ASX Small Caps Weekly Wrap: ASX up a little on a great week for banks and gold

It's been a great week for the banks and for gold, and a handful of small caps.

It’s Friday afternoon and I am that special kind of tired that comes from trying to combine my two favourite hobbies: working my backside off, and playing video games well past any reasonable notion of a proper bedtime.

- The ASX 200 up slightly at the end of a weird week

- Headline grabber this week is definitely Wisetech’s woes

- Who won the Small Caps race? Read on to find out…

Because I am a grown-up adult man who makes excellent life choices… early grave, here I come.

Anyway – this week’s been a bit wild in certain respects, with the topline look at the week showing that it was an excellent one for gold stocks and banks.

Somewhere deep, deeeeep down in that reptilian part of my brain that governs my flight-or-fight response, that’s ringing vague alarm bells.

But I’m sure it’ll be fine.

The ASX is hitting record highs, there’s a single company on Wall Street valued at well over 10 per cent of the entire GDP of the US, and anything that even smells vaguely of AI is banking big returns for anyone with cash on hand to throw at machines that look like they’re able to think for themselves.

The other big thing this week has been a spectacular fall from grace for Wisetech CEO Richard White – and the corresponding slide in the company's share price – as Wisetech went into damage control mode over the wearyingly familiar accusations of sexual impropriety by a billionaire.

If that wasn't enough to push your schadenfreude meters into overdrive, Star Enterainment Group's "too big to fail" lifeline from the NSW casino regulator – and the implicit nose-thwacking that a $15 million fine entails – should be enough to keep even the greediest hard-luck enthusiast happy.

For now, Star's NSW casino licence is in a weird limbo state – absolutely suspended, but the doors to the pokies rooms are still open for anyone who fancies popping down there in the middle of the night to empty their wallets into the jangling, sparkling cash vacuums that pass for entertainment, provided your definition of "entertainment" is very loose indeed. Bit of a personal view there, really.

And the last of the big ticket downers for the week belongs to Flight Centre, which has demonstrated that it has all of the gliding attributes of an anvil, after delivering a business update that probably looked like it was vague enough to not spook investors, but turned out to be sufficiently vague enough to spark a double-digit sell down after punters realised which bits of the puzzle they weren't being shown.

That's about it for this bit, because I'm out of time and you're almost definitely out of patience.

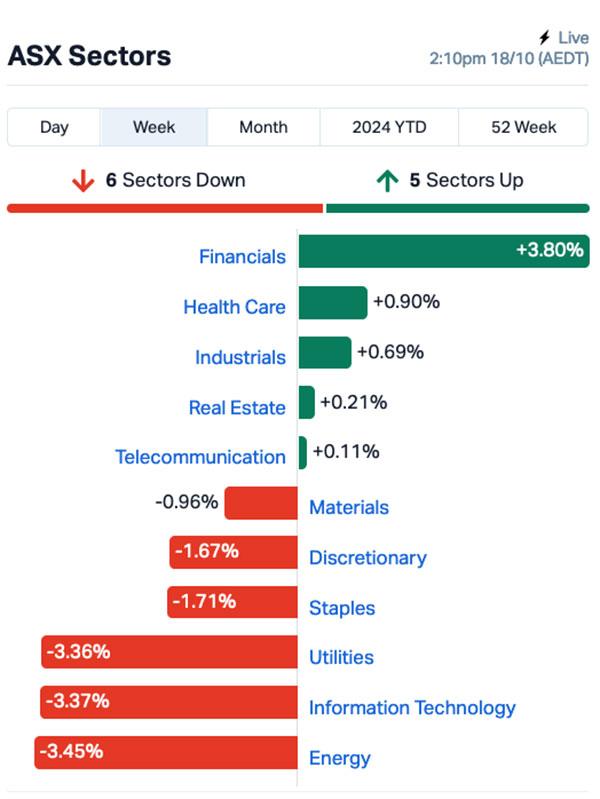

WHAT THE SECTORS DID

Here’s what the market sectors did:

