Mooners & Shakers: Nearly a quarter of Australians now hold crypto, as Bitcoin dips below $29k

The bad news is that Bitcoin and its top 100 currency mates are down. The good news is that a survey found that 23 per cent of Aussies are into crypto.

Bitcoin has dipped below the $US29,000 mark it’s been trading around for what seems like 10,000 lifetimes.

That said, it is still basically changing hands within a tight-ish $28k-$30k range.

But why the $700, or thereabouts, dip?

Sigh … must there always be a reason?

For the latest crypto news, sign up here for free Stockhead daily newsletters

In this case, it’s likely ye olde macro factors are at play – China’s economy woes, da Fed, inflation, some bloke at the US Securities and Exchange Commission who looks like Mr Burns … the Matildas losing the quarterfinal to the Poms. That kinda stuff.

More specifically, though, as our very own non-fungible Eddy Sunarto noted in his Market Highlights roundup on Thursday morn, the US Federal Reserve has thrown us all another curve ball, although one that is hardly unexpected:

“Overnight, the S&P 500 tumbled by 0.76 per cent, blue chip Dow Jones by 0.52 per cent, and tech heavy Nasdaq by another 1.15 per cent,” Eddy wrote.

“Traders dumped equities after the release of the Fed minutes for July showed that officials still saw ‘upside risks’ to inflation, which could lead to more rate hikes.

“The yield on the US 10-year note rose to 4.3 per cent after the release, as former US Treasury Secretary Lawrence Summers cautioned that it could go to 4.75 per cent over the next decade.”

In short, strap on the hiking boots, the Fed ain’t quite done yet.

Aussies are still buying … sorta

In new data released by local crypto exchange Swyftx (taken from its third annual Australian Digital Assets Survey, in collaboration with YouGov), it’s been revealed that about a quarter of Australians now own digital assets/crypto.

“An estimated 4.5 million Australians” today own digital assets, the report’s info shows.

However, the national rate of adoption has slowed somewhat over the past year – which, is to be entirely expected given the ongoing brutal (and brutally boring) bear market the industry is desperately hoping to get past by the end of 2023.

MORE FROM STOCKHEAD: Crypto ETF leader of the pack | New Aussie crypto rules to be ‘worth wait’ | Fintech payments global mega trend

The number of Aussie adults that reported owning cryptocurrency rose by 2 per cent between July 2022 and July 2023 to reach 23 per cent, according to the Swyftx survey. Last year’s survey found a four percentage point increase in ownership.

“Even at a slower than expected pace of growth, this data would suggest Australia still has the highest level of digital asset adoption among developed nations,” said Swyftx chief operating officer, Jason Titman

“We’ve seen no sign of Millennials pulling back from the market. But concerns over a lack of regulation and cost of living pressures are clearly weighing on national adoption rates among Gen Z and X.

“We saw both generations unexpectedly reduce their exposure to cryptocurrencies last year." For the survey, Swyftx polled more than 2100 Aussies and, the exchange notes, it adheres to national polling standards.

Bitcoin prediction for your hopium pipe

Yes, the crypto market, on the whole, has taken a few rough and cynical slide tackles to the ankles overnight, as you’ll see further below, but here’s something – a particularly bullish prediction from Fundstrat Global Advisors’ Tom Lee.

And he’s talking about a $150,000 to $180,000 Bitcoin price by the end of next year.

Yes, he’s made crazy bullish short-ish-term predictions about Bitcoin in the past that haven’t some to fruition, but … well … er, but nothing. In fact, move on quickly from this section if you like.

For what it’s worth, though, we’ll give him his full context …

Speaking with America’s CNBC, which we think secretly loves crypto, Lee said that “if a spot Bitcoin gets approved, I think the demand will be greater than the daily supply of Bitcoin. So the clearing price is over $150,000, could even be $180,000.”

JUST IN - Fundstrat's Tom Lee on live TV: If the spot #Bitcoin ETF gets approved, the clearing price of #BTC is $150,000 to $180,000. pic.twitter.com/CBKKnuBfrc

— Bitcoin Magazine (@BitcoinMagazine) August 16, 2023

The spot Bitcoin ETF approval process is a saga and a half. As it stands, the SEC, currently reviewing a spate of applications, including from finance giant BlackRock, is in full delay, delay, delay mode.

