Production potential of Felix Gold’s Treasure Creek buoyed by lab busting antimony assays

Near-term production is looking increasingly likely at Felix Gold’s Treasure Creek project after trenching and sampling returns +35% antimony.

Felix Gold’s trenching and rock chip sampling at Treasure Creek returns strong antimony and gold results

Nine samples found to have exceeded the laboratory assaying upper detection limit of 35% antimony

Bulk metallurgical samples have also been collected to refine processing strategies

Special Report: Felix Gold’s plan to bring its Treasure Creek project in Alaska into near-term production have received a shot in the arm after trenching to test historical antimony workings returned “exceptional” results.

This isn’t a term that is being tossed around casually either with the four trenches at NW Array returning a top result of 3m grading >35% antimony and 5.29g/t gold.

Felix Gold (ASX:FXG) could well have more antimony content in that particular trench assay, but the exact figure will elude it for now due to the upper detection limits for laboratory assaying being capped at 35%.

The same is also true for rock chip sampling at the historical Scrafford mine where six of the 16 high-grade samples returned antimony results that exceeded the upper detection limits.

It is certainly a problem that any explorer worth their salt would welcome and the company has bundled these and two other samples from the current trenching and rock face sampling program together for further specialised testing.

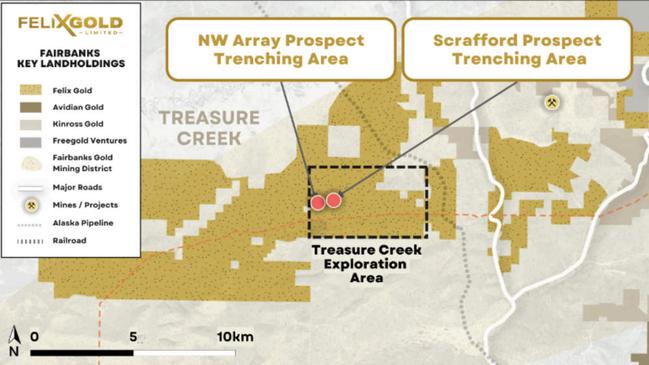

The NW Array and Scrafford prospects. Pic: Felix Gold

Increased confidence

“Exceptional trenching results at Treasure Creek, Alaska, have significantly strengthened our near-term production potential, confirming the opportunity for two high-grade antimony projects,” executive director Joe Webb said.

“NW Array, with standout results of 3m at >35% Sb and 5.29g/t Au, now complements the historic Scrafford Mine, which delivered 4m at 12.2% Sb and 4.24g/t Au.

“These results provide valuable insights and increased confidence in achieving our production ambitions.

“Bulk metallurgical samples have been collected, with results pending, to refine processing strategies.

“Treasure Creek’s strategic location in the US is crucial amid heightened national security concerns over supply chain reliability, particularly as China imposes restrictions on antimony exports.

“With its dual-project potential, Treasure Creek is poised to become a critical supplier of antimony, a mineral vital for national security and industrial applications, reinforcing its importance in addressing the US supply chain challenges.”

Visit the Felix Gold Investor Portal to request a Q&A video update on the trenching results. The Q&A features Felix Gold’s Executive Director, Joe Webb hosted by Reach Markets.

Trenching and sampling programs

The targeted trench excavation program completed at NW Array in October 2024 was carried out at an initial site chosen based on interpretations from previous drilling data with a focus on a north-northeast trending structural zone.

This included a primary 35m long trench excavated along the track and three shorter trenches ranging from 4.7-7m which extended from the main trench to better access the interpreted strike of mineralisation.

Multiple antimony and gold results from this program indicated the orientation of structures conforms with the apparent overall north-northeast trend of high-grade antimony intercepts reported in previous drilling.

FXG also collected a 30kg sample from this zone for future metallurgical testing to support processing optimisation efforts.

Over at Scrafford, three trenches and rock chip face sampling highlighted the high-grade antimony and gold potential of the historical mine.

Trench SCTR001 returned a result of 4m at 12.2% antimony and 4.24g/t gold within the 10m wide Scrafford Shear.

Meanwhile, 16 of the 38 rock chip samples returned assays of >10% antimony while 22 samples returned >1g/t gold.

Work ongoing

Work is continuing at Treasure Creek to assess the viability of a near-term, standalone production of high-grade antimony – prices of which have soared in response to its increasing use in solar panels to increase their efficiency as well as export restrictions imposed by China.

The elevated pricing isn’t coming down anytime soon.

Blue Ocean Equities flagged earlier this month that it saw potential for antimony prices to remain high for 3-4 years as the dominant supplier China cuts supply, stockpiles are depleted and demand grows.

China is restricting exports as its growing solar panel production chews up declining reserves, along with a tit-for-tat reaction to the US’ CHIPS Act and tariffs. Stockpiles have also been depleted by protracted military conflicts in Ukraine and the Middle East.

FXG – one of four antimony hopefuls liked by Blue Ocean analysts Carlos Crowley Vazquez and Elaine Faddis – notes that unlike lower-grade antimony often associated with larger gold systems, the higher-grade material at its project presents a unique opportunity for near-term production.

It is progressing initiatives aimed at achieving near-term production, noting its strategic location in the US opens up multiple opportunities for government funding and support.

This article was developed in collaboration with Felix Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.