Demand for beef products higher than ever before, driven by Chinese demand

The demand for beef products in September this year reached an all time peak, with ever growing demand from the Chinese market.

According to Rabobank in September of this very year, 2022, Year of the Tiger. The world saw more cow, cattle, calf, beef, bovine-meat, beouf (frozen, living or just chilled) shipped about this fine, hungry, possibly deteriorating planet by volume and value ever in history. Full stop.

The driver: Chinese demand, which has found another gear, possibly the 9th.

Over in the US – the world’s second-largest importer of beef after China – there’s likely to be searching for even more beef from global markets over the next three years, as its own domestic production declines, Rabobank says in a newly-released report.

As marbled as the marble kitchen top in this photo

And, while Australia is among the major global beef exporters that could help fill the gap, our own supply constraints are gathering momentum and pretty much mean it’ll be quite the challenge to find more cows to make up for the additional export volumes.

The tough fact is for lovers of premium bovine, cows and their production, it looks like it’ll be constrained across a whole heap of the world’s beef producing nations.

International markets will struggle to meet the cow-gap left by the contraction of cow volumes in the US, the rising demand of cow-eatin’ countries and a bit of a labour - slash - margin challenge in producers like, er, Australia.

And one doesn’t need to be a ranch hand to know that less cows usually leads to rising global beef (cow) prices and - moreover - a shake up in the pecking order. Or simply, the redistribution of trade volumes.

Although it is possible that the impact of slowing economic conditions and waning consumer confidence around the world may also soften global demand, Rabobank notes, which is why China has a pork ‘reserve’ like we have an oil reserve. Only it’s pork.

-

-

Interestingly (and as an aside dish)...

Pork prices in China jumped by about 22 per cent in October, Y-o-Y.

It followed the highest recorded month-on-month increase of 25.6 per cent in July, as CPI also hit a two-year high of 2.7 per cent. August’s rise occurred despite an unexpected slowdown of CPI inflation to 2.5 per cent.

China is the world’s biggest consumer of pork, and the country’s government maintains a frozen “reserve” supply as part of a vital stabilisation policy.

Before September’s mid-autumn festival and the National Day holiday on 1 October, for the first time this year, local authorities released some of their pork reserves.

But meatwhile... (Ed: stop)

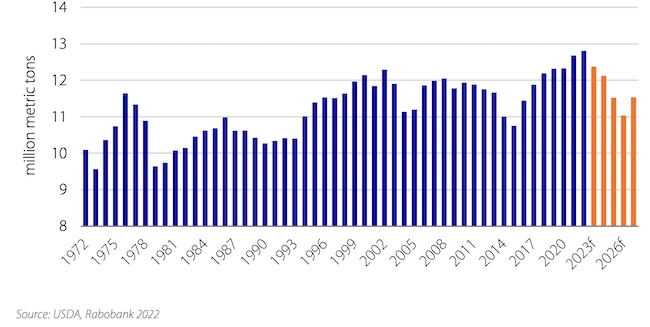

In its Q4 Global Beef Quarterly, the specialist agribusiness bank says while the reduction in the size of the US cattle herd is “nothing new” – with numbers declining rather than building in recent years – it has, to date, not impacted the amount of domestically-produced beef reaching US consumers.

But that is expected to change soon, with the bank forecasting the tipping point to be reached in 2023, when US beef production should fall by 3 per cent, with annual declines of two to five per cent possible into 2026.

“On average, that is the potential loss of 400,000 to 500,000 metric tonnes of beef from the US production system per year during this period,” the report said.

Behind the slide is what Rabobank senior animal protein analyst Angus Gidley-Baird reckons is a natural cyclical ‘liquidation’ (reduction) in cow numbers after the US herd had peaked in 2019, compounded by the impacts of recent drought conditions and high feed costs.

Show moo the money

First, because the heady scent of opportunity wafting through this post like chargrilled 9+ wagyu has you salivating, we should check out how a couple of ASX beef-ish stocks are performing lately.

And broadly, not great. Something about buying opportunity, something about falling knives.

Elders (ASX:ELD) is probably the most recognisable name. It’s a diversified agribusiness but helps beef farmers access global markets and technical advice as well as a feed and processing business with a cattle feedlot in New South Wales and a supply chain in Indonesia.

A year ago it began a ride from $11.72 all the way to $14.90 in May, but just this month it refinanced its receivables facility with Rabo, increasing the limit from $225m to $300m. It said that was to “accommodate significant growth over the past 12 months”.

The market said “bull’s bollocks to that” and knocked it down to a near two-year low of $10.03.

Australian Agricultural Company (ASX:AAC) actually runs beef farms. It was looking so good around June, master chartist Carl Capolingua himself was celebrating its bullishness with a great big green candlestick here.

It was largely helped by Twiggy Forrest snapping up another 10 per cent.

It hit a whacking ATH days after of $2.37, some 50 per cent up on the start of the 2022, but has since pulled back to a still impressive $1.74, up nearly 20 per cent on this time last year.

Then you’ve got Wellard (ASX:WLD), a pure-play exporter. It’s had a difficult year convincing shareholders to, well, hold.

Shipping is a fickle business, and things just haven’t lined up for Wellard this year. High fuel prices, Covid issues, buying a new boat - there’s a lot going on here.

Needless to say, it started the year at an ATH of 12.5c and is now languishing back at July ‘21 levels of 7c.

But it’s just locked in a couple of vessels until 2032, the new boat’s arriving mid next year, and to be fair, the FY22 financials were solid enough. Three straight years of profit, EBITDA up 86 per cent to $US21.6m, and cash at bank increasing to $US15.3m.

That’ll do cow. That’ll do.

Back to the big issues.

Beef that as it may (ED: please Christian)

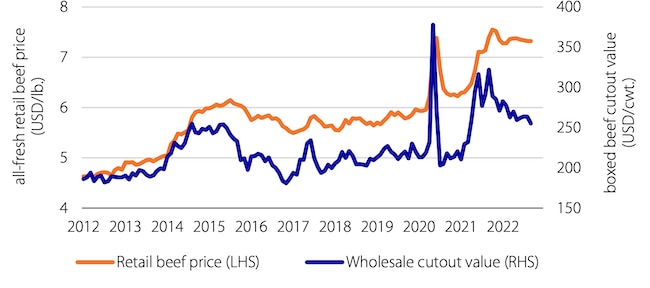

Real per capita disposable income growth has withered to 0.3 per cent compared to last year, while government assistance has become a smaller part of US personal incomes. Less than $US1,600/month in real transfer payments exists today, the lowest level since 2008.

However, government food assistance has increased considerably. Real monthly Supplemental Nutrition Assistance Program payments have been around $US150 per household since the pandemic – compared to $US97 in the two years prior.

Combined with generally stronger wages, this should underpin potential beef demand, says AG-B.

“Expect US beef demand to pull back, but retail prices could still push above US&8/lb over the next several years without retesting the pandemic-induced demand highs.”

Americans love their beef and will pay the premium to get it, says Gidley-Baird.

“Previous periods of decline in US beef production suggest the country’s retailers and restaurants will look to the global market to fill this void, and US consumers will likely outbid the rest of the world to keep their fill of beef.”

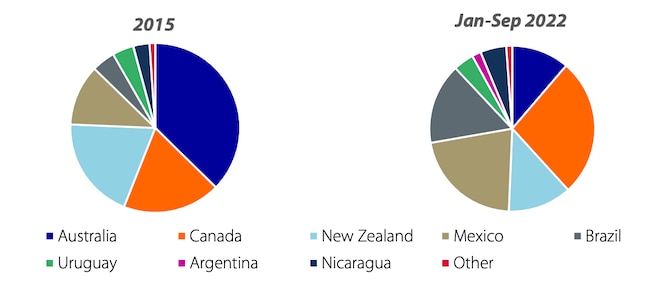

The changing cow face of US imports

“While neighbours Mexico and Canada – the two largest suppliers of beef to the US – are likely to take up some slack, Canada is going through its own cattle herd liquidation phase and likely limited in what it can supply,” he said.

“Australia and New Zealand, the third and fourth largest US suppliers, are the logical next options. But Australia’s recovery from its own beef cattle liquidation phase is being drawn out with some questions as to whether it will have the cattle available to produce the same volumes it has done in the past.”

According to Rabobank, Kiwi beef production is also expected to be limited – forecast to decline four per cent between 2023 and 2025 – while Europe, not a big supplier of beef to the US anyway, was set to continue to record a structural decline in production over that period.

“This leaves South America, which has volume, but lacks the trade access needed to fill the sizeable gap in US production,” he said.

“Brazil’s production is forecast to grow over the coming years, but we expect production in Argentina to decline then plateau. In combination, these two major South American exporters will not increase production enough to offset the drop in the US, even if trade arrangements are changed to increase exportable volumes from South America.”