Chairman Gary Gensler and pals (although not Hester “Crypto Mom” Peirce) essentially appear to be putting it all in the too-hard basket, kicking a bin full of cans as far down the road as it’s allowed to do so.

For want, that is, of a more elegantly phrased analogy – although we do like the image of Gensler stubbing his toe on a very heavy bin full of cans. Or the road.

Visit Stockhead, where ASX small caps are big deals

Top 10 overview

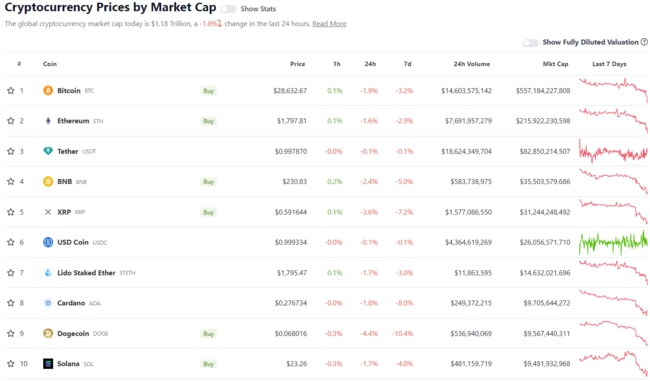

With the overall crypto market cap at $US1.18 trillion at 2.30pm Thursday (AEST), down about 1.8 per cent since the same time Wednesday, here’s the state of play among top 10 tokens – according to CoinGecko.

Down, down. Prices are down.

But wait, where there’s “horizontal support”, there’s hope, reckons Roman Trading. “You shouldn’t short support,” he notes here …

$BTC 1D

— Roman (@Roman_Trading) August 17, 2023

Yes we fell but where?

Right into horizontal support and our current weekly uptrend support from 15k area.

PA still not confirming anything bearish for me and just like you don’t long resistance, you shouldn’t short support.#bitcoin#cryptocurrency#cryptotradingpic.twitter.com/4dJhUILRzF

Uppers and downers

Some of the biggest 24-hour gainers and losers at 2.30pm Thursday (AEST). Stats based on CoinGecko.com data.

PUMPERS (11-100 market cap position)

- Rocket Pool (RPL), (market cap: $US537 million) +4.3 per cent

- Frax (FRAX), (market cap: $US806 million) +0.1 per cent

Yep, and that’s all folks.

SLUMPERS (11-100 market cap position)

- Rollbit Coin (RLB), (market cap: $US499 million) -11.9 per cent

- FLEX Coin (FLEX), (market cap: $US604 million) -10.8 per cent

- Shiba Inu (SHIB), (market cap: $US5.45 billion) -8.5 per cent

- Bitcoin SV (BSV), (market cap: $US603 million) -8.4 per cent

- Sui (SUI), (market cap: $US383 million) -8.4 per cent

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Bitcoin isn’t the only digital asset getting the ETF-related interest …

UPDATE: Here's what the #Ethereum futures ETF filings race looks like. This is a list of all filings including withdrawn AND the 16 active filings. Notice @ValkyrieFunds' date on $BTF currently looks to be the leader absent some action from SEC -- 10/3/23 https://t.co/DgZpDVbEqOpic.twitter.com/CYEcTJnkx8

— James Seyffart (@JSeyff) August 16, 2023

Meanwhile, damn, we just tried this little fake engagement trick (see below) … think Musk got on the tools and fixed it.

Elon Musk has no idea I know this one little trick. 🥰 pic.twitter.com/yi8X9bTG7l

— Altcoin Daily (@AltcoinDailyio) August 17, 2023

Something called HarryPotterObamaSonic10Inu has a marketcap of 150 million dollars. WTF?

— Lark Davis (@TheCryptoLark) August 16, 2023

JUST IN: El Salvador President Nayib Bukele scared off Wall Street by embracing #Bitcoin. Now El Salvador's bonds are up 70% this year - the best performing USD bonds in Emerging Markets - Bloomberg

— Bitcoin Archive (@BTC_Archive) August 16, 2023

ðŸ„🤙ðŸ„â€â™€ï¸ pic.twitter.com/BfyOGNOEJd

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here