America 2024: How the choice between Dems and GOP will shape US markets

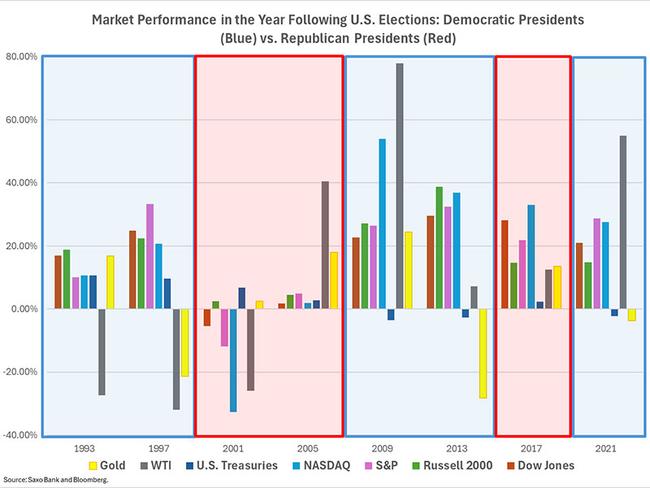

Saxo Markes has analysed asset class performances in Democratic vs Republican presidential election victories from the Clinton administration in 1993 to current day.

Saxo says equity markets tend to perform better in the first year of a Democratic presidency

Saxo has analysed asset class performances in Democratic vs Republican presidential election victories from 1993 to current day

Gold peaks observed during Republican presidencies due to economic uncertainty and geopolitical tensions

There’s an old saying about markets, they’re predictably unpredictable. However, when it comes to which party takes up residence in the White House, Saxo Markets reckons investors can be assured of some predictability.

Markets have been rocked in recent days with unfavourable US jobs figures spooking investors that the world’s largest economy could be heading into a recession.

All major three major US indices – the S&P 500, blue chips Dow Jones and tech-heavy Nasdaq – fell heavily earlier this week.

The Nasdaq slumped more than 10% from its July 10 peak, suggesting it might be in a technical correction.

And as another saying goes – when the US sneezes Australia catches a cold. In this case the diagnosis is more like a nasty influenza strain.

The concerning US data and consequent selldown on Wall Street saw more than $100bn wiped off the ASX on Friday and Monday, while European shares also hit near six-month lows.

Japan’s Nikkei 225 fell by 12% in its largest one-day loss since 1987 on Monday. Asian Markets recovered somewhat on Tuesday along with ASX, which took comfort from the Reserve Bank of Australia's decision to keep interest rates on hold at 4.35%.

The US Federal Reserve has indicated a September rate cut, but there’s growing concern the central bank has waited too long as it worked to bring inflation back to its 2% target.

All the while the US election is looming, with investors wondering what impact another Donald Trump or Democrat presidency could have on markets.

Biden decision changes election stakes

Saxo head of fixed income strategy Althea Spinozzi says US President Joe Biden’s decision to withdraw as the Democratic Party’s 2024 presidential nominee has changed the stakes for November’s US election.

Polling conducted after President Biden’s July 21 withdrawal has consistently shown current vice president and presumptive Democratic Party nominee Kamala Harris gaining ground on the former president and 2024 Republican nominee Donald Trump.

Spinozzi has assessed the market impact across all major asset classes of Democratic presidential election victories versus Republican presidential election victories, from the Clinton Administration (1993-2001) to the current day.

In her analysis, Spinozzi found that equity markets tend to perform better in the first year of a Democratic presidency, with indices like the Russell 2000 and Nasdaq showing stronger gains.

“Republican presidencies have seen more mixed performance, with certain sectors such as energy and industrials benefiting from deregulation efforts,” she says.

“The gold price often performs well regardless of the president’s party, but significant peaks are observed during Republican presidencies due to economic uncertainty and geopolitical tensions.”

Spinozzi says more significant gains in crude oil are usually seen under Republican presidencies due to policies favouring fossil fuel industries, but mixed performance is typical.

