ADX is pushing its European oil and gas agenda ahead with big moves

ADX Energy has plans to boost its oil and gas resources and production in Austria and Italy to fuel Europe’s hunger for more energy.

ADX Energy has plans to boost existing oil production and explore low-risk, low-cost gas targets

Gas play benefits from existing infrastructure and is expected to significant productivity

Plans also in the works to resume Welchau testing and explore the Sicily Channel gas project

Europe remains hungry for energy and with demand likely to climb further as data centres become more common, finding new sources of fuel – particularly gas – to supply generation is extremely important.

Couple that with the desire to achieve as much energy security as possible and it is clear why companies such as ADX Energy (ASX:ADX) are focusing their efforts on finding and developing new sources of gas – and to a lesser extent oil – in Europe.

The company has flagged several strategic priorities that will enable it to meet this objective.

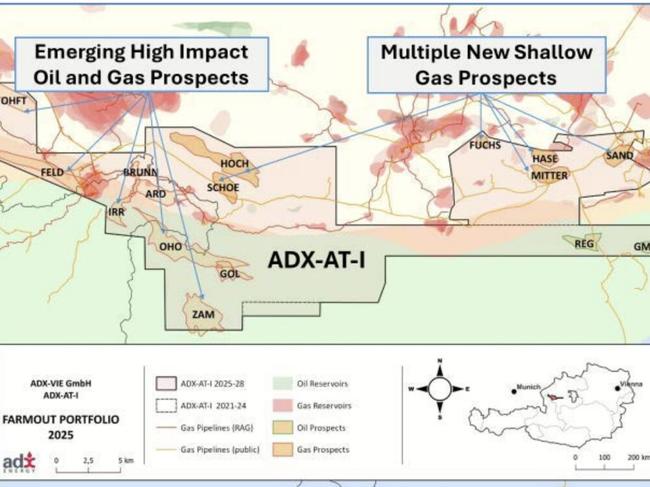

This include maximising its oil production at the Vienna Basin and Anshof oilfields in Austria, carrying out low-risk, low-cost gas exploration in Upper Austria, and finally pursuing high impact growth at its Welchau and Sicily Channel projects.

Initial steps

Speaking to Stockhead, executive chairman Ian Tchacos said the company had continued to do workovers at its Vienna Basin wells.

“We're also analysing a couple of well bores there that are probably not being optimally utilised and the possibility of drilling sidetrack wells and maybe an infill well.

“There’s a possibility of getting our production rate up from around 200 barrels a day maybe to over 300 barrels.”

He also flagged the potential of working with its neighbour OMV – a major Austrian petrochemical company – as some of their assets are not fully developed.

Tchacos adds that while its Vienna Basin assets probably have another seven years of life left, they have virtually no royalty attached to them, meaning that anything that increases production will enhance profitability.

ADX will also seek to drill at least one Anshof appraisal well with Tchacos saying that some targets could be reached with deviated wells from the existing facility while others could be vertical wells that will be tied back.

Concurrently, the company will seek to commence drilling of its extensive gas portfolio to increase its exposure to Europe’s well-priced gas market.

“We have been able to generate a prospect inventory of shallow gas prospects that have got a very high probability of success because they've already been successful nearby in the basin,” Tchacos said.

“We've been able to basically understand how the gas is distributed across the basin using a combination of AI and improved seismic processing and identified about 10-12 prospects.”

He added the gas play is close to existing infrastructure and features targets that are shallow and cheap to drill, making them potentially highly profitable.

“Historically, these things were drilled 10-15 years ago looking for deeper oil because they didn't have the 3D seismic that has now been enhanced and processed to the state that it is nowadays.

“More recently, there were a couple of these that were actually outside our acreage that we were trying to get access to drill were drilled by their operator RAG and they came in as we expected.”

Having worked on these targets for almost two years, ADX varied its exploration licence to take in more of the targets with plans to kick off operations by drilling up to three wells.

“We will try to drill them as a cluster so we can install a facility and a pipeline but the good thing is that they're also very close to open access infrastructure so that's going to be that's important just in terms of being able to get these things under production,” Tchacos said.

“They're pretty much 100% methane so they don't require a lot of processing and they're typically pretty good productivity with the sands expected to produce 5-10 million standard cubic feet of gas per day.”

High impact growth

ADX is also hoping to continue testing at Welchau-1 in the near-term with Tchacos saying that a judgement relating to a challenge to existing environmental clearances is expected soon.

He also flagged that quite a bit of work had gone into studying Welchau Deep, which is essentially a new play, as well as other follow-up structures.

Obviously we've been doing quite a bit of work on it and it is essentially a new play and there's a lot of follow-up potential within Welchau as well as follow-up structures.

The final piece of the puzzle is the company’s Sicily Channel exploration licence.

“We were informed by the ministry that we were offered the permit but there's a formal process for the award that we expect will conclude by the middle of May,” Tchacos said.

“We like that acreage a lot and we have identified a number of prospects.

“Again, what's interesting about this is the area was heavily explored for oil, there was an oil discovery in the area and the oil is deeper.

“There's very good quality 2D seismic across this because of ENI and Shell actually held this acreage through around 2014.”

“On that dataset we can see some nice prospects but also what we've been able to see from going through old well reports is that there was also gas across a lot of these intervals while they were drilling the wells.”

He added that while these gas intervals were not tested, they gave the company plenty of confidence that the amplitudes seen on seismic were likely to be gas.

“This acreage has been further enhanced by the new Cassiopea field within 100km of us that's being developed by a consortium of ENI and Energean.

“Those fields are in a very similar geological setting to where we're at. There's not a big reserve. It's probably around 300 or 400Bcf (billion cubic feet). We see at least that sort of potential in our block, so it would also make it sort of a very nice sort of tie-in opportunity.”

Road ahead

ADX is looking to mature the first three or four of its shallow gas locations by the end of May and start permitting in order to enable drilled by the end of 2025.

“The gas in terms of production rate and cash flow can be very exciting and very lucrative,” Tchacos added.

“We've got a bit of interest from potential farminees to come in and drill some of these things with us.

“The nice thing about that is because they're relatively shallow and quick to drill – the sort of things that we can start with drilling two or three wells and then go on to drilling further wells because we've identified quite a few of these things.

“If we can put it together in two or three drilling campaigns then we can also lower costs.”

He added that the oil appraisal at Anshof could follow a similar timeline.

In regards to the Sicily Channel project, he said that once the block is formally awarded, the company will buy more available seismic and then come up with an independent resource assessment as its ultimate goal would be to secure a partner and drill a well by the end of 2026.

At Stockhead, we tell it like it is. While ADX Energy is a Stockhead advertiser, it did not sponsor this article.