Emission Control: Electrolyser boom can pave way for cheaper green hydrogen

Manufacture of electrolysers to produce green hydrogen is tipped to boom, but sourcing the necessary platinum group metals is a challenge. An ASX stock is poised to oblige.

Emission Control is Stockhead’s take on all the big news surrounding developments in renewable energy.

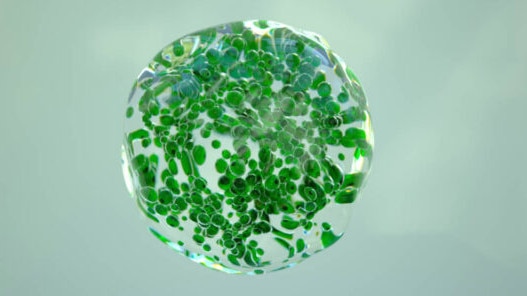

Green hydrogen produced from renewables via electrolysis is set to be at the very heart of the energy transition as more countries foster decarbonisation strategies to meet net-zero targets.

But as it stands, roughly 95 per cent of the world’s hydrogen is made using fossil fuels. Green hydrogen comprises a paltry remaining 5 per cent.

New data out of Norwegian-based Rystad Energy, an independent energy research firm, suggests 2023 might be the start of a long slog for this nascent sector, with electrolyser manufacturing capacity set to grow by 186 per cent from 2022 to 2023.

For the latest renewables news, sign up here for free Stockhead daily newsletters

This is good news for green hydrogen production – more manufacturing capacity means more electrolysers can be built and economies of scale could result in the reduction of costs.

In fact, by 2030, the Norwegian based company estimates green hydrogen production will reach 24Mt from 212 gigawatts (GW) of electrolysers, fuelled by the latest round of incentives such as the US Inflation Reduction Act and Europe’s multitude of support schemes.

Focus shifting to raw materials

Rystad says attention is now turning to the supply chain capacity necessary for electrolyser production.

Currently, the two most common electrolyser technologies are alkaline water electrolysis (AWE) and polymer electrolyte membrane (PEM).

Both PEM electrolysers and AWE electrolysers have experienced particularly high inflation in the past two years – on average prices for PEM electrolyser components have spiked around 30 per cent, while AWE costs increased around 21 per cent over the 2020-2022 period.

MORE FROM STOCKHEAD: Junior gas plays delivering new supply | First hydrogen-powered plane takes flight | Oil tipped to climb, solar to shine

Platinum group metals (PGMs) such as platinum and iridium are key ingredients in PEM electrolysers and are also some of the rarest materials in the world, with iridium only found in two parts per billion (ppb) in the Earth’s crust and platinum in five ppb.

The price volatility of these two materials has contributed to the recent inflation seen hitting catalyst-coated membranes, the component which splits the water into hydrogen and oxygen.

ASX player poised to do its bit

Rystad Energy supply chain analyst Selena Remmen says in the short term, electrolyser prices will start to decrease as the price of key raw materials stabilises.

In medium to longer term, Remmen says technological innovation and efficiency gains will reduce the need for iridium, resulting in a significant cost reduction.

“However, unexpected jumps in costs could occur as iridium faces supply pressures as key producer South Africa faces power outages,” she explains.

“This demonstrates how the energy transition will not be predictable, with many betting that green hydrogen will take a similar path to photovoltaics which saw investment costs drop by around 80 per cent between 2010 and 2020.”

In Australia, one junior miner positioned to cash in on this opportunity is Podium Minerals (ASX:POD), the owner of a 15km-long bulk tonnage PGM deposit at its Park Reef project in Western Australia.

The company wants to be Australia’s first platinum group metals producer and believes it is well placed to support the emerging demand from hydrogen electrolysers and hydrogen fuel cell technologies.

Podium says it has made a significant breakthrough at Park Reef, with world-leading recoveries of more than 90 per cent platinum achieved, using the company’s atmospheric leach process.

The recoveries, which were achieved with both oxide and sulphide ores under certain atmospheric leach conditions, represent a 30 per cent increase on previous oxide recoveries and 50 per cent gain on previously reported platinum recoveries.

The process also improved recoveries of iridium, nickel and cobalt.

Visit Stockhead, where ASX small caps are big deals

Other renewable energy news

ACCELERATE RESOURCES (ASX:AX8)

Accelerate Resources has signed a heads of agreement with US-based RedoxBlox to explore the future supply of manganese products and supply chain solutions for RedoxBlox’s patented zero-carbon thermochemical energy storage technology.

RedoxBlox has identified the high quality and favourable location of AX8’s manganese projects to provide a reliable and ethically sourced manganese feedstock to its developing business.

Their zero-carbon tech, based on unique high purity manganese and magnesium-based components, offers a novel and disruptive solution to store and dispatch renewable energy for industry energy requirements.

Under the heads of the agreement, the parties’ primary objective is to explore how AX8 can profitably supply manganese products and other input materials to RedoxBlox from its Woodie Woodie North Project (or elsewhere in Australia) for the synthesis of RedoxBlox pellets for its energy storage technology.

GENEX POWER (ASX:GNX)

Genex says a key milestone has been reached in the construction of its 50MW/100MWh Bouldercome Battery Project, with all 40 Tesla Megapack units having arrived at site.

“Reaching this major milestone significantly de-risks the overall construction schedule and represents the final piece of key equipment to arrive at the project,” the company says.

Key work activities at site will now focus on preparing Bouldercombe for commissioning, including completing all electrical connections from the Megapack units to the step up transformers, completing all interface works with Powerlink Queensland, as well as pre-commissioning of the Megapack units.

1414 DEGREES (ASX:14D)

A recent investment by Australian venture capital company, Blakford, will see funds be used to advance 14D’s brick technology, intended to decarbonise energy-intensive industries such as cement, alumina, and chemical processing.

14D says Blakford subscribed for three million shares at $0.10 each, which it believes shows confidence in the future of its technology and projects.

HYTERRA (ASX:HYT)

Hyterra says the first phase of exploration at the Hoarty NE3 natural hydrogen exploration well was successful, with the pump being installed on schedule.

The extended flow test is now under way and the operator is performing the necessary tests to monitor gas composition, pressure and flow rate.

While the testing is expected to continue for several months, the company intends to periodically report on the operations and outcomes.

This content first appeared on stockhead.com.au

At Stockhead we tell it like it is. While Podium Minerals is a Stockhead advertiser, it did not sponsor this article.

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here