Nova’s Estelle ranked as one of nine potentially viable near term global antimony projects

Nova Minerals is targeting antimony production at its Estelle gold and critical minerals project as prices continue to climb.

Nova Minerals is targeting production of antimony at its Estelle project as early as the end of 2025

Independent resources expert RFC Ambrian lists Estelle as one of nine potentially viable near-term antimony projects in the world

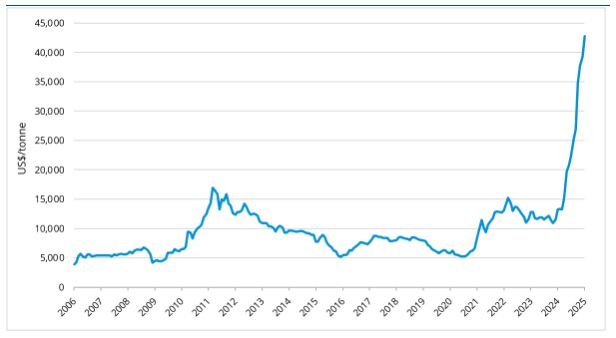

Antimony prices have surged more than 400% from last year to exceed US$50,000 this week

Special Report: The eye of a perfect supply-demand storm is rapidly approaching the antimony market and it could send prices soaring to at least US$100,000 per tonne.

Prices of the niche critical mineral have this week topped US$50,000/t – more than quadrupling from US$12,000/t at the beginning of 2024 when the critical metal flew under the radar of many investors.

Macro fund manager Fawkes Capital Management’s Xinyu Ru says the skyrocketing price is due to a market imbalance that’s comparable to some of the most infamous commodity price hikes in modern history.

He notes in a recent analysis that during first oil shock of 1973, supply of the fuel was cut by about 15%, driving a six-fold price rise. He adds that a drop of only 5% in copper supply has historically resulted in prices tripling.

This provides a hint of where antimony might go given that China’s ban on exports to the US last December has now cut supply to the Western world by about 30%.

China is the dominant global supplier of refined antimony and the US uses about 60% of that.

Russia and Tajikistan are the second and third largest producers, and alongside China they produce at least 80% of the world’s antimony.

But with antimony a key component in ammunition and other weapons, Russia has stopped exporting it to western nations as the war drags on in Ukraine.

Adding to the squeeze is the fact that antimony deposits are rare and, as Ru notes, typically found in only small and shallow veins.

Meanwhile, demand continues to surge due to the use of antimony in solar panels to increase their efficiency and in making batteries less flammable.

RFC Ambrian added in a February report that all these factors put the antimony market under “severe stress”.

It forecasts the record prices will continue into the medium term in order to lure new supply and identifies only nine projects globally, one of which is Nova’s Estelle, that have the potential for near term antimony production.

How antimony found Nova

Stepping into this huge global commodity shock is an Australian junior which came to antimony by pure accident - when Nova Minerals (ASX:NVA) Head of Exploration Hans Hoffman stumbled upon a shiny rock while out prospecting for gold at the company’s Estelle project in Alaska.

Initially thinking it would make a good paperweight, Hoffman later decided to have it assayed.

The paperweight returned high grade stibnite, the primary ore source for antimony, and after tracing it back Hoffman found massive stibnite all over the surface, putting Nova in the right place, at exactly the right time, with the right commodities.

“We were looking for gold and the antimony found us,” Hoffman said.

Estelle’s near-term gold and antimony potential

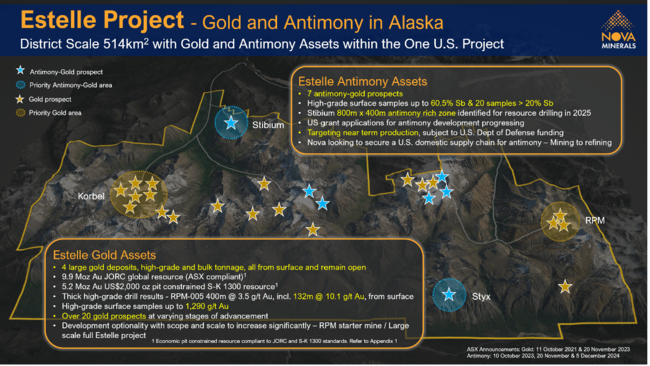

Located within Alaska’s prolific Tintina belt, the Estelle gold and critical minerals project has a current JORC resource of 9.9Moz gold.

Nova’s aiming to join the 10Moz club with targeted drilling planned for the 2025 field season, including at the strategically important 1.24Moz RPM deposit, which can also fund more exploration and development.

Estelle hosts more than 20 advanced gold and antimony prospects, four of them known large IRGS (intrusion related gold system) deposits. That’s with less than 5% of the 514sqkm property explored so far, and samples grading as high as 1,290 grams per tonne gold and 60.5 per cent antimony.

While concurrently developing Estelle’s impressive gold assets, a key goal for Nova this year is to also flesh out the antimony potential and in particular to define a gold-antimony resource at the Stibium discovery, with an eye to advance towards antimony production, potentially as soon as the end of this year.

As the US urgently chases its own domestic sources of antimony the Department of Defence is busy granting companies sizeable funding with a recent example being Perpetua Resources receiving US$60m in conditional grants

Nova is an early mover in the antimony space and has applied for its own DoD grant funding. The company believes that pending its successful application, which is well advanced, it could kickstart a material antimony focused drill campaign at the Stibium prospect in Q2 2025.

This would form a key part of its strategy to create a fully secure and integrated US domestic antimony supply chain based in Alaska.

The resource drill program will follow up on last year’s sampling which revealed high-grade antimony over an 800m by 400m zone. Grades were up to 56.7% antimony and 11 samples were over 30%, as well as high grade gold up to 141 g/t gold.

Drilling at the Styx prospect is also on the schedule after results including up to 54.1% antimony and other high-grade intercepts.

This article was developed in collaboration with Nova Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.