IPO Wrap: Newly listed vanadium, lithium players rise

Lithium and vanadium new listees are the talk of the town this week, with software, oil and gas and manganese/rare earths players set to join them on ASX.

Fresh lithium and vanadium listees are the talk of the town this week, with software, oil and gas and manganese/rare earths players set to join them on the bourse in the next fortnight.

But please note that these listing dates are extremely speculative.

If you’re interested, contact the company direct for a better idea of when they expect to start trading on the ASX.

For the latest ASX news, sign up here for free Stockhead daily newsletters

How are newly listed IPOs tracking?

ATLANTIC LITHIUM (ASX:A11)

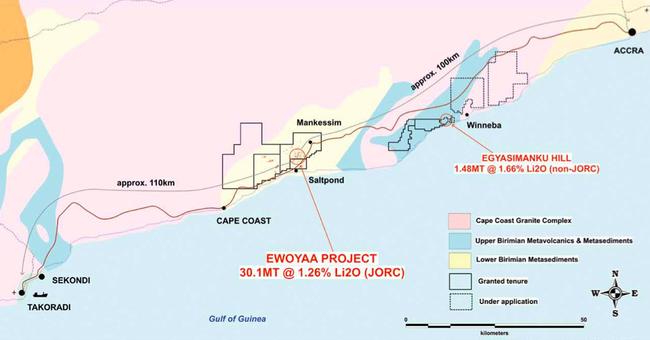

Atlantic listed on Monday after IPOing at $13.25m, with its main game the 30Mt Ewoyaa lithium project in Ghana, where it is funded through to production via a co-production agreement with fellow mine developer Piedmont Lithium (ASX:PLL).

Piedmont has the right to earn up to 50 per cent at the project level for 50 per cent SC6 spodumene concentrate offtake at market rates, by solely funding US$17m towards studies and exploration and US$70m towards mine capex.

Atlantic completed a scoping study for Ewoyaa in December 2021 and in March, updated the mineral resource estimate by a massive 42 per cent to 30.1 million metric tonnes at 1.26 per cent lithium, including indicated resources of 20.5 million tonnes at 1.29 per cent.

A project pre-feasibility study is due in the third quarter of CY2022 which will incorporate the expanded resource.

Atlantic also has two applications pending covering a combined 774km2 area for lithium in the Ivory Coast; Agboville and Rubino.

A11 is currently trading at $0.615, up 6 per cent from its listing price of $0.58.

CRITICAL MINERALS GROUP (ASX:CMG)

The vanadium company listed on Wednesday, IPOing at $5m at $0.20.

It’s currently sitting at $0.255, which is down 8 per cent from its initial high of $0.279 after it hit the bourse, but still up 27.5 per cent from its listing price.

The company holds the Lindfield vanadium project in Queensland, which has an inferred mineral resource of 210 mt @ 0.39 per cent V2O5 (vanadium pentoxide).

The plan is to complete bulk ore sample collection through its large-diameter core drilling campaign, add to the existing JORC resource, and complete metallurgy and pilot plant test work and a scoping study.

CMG also holds the Figtree Creek and Lorena Surrounds, both greenfield copper-gold projects in the Cloncurry region.

Plus, it has Japanese petroleum heavyweight Idemitsu on its register, with the conglomerate taking a 32 per cent slice of the company.

“We believe that vanadium has a critical role to play in the future of energy and are delighted to have Idemitsu Australia as a cornerstone investor,” MD Scott Drelincourt said.

“Our partnership with Idemitsu provides the capital and direction to deliver the Lindfield Project and value to our shareholders. We are thrilled to have their strategic support.”

While adoption of vanadium redox flow batteries has been relatively slow, representing just 10 per cent of the stationary battery market to date, the battery metal is widely expected to become a key resource as the world moves increasingly towards electrification to support net zero emissions.

In fact, vanadium consumption in batteries is forecast to grow at an average compound rate of 41 per cent per year from 2022 to 2031, and global production of vanadium, which is also used to strengthen steel, is expected to increase by as much as 50 per cent by 2030.

Visit Stockhead, where ASX small caps are big deals

Who else is listing soon?

ADRAD HOLDINGS (ASX:AHL)

Listing: September 30

IPO: $22m at $1.50

The company designs and manufactures Original Equipment (OE) industrial radiators, and engineered engine cooling for stationary and mobile heat exchangers are produced to specific customer requirements.

Adrad also manufactures, imports and distributes automotive parts for the aftermarket in Australia and New Zealand, supplying for passenger vehicles through to locomotives and ultra-heavy dump trucks, as well as agricultural machinery and construction equipment.

BRIDGE SAAS (ASX:BGE)

Listing: October 4

IPO: $4.5m at $0.20

This company provides Software-as-a-Service (SaaS) based customer relationship management (CRM) and workflow solutions to employment, care and support industries. The software is a single platform that simplifies the unique data, compliance and documentary evidence requirements of major government-funded programs through a unified user interface, BGE says.

LGI LIMITED (ASX:LGI)

Listing: October 4

IPO: $25m at $1.50

This company is focused on solving gas emission issues for landfill sites while generating dispatchable, distributed and renewable electricity and creating Australian Carbon Credit Units (ACCUs).

LGI has a current portfolio of 26 projects with long-term contracts, across the Australian eastern seaboard and says it has a strong pipeline of growth opportunities, investing capital to optimise the conversion of biogas to revenue,

The plan after listing is to increase biogas revenue through additional ACCU projects and landfill biogas-to-power stations, and expand existing biogas-to-power stations; increase exposure to high quality landfill gas sites; and strengthen the premium electricity offering deploying hybrid battery systems that increase LGI’s ability to optimise the price it receives for electricity.

OMEGA OIL & GAS (ASX:OMA)

Listing: October 11

IPO: $15m at $0.20

This O&G junior has two exploration permits in the Surat Basin in South East Queensland, ATP 2037 and ATP 2038. The two permits represent an area of over 250,000 acres (101,171ha) and are located about 50km away from critical gas transmission infrastructure.

The exploration program will explore the Permian Deep Gas play which, if successful, represents a potential multi-TCF gas resource.

BUBALUS RESOURCES (ASX:BUS)

Listing: October 13

IPO: $5m at $0.20

This explorer is focused on the exploration and development of manganese and rare earths projects in the NT and WA.

Projects include the Amadeus Project (prospective for manganese), the Coomarie Project (prospective for heavy rare earths), the Nolans East Project (prospective for light rare earths) and the Pargee Project (prospective for heavy rare earths).

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here