oil. | 0.002 | -20% | 720,000 | $2,504,457 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 590,609 | $15,000,000 |

| HLX | Helix Resources | 0.002 | -20% | 25,000 | $8,410,484 |

| RNX | Renegade Exploration | 0.004 | -20% | 930,051 | $6,420,017 |

| HE8 | Helios Energy Ltd | 0.013 | -19% | 1,384,371 | $41,664,791 |

| SUM | Summitminerals | 0.053 | -17% | 236,074 | $5,576,191 |

| HOR | Horseshoe Metals Ltd | 0.015 | -17% | 303,349 | $12,060,120 |

| REC | Rechargemetals | 0.015 | -17% | 322,962 | $4,616,819 |

| CCO | The Calmer Co Int | 0.005 | -17% | 120,170 | $15,300,416 |

| DAF | Discovery Alaska Ltd | 0.010 | -17% | 242,202 | $2,810,816 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 1,000,000 | $18,138,447 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 8,992,864 | $9,597,195 |

| SHE | Stonehorse Energy Lt | 0.005 | -17% | 373,753 | $4,106,610 |

| CYB | Aucyber Limited | 0.076 | -16% | 293,396 | $14,884,266 |

Silk Logistics (ASX:SLH) tanked 21% after the ACCC raised concerns about its proposed sale to DP World Australia. The competition watchdog released a Statement of Issues, questioning the deal’s impact on competition, and has asked for feedback by March 27. The final decision is expected by June 5, but Silk’s directors are still backing the deal, hoping to get approval from the ACCC and FIRB.

Infinity Mining (ASX:IMI) has just re-logged some drill core at the Cangai copper project in NSW and found magnetic pyrrhotite, which could point to more copper. With plans for a high-res drone magnetic survey, the company’s looking to find new drill targets and expand the project. This follows some solid earlier results, but the new survey is key to seeing if there’s more copper to be found. Shares, however, also fell 21%.

IN CASE YOU MISSED IT

Vertex Minerals (ASX:VTX) has appointed seven key operational personnel to advance its high-grade Reward underground gold mine, bringing in expertise across mining, geology, safety, and environmental management. The new additions include a commercial manager, senior mining engineers and geologists, an underground shift boss, a safety and training superintendent, and an environmental advisor.

Botanix Pharmaceuticals (ASX:BOT) will be elevated to the S&P/ASX 300 index after its share price more than doubled in the past year, driven by the FDA approval and US launch of its Sofdra treatment for excessive underarm sweating. The company is now focused on expanding sales, rolling out a digital content strategy, and maximising patient engagement to drive long-term growth.

Star Minerals (ASX:SMS) has secured $1.6 million in funding, including a strategic investment from Bain Global Resources, to advance its Tumblegum South gold project toward a mining decision. The funds will support drilling, resource upgrades, approvals and feasibility studies.

Top End Energy (ASX:TEE) has selected its first drill site at the Serpentine natural hydrogen project in Kansas, leveraging newly released data from its billionaire-backed neighbour, Koloma. With surface agreements in place and well engineering underway, the company is advancing toward drill-readiness while expanding its lease holdings.

New World Resources (ASX:NWC) has completed its planned placement of 700 million shares at 0.2 cents each, raising $14 million. The board and management have also committed to a further $640,000 in a second tranche, subject to shareholder approval in late April.

At Stockhead, we tell it like it is. While Vertex Minerals, Botanix Pharmaceuticals, Star Minerals, Top End Energy and New World Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.