CoreLogic’s Eliza Owen: What the federal budget fluffed on Aussie property

CoreLogic head of research and housing guru Eliza Owen has weighed up the federal budget’s property moves – and found them wanting in three key areas.

CoreLogic head of research and housing guru Eliza Owen has weighed up the federal budget’s property moves – and found them wanting in three key areas.

There had been talk the budget would have housing as one of its set pieces, but Treasurer Jim Chalmers made three big “misses” when it came to the Australian property sector on Tuesday last, Owen said.

She’s spent a shot while considering the document and outlined the three opportunities that have been lost.

For the latest property news, sign up here for free Stockhead daily newsletters

Commonwealth Rental Assistance

Owen says the budget failed to optimise CRA payments by making them better targeted.

She said even the productivity commission had noted (albeit before rent values boomed) that 28 per cent of CRA recipients would’ve avoided housing stress without the payment, and 27 per cent of recipients were in the top 60 per cent of household incomes.

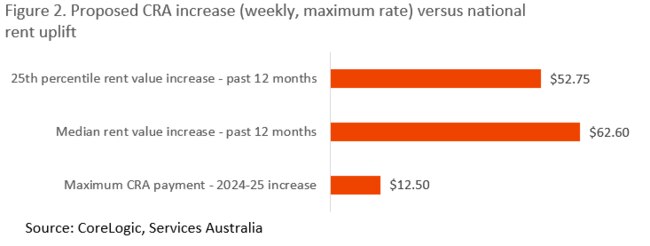

“CRA payments vary depending on circumstance, but the maximum rate of around $125 per week means the biggest increase under the budget will be $12.50 per week,” Owen said.

“As noted in our budget analysis last year, CRA increases offered by the government are very modest in dollar terms compared to actual rent increases in the private rental market.

“The pic below shows the maximum proposed 2024-25 increase to weekly CRA, against actual rent increases at the median and 25th percentile rent value across Australia in the year to April 2024.”

“A broadbased boost to CRA for those already receiving it is a pretty efficient way to ensure those in more vulnerable positions in the private rental sector can remain a little more competitive in the private rental market.

“But optimising the payment (would mean) more funding could be allocated to those who really need it.”

Construction capacity

Australia’s construction sector is a bit of a mess, said Owen.

She said it was “overheated”, with too many projects stuck in the pipeline, and not enough feasibly-priced labour and materials to deliver them.

The Cordell Construction Cost Index shows new house build costs are up 27.6 per cent since the pandemic through to March 2024, and the new dwelling purchase component of CPI is up 36.1 per cent in the same period.

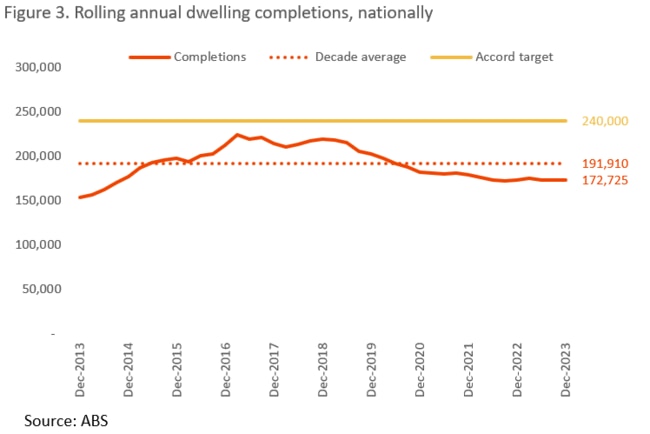

“Our construction sector is so woefully stretched, we are unable to deliver homes at historic average volumes, let alone a stretch target of 1.2 million homes in a five-year period,” Owen said.

She said project delays across both private and government-led housing projects were leading to a pileup of potential supply

“The number of dwellings approved but not yet completed was 260,000 at the end of last year, which is actually higher than the annual accord target,” Owen said.

“While lining up new projects to boost supply is well meaning, federal and state governments might be better off letting approvals continue to unwind in the short term amid high interest rates, so that cost pressures start to ease and the construction industry can focus on delivering the pipeline.”

This already seemed to be starting, she said, with ABS producer price indexes now showing a reduction in the cost of steel inputs for residential construction, and the new homes component of CPI slowing to 1.1 per cent growth in the March quarter, down from 5.7 per cent in the March 2022 quarter.

“In the meantime, governments should focus on boosting the productive capacity of the construction workforce.”

Owen said that one way to reduce cost pressures was to beef-up the construction workforce.

The budget actually outlined around $91 million in training to do this, including:

- $62.4 million for 15,000 fee-free training places at TAFE and VET vocational colleges

- $26.4 million for 1000 pre-apprenticeship places

- $1.8 million to fast-track skills assessment for 1,900 migrants

“This could add to labour supply to the tune of 22,000 workers, representing 1.7 per cent growth in an industry where employment had an average quarterly increase of 0.7 per cent over the past decade,” Owen said.

MORE FROM STOCKHEAD: House prices tipped to weaken | What population density means for values | Why April was weird ride for property

But, she pointed out, for now it was just not clear when the new workers might be added, with those just starting their training certificates/apprenticeships potentially taking years to be qualified.

According to the legends at the Grattan Institute, a quicker way to boost productive capacity could be to focus more on already qualified migrant labour.

“Reduced levies for businesses to take on overseas migrant workers, and streamlining skills recognition are important structural reforms that need to be made across a range of sectors, but especially construction at the moment,” the Grattan noted earlier this year.

Meanwhile Owen said that while it was great that lifting the participation rate of women in construction had been a focus for this budget (highlighted by the Building Women’s Careers program), the low starting base was alarm-bell-worthy at a disconcertingly low 14 per cent of total construction employment in Australia.

“Aside from labour, investing in research and innovation in construction processes would also help to boost productivity.

“Investment that helps to scale modular builds, and embracing technologies that can further streamline design processes are some examples.”

Demand

Aside from a more targeted, sustainable level of migration, this budget missed an opportunity to shape housing demand, Owen said.

“Bold tax reform on housing has the potential to increase government revenue, and shape housing demand so that our existing housing stock is used more fairly and efficiently, at a time when new supply is challenging to deliver,” she said.

“In some ways, demand for existing housing stock is increasingly inefficient among some cohorts.

“In previous analysis we have noted that the portion of two-person family households in dwellings with four or more bedrooms was rising over time.

“Working with state and territory governments to introduce land tax as a replacement for stamp duty, or factoring in the family home as an asset in the aged pension test, are examples of policies that can shape the amount of housing demanded.”

Owen said there was room to modify the way we tax assets such as housing.

Westpac’s Luci Ellis, reckons a redesign of capital gains tax, which could be constantly discounted by the long-term inflation target, could reduce market distortion.

While the Westpac chief economist didn’t specify this being applied to housing, Owen said replacing the “generous” 50 per cent discount on housing investments after a year could reduce short-term resales of investment property prompted by short-term capital gain windfalls, increasing stability of tenure for renters.

“Like many before it, this budget misses an opportunity to make meaningful changes that could make a fairer and more efficient housing system in the long term,” she said.

Visit Stockhead, where ASX small caps are big deals

Here’s what the budget did get right

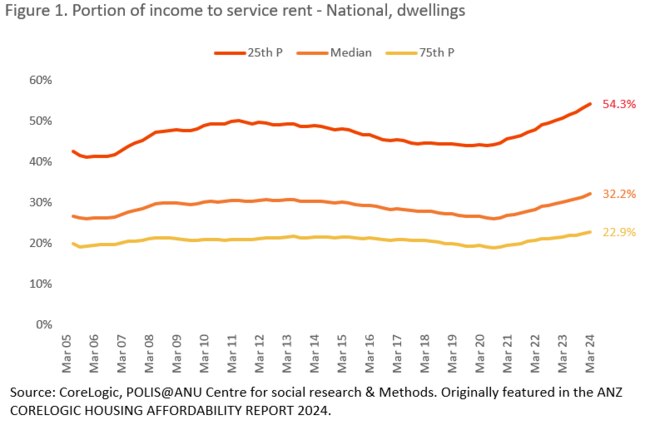

Increases in housing and rental costs since the pandemic have been especially hard on low- income households, says Owen, without much danger of contradiction.

“The decline of social housing over time has worn down the buffer between the private rental market and insecure housing, so when rents are rising as strongly as they are now, vacancies are low and demand is high, it’s low income renters who are increasingly vulnerable,” she said.

And the worst off had copped it hardest.

According to research by ANZ and CoreLogic, examining the rent-to-income ratio over the past four years, it’s clearly the low-income end of the spectrum which has seen the biggest increase

“The budget has allocated funding to where it is urgently needed: crisis accommodation, social and affordable housing funding, and a boost to rental assistance for renters receiving other social assistance payments.”

Housing initiatives in the budget included:

- An additional $423.1 million for the National Housing and Homelessness Agreement (taking total funding to $9.3 billion over five years) to deliver public housing and homelessness strategies. This also includes a doubling in funding for homelessness services at $400 million per year to be matched by the states and territories.

- A second-consecutive increase to Commonwealth Rental Assistance (CRA). This $1.9 billion investment over five years will increase the maximum rate of CRA by a further 10 per cent, following a 15 per cent increase last year.

- Additional concessional financing of up to $1.9 billion for community housing providers and other charities to support the delivery of new homes.

- An additional $1 billion targeted toward crisis and transitional accommodation for women and children fleeing domestic violence, and youth.

- An additional $1 billion for the states and territories to help speed up construction on infrastructure to support new housing (i.e., sewers, roads, energy and water infrastructure).

- Around $90 million for training and education to boost the construction workforce.

- A better targeted migration program, with student visa grants tied to the delivery of purpose-built accommodation.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here