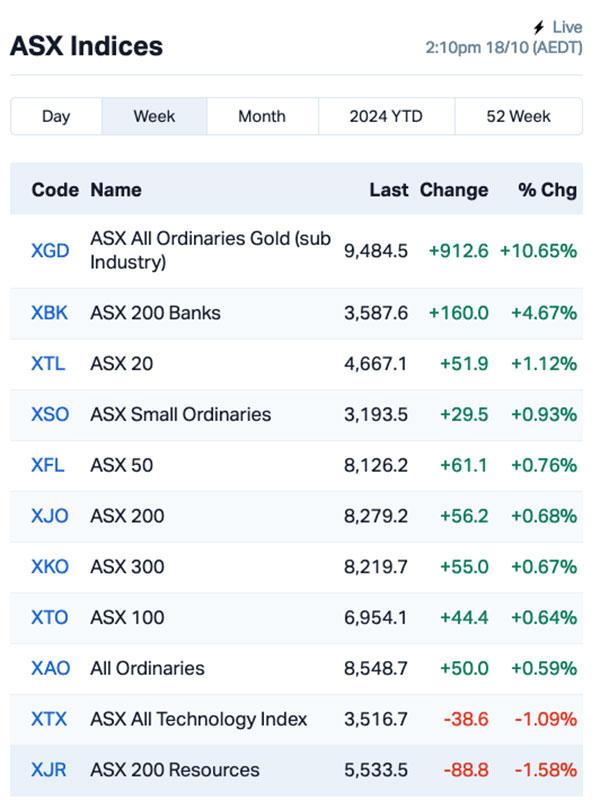

The standout is clearly the Financials sector, with most of that bumper 3.8 per cent jump coming from the banks, as they combined to stack on 4.67 per cent on their own this week.

Everything else has suffered to various degrees by comparison – but the triple whammy of worse-than-3 per cent drops for InfoTech, Utilities and Energy stocks has certainly weighed heavily on the broader market, and investor sentiment.

It’s not all bad news, by any measure… it just feels like it this week.

Here’s how the rest of the sub-sectors and ASX indices landed at the end of the week.

And here come the week's winners! Hooray! etc.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OVT | Ovanti Limited | 0.024 | 700% | $21,788,877 |

| AIV | Activex Limited | 0.012 | 140% | $2,370,528 |

| NSM | Northstaw | 0.032 | 129% | $4,823,274 |

| JBY | James Bay Minerals | 0.4 | 100% | $13,042,575 |

| VPR | Volt Group | 0.002 | 100% | $21,432,416 |

| ERA | Energy Resources | 0.005 | 94% | $50,657,590 |

| LGP | Little Green Pharma | 0.165 | 94% | $34,830,394 |

| PPY | Papyrus Australia | 0.021 | 91% | $9,853,852 |

| A1G | African Gold Ltd | 0.088 | 87% | $32,665,316 |

| NVU | Nanoveu Limited | 0.041 | 86% | $19,187,062 |

| TZL | TZ Limited | 0.049 | 81% | $12,572,573 |

| MKG | Mako Gold | 0.016 | 78% | $15,785,905 |

| EG1 | Evergreen Lithium | 0.079 | 76% | $4,723,320 |

| DOU | Douugh Limited | 0.007 | 75% | $4,869,310 |

| LKE | Lake Resources | 0.08 | 70% | $116,796,458 |

| CY5 | Cygnus Metals Ltd | 0.1375 | 68% | $53,169,885 |

| IR1 | Irismetals | 0.3 | 67% | $44,515,194 |

| XF1 | Xref Limited | 0.21 | 56% | $39,707,486 |

| BNZ | Benz Mining | 0.255 | 50% | $29,924,839 |

| EEL | Enrg Elements Ltd | 0.003 | 50% | $3,135,048 |

Ovanti (ASX:OVT) is so clearly the winner this week, it’s almost ludicrous. The company banked a seven-bagger on the back of news that it has managed to hire the former CFO of Zip Co, Simon Keast, as CEO – an observably favourable choice which will take effect from November 1 2024.

