Mooners & Shakers: Crypto market eyes China’s economic wildcard as Conflux, Filecoin surge again

China seems to be in the hopium trade, with hints it might reintroduce liquidity to markets, including crypto – thereby boosting the sector.

Bitcoin and the crypto market is awash in a turbulent sea of macroeconomic data and narratives flip-flopping about unconvincingly.

And it has been for some time.

January was generally a great month for Bitcoin and the Cryptoverse.

And February was okay, with BTC only just closing out a green month. Which way will the tide take us in March? Difficult to say.

For the latest crypto news, sign up here for free Stockhead daily newsletters

Chinese economic data boosts markets

We’re able to observe one thing for sure, though, and that’s some rising hopium based around China reintroducing liquidity into markets, including crypto.

Er, yep, despite the ongoing ban on crypto trading and mining over there.

There’s also no small amount of hope, too, for the concept of Hong Kong developing into a China-backed crypto-trading hub.

The founder of cryptocurrency Tron and a leading stakeholder with the Huobi exchange, Justin Sun is certainly encouraged by Hong Kong’s new licensing rules, which are set to boost institutional crypto trading and open up retail crypto trading in the region, as of June.

.@trondao founder @justinsuntron says Hong Kong’s new licensing regime could lead to a shift in mainland China’s crypto policy. His Huobi exchange is ready to apply for a license to operate once the rules go into effect in June. @_franvela reportshttps://t.co/xmWUIIR9VW

— CoinDesk (@CoinDesk) March 1, 2023

Meanwhile, the idea of more liquidity in global finance from a zero-Covid-policy-relaxed China could well mean a price rise in volatile, risk assets … in theory.

In any case, Bitcoin and the crypto market had a little pump overnight. And, while the market is still widely seen as correlating with the daily, weekly and monthly fortunes of US stocks and inversely correlated to the US Dollar Index, Chinese economic data and stocks performance is throwing a wildcard into the mix.

As Stockhead’s Eddy Sunarto reported earlier today in his excellent Market Highlights roundup, which you should definitely clock into every single morning, China recorded quite impressive manufacturing purchasing managers’ index (PMI) data overnight.

MORE FROM STOCKHEAD: February crypto winners | Illuvium DAO votes down NFT contest | Enter a ‘zombie-killing casino’

The index reportedly rose to 52.6 in February – the highest level in more than a decade, and indicating expanded economic activity within the eastern superpower.

This is potentially easing global financial growth concerns and giving certain commodities (oil, gold) a boost, as well as increasing risk appetite in markets.

It seems to have increased risk appetite slightly in Bitcoin and some of the crypto majors over the past 24 hours, but more so in “Chinese cryptos”, such as Filecoin and Conflux. Let’s take a gander …

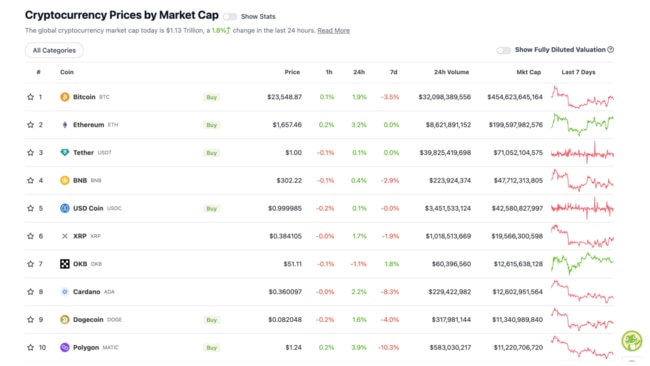

Top 10 overview

With the overall crypto market cap at $US1.13 trillion at the time of writing, up about 2 per cent since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Amid the overall green scene on the daily time frame in the majors, there a couple of standouts – Ethereum (ETH) and Polygon (MATIC).

