Closing Bell: ASX climbs as miners flex; US SEC eases up on crypto crackdown

The ASX pops with miners, Pinnacle smashes records, and SEC eases up on crypto while Trump gives a nod to talks with China.

ASX climbs as miners rally on tariff hopes

Pinnacle hits record, Insignia jumps on bids

US SEC eases up on crypto crackdown under Trump

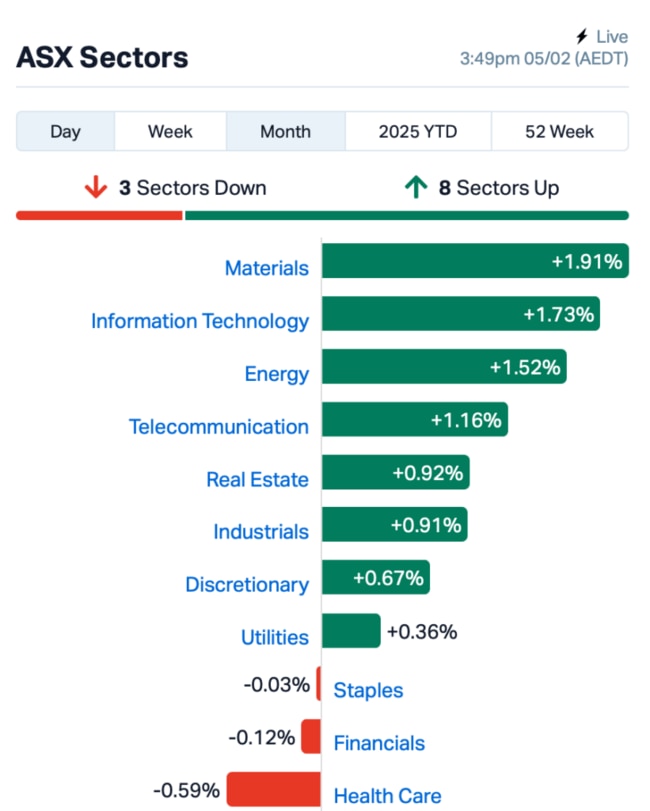

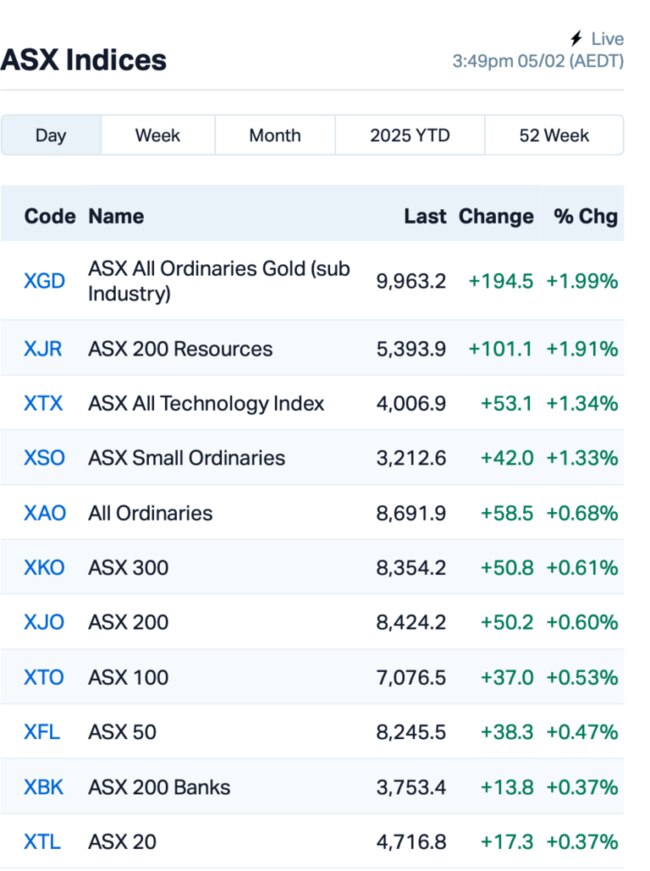

The ASX extended yesterday’s gains on Wednesday, picking up by 0.51% at close, as investors found some hope in China’s measured response to US tariffs.

