Uvre clears key hurdle in push for NZ gold deal

With approvals cleared, drills coming and top talent on board, Uvre’s gold pivot sets up potential upside near the 10Moz Waihi mine.

Uvre clears final hurdle in NZ gold deal

Drills, deals and directors all locked in

High-grade gold upside for Uvre with drilling on the way

Special Report: With key approvals cleared, drills incoming and seasoned dealmakers on board, Uvre’s gold pivot puts investors in line for potential upside in a proven gold district near 10Moz Waihi mine.

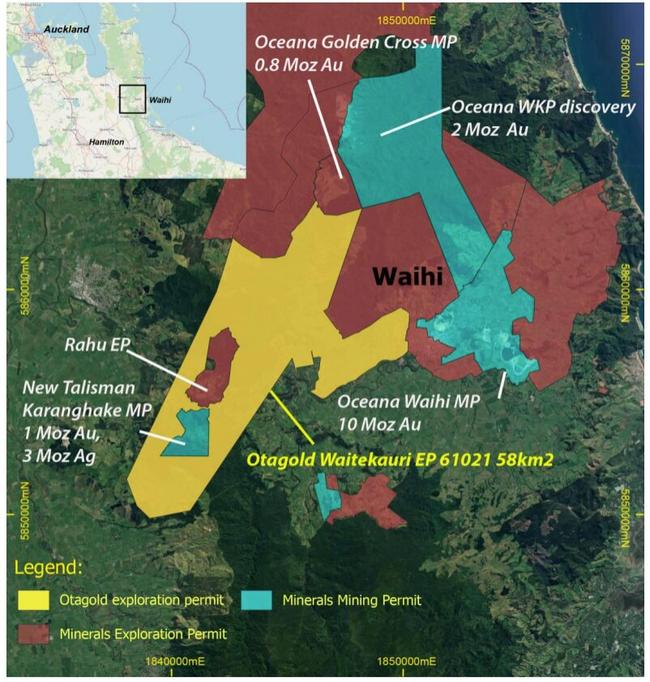

Uvre (ASX: UVA) has taken an important step towards acquiring highly prospective gold assets in New Zealand, with consent granted for the prior change in ownership of Otagold’s fully owned Tier 1 Waitekauri gold project.

In addition, during May, Otagold began fieldwork on its South Island projects.

This included collecting rock chip samples, which have been sent for assay. The company has also started identifying drill targets as it prepares for its first drilling at Waitekauri.

This consent follows Uvre’s binding agreement to acquire all the fully paid ordinary shares in Minerals Exploration (MEL) from its shareholders.

MEL’s wholly owned subsidiary is New Zealand gold explorer Otagold, which, in turn, holds a 100% interest in three exploration permits, one prospecting permit and one prospecting permit application in New Zealand.

Together, those permits cover 332 square kilometres of highly prospective ground, including the Waitekauri gold project, just 8km from OceanaGold’s Waihi mine.

Waitekauri also lies adjacent to three other gold deposits, each more than 1 million ounces, and has historically produced gold and silver at an average grade of 48g/t Au+Ag.

As part of the transaction, highly regarded mining executives Norman Seckold and Peter Nightingale – both major shareholders of MEL – will join Uvre as non-executive directors.

As part of the deal, they will also become major shareholders in Uvre, further aligning the board with investor interests.

Seckold was previously chairman of New Zealand gold developer Santana Minerals (ASX:SMI) and is currently chairman of Alpha HPA (ASX:A4N), Nickel Industries (ASX:NIC), Fulcrum Lithium (ASX:FUL) and Sky Metals (ASX:SKY).

Quick background of the acquisition

On May 19, Uvre announced a deal to buy MEL and its gold-focused subsidiary Otagold.

To go ahead, the deal needs a few boxes ticked, like due diligence on the companies and their permits, plus a $4 million capital raise.

That raise is already locked in, with strong support from investors. The two incoming directors, Seckold and Nightingale, have chipped in a combined $600,000; subject to shareholder approval.

Uvre will pay for the acquisition by issuing 75 million shares at 8c each, valuing the deal at $6m.

Key conditions met for acquisition

As of today, all the key conditions precedent to the transaction have been satisfied.

This required MEL and/or Otagold to apply under the Crown Minerals Act (CMA) for either retrospective consent or notification, depending on the type of permit.

These applications related to the change of control that took place when MEL acquired full ownership of Otagold earlier this year.

Completion of the Uvre transaction depended on Uvre being satisfied at its sole discretion with the Minister’s response to that application.

It also required confirmation that none of the permits would be revoked as a result of the change of control.

The Minister has now provided written confirmation and Uvre has confirmed it is satisfied with the response.

“The satisfaction of this critical condition precedent marks an important step along the path to completion of this transformational deal for Uvre,” executive chairman Brett Mitchell said.

“The combination of Norm and Peter’s vast resources experience to bring onto the board, the established team and these highly prospective assets sets up our company for a fantastic future based on wealth creation through exploration and project development.”

A shareholder meeting will be held on June 27 to approve the acquisition and the $4m capital raise.

This article was developed in collaboration with Uvre, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.