On any other week, ActivEX (ASX:AIV) jumping 140 per cent would have been headline news – and even though it’s a remarkable result (even in comparison to Ovanti’s barnstormer), the company managed to achieve the result despite barely blipping on my radar all week.

Similarly, North Stawell Minerals (ASX:NSM) crept stealthily into a very handy and nicely profitable third on the ladder with a 129 per centgain since this time last week.

Well played everyone, and we’ll see you here again next week when we play “How much other stuff did Gregor miss?”

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OFX | OFX Group Ltd | 1.445 | -37% | $351,560,753 |

| MOV | Move Logistics Group | 0.21 | -36% | $42,112,626 |

| CYQ | Cycliq Group Ltd | 0.004 | -33% | $1,782,067 |

| GMN | Gold Mountain Ltd | 0.002 | -33% | $7,814,946 |

| IVX | Invion Ltd | 0.002 | -33% | $13,533,183 |

| NOV | Novatti Group Ltd | 0.039 | -33% | $13,518,517 |

| SI6 | SI6 Metals Limited | 0.001 | -33% | $2,368,859 |

| TD1 | Tali Digital Limited | 0.001 | -33% | $3,295,156 |

| TKL | Traka Resources | 0.001 | -33% | $1,945,659 |

| IMI | Infinity Mining | 0.027 | -29% | $3,393,603 |

| QXR | Qx Resources Limited | 0.005 | -29% | $6,660,467 |

| SMP | Smartpay Holdings | 0.64 | -26% | $165,731,273 |

| BCM | Brazilian Critical | 0.009 | -25% | $7,476,655 |

| CAV | Carnavale Resources | 0.003 | -25% | $16,360,874 |

| CRB | Carbine Resources | 0.003 | -25% | $1,655,213 |

| ENT | Enterprise Metals | 0.003 | -25% | $3,534,952 |

| MHC | Manhattan Corp Ltd | 0.0015 | -25% | $8,995,940 |

| OPL | Opyl Limited | 0.018 | -25% | $3,072,863 |

| PKO | Peako Limited | 0.003 | -25% | $2,635,425 |

| RDS | Redstone Resources | 0.003 | -25% | $3,238,825 |

HOW THE WEEK SHOOK OUT

Monday October 14, 2024

Oar Resources (ASX:OAR) rose by 200 per cent on no specific news, prompting the ASX to issue the company with a speeding ticket. Oar confirmed there was no insider news or anything to worry about, except for ongoing management restructuring and a renewed focus on its uranium projects.

ReNu Energy (ASX:RNE) has partially disclosed a behind-doors offer for its hydrogen assets including Tasmanian green hydrogen project that was recently awarded an $8m grant from the Tasmanian government based on delivering green hydrogen to customers. The receipt of a non-binding indicative offer for its hydrogen subsidiary, Countrywide Hydrogen, generated investor interest.

James Bay Minerals (ASX:JBY) made headlines with a surprise $2.4 million acquisition of the high-grade Independence gold project in Battle Mountain, Nevada. Known for its extensive landholdings in the James Bay region, JBY has focused on lithium in Quebec but is shifting to gold as lithium prices cool and gold hits record highs of around $2650/oz.

The Independence project features the Skarn deposit, which has a resource of 796,000 oz at 6.53 g/t gold, with potential for further expansion. Located near Nevada Gold Mines’ Phoenix project and 16 km south of Battle Mountain, the site has shown promising new high-grade discoveries, including a notable hit of 24.4 m at 9.11 g/t gold.

The acquisition terms include $2.4 million in shares for an initial 51.54 per cent stake, with the option to acquire the remaining 48.46 per cent over the next two years.

Xref (ASX:XF1) was up after announcing that it is set to be acquired by jobs platform Seek (ASX:SEK). XF1 said it had entered into an exclusivity deed with SEK following receipt of a non-binding indicative offer to acquire all of its shares for 21.81 cents in cash/share, by way of a scheme of arrangement.

