Mooners & Shakers: Twitter teams with eToro for crypto trading; LSE to offer BTC futures

Plenty of big news in crypto, with the London Stock Exchange to offer Bitcoin futures and Twitter teaming with eToro to streamline crypto trading.

The big news keeps on coming in Cryptoland. Elon Musk has taken time out from grilling the BBC to help enable crypto and stocks trading on the eToro platform, via Twitter “cashtags”.

Also, Ethereum has made a strong move above $US2k since the Shanghai/Capella (Shapella) upgrades took place yesterday, and Bitcoin is travelling along very nicely around $US30,822 noon on Friday (AEST).

For the latest crypto news, sign up here for free Stockhead daily newsletters

Yes, there’s plenty more happening, too. How to cover it all quickly? Thank all that’s holy for bullet points, eh?

Twitter and eToro; PPI; London Stock Exchange

- Twitter has partnered with trading app eToro to expand the functionality of its “$” cashtags and enable users to buy and sell stocks, crypto and other financial assets. Cashtags? They’re like hashtags, only using an $ as the prefix – like this: $BTC; $ETH; $ASS. Per a CNBC report, an eToro spokesperson said cashtags would be expanded to cover “far more instruments and asset classes”. Reportedly, if interested in a stock or crypto token, you’ll be able to click on a “view on eToro” button that takes you to the eToro site, where you’ll be able to buy or sell. Well, that’s the idea anyway. At the time of writing, the crypto cashtags don’t yet appear to be enabled.

🎉Very excited to be launching a new $Cashtags partnership with @Twitter which will enable Twitter users to see real-time prices for a much wider range of stocks, crypto & other assets as well as having the option to invest through eToro. @elonmuskhttps://t.co/Iv2q9iNxbf

— eToro (@eToro) April 13, 2023

- PPI (Producer Price Index) data has landed in the US of A. As Stockhead’s very own non-fungible Eddy Sunarto reports in today’s Market Highlights update, “US producer prices fell in March by the most since the start of the pandemic, signalling an easing in inflation. The producer index or PPI rose by just 2.7 per cent from a year ago, the smallest gain in more than two years.” Fed pivot and crypto bullrun hopefuls … light one up, because this is another piece of info to stuff in your hopium pipe. It helps, too, that the US dollar is on a slumping trend. Can it find support and a strong bounce back up soon? Hardcore gold and Bitcoin bugs will likely be hoping not.

US March PPI fell 0.5% MoM, below estimate of 0%, in another sign that US #inflation may have peaked. pic.twitter.com/mfI7ab03ev

— Holger Zschaepitz (@Schuldensuehner) April 13, 2023

- The London Stock Exchange is reportedly teaming with Global Futures Options to start offering the UK’s first regulated trading clearing in Bitcoin index futures and options derivatives. You know, just in case you didn’t have enough fresh crypto-adoption news today already. The date of the product launch hasn’t been announced yet, but the indications are that it could kick off in Q4 this year.

BREAKING: 🇬🇧 London Stock Exchange plans to begin clearing #bitcoin index futures and options. 😱 pic.twitter.com/8xG5SFATLn

— Bitcoin News âš¡ (@BitcoinNewsCom) April 13, 2023

Top 10 overview

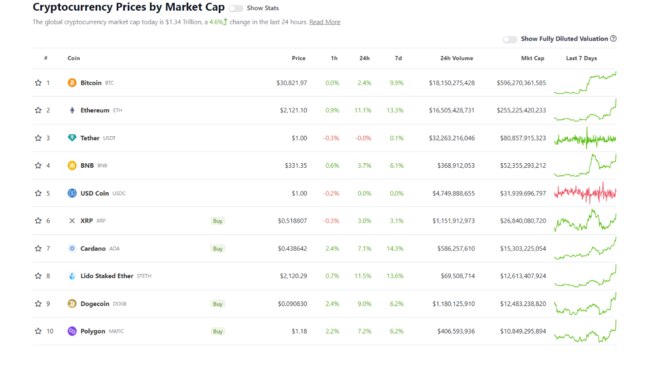

With the overall crypto market cap at $US1.34 trillion at noon Friday (AEST), up 4.6 per cent since the same time Thursday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Yes Cardano (ADA) is well up today, and DOGE and others, but it’s Ethereum (ETH) that stands out in the majors today.

The leading crypto that isn’t Bitcoin answered the question of whether the “Shapella” upgrade would be an immediately bearish event with a resounding pfffffffft! Which means no.

In fact, up more than 11 per cent over the past day, and over 13 per cent for the week, ETH has breached the $US2k psychological level and is flying at altitudes it hasn’t seen since last August.

MORE FROM STOCKHEAD: Ordinals doing better than expected | Big guns bullish on BTC | Brutal epitaph for SBF

Shapella, in case you needed a recap, is the pastiche Ethereum upgrade on the blockchain’s execution (Shanghai) and consensus (Capella) layers. The main thing you need to know there is that it enables stakers of ETH to withdraw their staked deposits for the first time.

Plenty of Twitter-residing crypto analysts seem bullish about major cryptos on Friday … and they’re not the only ones.

The Shanghai upgrade is, possibly, a bullish outcome for the markets and #altcoins.

— Michaël van de Poppe (@CryptoMichNL) April 13, 2023

Altcoins tend to wait for $ETH before they want to start moving upwards, they need confidence (including the investors).

Instead of a bearish outcome, the event is a bullish outcome.

#BTC broke out$ETH has most recently broken out

— Rekt Capital (@rektcapital) April 13, 2023

I wonder what comes next?$BTC#Crypto#Bitcoinpic.twitter.com/OAL0UJ85O1

Sure is looking like a technical and fundamental market bottom is being confirmed today.$DXY below 101$BTC above multi year resistance

— Roman (@Roman_Trading) April 13, 2023

PPI looking positive$SPX looking to break 4200.

It’s hard for me to see many bearish outcomes now.#bitcoin#cryptocurrency#stocks

Uppers and downers: 11–100

Sweeping a market-cap range of about $US9.55 billion to about $US439 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at noon. (Stats based on CoinGecko.com data.)

PUMPERS

- Arbitrum (ARB), (market cap: $US1.98 billion) +31.3 per cent

- Radix (XRD), (mc: $US824 million) +23.9 per cent

- WOO Network (WOO), (mc: 479 million) +17.6 per cent

- Rocket Pool (RPL), (mc: $US940 million) +15.4 per cent

- Optimism (OP), (mc: $US808 million) +13.2 per cent

- Lido DAO (RPL), (mc: $US2.25 billion) +13 per cent

- Aptos (LDO), (mc: $US2.37 billion) +11.3 per cent

- Rocket Pool ETH (RETH) (mc: $US525 million) +11.3 per cent

Visit Stockhead, where ASX small caps are big deals

SLUMPERS

Not much going on here today … actually, at noon, nothing, with even the worst-performers staying static over the past 24 hours.

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

ELON MUSKâ€¼ï¸ I want Twitter to be the biggest financial institution in the world. pic.twitter.com/HMJ0h9NI8s

— Radar🚨 (@RadarHits) April 13, 2023

yesterday i thought there was a chance of a sell off.

— Matthew Harcourt 🇦🇺 (@DeFiGuy3) April 14, 2023

today im respecting the pamp.

always i am long and strong.https://t.co/XC8Tlfo5b8

#Bitcoinpic.twitter.com/CuD7NZhvjN

— naiive (@naiivememe) April 11, 2023

This content first appeared onstockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here