“Bond markets generally remain stable under both parties, showing neither consistent gains nor losses directly tied to the president's party,” she says.

“Safe-haven demand and economic policies significantly influence performance.”

Challenges for Clinton

Spinozzi notes Republican and Democrat presidents have all had their unique economic challenges to deal with during their terms in office.

For Democratic President Bill Clinton his tenure from January 20, 1993-January 20, 2001 was predominantly a time of economic growth.

“The early 1990s saw the end of a recession, followed by a period of robust economic growth,” she says.

“Clinton's presidency is often associated with fiscal discipline, technology boom, and globalisation.”

“By 1997, the stock market saw an even stronger performance, with the S&P 500 rising by about 33%,” she says.

Gold was volatile during the Clinton years rising steeply due to the lingering effects of the early 1990s recession, before dropping just as steeply in 1997 driven by a strong US dollar, reduced inflation concerns, and robust economic growth.

Aftermath of dot.com bubble and Sept 11

Spinozzi says Republican President George W Bush's presidency from January 20, 2001 to January 20, 2009 was particularly volatile for markets.

Bush oversaw the aftermath of the dot-com bubble burst and the September 11 attacks, along with the early days of the global financial crisis (GFC).

“There was mixed performance, with significant declines following the 2001 attacks and the dot-com crash, but recovery in later years,” she says.

The Saxo analyst says gold performed well as a safe-haven asset during these times of uncertainty.

Obama inherits GFC

Barack Obama was in office from January 20, 2009 to January 2017, inheriting the GFC leading to significant challenges for the first African-American president and his administration.

Spinozzi says, however, stock markets experienced a strong rebound from the recession lows, driven by economic recovery measures and improved investor confidence.

“In 2013, stock markets had a robust performance, with major indices reaching new all-time highs,” she says.

“Gold prices saw significant increases in 2009 as investors flocked to safe-haven assets amid the economic uncertainty of the Great Recession.

“However, following President Obama's re-election in 2012, gold prices declined as the global economy began to recover, inflation fears eased, and the Federal Reserve initiated the tapering of its stimulus measures.”

‘It’s a miracle’, declared Trump

Current Republican presidential nominee Donald Trump had his first stint in the White House from January 20, 2017 to January 20, 2021. He saw stock market performance as a measure of his achievement in office.

Spinozzi says Trump's presidency focused on tax cuts, deregulation, and trade policies, which influenced market performance.

She says US stock markets benefited from optimism from tax cuts although trade tensions with China increased.

“It was a miracle. The stock market set one record after another, with 148 stock market highs during this short period of time, and boosted the retirements and pensions of hardworking citizens all across our nation,” Trump declared in his farewell address.

“We’ve never seen numbers like we’ve seen, and that’s before the pandemic and after the pandemic.”

Spinozzi says gold tended to perform well, reflecting geopolitical uncertainties and trade tensions.

Biden's Covid-19 recovery efforts

Current president Joe Biden took up office on January 20, 2021 amid the Covid-19 pandemic, with significant economic disruptions and subsequent recovery efforts.

Spinozzi say there were broad positive performance driven by vaccine rollouts, economic stimulus, and infrastructure plans.

“The tech sector, in particular, benefited significantly, with companies like Apple, Microsoft, Amazon, and Tesla seeing substantial gains.

“These companies thrived due to increased demand for digital services and products during the ongoing pandemic and the broader digital transformation.”

She says gold prices dropped in 2021 primarily due to the US Federal Reserve signalling potential interest rate hikes, which strengthened the US dollar and reduced the appeal of gold.

“Additionally, as the economic outlook improved, investors shifted towards riskier assets, further diminishing demand for gold.”

So then…

As to who wins the next election and what happens next, hold on tight as it may be a rollercoaster ride. Remember the old saying – markets are predictably unpredictable.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

At Stockhead, we tell it like it is. While Saxo Markets is a Stockhead advertiser, the company did not sponsor this article.