Patriot Lithium (ASX:PAT) was up on news. But recently, Patriot announced it was acquiring the Katwaro copper project in Zambia. PAT’s move into copper aligns with its strategy to diversify and enhance its battery metals portfolio. The company is currently conducting due diligence on Katwaro and plans to resume exploration at its lithium projects as conditions improve in spring.

Clarity Pharmaceuticals (ASX:CU6) is set to launch a phase III trial in the US for diagnosing recurrent prostate cancer, following positive feedback from the FDA. The Amplify trial will enrol around 220 patients with rising prostate-specific antigen levels, and will utilise Clarity’s 64Cu-SAR-bisPSMA PET imaging device.

Meanwhile, the Australian Government has given a special status to Chalice Mining’s (ASX:CHN) Gonneville Project in Western Australia. This project is critical for producing critical minerals like nickel, copper, and platinum, which are needed for clean energy and urban development. With this status, Chalice will receive extra help from the government to get the necessary approvals faster. The project is located on farmland about 70km northeast of Perth, and is currently in the planning stage.

Tuesday October 15, 2024

Nanoveu (ASX:NVU) came rocketing up the charts on news it plans to acquire a company called EMASS. This company has advanced chip technology that allows devices to perform complex tasks quickly without relying on the internet. By purchasing EMASS for $5 million in shares, NVU gains access to unique technology and patents. This innovation can create glasses-free 3D experiences, making products more engaging across various devices. Investors are excited as NVU plans to integrate this technology into its own offerings, potentially opening up new opportunities in the AI market.

African Gold (ASX:A1G) was up on news of drilling results, which included a “spectacular, wide, high-grade intercept” of 65.0m at 5.6 g/t of gold from 177m, along with shallow intercepts of 9.0m at 1.7 g/t of gold from 23m, and 28m at 1.1 g/t of gold from 77m. There have also been changes to the company’s board announced this morning, with Adam Oehlman stepping in as chief executive officer, and Phillip Gallagher set to step down as managing director.

And while there’s no news from Many Peaks Minerals (ASX:MPK), its stock is perhaps riding up on the news of today’s heavily traded neighbour A1G. MPK has projects in the same region, near Didievi, and recently increased its footprint in the country by 50 per cent with the acquisition of the Baga gold project.

Invion (ASX:IVX) was trading higher on news of a share consolidation, with the effective date pegged for 18 October, with the number of securities falling from 6.76 billion to a far more manageable 6.76 million.

Eclipse Metals (ASX:EPM)’s historical drill core assessments from HyperXRF handheld readers have shown early signs of REE potential at the Grønnedal prospect within the Ivigtût project in southwest Greenland.

While still early doors with exploration, the explorer says there’s high magnetic REE ratios of neodymium that warrant further investigation over the Grønnedal carbonatite. The project already has a resource estimate of 1.18Mt at an impressive 6859ppm total rare earth oxide (TREO) for >8000t of TREO. Further analysis of historical diamond drill cores suggests that REE concentrations are much deeper than previously mapped 500m deep mineralisation.

AnteoTech (ASX:ADO) was rising on news that the company has received the first commercial order for its proprietary Ultranode battery anode technology containing 70 per centsilicon, from leading European EV manufacturer EV1, which is seeking step change in silicon content for their next generation EV batteries.

Earlier, eHealth tech plater Respiri (ASX:RSH) rose on news that it has secured a $1.6 million strategic placement at $0.045 per share representing a 4 per cent premium on the 10-day VWAP, via high-performing institutional investor Merchant Biotech Fund and other associated prominent investors including Hamma Capital.

And Lithium Australia (ASX:LIT) was up after releasing its quarterly report this morning, featuring news that recycling operations have generated revenue of ~$2.5m and gross profit of ~$1.7m, representing a record gross profit margin of 70 per cent, while also continuing to achieve operating cash profits.

Second-stage soil sampling at Adelong Gold (ASX:ADG)’s namesake gold project in NSW has identified further drill targets in the area northwest of the Adelong Mill and along strike from the Currajong deposit.

