Closing Bell: Arcadium soars 47pc as Rio makes move; retailers beg RBA to cut rates before Christmas

Arcadium Lithium surged after Rio Tinto confirmed interest in acquiring it amid declining lithium valuations.

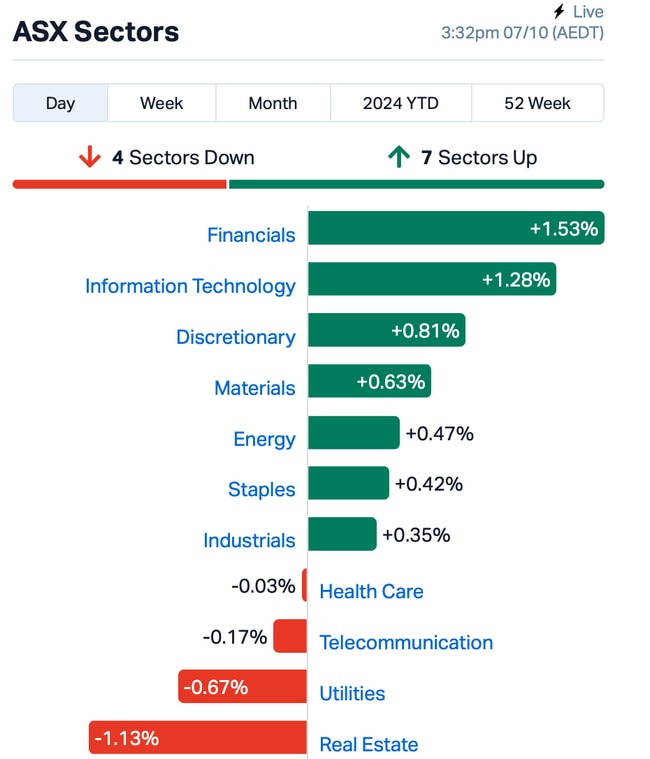

ASX rises as banking and tech sectors lead gains

Arcadium Lithium surges on potential acquisition by Rio Tinto

Retail groups urge Reserve Bank to cut rates ahead of holiday sales

The ASX200 index rose by 0.7% on Monday though investors remained cautious amid escalating conflicts in the Middle East and their potential impact on oil supply.

Among the 11 sectors, seven saw gains, with financials and technology taking the lead.

Arcadium Lithium (ASX:LTM) was the best large cap performer today, up by 47%, after Rio Tinto (ASX:RIO) “confirmed that it has made an approach to Arcadium Lithium regarding a potential acquisition.” More on this, below.

Arcadium’s stock price has fallen significantly over a number of months – from a high of $11.57 in December 2023 to a low of $3.30 in September 2024 – a decline of over 71%, causing it to be removed from the S&P/ASX 100 index.

Elsewhere, mining giants BHP (ASX:BHP) and Fortescue (ASX:FMG) saw gains today, driven by a rise in iron ore prices as China came back from a week-long holiday.

Energy shares mostly rose in a volatile trading session, while gold prices remained steady as traders balanced ongoing tensions in the Middle East with a stronger-than-expected US jobs report.

Overnight, a blowout jobs report in the US boosted stocks on Wall Street. The report shows robust health of the US labour market, with the US adding 254,000 jobs in September, far exceeding expectations by over 100,000. The US unemployment rate also unexpectedly fell to 4.1%.

Back home, Aussie investors are eagerly awaiting the release of the Reserve Bank's September board meeting minutes on Tuesday, which will clarify the reasons behind keeping interest rates steady at 4.35% a couple of weeks ago.

Rates have been at a 12-year high since November, and Governor Michele Bullock indicated that this was the first meeting since March where a rate increase was not even considered.

Retail groups are urging the RBA to lower interest rates at its next meeting on November 4 and 5, as they enter their busiest season with Black Friday and Christmas sales approaching.

What else happened today?

Most stock markets in Asia advanced today following the strong US payroll data overnight.

Sentiment is driven by signs of US economic resilience, especially after employers added the most jobs in six months in September. This has led to speculation about a “no landing” scenario.

Goldman Sachs, meanwhile, has upgraded its view on Chinese stocks to overweight, joining a group of optimists excited about the impact of Beijing's stimulus efforts.

GS says that if the government follows through on its plans, the country’s stock indexes could rise by 15%-20%.