Ethereum (ETH) might be one of the better-performing cryptos in the top 10 today on the back of news its blockchain has already deployed its “account abstraction” feature, often touted by co-founder Vitalik Buterin as a positive enhancement for the network.

As CoinDesk reports, the upgrade, known as ERC-4337, is designed to make it easier for users to recover their crypto if they lose private keys to an online wallet.

“Account Abstraction is a concept that turns users’ wallets into smart contract accounts, in order to make Ethereum wallets more user-friendly and to prevent any loss of crypto keys,” reads the report.

The big really valuable and necessary thing that ERC-4337 provides for account abstraction is a *decentralized fee market* for user operations going into smart contract wallets.https://t.co/JUigSO5OtW

— vitalik.eth (@VitalikButerin) October 1, 2022

Meanwhile, Polygon’ MATIC token price has lifted out of its early-week doldrums. Guess you can’t keep a good “zk-rollups” Ethereum scaling-solution narrative down for too long.

Polygon's zkEVM Mainnet is launching soon.

— Rekt Fencer (@rektfencer) February 28, 2023

Time to explore the most interesting projects on Polygon and find the best plays for the Polygon narrative 👇🧵 pic.twitter.com/QhYPb53fMU

Uppers and downers: 11–100

Sweeping a market-cap range of about $US10.2 billion to about $US480 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

Visit Stockhead, where ASX small caps are big deals

DAILY PUMPERS

- Conflux (CFX), (market cap: $US503 million) +23 per cent

- Maker (MKR), (mc: $US839 million) +17 per cent

- Filecoin (FIL), (mc: $US2.9 billion) +12 per cent

- SingularityNET (AGIX), (mc: $US656 million) +12 per cent

- Fetch.ai (FET), (mc: $US462 million) +2 per cent

Conflux and Filecoin. We’ve covered both a little bit recently.

The former is apparently China’s only fully regulated, government-backed public blockchain. And it’s been making a few partnership and funding waves just lately, including a deal to build blockchain-based SIM cards with China’s second-biggest wireless carrier – China Telecom.

Also, this – a hefty chunk of funding from Singaporean investment firm DWF Labs:

Conflux raises $10 million from DWF Labs in token round https://t.co/bBohgSO85O

— The Block (@TheBlock__) March 1, 2023

Meanwhile, like Ethereum and its suite of impending upgrades, Filecoin is making some noise over at the ETHDenver “innovation festival” as it gears up to launch its Filecoin Virtual Machine (FVM) – which will bring smart-contract user programability to the Filecoin network, much like Ethereum.

"Filecoin is the world’s largest decentralized storage network! Amassing that quantity of hardware around the world is no small task." @colinevran kicks off the Countdown to FVM Ⱐevent at #ETHDenver.

— Filecoin (@Filecoin) March 1, 2023

Watch live: https://t.co/hVwETX3zYPpic.twitter.com/Z7EXGBV5Qo

DAILY SLUMPERS

- Osmosis (OSMO), (market cap: $US510 million) -1 per cent

- ImmutableX (IMX), (mc: $US895 million) -1 per cent

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Feel like we’re not giving bearish views enough of a say here? Okay, here’s impartial trader/analyst Justin Bennett with something negative for traders and investors to consider …

The US 10-year yield just closed above that level.

— Justin Bennett (@JustinBennettFX) March 1, 2023

Terrible look for risk assets if this holds.

Be careful out there. #stocks#cryptohttps://t.co/zdKA4cK6cIpic.twitter.com/DRQyInuf6A

But then there’s this, from another popular analyst, Rekt Capital:

The time to accumulate #BTC at sensibly low levels is slowly running out

— Rekt Capital (@rektcapital) March 2, 2023

Macro Downtrend breakout isn't too far off$BTC#Crypto#Bitcoinpic.twitter.com/lK4X7roO4W

#Bitcoinpic.twitter.com/yk2CNiAJck

— naiive (@naiivememe) February 26, 2023

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here