Five themes to cure life sciences sector’s woes

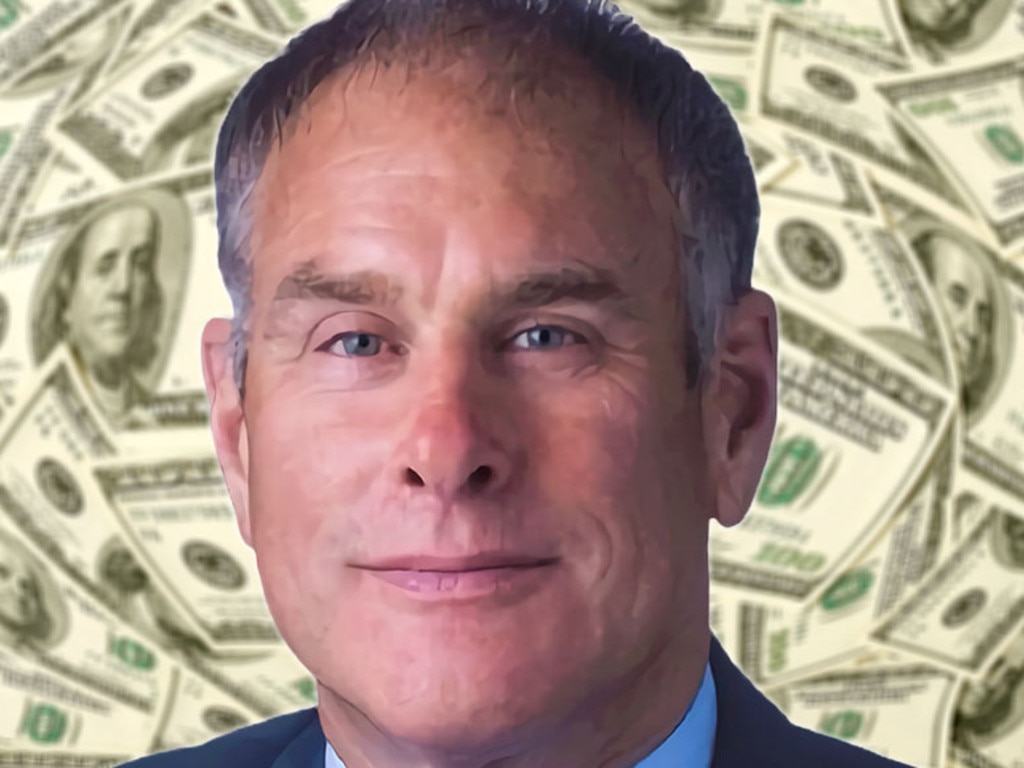

The Australian life sciences sector hasn’t had a good run in the past year, but senior analyst Scott Power sees five rays of hope.

The Australian life sciences sector hasn’t had a good run in the past year.

While the S&P/ASX 200 is up ~8%, the S&P/ASX 200 healthcare index has fallen ~2%.

However, Morgans senior analyst from the healthcare team Scott Power is confident five key emerging themes will bring the Australian life sciences sector back into favour.

Here’s what he told Stockhead.

1. M&A activity

Pfizer offering $100m to ResApp Health (ASX:RAP), which invented a smartphone app to diagnose Covid-19 by listening to someone cough is a great example of M&A activity in the Australian life sciences sector heating up.

“Private equity groups and industry players are all over the space and coming in to find quality companies,” Power said.

“We’ve had Pfizer make a big play for ResApp and I think that thematic is going to continue.”

2. Hospitals without walls

Remote monitoring of various health conditions and consultations through telemedicine settings as physicians move outside the hospital walls has been a very modern theme.

“Hospitals without walls and moving the decision making into a different setting is something we talk about a lot and it has been fast-forwarded by Covid,” he said.

He said companies in this space that have caught Morgans’ eye include health imaging companies Mach 7 (ASX:M7T) and Promedicus (ASX:PME) and medical supplier Resmed (ASX:RMD).

3. Personalised medicine

Personalised medicine uses a patient’s genetics, history and other factors for prevention, diagnosis, monitoring and treatment of disease. Pharmaceutical therapies, for example, can be matched to specific patient types to achieve optimal outcomes.

Power said a good example of a company operating in this space is small cap health imaging company Volpara (ASX:VHT), which specialises in the early detection of breast cancer.

Volpara uses more than 60 million images from ~5.5 million women to help advance earlier detection of breast cancer and improve treatments.

“If you listen to the Volpara story they’re all about using machine learning to help guide radiologists as to where a tumour might be sitting and importantly monitor changes to breasts over time,” Power said.

4. Value of medical data

Simply, Power said health data has currency. Unlocking the insights from health data sets is providing significant value to patients, healthcare providers, insurance payers, pharmaceutical companies and medical device companies.

He said some industry reports estimate that 30% of the world’s data volume is generated by the healthcare industry.

“The benefits are widespread including operational savings in hospitals and health care networks, better disease understanding, earlier disease detection, better treatment outcomes through personalised treatments observation of real world patient outcomes and better clinical trial and better design leading to reduced time to market,” he said.

Power said the great value of data is being recognised by big tech companies moving into the space. He said as examples Cerner (Nasdaq:CERN) is being taken over by Oracle (NYSE:ORCL) for ~US$28 billion and Microsoft (Nasdaq:MSFT) has acquired Nuance ~US$16 billion.

In other examples of big tech in biotech, Facebook has launched preventable care solutions while Apple has wearable devices to capture health data.

Again, Power pointed to Volpara, Mach 7 and ProMedicus as good examples of companies Morgans was backing in this space.

“They have much more value than is being recognised on the market,” he said.

5. Improving clinical trial efficiency

Clinical trials are expensive to recruit, run and interpret. Big pharmaceutical companies are seeking innovation and efficiency in clinical trials.

“Trials are a high-cost component and there are contract research organisations (CROs) worldwide helping with recruitment of patients into trials,” Power said.

“But there are always issues around recruitment like it might take longer or they don’t always get the right patients.

“Trying to use technology whether its machine-learning or social media to try and get the right patients into trials has become of great interest.”

Power’s pick of companies in this space is Aussie micro-cap Opyl (ASX:OPL) which is using technology to identify patients and working closely with big pharma to improve trial efficiency.

“Opyl are doing some really interesting work in the clinical trial space,” Power said.

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout