Mooners & Shakers: Bitcoin keeps tapping on $25k as Hong Kong looks set to embrace crypto

It’s been hard for Bitcoin to really warm up. It’s mostly been trapped under the $25k ice, breaking through, then getting frozen out again.

Tap, tap, tap. Bitcoin has spent much of Tuesday trapped just under the $25k-level ice.

It broke through, then slipped again, then broke through, then slipped again – you get the idea.

Meanwhile, Hong Kong regulators have provided the market with a hefty hit of hopium.

Is Hong Kong the next crypto hub?

While US regulators – okay, namely Gary “I AM the Law Round These Parts” Gensler – seem to be on a crypto-innovation-stifling mission, it appears Hong Kong is looking to embrace digital asset trading with comparatively open arms.

Overnight, AEDT, Hong Kong regulator the SFC proposed a set of rules that would let retail investors – in other words plebs like you and me – trade certain “large-cap tokens” on licensed exchanges.

For the latest crypto news, sign up here for free Stockhead daily newsletters

Sorry, DogeBonk fans, but you’ll probably have to look elsewhere for now, as the tokens alluded to probably mean the likes of Bitcoin and Ethereum.

Still, this is potentially great news for further global expansion of the asset class, considering Hong Kong’s power as a financial centre throughout Asia and its obvs close ties with a rather large and influential mainland superpower just near it.

Animoca Brands CEO Yat Siu likes it …

#hongkong plans to let retail trade #crypto in a newly released consultation paper. Excited about how #hk#asia will drive broader #web3#NFTs and #blockchain#digitalpropertyrights adoption https://t.co/ULJ7MN0ho3

— Yat Siu (@ysiu) February 20, 2023

And this news follows revelations earlier in February that the finance powerhouse would soon be allowing accredited institutional investors to obtain crypto licences.

There are even reports and rumours that the move to relax crypto-trading laws in Hong Kong could be a harbinger for things to come in China, with the island nation potentially acting as something of a blockchain/crypto testing ground for the Chinese Communist Party.

That’s probably a hopium hit too far for the moment.

But, as TechCrunch noted, with money and talent pouring into the Web3 space, “it’s hard to imagine Beijing sitting still while the rest of the world works on the building blocks that some argue would spark a new wave of innovation as big as the current internet itself”.

In any case, it’s part of what appears to have sparked a new mini-narrative – “Chinese coins”, as we mentioned on Monday.

How are some of those going?

Filecoin (FIL) has actually pulled back a tad but is still up roughly 70 per cent over the past week.

Conflux (CFX), meanwhile, which is China’s only public blockchain and recently signed a big partnership with China Telecom, is up close to 1,000 per cent over the past month.

It was probs a wise choice for Conflux to avoid the CON ticker, by the way.

Which reminds me of the time a, erm, friend invested in something called Confido back in 2017. Yep, $200 well spent. The founders promptly pulled the rug. Valuable due-diligence lesson learnt.

Interestingly, confido is also the name for a drug to treat erectile dysfunction. Maybe that should have been a hint.

MORE FROM STOCKHEAD: Bears to rule for a while yet: Przelonzny | Lido DAO’s token LODO pumps | Aussie platforms join forces

Top 10 overview

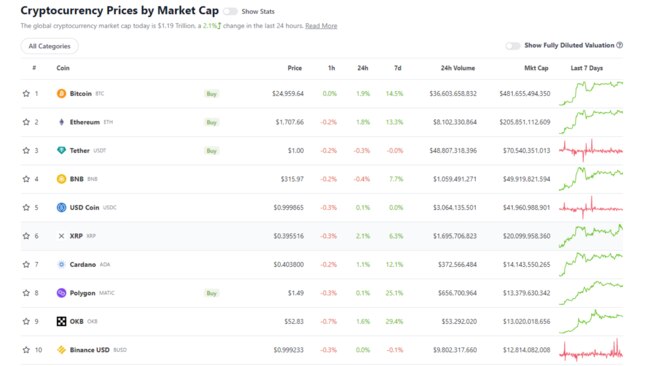

With the overall crypto market cap at $US1.18 trillion at 2.30pm Tuesday (AEDT), up 2.1 per cent since the same time Monday, here’s the state of play among top 10 tokens – according to CoinGecko.

Well, Bitcoin (BTC) did poke its head, AGAIN, very briefly above the fabled $US25k mark overnight, only to sink back down into teaser territory. Jumped up again through the afternoon but couldn’t stay on top of the ice. Guess it’s just biding its time.

Look, no rush, BTC, but if you wouldn’t mind engaging one of your trademark mega-pumps so all these speculative altcoins we’ve invested in can 10x … that’d be great. (Definitely not anything remotely resembling financial advice.)

Visit Stockhead, where ASX small caps are big deals

That $US25k mark, though. Just above it, according to various chartists and analysts, lies a rather important level – the 200-week simple moving average – which, in much of Bitcoin’s history has acted as a level of strong support, but is currently proving to be resistance.

It’s crucial to reclaim that level, according to the likes of Rekt Capital, Lark Davis and others, and then maybe, just maybe … nope, not even going to jinx it.

In the end, #BTC repeated its March 2020 downside wicking depth below the 200 MA$BTC deviated by -28% to reach the ~$15500 price point

— Rekt Capital (@rektcapital) February 18, 2023

Since then BTC has rallied +60% from the lows

Now, 200 MA acts as resistance

Reclaim it as support & BTC will rally higher#Crypto#Bitcoinhttps://t.co/BesEbj5RCRpic.twitter.com/hxoi5OXMtl

Uppers and downers: 11–100

Sweeping a market-cap range of about $US12 billion to about $US493 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at 1pm-ish (AEDT). (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

- Conflux (CFX), (mc: $US723 million) +58.8 per cent

- NEO (NEO), (market cap: $US1.01 billion) +36.8 per cent

- WEMIX (WEMIX), (mc: $US601 million) +24.7 per cent

- Huobi (HT), (mc: $US1 billion) +18.9 per cent

- Bitcoin Cash (BCH), (mc: $US887 million) +10.8 per cent

Guess where most of the main pumpers today have ties to? That’s right, China. Or at least, in WEMIX’s case, Asia. And here’s the Justin Sun-invested Huobi exchange, with news that it’s “stoked” about Hong Kong potentially becoming a crypto hub …

Exciting news! Huobi is stoked about Hong Kong's pro-crypto policies & we're working hard to secure our crypto license there. Our aim is to be one of the first fully compliant exchanges in HK & collaborate with our Asia-Pacific users to drive digital asset growth! #Huobi#Cryptopic.twitter.com/ktZw1WE2cs

— Huobi (@HuobiGlobal) February 20, 2023

DAILY SLUMPERS

- Stacks (STX), (mc: $US813 million) -23 per cent

- Monero (XMR), (mc: $US2.9 billion) -1.8 per cent

- Filecoin (FIL), (market cap: $US3.28 billion) -1.7 per cent

- Litecoin (LTC), (mc: $US6.96 billion) -1.3 per cent

- Flow (FLOW), (mc: $US1.43 billion) -1.3 per cent

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Dutch crypto trader and chart watcher Michaël van de Poppe has an ambitious plan for the months ahead …

Corrections remain to be relatively shallow.

— Michaël van de Poppe (@CryptoMichNL) February 20, 2023

I think that we'll continue the run towards $35-40K before we'll have a harsh correction, maybe even to $20-25K.

Maximize profits, start allocating towards $USDT the higher we come, buy on the correction in second half of 2023.

Meanwhile, “Dave the Wave” reckons if we’re not looking, BTC can get big, fast …

A #btc risk to the upside. Number can get big fast... pic.twitter.com/QADPx6UtL6

— dave the wave🌊🌓 (@davthewave) February 18, 2023

Lastly, a bit more speculation for you based around the Chinese economy-opening narrative. Here’s Gemini twin Cameron Winklevoss …

My working thesis atm is that the next bull run is going to start in the East. It will be a humbling reminder that crypto is a global asset class and that the West, really the US, always only ever had two options: embrace it or be left behind. It can't be stopped. That we know.

— Cameron Winklevoss (@cameron) February 19, 2023

And Coinbase CEO Brian Armstrong talking up crypto as a global hub. Got that, Americans?

America risks losing it's status as a financial hub long term, with no clear regs on crypto, and a hostile environment from regulators.

— Brian Armstrong (@brian_armstrong) February 16, 2023

Congress should act soon to pass clear legislation. Crypto is open to everyone in the world and others are leading. The EU, the UK, and now HK. https://t.co/i9WeUZ7K6H

For more:https://t.co/J5JnKx9oGw

— tedtalksmacro (@tedtalksmacro) February 20, 2023

Maybe what America needs is a bit of Dutch courage, Churchill style.

During prohibition, Winston Churchill got a prescription to drink alcohol when visiting the United States. pic.twitter.com/42DBkpb8rp

— Fascinating (@fasc1nate) February 20, 2023

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox.Click here