The recent stimulus by the Chinese government has led to several upgrades from major firms like HSBC and BlackRock, as hopes grow that the struggling Chinese stock market is finally recovering.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| KM1 | Kali Metals | 0.195 | 63% | 3,449,006 | $9,219,315 |

| MEL | Metgasco Ltd | 0.006 | 50% | 7,357,191 | $5,830,347 |

| SI6 | SI6 Metals Limited | 0.002 | 50% | 100,000 | $2,368,859 |

| LTM | Arcadium Lithium PLC | 6.170 | 48% | 11,470,657 | $1,441,850,132 |

| RHY | Rhythm Biosciences | 0.105 | 38% | 4,675,064 | $18,893,353 |

| CR9 | Corellares | 0.012 | 33% | 512,324 | $4,185,832 |

| HVY | Heavymineralslimited | 0.135 | 29% | 285,176 | $7,039,577 |

| GLN | Galan Lithium Ltd | 0.145 | 26% | 9,465,507 | $68,547,402 |

| RIM | Rimfire Pacific | 0.039 | 26% | 8,922,010 | $71,152,267 |

| PEC | Perpetual Res Ltd | 0.015 | 25% | 20,165,383 | $8,832,365 |

| IR1 | Irismetals | 0.225 | 25% | 335,473 | $25,039,797 |

| WC8 | Wildcat Resources | 0.320 | 23% | 10,289,297 | $319,556,717 |

| ARL | Ardea Resources Ltd | 0.450 | 20% | 180,798 | $74,881,093 |

| PR1 | Pureresourceslimited | 0.120 | 20% | 72,731 | $4,391,293 |

| FTC | Fintech Chain Ltd | 0.006 | 20% | 178,651 | $3,253,848 |

| SFG | Seafarms Group Ltd | 0.003 | 20% | 270,786 | $12,091,498 |

| IAM | Income Asset | 0.061 | 20% | 5,489 | $16,874,412 |

| LTR | Liontown Resources | 0.885 | 20% | 34,802,543 | $1,794,503,611 |

| FL1 | First Lithium Ltd | 0.190 | 19% | 228,511 | $12,744,577 |

| ARV | Artemis Resources | 0.013 | 18% | 2,126,576 | $21,085,707 |

| NMR | Native Mineral Res | 0.026 | 18% | 996,000 | $8,764,209 |

| G11 | G11 Resources Ltd | 0.020 | 18% | 8,050,702 | $15,837,576 |

| PLL | Piedmont Lithium Inc | 0.170 | 17% | 2,548,824 | $59,512,640 |

Rhythm Biosciences (ASX:RHY), a predictive cancer diagnostics technology company, is also shooting up the bourse today, having announced it’s received the first batch of the ‘Alpha’ version of multiplex antibody detection kits developed and manufactured by the Company’s CMO, Quansys Biosciences, in the USA.

Meanwhile, Kali Metals (ASX:KM1) has expanded its JV with Chilean lithium giant SQM, adding two new tenements: DOM’s Hill and Pear Creek. Kali is acquiring the new DOM’s Hill tenements from major shareholder Kalamazoo Resources (ASX:KZR) for a cash consideration of $100,000, while the Peak Creek tenement is being snapped up from KZR for just $20,000.

Arcadium Lithium (ASX:LTM) surged as Rio Tinto (ASX:RIO) confirmed its interest in acquiring the smaller company, known for its direct lithium extraction at the El Fenix site in Argentina's Hombre Muerto Salar.

Speculation about a takeover has been growing since a report in The Australian suggested Arcadium and Albemarle as potential targets for Rio, which aims to secure a major producer as lithium valuations have dropped. Rio is also testing its own DLE technology at the Rincon project, with a pilot set for completion this year. Despite recent challenges in lithium prices, Arcadium plans to expand production from 5,000tpa to 170,000tpa LCE by 2028.

Nimy Resources (ASX:NIM), one of the small-cap stand-outs last month, saw its stock price rise 106% on the back of the identification of massive sulphides at its Mons nickel project in WA. Mons is at the northern end of the renowned Forrestania nickel belt, host to the world-class nickel endowment at the Southern end with numerous other high-grade nickel deposits extending north. With an ever-growing pipeline of targets, NIM has intersected high-grade copper, nickel, cobalt and PGE mineralisation within broad intervals at Masson – confirming the prospect as a ‘significant discovery’.

Results include 13m at 0.62% copper, 0.36% nickel, 0.04% cobalt, 0.25g/t PGE and 2.30g/t silver from 126m. All three holes returned grades at greater than 1% copper, signifying a dynamic system that is part of a much larger mafic intrusion.

Piedmont Lithium (ASX:PLL) was up on no news. In February, the lithium producer cut its workforce by 27% as a reflection of drastically lower lithium prices to save operational costs across its North American Lithium (NAL) JV with Sayona Mining (ASX:SYA).

This didn’t stop PLL working across its NAL and Ghana lithium projects, expanding NAL’s mineral resource by 39% to 87.9Mt at 1.13% Li2O in late August and receiving an environmental permit for its Ewoyaa lithium project with JV partner Atlantic Lithium (ASX:A11). More news is expected from the global lithium developer in the coming weeks.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 4,457,092 | $1,223,243 |

| INP | Incentiapay Ltd | 0.002 | -33% | 326,222 | $3,795,720 |

| NES | Nelson Resources. | 0.002 | -33% | 3,000,000 | $1,915,783 |

| MBK | Metal Bank Ltd | 0.019 | -30% | 164,087 | $10,542,401 |

| BCB | Bowen Coal Limited | 0.009 | -29% | 236,228,026 | $35,165,876 |

| AQD | Ausquest Limited | 0.008 | -27% | 8,431,881 | $9,087,641 |

| ATH | Alterity Therap Ltd | 0.003 | -25% | 2,155,649 | $21,281,344 |

| IVX | Invion Ltd | 0.003 | -25% | 1,471 | $27,066,367 |

| MHC | Manhattan Corp Ltd | 0.002 | -25% | 1,200,000 | $6,185,067 |

| OVT | Ovanti Limited | 0.003 | -25% | 634,627 | $6,225,393 |

| RNE | Renu Energy Ltd | 0.002 | -25% | 63,449 | $1,608,268 |

| SIS | Simble Solutions | 0.003 | -25% | 2,000,000 | $3,013,803 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 14,670,166 | $7,923,243 |

| VML | Vital Metals Limited | 0.002 | -20% | 559,991 | $14,737,667 |

| WAF | West African Res Ltd | 1.348 | -19% | 20,790,688 | $1,895,033,022 |

| BSN | Basinenergylimited | 0.028 | -18% | 49,911 | $2,827,098 |

| M2M | Mtmalcolmminesnl | 0.033 | -18% | 1,691,599 | $8,999,025 |

| IMC | Immuron Limited | 0.084 | -16% | 2,472,093 | $22,799,835 |

| FSG | Field Solu Hldgs Ltd | 0.017 | -15% | 785,813 | $15,468,891 |

| MRQ | Mrg Metals Limited | 0.003 | -14% | 468,714 | $9,490,315 |

| SRN | Surefire Rescs NL | 0.006 | -14% | 1,367,228 | $13,904,155 |

| TEG | Triangle Energy Ltd | 0.006 | -14% | 8,346,071 | $14,560,938 |

West African Resources (ASX:WAF) was down 19% despite affirming its guidance and stating that the Burkina Faso government remains supportive of its gold mining activities, with no indications of any plans to revoke permits.

IN CASE YOU MISSED IT

Arizona Lithium (ASX:AZL) has entered into agreements with Homestead Energy where on completion, it will raise $11m by selling non-core acreage and data at the Prairie lithium project.

Orthocell (ASX:OCC) has has delivered a second consecutive quarter of record revenue reporting $2.03m in Q1 FY25, up 7.82% on the $1.88m achieved in Q4 FY24 as the company gains traction with new and existing surgeons, translating to growing sales of Striate+ and Remplir. Striate+ is a trademarked, collagen membrane designed to support dental guided bone and tissue regeneration procedures. Remplir is OCC’s trademarked collagen wrap used for peripheral nerve repair.

Celsius Resources (ASX:CLA) has reached an agreement to build the capacity of qualified individuals from local communities ahead of early works this year at its flagship Maalinao-Caigutan-Biyog (MCB) copper-gold project in the Philippines. Under the memorandum of understanding with the Regional Technical Education and Skills Development Authority (TESDA), the company will develop and enhance the skills of the host and neighbouring communities’ workforce. This will encompass employment and business opportunities for early works as well as the subsequent construction and operations phases.

Arika Resources (ASX:ARI) has secured firm commitments from sophisticated investors to raise $3.2m via a placement at $0.025 per share to accelerate drilling at its Yundamindra gold project in WA. The project sits on a mining lease strategically located 65km south-east of Leonora – meaning it’s in close proximity to a number of mills in a hot gold-mining district and is easily accessible by road.

Belararox (ASX:BRX) has plans to drill up to 6,000m at the highly prospective Toro-Malambo-Tambo (TMT) in Argentina after executing a letter of intent with Consour Drilling. The TMT copper project is situated smack-bang in the middle of several large operating mines and neighbours Filo del Sol, the project being acquired by BHP (ASX:BHP) and Lundin for $4.5b.

TRADING HALTS

Echo IQ (ASX:EIQ) – pending US FDA clearance and the appointment of a US based CEO

Vertex Minerals (ASX:VTX) – cap raise

Cyclone Metals (ASX:CLE) – pending announcement on pilot pellet production results

White Cliff Minerals (ASX:WCN) – cap raise

Riversgold (ASX:RGL) – cap raise and acquisition

Pilot Energy (ASX:PGY) – pending an offer to acquire its 376MW solar farm development project being developed in Three Springs, WA

Matsa Resources (ASX:MAT) – entitlement offer prospectus

At Stockhead we tell it like it is. While AZL, OCC, CLA, ARI and BRX are all Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.