A lot of the action came from the miners, with China’s retaliatory tariffs on US goods, including coal, LNG and oil, sparking hopes of higher prices for Aussie exports.

Coal stocks like Coronado Global Resources (ASX:CRN) and Whitehaven Coal (ASX:WHC) surged.

Champion Iron (ASX:CIA) and BHP (ASX:BHP) also made strong gains as iron ore prices hit above $US104 a tonne.

Oil also got a lift as Brent crude bounced back to $US76.40 per barrel, which gave oil producers like Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) a nice boost.

In the large caps space, Pinnacle Investment's (ASX:PNI) shares hit a record, soaring 4% after posting a stunning 151% jump in profit for the half-year.

Not to be left behind, Insignia Financial (ASX:IFL) rose 7% after Brookfield Capital Partners made a $4.60-per-share offer, matching bids from Bain and CC Capital.

This is how things stood leading up to today's close:

Across the water in China, stocks were feeling more cautious as the market reopened after the Lunar New Year break.

US President Trump has hinted that talks with Chinese President Xi Jinping could take place soon, but he's not rushing into any discussions, leaving the market to wait and see.

Meanwhile, good news for crypto traders as the US SEC is dialling back its crypto crackdown, cutting down its special unit of 50+ lawyers focused on crypto enforcement.

This move marks one of Trump’s first steps in easing up on crypto regulation.

The SEC’s new acting chair, Mark Uyeda, has been reshuffling the deck, with some of the crypto team being reassigned to other roles.

At the time of writing, Bitcoin is trading at US$98,101, down 2% in the last 24 hours.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap AKN Auking Mining Ltd 0.005 67% 3,153,333 $1,544,336 OZM Ozaurum Resources 0.100 54% 28,450,701 $12,818,750 EDE Eden Inv Ltd 0.002 50% 353,048 $4,109,881 RNX Renegade Exploration 0.007 40% 6,560,791 $6,420,017 AIV Activex Limited 0.011 38% 500,000 $1,724,021 EQR Eq Resources Limited 0.039 34% 19,611,614 $67,715,941 CRB Carbine Resources 0.004 33% 72,571 $1,655,213 CT1 Constellation Tech 0.002 33% 25,000 $2,212,101 EEL Enrg Elements Ltd 0.002 33% 551,543 $4,880,668 LNU Linius Tech Limited 0.002 33% 750,000 $9,226,824 MRQ Mrg Metals Limited 0.004 33% 100,000 $8,179,556 PRM Prominence Energy 0.004 33% 1,146,841 $1,167,529 TGN Tungsten Min NL 0.115 31% 2,107,847 $78,664,456 CVB Curvebeam Ai Limited 0.150 30% 2,544,016 $36,865,299 DBO Diabloresources 0.018 29% 100,000 $1,443,000 MGL Magontec Limited 0.250 25% 25,000 $15,928,753 PRX Prodigy Gold NL 0.003 25% 383,331 $6,350,111 VML Vital Metals Limited 0.003 25% 381,230 $11,790,134 AGD Austral Gold 0.043 23% 147,948 $21,430,897 AUA Audeara 0.045 22% 1,157,393 $6,480,280

Auking Mining (ASX:AKN) has struck a deal with Beijing-based Gage Capital. The deal includes a placement of 60 million shares at $0.005 each, raising $300,000 for working capital. Gage now holds about 10% of AuKing. On top of that, Gage is set to buy two of AuKing’s prospecting licences in Tanzania for $300,000, with some conditions to be met. Despite the sale, AuKing said it is still focused on drilling at its Mkuju uranium project in Tanzania and has no plans to change its drilling priorities.

OzAurum Resources (ASX:OZM) is buzzing after hitting high-grade gold at Mulgabbie North. In a recent aircore drill, the company said it found visible gold with a solid 4m at 14.17 g/t. With a rig on its way next week for follow-up RC drilling, the team is fired up to expand on this find. The gold’s hosted in sandstone, a promising sign, as it’s linked to big deposits like Carosue Dam nearby.