The report said the net result was Rabobank expected the decline in US beef production would not be met by production growth in major exporting countries.

“And this is even without consideration of any other increases in global beef demand over the same period,” the bank said.

AG-B: Strong upside to global topside (Ed: ok that’s it, we’ll talk about this in the morning)

Gidley-Baird says given the supply pressures across international beef markets both global beef importers – and their consumers – are going to need to cough up a lot more for their cows, “and to compete for available supply”.

“And this could create a strong upside to prices and a redistribution of trade volumes in coming years,” he said.

The global beef market currently remains solid, according to the Q4 report, with cattle prices generally favourable, supported by “predominantly positive seasonal conditions and resilient consumer demand.”

“But given the slowing economic backdrop – with high inflation and waning consumer confidence – demand may yet soften,” Gidley-Baird warned.

“The central question is whether beef markets are shaped more by demand-side or supply-side pressures as we head into 2023.”

Aussie beef: We could always be slaughtering a lot more

Despite tracking some apparent softening at the retail end of the supply chain, the report places the Aussie beef industry in pretty good nick, with seasonal conditions continuing to support producer demand and, in turn, cattle prices.

Ahead of Christmas, local beef prices are expected to hold steady - which means expensive - although prices are set for “a likely dip in the new year as cattle volumes increase and summer pasture growth starts to dry off”.

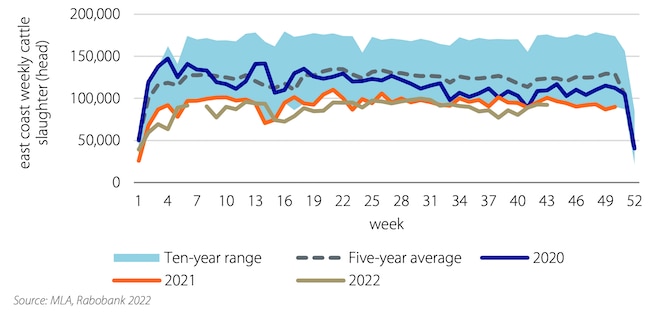

Labour constraints and tight margins are leading to a reduction in slaughter numbers in the Australian beef market, according to the report:

“Volumes dropped below 2021 volumes through September and October as labour continues to be a problem,... while more recently the bank says poor margins have led to some plants scaling back.”

More cows are coming

Mincing its words just a little, Rabobank reckons the Australian cattle herd is growing, just “possibly not doing so at the rates we have seen in the past”.

“We think producers are taking advantage of good feed availability and high cattle prices to trade cattle rather than build breeding numbers,” Gidley-Baird said.

“As a result, we haven’t seen cattle prices ease and slaughter numbers lift, despite more than two and a half years of good seasonal conditions – particularly in the southeast.”

Rabobank believes cattle numbers would increase through 2023, however.

“The challenge now is that cattle prices will need to drop further than previously to generate viable processor margins given the rising costs and softer consumer markets,” AG-B added.

Do you remember the cows of September?

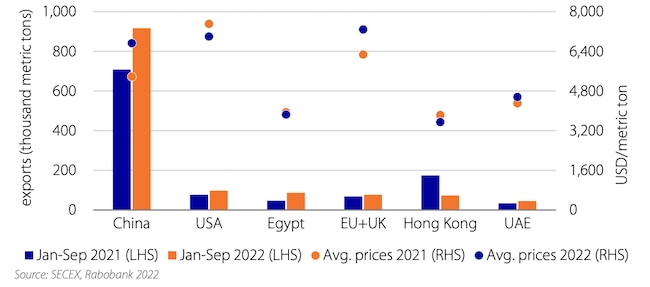

Buried somewhere in the fabulous report - global beef shipments in September registered the highest volume and value in history, driven by the increase in Chinese demand.

Exports increased 8 per cent Year-on-Year (YoY) to 229,000 metric tonnes with values increasing 11 per cent YoY to $US1.3b.

China alone was responsible for 137,000 metric tonnes and $US868m.

Partial data for October exports shows a strong increase of 148 per cent YOY in daily shipments, elevated by the effects of the Chinese trade embargo between mid-September 2021 and mid-December 2021.

“We expect the pace of exports to China to slow down in the short term,” Gidley-Baird says, “with pressure to reduce prices causing some exporters to hold volumes hoping to get better prices at a later date.”

Rabobank projects export volume growth of around 15 per cent to 18 per cent this year, Y-o-Y.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here