The company says 30 per cent of the samples contained over 0.1g/t gold, which indicates proximity to the gold sources while peak results of 3.03g/t and 1.39g/t were also received. Some elevated gold in soil samples are at the end of traverses, which requires follow-up sampling. It added that this appeared to delineate target zones and a drilling program is being planned to upgrade and extend resources within the scoping study area (Challenger, Currajong and Caledonian) to support an upgraded study.

Volt Resources (ASX:VRC) successfully rebooted the Zavalievsky graphite project in Tanzania yesterday and has plans to produce various graphite grades starting with high quality graphite ore via multi shift operation.

The junior acquired a 70 per cent stake in the project in 2021 which has a processing plant, mining equipment and power substation and a revised feasibility study for a Stage 1 development will see an annual run rate of 400,000tpa to produce 24,7800tpa of graphite.

Wednesday October 16, 2024

Drug discovery company Nyrada (ASX:NYR) jumped 36 per cent after the company moved closer to starting a phase I human trial for its drug NYR-BI03, aimed at treating strokes and traumatic brain injuries. Nyrada completed safety studies in rats, showing no harm during a 14-day toxicology assessment. The next step is to obtain ethics approval, with the trial expected to begin this quarter. NYR-BI03 works by blocking certain channels that affect heart function and has shown promising preclinical results, including a significant neuroprotective effect in stroke studies. Investors are eagerly awaiting human trial results, as the stroke treatment sector has been a growing area for ASX-listed biotechs.

GTI Energy (ASX:GTR) was up after releasing an investor presentation this morning, focused on its Lo Herma uranium play in Wyoming, which the company says is currently “the only “junior”in Wyoming with compliant ISR uranium resources”, with current drilling underway aimed at a providing a resource upgrade and scoping study. Currently, the company says it has an inferred resource of 7.4 Mlbs so far in Wyoming, and at an $80/lb contract price, that makes Wyoming ISR projects “very attractive”.

TMK Energy (ASX:TMK) was up after announcing a three day extension to the closing date of Entitlement Issue (Offer), which will now close at 5 pm (AWST) Friday, October 25 to allow additional time for shareholder participation. The company also notes that directors and management have agreed to a 50 per cent reduction in cash fees for the next 6 months, with the company aiming to reduce costs by $250,000 through the initiative, as it moves towards a commercial outcome from its 100 per cent owned Gurvantes XXXV Coal Seam Gas Project in the South Gobi Desert of Mongolia.

Mako Gold (ASX:MKG) was up quite rapidly ton news the company has entered into a Bid Implementation Agreement with Aurum Resources (ASX:AUE), for “an agreed merger pursuant to which Aurum proposes to acquire 100 per cent of the issued shares in Mako and 100 per cent of two classes of unlisted options by way of an off-market takeover bid”.

The deal, as it stands, is for 1 Aurum share for every 25.1 Mako shares, representing an offer price of $0.018 per Mako share, along with 1 Aurum share for every 170 Class A Options, and 1 Aurum share for every 248 Class B Options, with the merger aimed at creating “an emerging exploration and development gold business in West Africa, with cash of over $20 million to advance the flagship Napié and Boundiali Projects in northern Côte d’Ivoire”.

Energy Resources of Australia (ASX:ERA) was up on news that the ASX Takeover Panel had knocked back requests from two ERA shareholders – Zentree Investments and WA stockbroker Willy Packer’s Packer and Co. – which had complained that ERA’s 19.87 for 1 renounceable entitlement offer would enable Rio Tinto (ASX:RIO), which owns 86.3 per cent of ERA, to take its stake beyond 90 per cent and compulsorily acquire the rest of its stock at just 0.2c a pop. The entitlement offer has resumed, with an updated Ex-Date set for Friday, October 18 (yep, that would be today).

TG Metals (ASX:TG6) said its lithium deposit, Burmeister, has produced excellent lithium concentrate using simple processing methods. The spodumene concentrate achieved a grade of up to 6.31 per cent Li2O. By using ore sorting technology, the company improved the lithium content by 15-39 per cent and significantly reduced iron levels. Initial tests also indicate that it can produce a high-grade, low-impurity concentrate. Ongoing tests will continue to refine the processing methods, aiming for efficient and cost-effective lithium extraction from the Burmeister deposit in Western Australia.