Renegade Exploration (ASX:RNX) has identified high-grade critical defence metals, germanium and gallium, at its Andrew Zn-Pb-Ag deposit in Yukon, Canada. Recent drilling results revealed significant concentrations of these sought-after metals, with impressive grades in several samples. The company is now investigating the potential to reanalyse drill samples for germanium and gallium using more accurate methods.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap MGU Magnum Mining & Exp 0.006 -40% 11,871,589 $8,093,614 ASR Asra Minerals Ltd 0.002 -33% 250,110 $6,937,890 TX3 Trinex Minerals Ltd 0.001 -33% 4,105,554 $2,817,978 88E 88 Energy Ltd 0.002 -25% 14,473,750 $57,867,624 BEL Bentley Capital Ltd 0.012 -25% 5,000 $1,218,047 GLL Galilee Energy Ltd 0.009 -25% 1,032,374 $6,686,315 BMO Bastion Minerals 0.004 -20% 3,433,263 $4,223,623 CYQ Cycliq Group Ltd 0.004 -20% 525,000 $2,302,583 M2R Miramar 0.004 -20% 1,727,709 $1,984,116 RLG Roolife Group Ltd 0.004 -20% 7,881,185 $5,980,156 NOR Norwood Systems Ltd. 0.025 -17% 583,860 $14,308,355 R8R Regener8Resourcesnl 0.125 -17% 227,999 $4,875,375 ERA Energy Resources 0.003 -17% 605,709 $1,216,188,722 MTB Mount Burgess Mining 0.005 -17% 539,716 $2,037,225 XPN Xpon Technologies 0.010 -17% 58,455 $4,349,298 VRX VRX Silica Ltd 0.039 -15% 2,418,751 $34,211,666 BXN Bioxyne Ltd 0.040 -15% 4,542,788 $96,313,750 ADN Andromeda Metals Ltd 0.006 -14% 37,445,930 $24,001,094 IPB IPB Petroleum Ltd 0.006 -14% 86,993 $4,944,821 SPD Southernpalladium 0.450 -14% 11,783 $47,748,750 SVG Savannah Goldfields 0.015 -14% 2,554,385 $4,918,986 GNM Great Northern 0.013 -13% 67,854 $2,319,436

IN CASE YOU MISSED IT

One of the few active ASX copper producers,Hillgrove Resources (ASX:HGO)saw a 21% rise in in-situ copper mined and a 13% grade increase to 0.97% at its Kanmantoo mine in South Australia for January. The company sees Kanmantoo to still hold significant exploration potential for further cash generation and new discoveries.

New Age Exploration (ASX:NAE) has wrapped up an Aboriginal cultural heritage survey at its Wagyu gold project in WA, securing access to high-priority targets. A 3000m RC drilling program is set to begin in March.

Neurizon Therapeutics (ASX:NUZ)has been granted a US patent for NUZ-001, covering its use in mTOR pathway-related diseases, neurodegenerative conditions, and cancer. The latest milestone follows FDA Orphan Drug Designation in late 2024.

Brazil-based rare earths explorer Meteoric Resources (ASX:MEI) has reported ionic clay intercepts up to 19,183ppm TREO through the latest drilling carried out outside the 619Mt Calderia resource. The company confirmed MREO peak zones of up to 38%, with resource estimates slated for the June quarter.

Trigg Minerals (ASX:TMG) has become the first ASX-listed company accepted into the International Antimony Association, a global industry body promoting the responsible production, use, and trade of antimony. Membership provides Trigg access to key industry stakeholders, regulatory developments, and global market insights as it looks to advance its portfolio of high-grade projects in New South Wales.

Lithium Energy (ASX:LEL) has secured final environmental approvals for the next phase of development at the Solaroz lithium brine project in Argentina. While shareholders have approved the disposal of the company’s interests in Solaroz, it will continue advancing operations until the sale is completed in January ‘26. Under the terms of the amended sale agreement, CNGR will provide up to US$15 million in funding.

At Stockhead, we tell it like it is. While Hillgrove Resources, New Age Exploration, Neurizon Therapeutics, Meteoric Resources, Trigg Minerals and Lithium Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.