Allens says more lithium M&A activity on the cards next year

Research firm Allens says more M&A activity is expected in 2025, confirming lithium’s positive long-term outlook.

Lithium M&A total deal value soared over $14.8bn in 2024

Allens Critical Minerals Outlook flags more deals for the sector in 2025

More joint ventures and dual US-AU listings also expected

Research firm Allens says, despite pricing woes this year, recent M&A activity highlights that lithium’s long-term demand is still growing.

“We see reasons for optimism in the coming year,” Allens said in its recent Critical Minerals Outlook.

“Recent large-scale M&A activity shows that – while there may be oversupply of certain critical minerals in today's market –long-term demand is growing in line with the expansion of clean energy technologies and the global energy transition.

“Moreover, we expect to see increasing competition for ownership and control of assets and associated infrastructure as governments around the world increasingly look to inject themselves (and their capital) into securing and investing in critical minerals supply chains.”

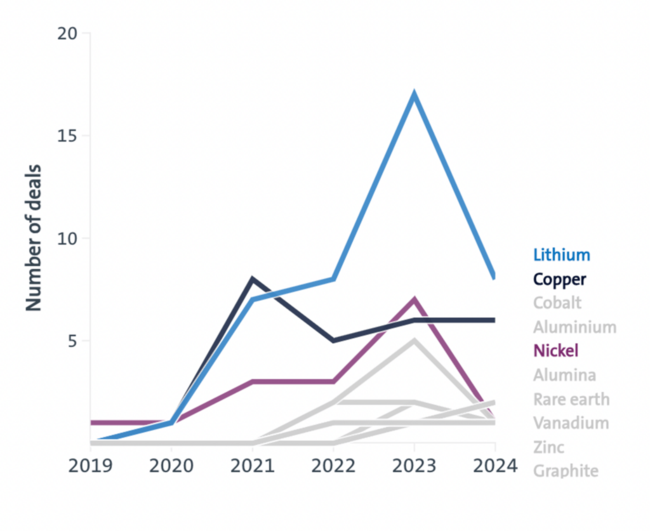

Although there have only been 24 critical minerals M&A deals in 2024 (so far) compared to 49 in 2023, the total deal value is markedly higher – $14.8 billion, compared to only $5.3 billion in 2023.

Lithium stands out with both the highest volume of deals and largest total deal value from 2020-24 ($24 billion).

Allens points to a range of billion dollar deals, like:

- Albermarle's abandoned A$6.6bn bid for Liontown

- The merger of equals between Allkem and Livent for A$10bn

- Rio Tinto's (ASX:RIO) proposed acquisition of Arcadium Lithium for A$10bn; and

- SQM and Hancock Prospecting's acquisition of Azure Minerals for A$1.7bn.

Honourable mentions go to Pilbara Minerals' (ASX:PLS) acquisition of Latin Resources (ASX:LRS) for A$560m, and Sayona Mining (ASX:SYA) buying US-based Piedmont Lithium (ASX:PLL) to consolidate its Canadian operations and strengthen its exposure to the North American electric vehicle sector.

While the sky-high lithium prices of the past are not expected to return any time soon, the research firm says that it's clear that structural sources of demand driven by the global energy transition, as well as a narrowing of the market surplus for certain minerals (including lithium) mean the outlook for critical minerals over the medium to longer term remains positive.

“In our view, those that are able to ride out this pricing storm will be well positioned for the inevitable market upturn,” Allens said.

M&A activity set to ramp up further

Allens says there’s likely more to come, with interest rate cuts in the US and Europe (and maybe Australia) and a moderate price recovery for critical minerals next year will set the scene for an action packed year in which M&A activity is expected to rebound.

“While the last year or so has been turbulent, we’re seeing a lot of confidence in the long-term strength and viability of the lithium market,” Allens partner and head of critical minerals, Bryn Hardcastle said.

“This sentiment is continuing to drive M&A activity, which we only expect to increase in 2025 as interest rates fall and supply and demand pressures equalise.

For explorers and developers with quality assets, the expected increase in M&A activity puts the prospect of consolidation in play.

“We also expect to see more government involvement in the sector – particularly through direct funding of exploration and development assets,” Hardcastle said.

“This presents real opportunity for small caps and represents another potential source of capital.”

And lithium isn’t the only market getting M&A interest.

“The trend over the last couple of years has been towards competition for access to high-quality copper assets,” Hardcastle said.

“We expect this to continue driven by long term supply deficits, significant exploration expenditure having been committed to proving up resources over the last 18-24 months, and majors looking to capitalise on current valuations.”

More joint ventures and dual listings, too

Almost all critical minerals are looking down the barrel of a long-term supply deficit, and that demand will require more exploration and mine development.

“This is where we see the small caps coming in,” Hardcastle said.

“We expect a significant amount of activity to take place in the small and mid-caps driven by a need to fill funding shortfalls.”

Dual listings are also set to grow, Hardcastle added. With more interest from TSX and TSX-V companies looking to access capital in Australia.

“As that path becomes more well trodden, and the response to these listings remains positive, we expect the number of dual-listings to grow,” he said.

“There also seems to be an increasing willingness by majors to enter into joint venture and farm-in arrangements for prospective assets.

“We expect creative joint development options will be front of mind for many in the sector next year.”