MTM Critical Metals (ASX:MTM) has successfully raised $8 million from investors to speed up the commercialisation of its Flash Joule Heating (FJH) technology. This funding will help develop a demonstration plant capable of processing one tonne per day, which is a key step towards commercial operations. The company plans to use this technology to extract valuable metals like gallium, indium, gold, copper, and lithium from waste materials, making the process more sustainable and efficient. Collaborations with industry partners are already in progress, aimed at boosting the supply of critical minerals.

Thursday October 17, 2024

Ovanti (ASX:OVT) was up after revealing that, following a lengthy search, the company has appointed former US CFO of Zip Co Simon Keast as CEO, which will take effect from November 1 2024. This is, apparently, big news – Ovanti was up more than 200 per cent by lunchtime.

Cygnus Metals (ASX:CY5) was up on news that the company has received firm commitments for A$11 million via a share placement to institutional and sophisticated investors amid “overwhelming demand” ahead of Cygnus’ planned merger with TSXV-listed Doré Copper Mining Corp. The placement was priced at $0.072 per share, being a 10 per cent discount to the last sale price of $0.08.

Koonenberry Gold (ASX:KNB) was up for a few reasons, most notably its decision to acquire 100 per cent of the Enmore gold project in New South Wales from Global Uranium and Enrichment (ASX:GUE), in exchange for 35 million fully paid ordinary shares in KNB.

On top of that, KNB is also buying the Lachlan Project from Gilmore Metals, taking KNB’s landholding in NSW to 4,410sq km, while building a “one of the most significant portfolios in NSW” across “a portfolio of projects in frontier, emerging and world class terranes”. To help fund it all, Lion Selection Group (ASX:LSX) has committed $350,000 towards the $4.5 million fundraising and transformation for Koonenbery.

North Stawell Minerals (ASX:NSM) was up after it announced the completion of the Shortfall Bookbuild which concludes the four for five non-renounceable pro-rata entitlement offer at an offer price of $0.01 per new dhare, fully underwritten by Henslow, to raise approximately $1.1 million.

Redcastle Resources (ASX:RC1) was up on news that the company is set to increase its tenement footprint in the highly prospective Redcastle–Queen Alexandra gold corridor following the acquisition of a strategic tenement, allowing it access to new multiple exploration targets along a trend of historical workings at the site.

Little Green Pharma (ASX:LGP) jumped after it delivered a heathy quarterly report, showing record revenue of $10.2 million (unaudited), up 40 per cent on prior quarter and cash receipts of $10.8 million, up over 30 per cent on prior quarter. The company’s net operating cash inflow of over $1.0 million has resulted in a cashflow positive quarter of $0.6 million.

Blaze Minerals (ASX:BLZ) was up on news it has has executed a binding agreement with Gecko Minerals, an Australian unlisted public company, to acquire a 60 per centinterest in Gecko Minerals Uganda, the legal and beneficial owner of the Ntungamo project (three granted exploration licences) and the Mityana Project (one granted exploration licence) which are prospective for critical metals including beryllium, rubidium, lithium, tin and tantalite in western and central Uganda. The company also has an option to acquire the remaining 40 per cent of Gecko Uganda within a two-year period.

Bioxyne (ASX:BXN) rose after delivering a quarterly that showed quarterly revenue of $4.6 million, up 48 per cent on Q4 FY2024 and an 119 per cent increase on Q1 FY2024, and quarterly cash receipts of $5.8 million, generating positive operating cash flow for the quarter of $1.2 million.

Hubify (ASX:HFY) climbed after the company released a statement from chairman Anthony Ghattas, noting a promising start to FY25.

Shares in Deep Yellow (ASX:DYL) were up after it notified the ASX that global metals investment manager Sprott increased its shareholding in the yellowcake hunter from 5.96 per cent to 7.82 per cent.

Sprott did the same with Lotus Resources (ASX:LOT), which also rose after the metals investor took up a greater position in the junior from 7.32 per cent up to 8.32 per cent on the back of a reduction in held shares by JP Morgan earlier in the month. Overall, Lotus is up more than 30per cent for the month as it looks to accelerate the restart of the 19.3Mlb Kayelekera mine in Malawi after reducing capex to production from $US88m down to $US50m. DYL on the other hand is progressing development of its two advanced projects: its flagship 121Mlb Tumas project in Namibia and the 104.8Mlb Mulga Rock in WA.

Global Uranium and Enrichment (ASX:GUE) and Koonenberry Gold (ASX:KNB) were rocketing up the charts via KNB’s proposed acquisition of the Enmore gold project in NSW’s Lachlan Fold Belt, 20km from Larvotto Resources’ (ASX:LRV) 1.7Moz Hillgrove gold-antimony mine. KNB is also snapping up 10 granted exploration licences and one exploration licence west of its current projects through the acquisition of Gilmore Metals.

It will pay GUE 35 million shares for the Enmore project and will issue Gilmore Metals’ shareholders with 95 million shares, as well as grant GUE a 2 per cent net smelter royalty. Enmore covers 134sq km about 30km from Armidale town and sits within the New England Fold Belt that holds large deposits such as the 8Moz Ravenwood mine, the 7.7Moz gold and 0.36Mt copper Mt Morgan mine, and the 2.5Moz Cracow project. Despite this, the region remains underexplored, with the NSW segment considerably less explored than the Queensland segment.

Meanwhile, Stockhead’s Tim Boreham reports that the ASX cannabis sector, once struggling, is now showing promising signs of growth. Bioxyne (ASX:BXN) is on track to hit its annual revenue target of $20 million, reporting a 48 per cent revenue increase from the previous quarter, driven by strong sales of its gummies.

Little Green Pharma (ASX:LGP) also reported record revenue of $10.2 million, a 40 per cent increase from the previous quarter, thanks to high demand from Europe. LGP’s shares rose by 42 per cent on Fridya.

Elsewhere, Althea Group (ASX:AGH) is shifting focus by selling its UK clinics to invest in cannabis beverages, while still maintaining some product sales in the UK market.

Friday October 18, 2024

Energy Resources of Australia (ASX:ERA) opened way higher Friday morning following Thursday’s resumption of the company’s Rio Tinto-led 19.87 for 1 non-underwritten pro rata renounceable entitlement offer, seeking to raise about $90 million.

InhaleRX (ASX:IRX) has entered into a significant funding agreement with Clendon Biotech Capital, securing up to $38.5 million in funding to cover all direct costs associated with the Phase 1 & 2 clinical development of the Company’s key projects, IRX-211 and IRX-616a. IRX-211 is a drug-device medication, specifically designed to target breakthrough cancer pain, while IRX-616a is an innovative drug device medication designed to offer fast and effective relief for individuals suffering from panic disorder.

AnteoTech (ASX:ADO) was up after it announced a few days ago that it had secured a deal for the first commercial order of its Ultranode product from “leading European EV manufacturer EV1”. This morning’s announcement, in response to a query from the ASX, is that EV1 is in fact the AMG arm of German automaker Mercedes Benz.

BSA (ASX:BSA) rose nicely after delivering a healthy quarterly, revealing that the company has continued its strong financial performance into the new financial year, delivering Q1 FY2025 revenue of $76.9 million, an improvement of 35.6 per cent on pcp. The company also announced Q1 FY2025 EBITDA of $6.5m, and an increase of 47.7 per cent on pcp, with an EBITDA margin of 8.4 per cent also increasing on pcp as the Group aims for improved margins throughout FY2025.

Meanwhile, Flight Centre (ASX:FLT) was sinking badly after releasing a business update that was a little skimpy on some details, but looks like it lays out a pretty severe downturn for the business over the first 6 months of this financial year. Flight Centre said 1QFY25 was trading “marginally above” the previous corresponding period on TTV, profit margin and underlying profit, and tried to gloss things over, saying its FY25 profit was “again expected to be heavily second-half weighed.”

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.